Summary:

- On August 2, 2023, Teva Pharmaceutical, one of the world’s top generic drug manufacturers, will publish its financial report for the second quarter of 2023.

- The company has launched generic versions of several medicines and is conducting phase 2 trials for TEV-48574, an experimental drug for moderate to severe ulcerative colitis or Crohn’s disease.

- Despite an agreement with Nevada, Teva’s share price has dropped over 15% since the start of 2023, underperforming competitors like Dr. Reddy’s Laboratories and Viatris.

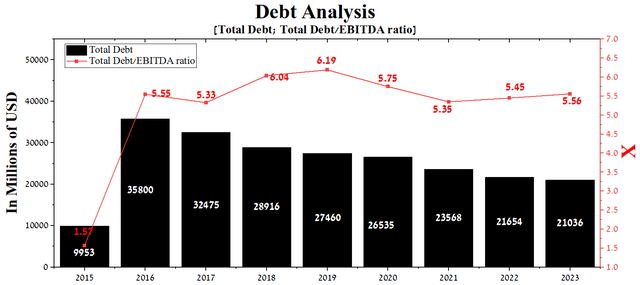

- At the end of the March 2023 quarter, Teva Pharmaceutical’s total debt was about $21.04 billion, down $2.53 billion from 2021.

- We continue our analytics coverage of Teva Pharmaceutical with an “outperform” rating for the next 12 months.

Drazen_

On August 2, 2023, Teva Pharmaceutical (NYSE:TEVA), one of the world’s top generics manufacturers and a leader in the global central nervous system therapeutic market, will publish its financial report for the second quarter of 2023.

The company has had an outstanding past two quarters, from Richard Francis’s inauguration as CEO and President to the successful launch of the “Pivot to Growth” strategy. This strategy aims to transform Teva from a company with declining margins into a company with a rich portfolio of innovative medicines that can return it to the top of the pharmaceutical industry. One of her first initiatives was the news of Teva Pharmaceutical’s plans to consider selling its $2 billion active pharmaceutical ingredients business.

In addition, in the first half of 2023, the company delighted investors with the launch of generic versions of medicines such as Revlimid at a dosage of 2.5 mg and 20 mg, Aubagio, Amitiza, Trokendi XR, and more. Moreover, Richard Francis continues to pursue an active R&D policy. Besides expanding the biosimilars portfolio, Teva’s main gem is TEV-48574, an experimental drug targeting the TL1A signaling pathway. The company is conducting phase 2 clinical trials to investigate its efficacy and safety profile in treating patients with moderate to severe ulcerative colitis or Crohn’s disease. The commercial markets for treating these diseases are valued at nearly $15 billion annually in the US and continue to grow, representing a huge opportunity for the company.

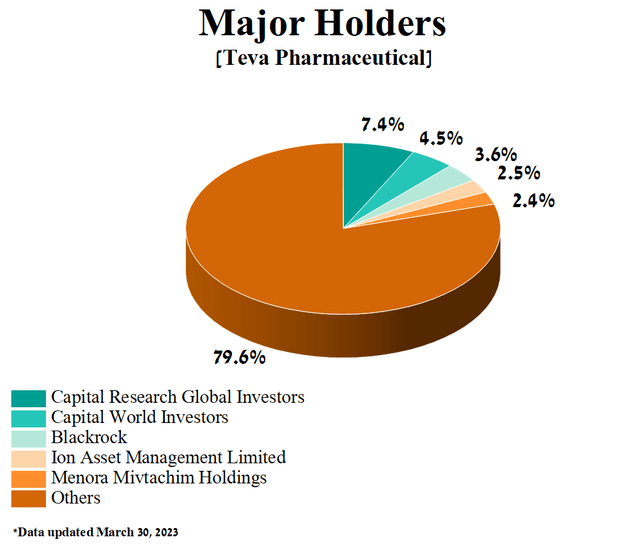

The five largest shareholders of Teva Pharmaceutical, with a combined stake of 20.4% in the company, have long been such Wall Street mastodons as Capital World Investors, Capital Research Global Investors, Blackrock, Ion Asset Management, and Menora Mivtachim Holdings.

Author’s elaboration, based on Yahoo Finance

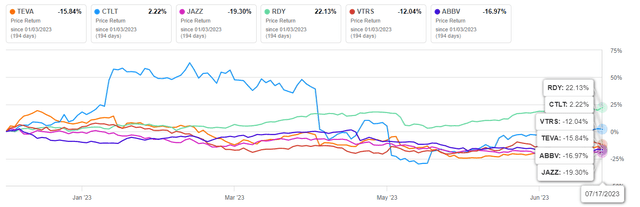

Despite reaching an opioid settlement with the final state of Nevada, Teva’s share price has seen a decline of more than 15% since the beginning of 2023, underperforming health-sector competitors such as Dr. Reddy’s Laboratories (RDY) and Viatris (VTRS).

Author’s elaboration, based on Seeking Alpha

We continue our analytics coverage of Teva Pharmaceutical with an “outperform” rating for the next 12 months.

The financial position of Teva Pharmaceutical and its prospects

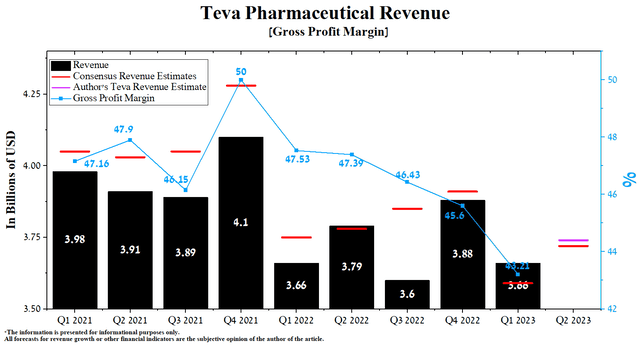

Teva Pharmaceutical’s revenue for the first three months of 2023 was about $3.66 billion, down 5.7% from the previous quarter, but it remained at the same level as in the first quarter of 2022.

Moreover, Teva’s actual revenue beat analysts’ consensus estimates in only the last two and nine quarters, which may indicate that Wall Street is overestimating its business prospects. The key culprits behind this trend are declining sales of Copaxone and generics in North America.

Author’s elaboration, based on Seeking Alpha

According to Seeking Alpha, Teva’s Q2 2023 revenue is expected to be $3.61-$3.85 billion, up 3.62% from analysts’ expectations for the first three months of 2023. While according to our model, the company’s total revenue will be slightly higher at $3.74 billion. While according to our model, the company’s total revenue will be slightly higher at $3.74 billion.

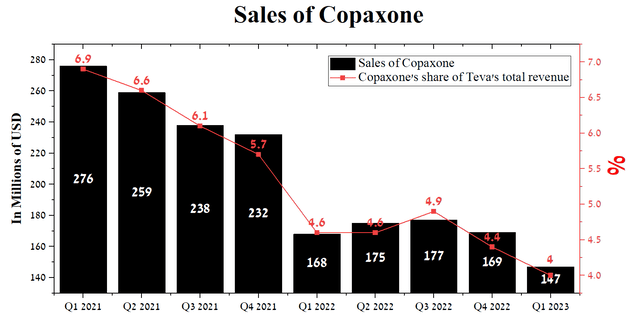

Sales of Copaxone, a blockbuster drug for treating some forms of multiple sclerosis, have long been a headache for Teva Pharmaceutical management. At this point, the impact of this issue on the company’s financial position is exaggerated due to a slowdown in the rate of decline in its sales year-on-year, as well as a decrease in its share, which amounted to only 4% of the company’s total revenue for the first quarter of 2023.

Author’s elaboration, based on quarterly securities reports

We believe that this percentage will continue to decline in subsequent quarters, which will undoubtedly positively impact the company’s perception by analysts and other market participants.

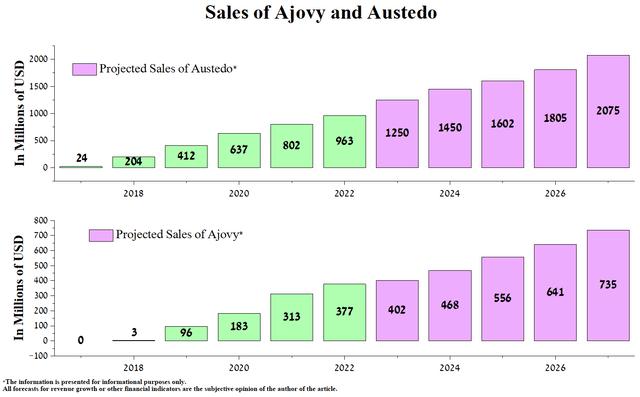

That being said, Teva’s marginal QoQ increase in revenue will be due to higher sales of Ajovy and Austedo, which are currently its flagship medicines. They can partially minimize the damage from the decrease in revenue of the generic medicines segment and the FDA’s refusal to approve the Humira biosimilar due to identified shortcomings at Alvotech’s (ALVO) manufacturing facility.

Thus, sales of Ajovy amounted to $95 million in the 1st quarter of 2023, an increase of 31.9% compared to the previous year due to the rise in the volume of prescriptions and the introduction of an automatic device for drug administration into medical practice. We believe its sales will continue to grow yearly due to the publication of additional data on its effectiveness in combating migraine.

So, on June 30, 2023, Teva Pharmaceutical reported that in the third interim analysis of the PEARL real-world study. According to their data, about 60% of patients taking Ajovy achieved a reduction in the number of monthly migraine days by more than 50% compared to baseline. In addition, about 82.3% of patients continued to use Ajovy during the twelve months of treatment, which is a high value indicating that patients are pleased with the product. This result suggests that patients are not only satisfied with the drug’s effectiveness in preventing migraine attacks but also in reducing the severity and duration of remaining migraine attacks.

Overall, we estimate cumulative sales of Ajovy to be $402 million in 2023, up 6.6% year-on-year to $735 million by 2027. On the other hand, sales of the blockbuster Austedo will increase from $963 million to $1.25 billion by the end of 2023, somewhat higher than the company’s management guidance.

Created by author

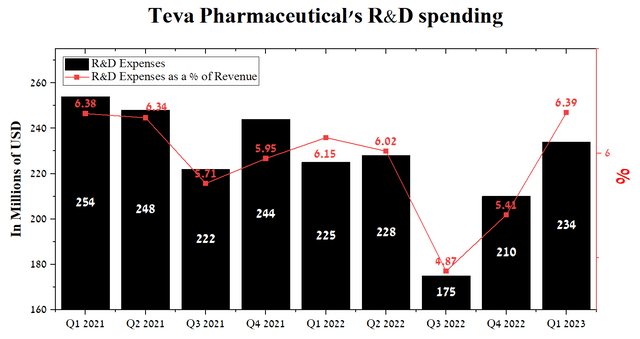

In our estimation, the fundamental root causes for Teva’s lack of significant revenue growth are its previous R&D strategy, the tense litigation caused by the opioid crisis, and high total debt. However, with the arrival of Richard Francis as CEO, the issue began to improve. The launch of the “Pivot to Growth” strategy will help transform from a company whose main share of revenue comes from the sale of generic drugs to a company that offers customers new-generation medicines that can improve not only the quality of life of patients but also the financial situation of the company. Thus, Teva’s R&D spending in Q1 amounted to $234 million, or 6.39% of total revenue, a record high in recent years.

Author’s elaboration, based on Seeking Alpha

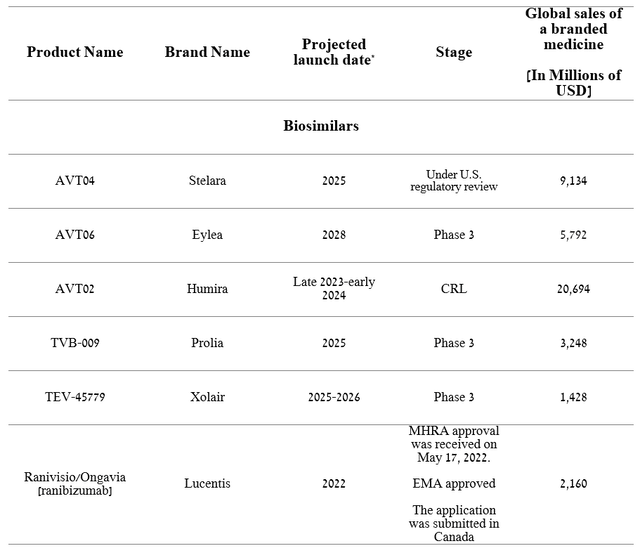

Teva Pharmaceutical’s Q1 2023 operating income margin was 13.6%, declining sharply quarter-on-quarter due to the higher cost of raw materials needed to manufacture medicines and lower profitability from Anda. However, the company has an extensive portfolio of biosimilars, some of which will appear on the market in the next two years.

Created by author

We believe that the Stelara biosimilar, under review by the FDA and a decision on which is expected in the second half of 2023, can significantly improve the company’s margins. The first reason is the high sales of J&J’s Stelara, which amounted to $2,444 million in the 1st quarter of 2023, an increase of 6.8% compared to the previous year. The second reason is the settlement of the lawsuit with Johnson & Johnson (JNJ). Despite the lack of disclosure of the settlement terms, it is known that they will allow Teva Pharmaceutical to sell their medicine “no later than February 21, 2025.”

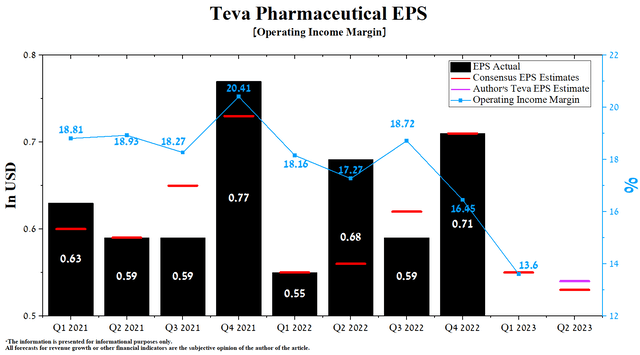

The company’s earnings per share (EPS) for the first three months of 2023 was $0.55, in line with the previous year. According to Seeking Alpha, Teva’s Q2 EPS is expected to be $0.49-$0.57, down 3.6% from the consensus estimate for Q1 2023. While we believe this is slightly underestimated, our model puts Teva’s EPS at $0.54, given the continued expansion of the drug portfolio and declining inflation in the US and the European Union.

At the same time, Teva Pharmaceutical’s Non-GAAP P/E [TTM] is 3.42x, which is 81.98% less than the sector average and 16.93% lower than the average over the past five years. On the other hand, Non-GAAP P/E [FWD] is 3.53x, which is one of the factors indicating that the company is significantly undervalued in the current period of the battle of pharmaceutical companies against President Biden’s Inflation Reduction Act and recovery of economic activity in China.

Author’s elaboration, based on Seeking Alpha

At the end of the March 2023 quarter, Teva Pharmaceutical’s total debt was about $21.04 billion, down $2.53 billion from 2021. On the other hand, due to the decrease in the company’s EBITDA in recent quarters, the total debt/EBITDA ratio has increased from 5.35x to 5.56x.

Author’s elaboration, based on Seeking Alpha

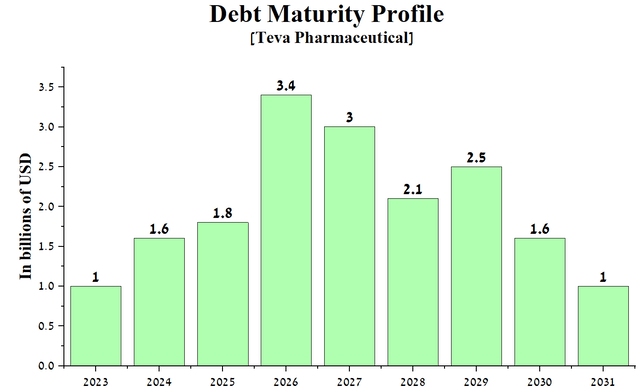

With Teva Pharmaceutical’s total debt/EBITDA ratio exceeding 5x, we expect the company to need to refinance its senior notes maturing in 2026 and 2027 to continue its active R&D program and start working on the issue of beginning dividend payments.

Author’s elaboration, based on quarterly securities reports

Conclusion

On August 2, 2023, Teva Pharmaceutical, one of the world’s top generics manufacturers and a leader in the global central nervous system therapeutic market, will publish its financial report for the second quarter of 2023. The company has had an outstanding past two quarters, from Richard Francis’s inauguration as CEO and President to the successful launch of the “Pivot to Growth” strategy.

Teva Pharmaceutical’s management continues to address the company’s structural issues hurting sales of generics and Copaxone. Thus, sales of Copaxone, a blockbuster drug for treating certain forms of multiple sclerosis, have long been a headache for the company’s management. However, the impact of this problem on Teva’s financial position is somewhat exaggerated due to a slowdown in the rate of decline in its sales year-on-year, as well as a decrease in its share, which amounted to only 4% of the company’s total revenue for the first quarter of 2023.

On the other hand, in the second quarter of 2023, the company received the FDA’s refusal to approve the Humira biosimilar due to identified shortcomings in Alvotech’s manufacturing facility. We believe that due to the insignificance of the problem, Teva will be able to solve them relatively quickly and expect its biosimilar to appear on the US market in late Q4 2023/early 2024.

Following the settlements of the opioid crisis litigation, the company’s two priorities are to continue to reduce total debt and expand its portfolio of new-generation experimental drugs. We see that Richard Francis is starting to actively solve them, which will undoubtedly positively impact the perception of Teva Pharmaceutical by analysts and other market participants.

We continue our analytics coverage of Teva Pharmaceutical with an “outperform” rating for the next 12 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TEVA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.