Summary:

- Teva Pharmaceutical stock has rebounded from lows, driven by debt reduction, halted price deflation in generics, and new product launches, making it a strong buy.

- Teva’s innovative branded drugs and biosimilar pipeline, including AUSTEDO and upcoming biosimilars like PROLIA and RANIVISIO, offer substantial growth opportunities.

- Teva’s business has followed a boom and bust cycle. Substantial biologic patent expirations in the coming years point to another boom.

- Analysts project Teva’s revenue to grow at a CAGR of 4.1%, but recent results have outperformed, supporting a 12-month price target of $23.50/share.

Building of Teva Canada Markham manufacturing facility. JHVEPhoto

Teva Pharmaceutical Industries Overview

Teva Pharmaceutical Industries Ltd. (NYSE:TEVA) is a global generic pharmaceutical company headquartered in Israel, selling traditional generic drugs as well as its own portfolio of branded medicines. It is among the three largest such companies in the world, with over half of sales coming from North America (51%), the remainder mostly coming from Europe (31%) and international markets (12%).

Since topping around $72/share in August 2015, a number of factors caused a collapse in the stock price. Most importantly, patents on Teva’s best selling drug Copaxone were ruled invalid, exposing sales of Copaxone to generic competition. Copaxone accounted for $4 billion in annual sales, nearly 20% of Teva’s revenue. As a result, from 2016 to 2019, revenues fell from $21.90 billion to $16.89 billion, largely driven by low-priced generic competition. Importantly, while Teva is a generic pharmaceutical company, it has invested in developing its own brands, leading to a boom and bust cycle, which in this case blindsided investors who had expected Copaxone patent protection to extend until 2030.

Another factor in Teva’s fall between 2016 and 2019 was pressure on generic drug prices. Consolidation of customer pricing power in generic drugs placed great pressure on manufacturers of generic drugs. Teva was not immune and unfortunately closed on an acquisition of Actavis Generics in late-2016 for a total of over $40 billion in cash and stock. The merger bloated Teva’s debt load at precisely the wrong moment, creating a perfect storm for Teva, whose stock price fell nearly 90% to the $7/share range in 2019 and 2020.

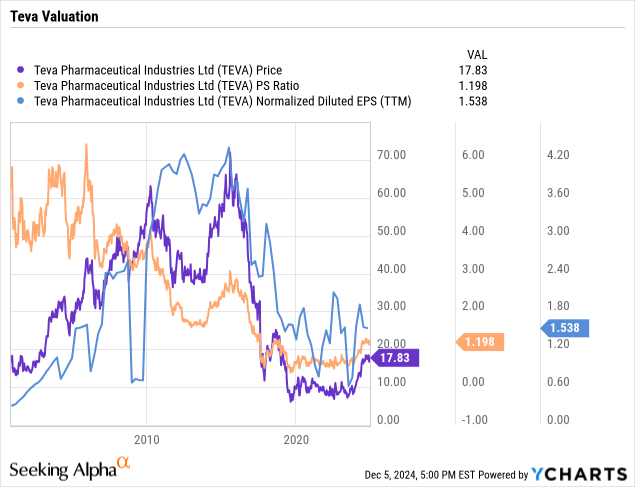

After several years of consolidation and incremental improvements to the business, Teva’s stock has gained momentum, more than doubling from the lows to around $18/share. In the stock market, it is rare for a company to ‘boomerang,’ losing most of its value only to regain it later. However, Teva may have the opportunity to accomplish just that. With debt being paid down to a more reasonable threshold, price deflation in generics halted and a plethora of new products on the Horizon, Teva may be able to extend its run toward all-time highs over the next 5 years. Even following the past year’s rally, Teva appears very cheap, trading at 6.35x expected 2025 earnings and 1.18x 2025 sales.

Teva’s turnaround appears to be in full swing and momentum is strong with the company repeatedly exceeding analyst’s forecasts this year. As such, Teva is a strong buy with a 12-month price target of $23.50/share.

Teva Pharmaceutical Q3 Earnings Summary

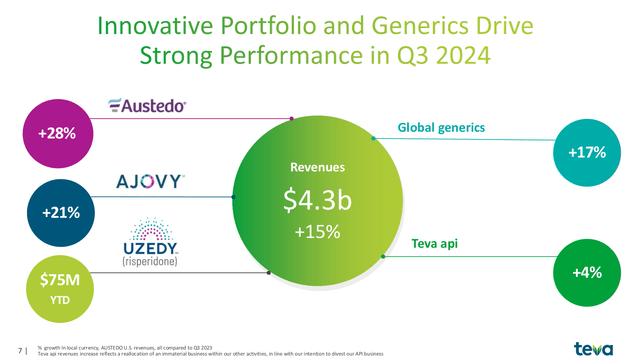

Teva reported Q3 earnings last month, treating investors to a beat on the top and bottom lines. Revenue for the quarter was $4.3 billion, a 15% increase on a constant currency basis. Since Q1 2023, Teva has rewarded investors with seven consecutive quarters of revenue growth. While the overall generics market has returned to robust growth (+17%), Teva’s branded products Austedo, Ajovy and Uzedy have outperformed, leading the company to raise its guidance multiple times in 2024.

Revenue Growth by Segment (Teva 2024 Q3 Earnings Presenation)

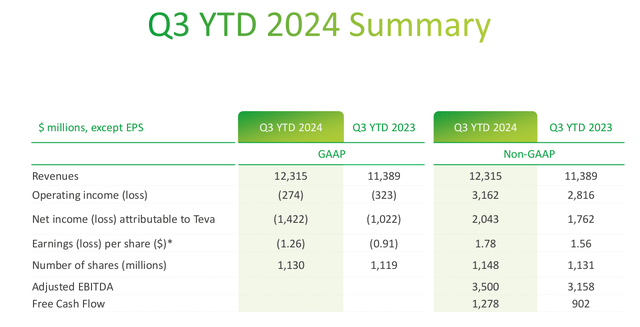

While Teva has grown revenues and increased guidance, the company continues to be unprofitable on a GAAP basis. This is “mainly due to a goodwill impairment charges related to our API reporting unit and higher legal settlement” losses in the third quarter. The fallout from Copaxone continues with Teva being fined $503 million over charges that the company abused its market position in order to lengthen the exclusivity of the drug. The market reaction to the decision was muted, implying that investors had previously discounted it. However, it should be noted that the fallout from Copaxone has not entirely passed.

Q3 YTD 2024 Summary (Teva 2024 Q3 Earnings Presenation)

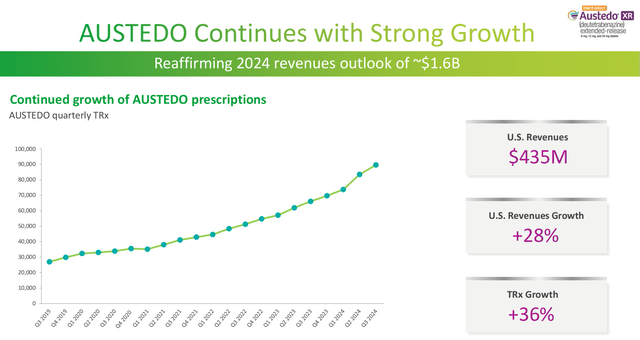

Austedo is a good example of Teva’s innovative portfolio. Austedo (deutetrabenazine) is used to treat chorea (sudden involuntary movements) caused by Huntington’s Disease. The drug is a deuterated analog of tetrabenazine, a drug that was sold under the trade name Nitoman and Xenazine, but has since become generic.

Teva recognized that incorporation of deuterium could extend the biological half-life creating a more effective drug. Thus, the drugs in Teva’s innovative portfolio are able to make incremental gains on existing drugs, carving out a valuable niche in the generic drug space, while foregoing much of the expense of discovering a completely new drug.

Austedo Sales Growth (Teva 2024 Q3 Earnings Presenation)

Currently, none of Teva’s top products account for a percentage of sales as material as Copaxone’s 20%, which contributed to 2015’s share price decline. The top-selling Austedo accounts for approximately 10% of 2024 sales. Generally speaking, Teva’s patent protections are less robust because they cover modifications to already existing drugs. At the present time no single product presents major risk to the overall portfolio.

| Product | Nov. 2024 Outlook | July 2024 Outlook | Feb 2024 Outlook | Increase |

| Austedo ($m) | $1,600 | $1,600 | $1,500 | 6.67% |

| Ajovy ($m) | $500 | $500 | $500 | 0% |

| Uzedy ($m) | $100 | $80 | $80 | 25% |

| Copaxone ($m) | $500 | $450 | $400 | 25% |

| Revenue ($b) | $16.1 – 16.5 | $16.0-16.4 | $15.7-16.3 | 2.55% |

In total, Teva has presented investors with impressive results, a new portfolio of branded drugs and good execution with meaningful increases in outlook over the course of the year.

Teva: Growth Prospects in Biosimilars and Innovative Drugs

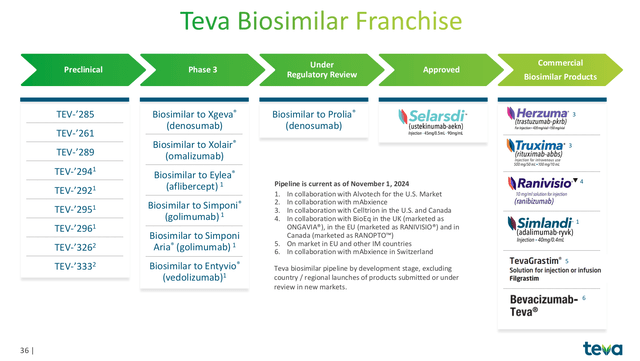

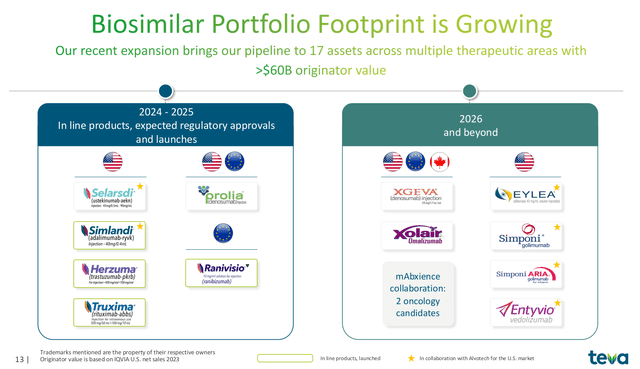

Teva currently sells three biosimilars, with progress toward additional biosimilar products. These are: HERZUMA, SIMLANDI and TRUXIMA.

- HERZUMA (Trastuzumab) is a biosimilar of Genentech’s best selling HER2 inhibitor monoclonal antibody, Herceptin. In 2018, peak sales of Herceptin reached $7 billion, which have declined since the drug lost patent exclusivity. There are 5 Herceptin biosimilars.

- SIMLANDI (Adalimumab) is a biosimilar of Abbvie’s best selling drug Humira for the treatment of rheumatoid arthritis. Humira hit peak sales of $21.2 billion in 2022, but has declined since as biosimilars have come to market. There are 10 Humira biosimilars available.

- TRUXIMA (Rituximab) is a monoclonal antibody used for the treatment of cancer and is a biosimilar of the branded drug Rituxan. Rituxan had peak sales of $7.5 billion in 2014 prior to generic competition. There are 3 biosimilars available.

Biosimilar drugs generally sell for less than the branded medicines they reproduce. However, they also sell for more than corresponding small molecule generic drugs. Prices for biosimilar drugs are generally 15-35% less than the corresponding branded drugs. Teva has not itemized the sales of its biosimilar drugs.

Teva’s Biosimilar Franchise (Teva 2024 Q3 Earnings Presenation)

Moving forward, there are a large number of coming biosimilar opportunities for Teva in the next several years. In addition to the products already on the market discussed above, Teva has a total of 17 assets in its biosimilar pipeline across multiple therapeutic areas, representing >$60 billion in originator value. The most consequential growth catalysts in the near-term are:

- PROLIA (denosumab), which has been accepted for review by the EU EMA and the US FDA. This Amgen drug has $3 billion in annual sales. Teva anticipates a decision by both agencies in the second half of 2025.

- RANIVISIO (ranibizumab), previously sold under the brand name Lucentis. A monoclonal antibody for the treatment of eye-related diseases such as macular degeneration. Lucentis recorded peak sales of $4 billion.

- SELARSDI (ustekinumab-aekn) is a biosimilar to Stelara and has been approved by the FDA. Peak sales of the drug were $11.3 billion in 2023.

Teva’s Growing Biosimilar Business (Teva 2024 Q3 Earnings Presenation)

Further on, a number of other prospects emerge from Teva’s pipeline. A number of biologic drugs are set to lose patent exclusivity in the coming years including: Xgeva ($2.1 billion in 2023 sales), Xolair ($2.47 billion in 2023 sales), Eylea ($5.89 billion in 2023 sales), Simponi ($2.20 billion in 2023 sales) and Entyvio ($5.35 billion in 2023 sales). These catalysts are further off and multiple companies are vying for biosimilars of each drug. Thus prices and the proportion of sales will be a fraction of the current branded market. However, the shear number of opportunities is impressive.

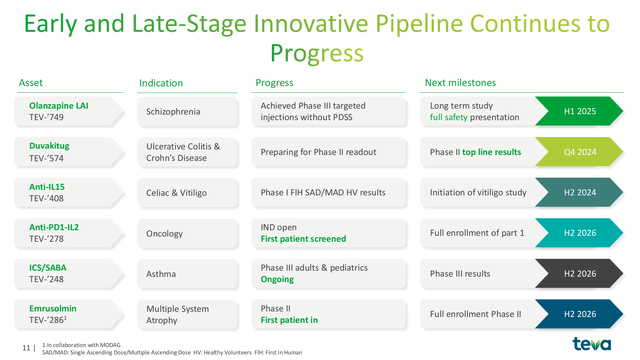

In addition, there are a number of other opportunities in Teva’s early stage pipeline. They are numerous, however, the most exciting are:

- Olanzapine LAI: Olanzapine was previously sold under the brand name Zyprexa for schizophrenia. Teva’s Olanzapine LAI is formulated for subcutaneous administration. While other generic forms are available, Teva believes that this can add value in a hospital setting when fast administration is key. The drug met its primary endpoint in early studies.

- TEV-‘278: A biosimilar of Merck’s Anti-PD1-IL2 drug pembrolizumab (KEYTRUDA). The patent on KEYTRUDA is set to expire in 2028. 2023 sales of the drug were $25.0 billion and sellers of biosimilar drugs are eagerly anticipating taking market share.

Teva Early Stage Pipeline (Teva 2024 Q3 Earnings Presenation)

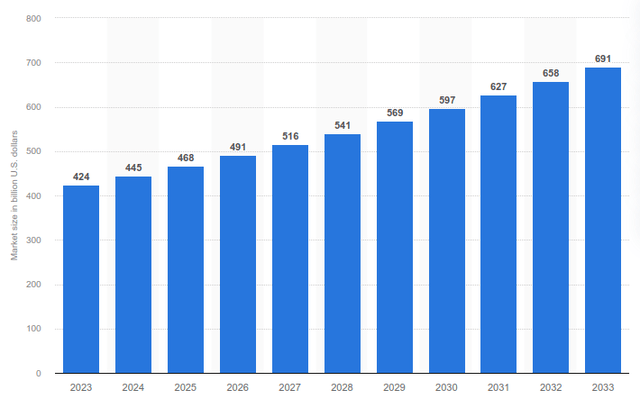

While Teva’s biosimilar pipeline is undoubtedly the most exciting feature of the company, trends in traditional small-molecule generics have also become favorable. According to Statista, the market for generic drugs is expected to see robust growth in the coming years. In 2023, $424 billion was spent on generic drugs, with growth expected to reach nearly $700 billion within 10 years, a CAGR of 4.8%. Thus the base level growth without innovative products

Total global generic drugs market forecast from 2023 to 2033 (Statista.com)

Thus, the number of coming opportunities in generic drugs is reminiscent of the ‘patent cliff’ that occurred in 2010, preceding a golden age opportunity for investment in generic drug producers. Currently, there are a large number of biologic drugs suddenly facing generic competition. Teva has shown itself able to enter this space and it is expected that the coming five years or so should be very favorable for investors.

Teva Stock: Debt Reduction, Earnings Forecast and DCF Valuation

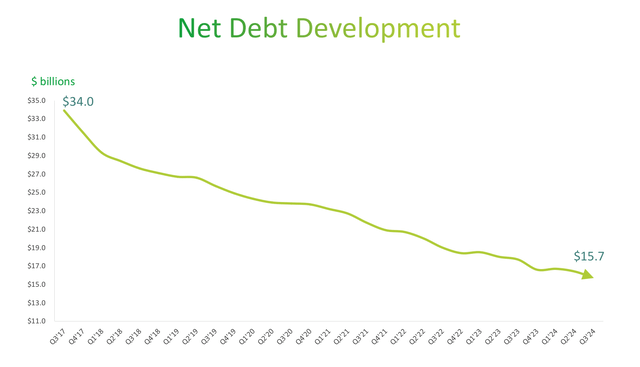

As mentioned previously, Teva’s net debt ballooned following the acquisition of Activis Generics in late 2016. In 2017, Teva owed on net debt of $34 billion, an amount that has been substantially reduced over the past seven years. Currently, net debt stands at $15.7 billion, or 3.04x 2024 EBITDA.

Given the debt repayment, both Fitch and Moody’s have upgraded Teva’s credit outlook, with Fitch upgrading to BB with positive outlook. This was Teva’s first upgrade in a decade and bodes well for the company moving forward. In order for Teva to return to all-time highs, debt is a key issue that must be addressed. Increased interest rates have made carrying such debt levels unsustainable and investors have lowered the valuation Teva receives in response. Finally, as debt is paid down other alternative uses of capital, such as share repurchases and dividends should entice new investors to the stock.

Teva Net Debt Repayment (Teva 2024 Q3 Earnings Presenation)

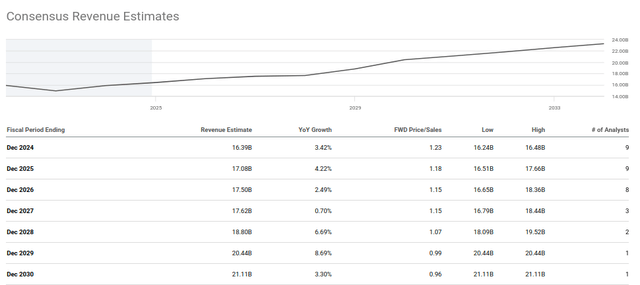

Analysts are projecting revenue growth in the low single digits over the coming years. Teva’s guidance midpoint expects revenue for 2024 to be $16.3 billion, with analysts expecting growth to $20.44 billion by 2029 over 5 years, a CAGR of 4.1%. These estimates seem very attainable, as mentioned above the expected rate of growth in generic drugs over the coming years is 4.8%. This ignores potential opportunities in Teva’s biosimilars and innovative pipeline. As such, it is expected that Teva has ample opportunity to outperform analysts expectations in the coming years.

Teva: Consensus Revenue Estimates (Seeking Alpha)

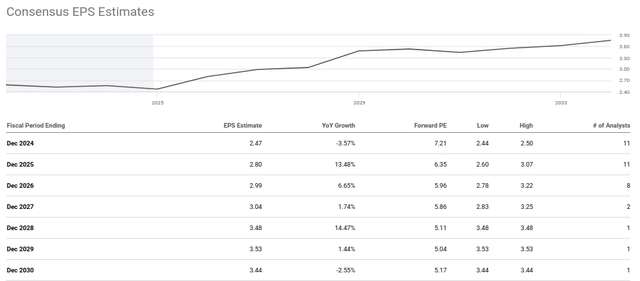

Taking the above analyst expectations of revenue growth, EPS should climb substantially in the coming years. In the halcyon days of 2015, Teva traded at approximately 15x peak earnings. If revenues continue to expand as projected, Teva trades somewhere around 5x 2029 earnings. An outcome better than this and one can begin to entertain the approximately 4x increase required for the stock price to revisit its 2015 highs.

Teva: Consensus EPS Estimates (Seeking Alpha)

On a price to sales basis, Teva remains nearly as cheap as anytime in its history except the bottom a few years back. Rebounding earnings for the company would enable substantial expansion in the valuation as the turnaround continues.

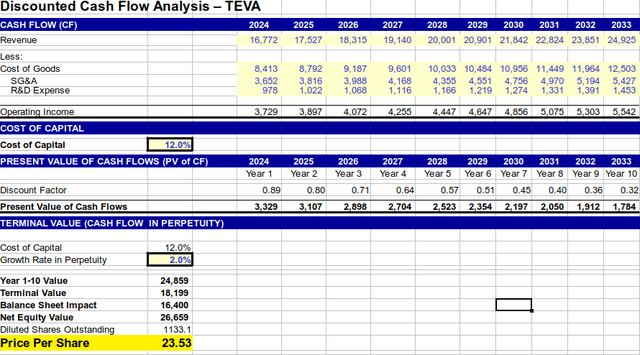

A discounted cash flow analysis was conducted for Teva. Revenues were modeled to grow at 4.5% over the next 10 years and 2% in perpetuity thereafter. A cost of capital of 12% was applied and the net debt was subtracted, realizing an equity value of $23.50/share.

DCF Valuation for Teva (Author’s Projection)

As can be seen from the price to sales, the valuation of the company is still very low compared with most of its history. Earnings, cash-flow and other metrics have been depressed by the perfect storm that Teva encountered starting in 2015. Thus, while the stock has more than doubled from the lows, it still remains attractively priced.

Conclusions

At the start of the last decade, big pharma lost patent exclusivity on many small-molecule drugs that had fueled growth. This ‘patent-cliff’ around 2010 was so substantial that it stalled many large pharmaceutical companies for years, but preceded substantial opportunities in the stocks of generic pharmaceutical companies. These opportunities in some cases spiked into disastrous excess: Teva being a benign example compared to Valeant and Turing Pharmaceuticals, which epitomized the excesses wrought from a deluge of new generic revenues.

Today, an even larger loss of patent exclusivity looms, with more than $200 billion in annual revenue at risk through 2030. Many of the brand name drugs losing exclusivity are biologic products and the companies most poised to benefit must execute effectively this area. These drugs have names synonymous with pharmaceutical blockbuster products, including: Humira, Keytruda, Opdivo and Eylea.

With multiple products already on the market, Teva has proven its credentials in this area while also navigating the early stages of a turnaround. Over the coming 12-months there are many opportunities in generic and biological drugs that have the opportunity to expand the company’s revenues and earnings. Teva is rated as a strong buy with a price target equal to the DCF valuation ($23.50/share) a 30% premium to the market price. This price is 8.4x the consensus analyst estimate for 2025 earnings ($2.80/share).

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TEVA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All investment opportunities carry inherent risk, including potential loss of principle. Carefully consider your investment objectives, level of experience and risk appetite before making any investment. The above discussion is a framework for investors (both long and short), to understand the factors that will move the underlying security’s price. It is not a prediction and should not be considered investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.