Summary:

- TEVA’s new plan will see it shift its focus and resources to innovative medicines like Austedo that enjoy higher margins than generics.

- Austedo has been performing well historically, with plans to grow its sales to $2.5 billion in 2027 from the $1.2 billion expected in 2023.

- If the new growth plan is successful, the upside will be immense as TEVA is currently valued like a failing company.

- The risks, however, are significant and investors need to keep an eye out on debt and the pace of the slowdown in the generics business.

JHVEPhoto

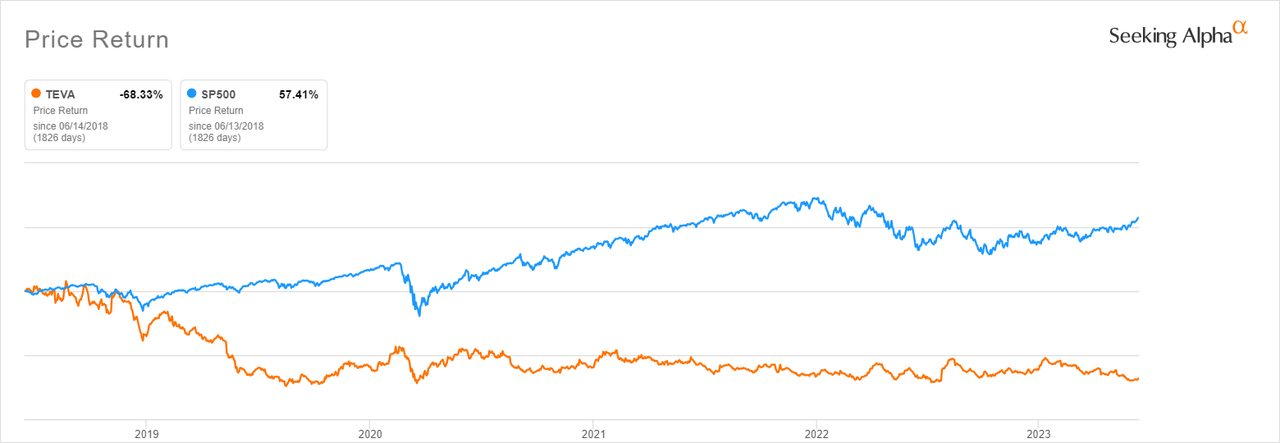

Teva Pharmaceutical Industries (NYSE:TEVA) is a well established pharmaceutical multinational that is known for its dominant position in the global generic drugs business. Headquartered in Israel and incorporated in 1944, TEVA has a significant presence in North America and Europe and operates worldwide in over 60 markets. Despite having a storied past, the company has since 2016 suffered a series of financial and commercial setbacks that have dented investor confidence. This has resulted in the stock massively underperforming the broader market. TEVA is down 68% in the past 5 years vs the S&P 500’s 57.4% gain.

TEVA vs S&P 500 past 5 years (Seeking Alpha)

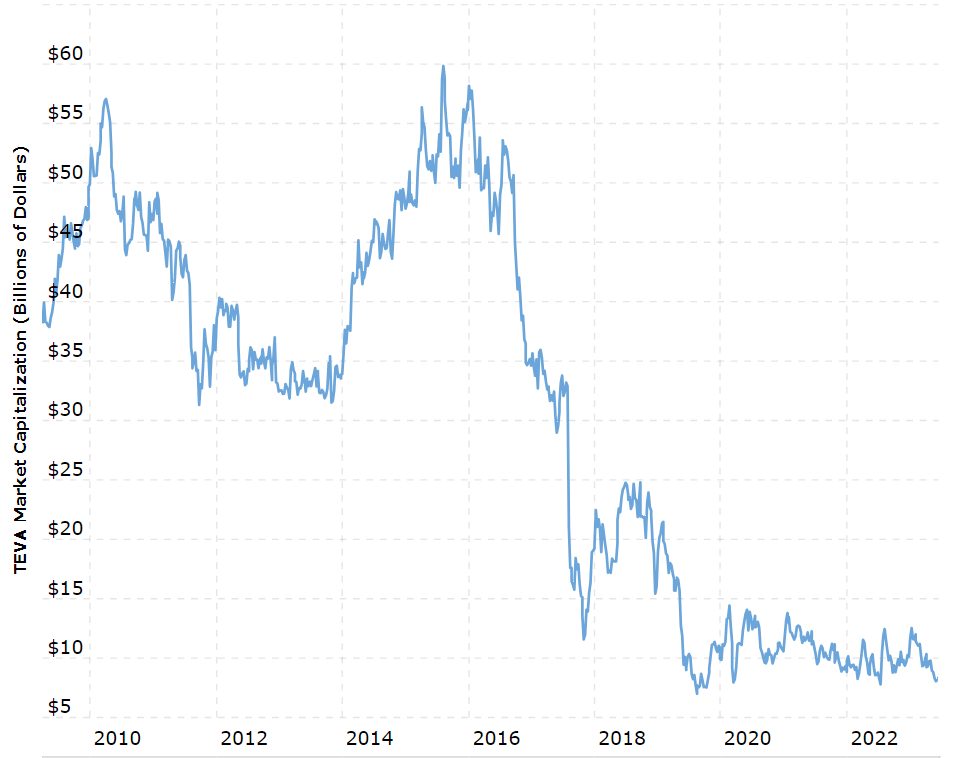

The chart below showing TEVA’s market cap over the past 10 years tells a story of a company that has fallen out of favor with investors. Understanding why is a crucial first step in deciding whether or not to put your hard earned money in the stock.

macrotrends

The reason TEVA fell out of favor

The sequence of events that triggered this bearish reaction by investors can be traced to TEVA’s move to acquire Allergan for $40 billion in 2015. This big ticket purchase resulted in TEVA’s long-term debt increasing 3.8 times from $8.35 billion in Dec 2015 to $32.52 billion in Dec 2016. However, in an unfortunate turn of events, TEVA failed to achieve the targeted commercial and financial results post-merger due to a number of factors, including regulatory action by the Federal Trade Commission which directed that TEVA divest some of its assets in its US generics drug portfolio to preserve market competition.

As a result of these challenges, TEVA’s revenues, which were $19.65 billion in 2015, increased marginally after the deal to $21.9 billion in 2016 and $21.8 billion in 2017. They have been steadily declining ever since amid several headwinds such as increased competition in the generics drug business, price reforms in key markets such as the US, a slew of lawsuits related to the opioid crisis, narrowing business margins and huge debts. In 2022, TEVA reported revenues of $14.92 billion, a net loss of $1.6 billion and had net debt of $18.8 billion.

This in summary explains the steady decline in TEVA’s stock price over the past few years. With the current stock price just a dollar above the all-time low of around $6.50, the important question for investors to ask is whether the business can reverse its fortunes and deliver revenue growth and profitability after this difficult episode. The management believes this is possible. TEVA in May launched a new strategy called “Pivot to Growth” that is aimed at redirecting the focus of the business to areas with the greatest growth potential.

Going all in on innovative medicines

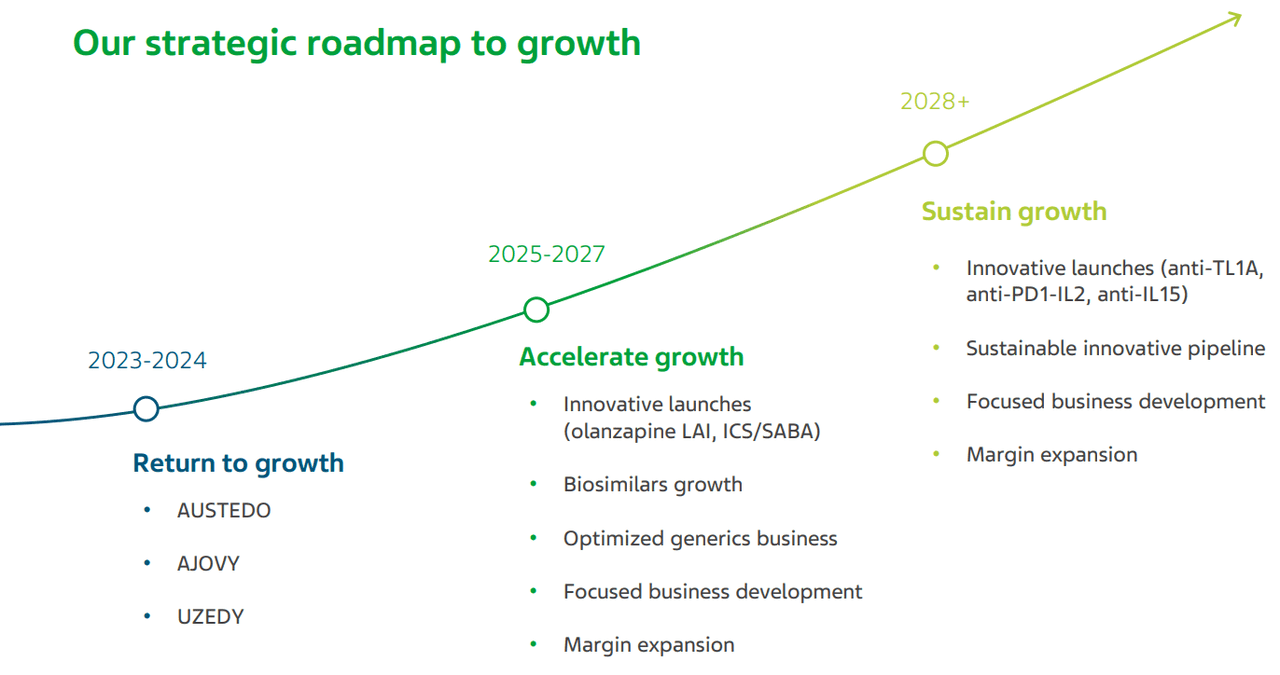

Through the strategic plan, TEVA has essentially asked investors for a few more years to reinvent itself. The new “Pivot to Growth” plan places ambitious growth targets for 2027 and provides a roadmap of how the company will get there by shifting its business focus. The key plank of TEVA’s new growth strategy entails prioritizing its innovative medicines portfolio which has name-brand drugs like Ajovy, Austedo and Copaxone. The focus on innovative medicines is aimed at countering the effects that the decline in the generics segment is having on revenue growth and margins.

Generics are getting less profitable because stiffer competition in the generics market is impacting individual companies’ volumes while also leading to price erosion for different brands — basically a double whammy of lower sales and lower margins. This is a concern for TEVA because generics accounted for $8.60 billion or 58% of TEVA’s total 2022 revenues. This overreliance on generics explains why TEVA’s business as a whole has been failing to grow year after year, even as margins collapse due the low margin nature of the generics business. Switching the business’s focus and resources to innovative medicines as this new “Pivot to Growth” strategy proposes is aimed at addressing this issue.

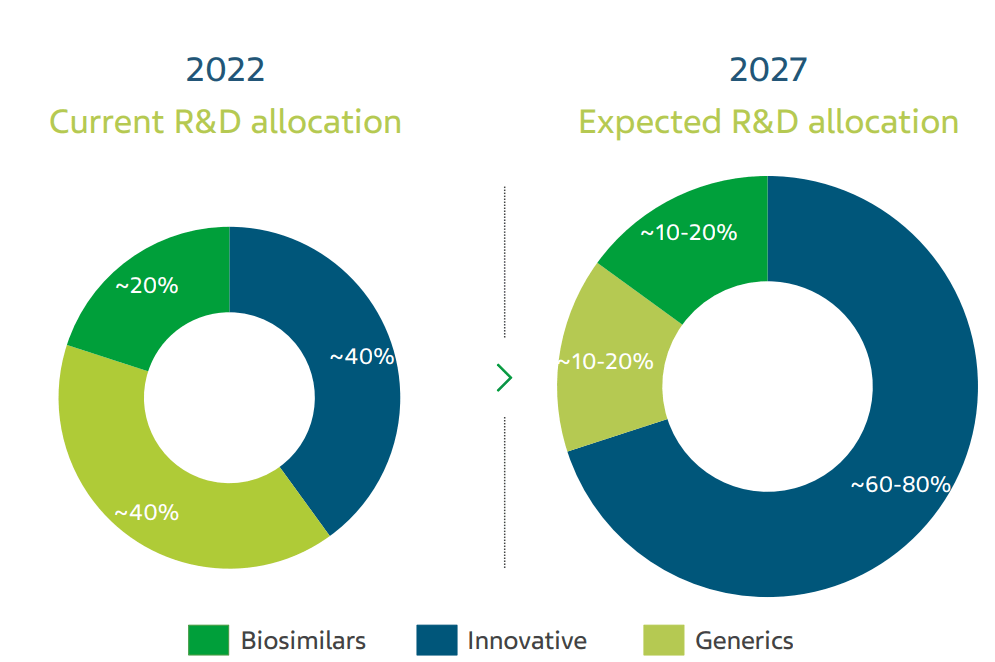

Teva Investor Day Presentation

R&D spending is a leading indicator of the long-term direction a business is taking with its product mix. From the chart above, which shows how TEVA’s R&D capital allocation will change in the newly launched strategic cycle, it is clear that TEVA wants innovative medicines to be the growth driver of its business going forward. TEVA’s hopes in this plan are pegged on Austedo, a medication that treats involuntary movements caused by tardive dyskinesia or Huntington’s disease.

TEVA CEO Richard Francis told investors in May that Austedo should reach sales of $2.5 billion by 2027, adding that TEVA would ramp up investments in the drug, including assembling a bigger salesforce. TEVA’s management is basically saying Austedo will roughly double as a business in the next four years. TEVA expects revenue from the drug to reach $1.2 billion in 2023 from $971 million in 2022.

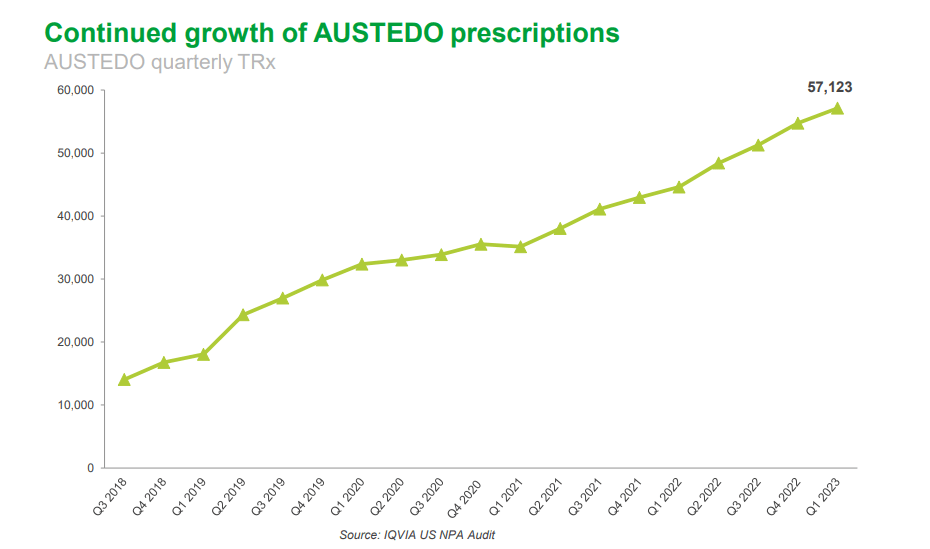

“We are going all in on Austedo,” CEO Francis was reported as saying by Reuters. TEVA’s bold plans for Austedo are informed by the fact that the patient population for tardive dyskinesia or Huntington’s disease is significantly undiagnosed. Francis noted that only 15% of the 800,000 people suffering from tardive dyskinesia take medication. As the chart below shows, TEVA has been growing the number of prescriptions at a healthy clip in recent years. If it can maintain this growth trend – and assuming the unmet need is as great as believed – the odds of success for this new “Pivot to Growth” strategy would increase considerably.

New prescriptions and refills steadily growing (Teva )

Successful return to growth could deliver outsized gains

Investors will likely turn bullish if TEVA succeeds in restoring revenue growth through a high margin product such as Austedo. Looking at where the valuation multiples are today, investors who buy at current prices could enjoy outsized gains if this scenario plays out. TEVA’s EV/EBITDA is 6.22 vs the sector median of 13.19 while its P/S is 0.56 vs the sector median of 4.47. (I’ve used EV/EBITDA and P/S instead of P/E since TEVA has recently posted negative GAAP earnings). Both on an EV/EBITDA and P/S basis, the stock is the cheapest it’s ever been. Such a low multiple that is out of tune with the broader market is usually a bearish sign. It shows there are no investors willing to buy the stock at higher prices. It also shows that the business faces unique challenges not affecting peers.

TEVA is basically valued like a failing company, meaning any sign that is not in fact a failing business but a thriving one could lead to outsized gains as investors rush in to take advantage of the steep undervaluation. Nobody has a crystal ball to know whether or not Austedo will live up to the expectations set by TEVA’s management. However, if it does, the return for investors who buy the stock today will be well worth the risk.

The prospects for Austedo’s possible success are supported by several factors. To begin with, Austedo has already garnered significant sales momentum as earlier indicated with the example of the growth in prescriptions. The company is also matching its ambition with financing and resources as shown by TEVA’s ongoing shift in R&D spending to innovative medicines. Importantly, TEVA has the experience of successfully marketing a name-brand drug called Copaxone. The medication, which was launched in 1997 to treat multiple sclerosis, has been generally successful, raking in billions of dollars through the years. While Copaxone sales have in recent years slowed down after its patents expired several years ago and generics entered the market, the drug’s success while TEVA enjoyed exclusivity shows that the company has the expertise and experience to successfully market a name brand drug.

TEVA also has an important tailwind in the form of the settlement of multiple lawsuits relating to the opioid crisis. The company has made substantial progress towards the US nationwide opioid settlement agreement with 49/50 states having reached a deal at the time of writing. This is good news for investors as the financial uncertainty relating to these lawsuits is now in the rear view mirror. The management also has more time and resources to focus on the core business.

Overall, the success of Austedo could help revive investor interest in TEVA. It will also set the stage for future success of other drugs. The company has a diverse portfolio and promising pipeline of innovative medicines and biosimilars that could help drive future growth if successful. Its Investor Day presentation goes into more detail about these medicines, but the chart below briefly captures the ambitions for the coming years to launch new products.

Several launches planned for next 3 years (Teva)

Take heed of the risks

Despite the bullish prospects of a recovery supported by investments in innovative medicines such as Austedo, investors interested in TEVA need to take heed of the risks. To begin with, TEVA is not moving out of generics and into innovative medicines. The strategy is simply a matter of rebalancing its portfolio and product mix to position higher margin innovative medicines more prominently. The generics business is still important, with the company maintaining that it seeks to “sustain the generics powerhouse” in its Investor Day presentation.

This means that the effects of the slowdown in the generics business could still undermine future plans for growth. If the generics business continues shrinking at a fast pace, it could offset whatever growth is achieved through Austedo and the broader innovative medicine portfolio. A faster than anticipated slowdown in the generics business could also slow cash generation, making debt repayment much harder. TEVA has been paying down debt aggressively but still owes creditors as much as $18.5 billion. This debt load is proving burdensome amid slowing sales and compressing margins. Tellingly, “S&P Global Ratings recently revised the rating outlook for TEVA to stable from positive. S&P noted that over the last few quarters, the company’s revenue constraints and margin pressures have raised leverage from 5.9x for 2022 to about ~6.5x as of March 31. The credit ratings agency said that the company’s EBITDA has been weak over the last two quarters, which adds uncertainty to its performance.”

Conclusion

After years of turmoil, TEVA is steadying the ship and seems to have a clearer strategy of how to reverse its fortunes by focusing on higher margin innovative medicines. Given the steep undervaluation as measured by EV/EBITDA and P/S and the 20% decline YTD in the stock price, TEVA is starting to look attractive based on the possibility of a return to growth.

The risks are, however, real and I wouldn’t be surprised if the stock continued sliding in the next few quarters as investors stay unconvinced about the prospects of recovery. I was bearish on the stock in Q1 but must admit that the new plan has restored some confidence. Now I’m neutral and would switch to bullish if Austedo met 2023 sales forecasts and showed prospects of continued growth in 2024. Continued debt reduction, margin expansion and improvement in cash generation are also important metrics to monitor if you’re thinking of buying this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.