Summary:

- Teva Pharmaceutical’s stock is up 69% since December, driven by legal resolution, blockbuster drugs, debt reduction, and new product launches.

- Recent developments include the launch of biosimilars and generics, positive data on Uzedy and Ajovy, and an accelerated timeline for TEV-48574.

- Financially, Teva’s current ratio is under 1, with upcoming debt maturities posing a challenge. Recommendation remains “Hold” pending Q2 earnings.

Shutter2U

Introduction

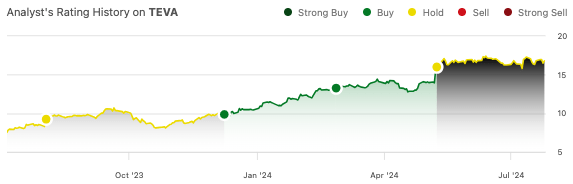

Teva Pharmaceutical’s (NYSE:TEVA) stock is up 69% since I called for a “2024 revival” last December. My excitement centered on the company’s progress with its anti-TL1A drug, TEV-48574, as well as its high-flying drugs like Austedo and Ajovy. I last wrote about Teva in May, when I highlighted its Q1 results. Its current ratio creeped under 1 and the 50%+ gains since my December recommendation lowered its return potential in my view. I downgraded the stock to “hold.”

Seeking Alpha

The company is set for Q2 earnings on July 31, so I figure it’s a good time to take another look.

Teva’s Market Expansion: New Biosimilars and Therapies Lead the Charge

Teva has had quite a few developments in recent weeks that align with their strategic outlook. In May, Teva, alongside its partner, Alvotech, announced that their “interchangeable biosimilar” to Humira, Simlandi, became available in the US. Recall that “interchangeable biosimilars” are especially interesting because they can be automatically substituted for the “original” Humira without a doctor’s prescription. AbbVie (ABBV) markets Humira, and the blockbuster drug is quickly losing market share to generics. For example, Q4 global Humira net revenues were down 40.8% from the previous year. In Q1, Teva’s “generic product” business made up 46% of their total revenues. Given Teva’s experience marketing generic products, Simlandi is expected to have some impact on their bottom line, though its potential is undeniably limited due to the presence of several other Humira biosimilars on the market.

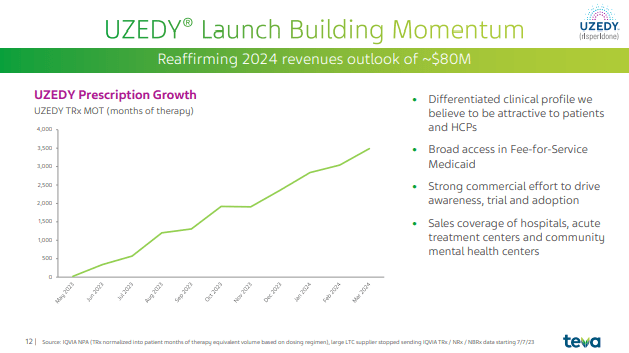

Teva highlighted data on their long-acting, subcutaneous formulation of a popular anti-psychotic drug, risperidone, Uzedy. Uzedy can be given every one or two months to treat schizophrenia. The pharmacokinetic data remained consistent when patients switched from their once-monthly intramuscular injection to Uzedy four weeks after their last dose. Obviously, getting patients to switch to Uzedy, as well as taking it (at the time of initial diagnosis, for example), is critical to its widespread adoption. Uzedy, while unique in its long-acting, subcutaneous formulation, competes with other long-acting injectable antipsychotics such as haloperidol and olanzapine. Recall that Uzedy is one of three drugs mentioned in Teva’s “pivot to growth strategy.” As they pointed out in Q1, Uzedy is seeing strong adoption.

Teva

In June, Teva announced the launch of generic Victoza, “the first-ever generic GLP-1,” for type 2 diabetes. According to Teva, Victoza had annual sales of $1.66 billion in April 2024. Victoza’s popularity as a GLP-1 has waned in favor of Ozempic and Mounjaro. In fact, Victoza is primarily used to address ongoing shortages of popular GLP-1s due to high demand.

Ajovy is Teva’s foray into migraine prevention. Recall that global revenue grew to $113 million in Q1. Ajovy is one of a few CGRP antagonists that are utilized first-line in preventive treatment of episodic migraine in adults. The market for migraines is anticipated to eclipse $17 billion by 2027, so there is room for several drugs. Earlier this month, Teva announced Phase 3 data testing Ajovy in pediatric patients (ages 6–17). As expected, the study met its primary endpoint (in reducing monthly migraine days) compared to placebo. In the same press release, Teva notes that “the SPACE data are the first Phase 3 trial evidence of the safety and efficacy of an anti-CGRP monoclonal antibody for the treatment of migraine in a pediatric population.” As a result, Ajovy should see additional growth, with analysts expecting peak annual revenue to range between $500 million and $750 million.

Teva and Sanofi’s Anti-TL1A Trial: Accelerated Timeline for IBD

Finally, just yesterday, Teva and its partner, Sanofi (SNY), revealed an “accelerated timeline” for their anti-TL1A, TEV-48574, Phase 2b clinical trial in patients with inflammatory bowel disease. They now anticipate topline data for both ulcerative colitis and Crohn’s disease in Q4. This could really move Teva’s stock. Anti-TL1As are believed to have the potential to disrupt IBD treatment. Recall that this class inspired Merck’s (MRK) $10.8 billion acquisition of Prometheus Biosciences and Roche’s (OTCQX:RHHBY) $7.1 billion acquisition of Televant Holdings (Roivant). Merck is ahead in the game and currently recruiting 1,020 (estimated) patients in a Phase 3 trial.

| Drug Candidate | Company | Development Phase | Indication |

|---|---|---|---|

| TEV-48574 | Teva & Sanofi | Phase 2b | Ulcerative Colitis, Crohn’s Disease |

| RVT-3101 | Roche (acquired from Roivant Sciences & Pfizer) | Phase 2b | Ulcerative Colitis, Crohn’s Disease |

| PRA023 (MK-7240) | Merck (acquired from Prometheus Biosciences) | Phase 3 | Ulcerative Colitis, Crohn’s Disease |

| FG-M701 | AbbVie & FutureGen Biopharmaceutical | Preclinical | Inflammatory Bowel Disease |

| SPY-002 | Paragon Therapeutics & Spyre Therapeutics | Preclinical | Inflammatory Bowel Disease |

So, this development is important as it is critical to get TEV-48574 to market as soon as possible before another anti-TL1A becomes established. Needless to say, and as evidenced by Merck’s and Roche’s multi-billion dollar anti-TL1A acquisitions, TEV-48574 has the potential to be the “next Austedo” for Teva.

Q2 Earnings: Focus on Austedo’s Growth and Ajovy’s Recovery

When Teva reports Q2 earnings next Wednesday, analysts expect $4.05 billion in revenue and a GAAP EPS of -$0.40. Teva has exceeded revenue expectations in the previous five quarters. Looking forward to the report, I am curious about how Ajovy will recover from a disappointing Q1 in the US segment, where revenue of $45 million was flat compared to Q1 2023. This was most likely due to strong competition among CGRP antagonists. Teva’s Austedo, which primarily competes with Neurocrine Bioscience’s (NBIX) Ingrezza in tardive dyskinesia, should see further growth, though I do not expect the 67% YoY increase in Q1 to continue throughout the year. When looking at the current treatment recommendations, Ingrezza and Austedo are used interchangeably. Although Ingrezza has a larger share of the tardive dyskinesia market, Austedo’s growth has accelerated considerably. Financially, Teva saw increases in gross profit and lower S&M and G&A expenses; given their significant debt obligations, continued improvements in these figures will be critical moving forward. Finally, the recent introduction of generic products such as Victoza and Simlandi should have an impact in the near future.

Financial Health

As of March 31, Teva’s cash and cash equivalents totaled $2.99 billion. Current assets total $12.297 billion, while current liabilities equal $13.792 billion. This indicates a current ratio of 0.89. Their current ratio was greater than one at the same time last year.

Based solely on operating outflows in Q1 2024, Teva has nearly 6 years of cash runway available. However, this does not take into account future revenue changes, debt repayments, or other cash flow-related factors.

As Teva points out, $1.6 billion in debt matures this year, so as analysts anticipate (based on the estimated negative EPS), we should see a large payment in Q2. Another $1.8 billion in debt will mature next year.

Risk/Reward Analysis and Investment Recommendation

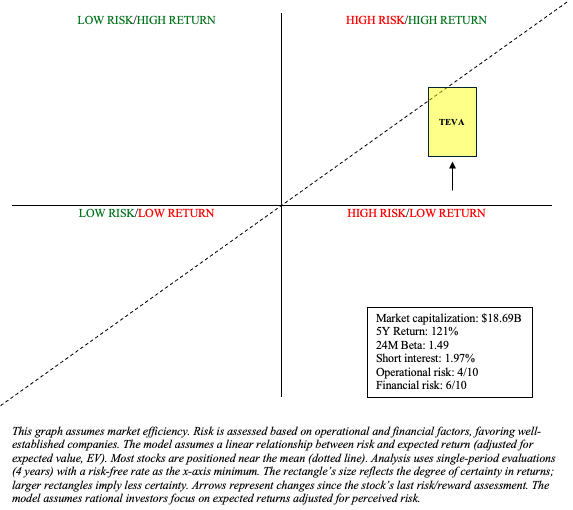

My recommendation for Teva remains “hold” heading into Q2 earnings, though I have adjusted my risk/reward chart to account for more potential return (y-axis) due to some positive developments since my last update (e.g., migraine data in pediatrics and an accelerated timeline for TEV-48574).

Author

Depending on the operational and financial changes that will be revealed in the coming days, Teva may once again be recommended as a “buy.” Until then, the safe bet is to wait for Q2 earnings before making any additional investment decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.