Summary:

- Teva Pharmaceutical is deeply undervalued, trading at a 77% discount per my calculations, and the new CEO’s turnaround plan looks promising.

- Teva is an Israeli pharmaceutical company focused on affordable generic medicine, with a strong presence in North America.

- The company has consistent profitability, with a 50% gross margin and 20% operating margin, and plans to deleverage and diversify its product offerings.

JHVEPhoto

My thesis

I usually avoid investing in deeply undervalued stocks like Teva Pharmaceutical (NYSE:TEVA) because markets are rarely wrong and generous discounts usually mean that there are numerous risks factors related to investing in such stock. TEVA’s deep discount is explained by inefficiencies and controversies from the previous management and the stock now trades at a 77% discount, according to my intrinsic value calculations. But I am optimistic about the new CEO’s turnaround plan and think that the planned direction and the timeline look realistic. The turnaround plan is long-term and its execution commenced only in 2023, meaning there is still a lot of work to be done by the management. At the same time, the last few quarters under the new CEO were marked with a return to revenue growth path, while profitability is improving consistently after several years of stagnation. I think that TEVA is a solid risk-reward play and I recommend a Buy on the company’s shares.

TEVA: Business perspective

Teva is an Israeli pharmaceutical company concentrating mostly on offering affordable generic medicine. According to the latest annual report, sales of generic products represented 55% of total revenue in FY2023. The company operates internationally with strong presence in North America. Teva markets approximately 500 generic products in the U.S. Teva operates 36 plants across 27 countries.

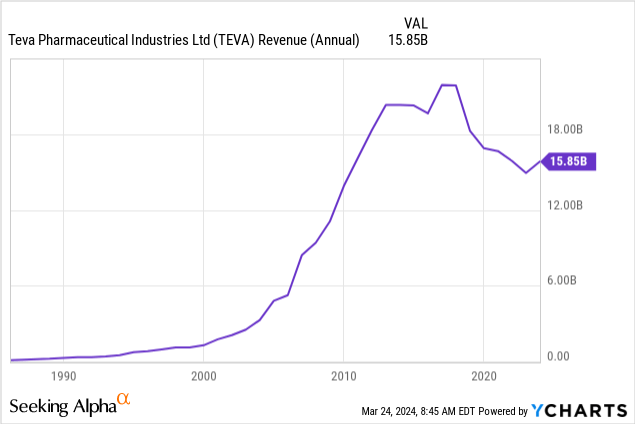

Teva had stellar growth story in the beginning of the 21st century, but the business started stagnating in 2010s. The company was involved in several scandals (which I will cover a little deeper later in the article) under previous management and struggled to drive revenue growth during multiple years.

To resolve struggles of the business, the new CEO, Richard Francis, was appointed in late 2022. After few months of working on the turnaround strategy, the new CEO presented a “Pivot to Growth” plan for 2023-2028 aimed to ensure sustainable growth of the business over the long-term. The plan is well-rounded and the balanced approach to sustain generics powerhouse but diversify with innovative products as well. I also like that the management sets the timeline which seems realistic.

TEVA

TEVA: Financial perspective

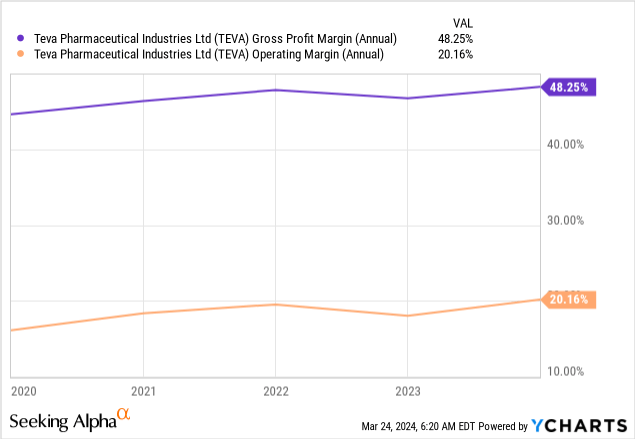

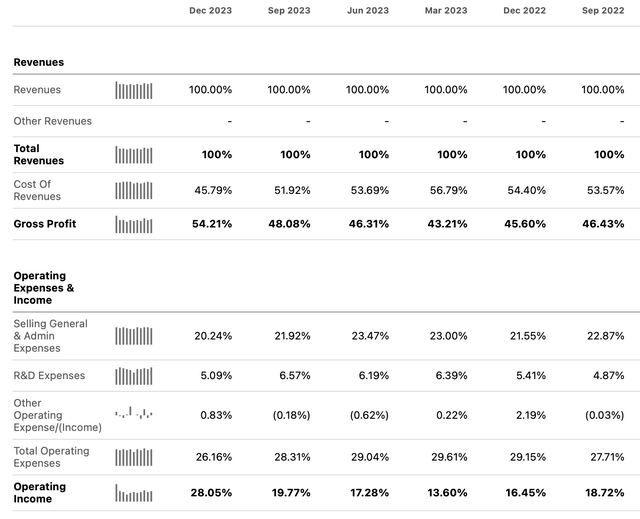

Having leading position in its niche of generic medicine ensures TEVA’s consistent profitability. As shown below, the gross margin is almost 50%, which means that TEVA is able to reinvest significant portion of its revenue in developing new products. After SG&A and R&D deducted, TEVA generates a 20% operating margin. Both aforementioned profitability metrics are steadily expanding. Consistently improving profitability metrics allows TEVA to generate 20% in free cash flow margin.

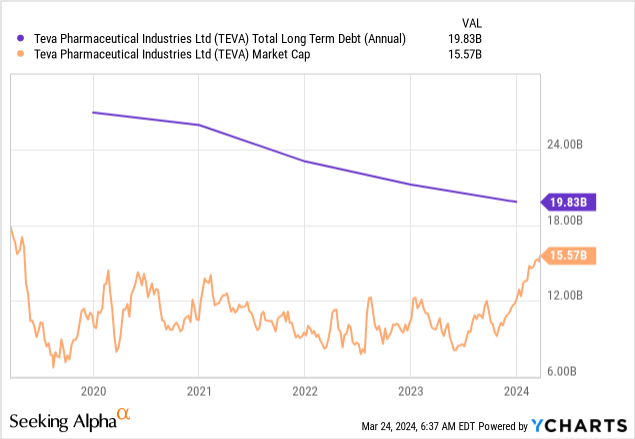

Having strong free cash flow margin is crucial for TEVA considering its high leverage, which needs to be repaid. As of the latest reporting date, the company had more than $20 billion in total debt ($19.8 billion is long-term debt), which is higher than TEVA’s market cap. As part of the “Pivot to Growth” strategy which I described in business perspective analysis, the management also emphasizes on the importance to deleverage. With having solid free cash flow as well as new growth and cost efficiency plans, the management has a solid basis to complete its deleveraging aims.

My optimism around the ability to deleverage is also supported by the financial performance of TEVA in previous two quarters. September and December quarters of 2023 demonstrated much stronger gross and operating margins figures compared to the same quarters of 2022. Fortunately, Seeking Alpha’s P&L format allows us to compare multiple previous quarters which makes YoY comparisons much easier. As we can see below, both profitability ratios have also improved notably on a QoQ basis over the last four quarters. Therefore, I think that the management’s turnaround initiatives are being executed well.

Seeking Alpha

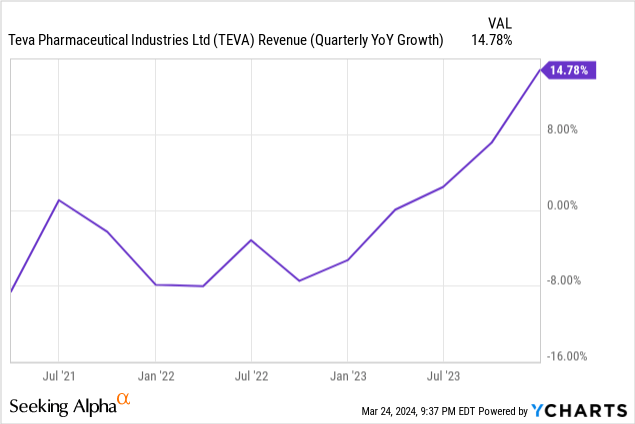

In recent quarters, revenue has also returned back to the growth path which investors have not seen in previous three years. As we can see below, quarterly revenues were declining on a YoY basis for several quarters and only last four quarters were positive. Growing revenue together with consistently improving profitability ratios is a solid evidence that the new CEO’s turnaround plan is working.

Intrinsic value calculation

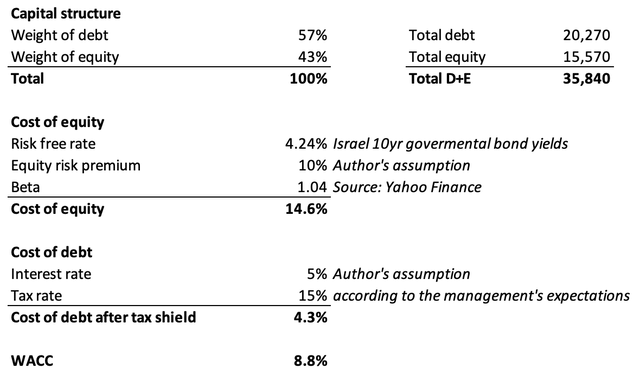

I start my intrinsic value calculation by determining the weighted average cost of capital (WACC), which is a crucial assumption for the discounted cash flow (DCF) approach. To figure out WACC, I implement a classic CAPM method. As shown in my working below, my WACC for TEVA is 8.8% and all the logic behind is outlined in the working.

DT Invest

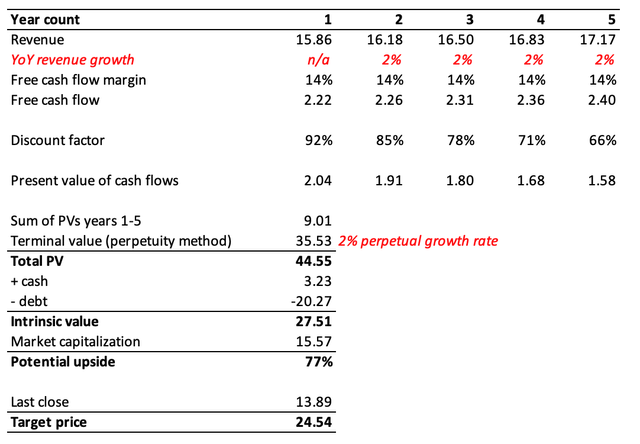

With WACC figured out I can move forward and calculate TEVA’s intrinsic value. I use a conservative 2% revenue growth assumption for both years 1-5 and for the perpetual growth rate. Revenue estimate for the base year (2024) was found at Seeking Alpha, in the “Earnings Estimates” tab. I use a 14% levered free cash flow margin, rounding down the last 5 years’ TEVA’s average. I add up $3.23 billion outstanding and deduct $20.27 billion total debt from my intrinsic value calculation.

Based on all the above assumptions and my WACC calculations, the intrinsic value of the company is $27.5 billion. The intrinsic value is 77% higher than the market capitalization, meaning that the target price is $24.54. I arrived at this figure by multiplying the last close by the potential upside plus 100%.

DT Invest

What can go wrong with my thesis?

Maintaining good reputation is important for all business, but for public companies reputation is also a big factor that might affect the share price. Teva was the subject of several misconduct allegations in the past, even litigations related to corruption. The company paid more than $500 million in 2016 to settle bribery investigations. Last year, there were price-fixing allegations and Teva paid around $225 million to settle the charge. There were few other cases in recent years, and I do not want to highlight them all. I just want to pay attention of my readers that these ethical issues took place due to decisions and actions from the previous leadership. I do not expect such cases again under new management, but it might take a long time before the public image of the company recovers 100%.

In general I try to avoid deeply undervalued companies because markets are usually quite efficient and if something is cheap it means there are massive risks behind deep discounts. In case of TEVA such a discount is explained by the flawed reputation, high leverage, and turnaround risks. Therefore, investors should be aware that the discount is not because the market is wrong but because of numerous risks. My thesis is based on my expectations that the new management succeeds in turnaround which includes sustaining and improving profitability to be able to deleverage. But if the new management fails in its turnaround completion and recent quarters were just anomalies, my thesis is unlikely to age well and TEVA is likely to continue trading with deep discount.

Summary

Investing in TEVA might be not a good choice for investors with low tolerance to risk, but if the turnaround plays out well the stock can almost double in price over the relatively short timeframe (12-18 months). The new management’s strategic priorities look sound enough to return TEVA to its robust growth path demonstrated before the 2010s. With the company boasting 20% free cash flow margin and the positive dynamic in financial performance since the implementation of new strategy, I am optimistic about its ability to deleverage and support the development of innovative products.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.