Summary:

- Step by step, Teva’s management is making progress in transforming it from a generic drugmaker into one that will play a key role in the fight against immune-related disorders.

- Its revenue was about $4.16 billion in the second quarter of 2024, up 7.2% year-on-year.

- So, in addition to the growth in sales of its generic products, there is also increased demand for innovative medications, including Austedo and Uzedy.

- One of the key milestones in Teva’s history will be the publication of results from a clinical trial evaluating the efficacy of duvakitug in the treatment of inflammatory bowel disease in late 2024.

- Ultimately, I continue to cover Teva Pharmaceutical with a ‘Buy’ rating.

Jose Luis Pelaez Inc/DigitalVision via Getty Images

As the AI hype bubble continues to deflate, fears about a potential US recession intensify, and risks of a large-scale war in the Middle East remain, Teva Pharmaceutical’s stock price (NYSE:TEVA) is moving in an accumulation phase above $17, reflecting the continued strength of the bulls.

What are the reasons for Wall Street’s growing optimism about the Israeli company, which is one of the leaders in the generic drug market?

First, on July 31, Teva released its financial results for the second quarter of 2024, which once again showed that it should not be written off, despite the years of disappointment it has brought to investors following the acquisition of Allergan Generics and the loss of Copaxone exclusivity.

However, over the past year and a half, under Richard Francis’ leadership, the company has continued to flourish, with revenue and profit growth in its Europe and United States segments, the successful launch of biosimilars and Uzedy, as well as achieving record sales of Austedo, which is its blockbuster for the treatment of certain neurological disorders.

In addition to growing sales of generics, Teva has also accelerated the development of its innovative medications, which have the potential to become “gold standards” in the treatment of schizophrenia, as well as some chronic inflammatory diseases.

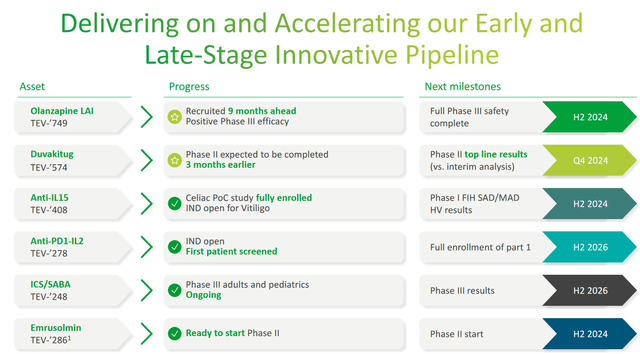

So, on July 25, the company pleased investors by announcing that it had completed the enrollment of patients in the Phase 2b clinical trial evaluating the efficacy and safety profile of duvakitug in the treatment of patients with ulcerative colitis and Crohn’s disease ahead of schedule due to strong interest from healthcare professionals and patients.

Teva Pharmaceutical’s financial results for the second quarter and 2024 outlook

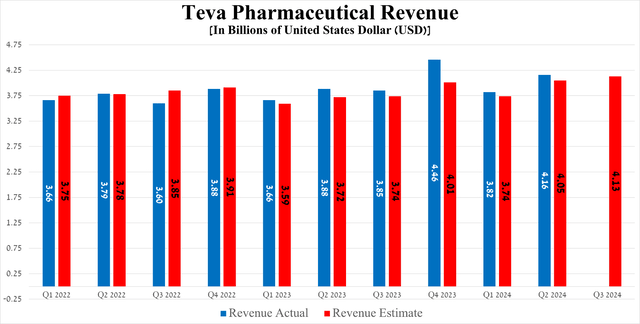

After years of investor pain, the Tel Aviv-based company’s revenue once again surpassed the $4 billion mark, reaching $4.16 billion in the second quarter of 2024, up 7.2% year-on-year and beating consensus estimates by $110 million.

Source: Seeking Alpha

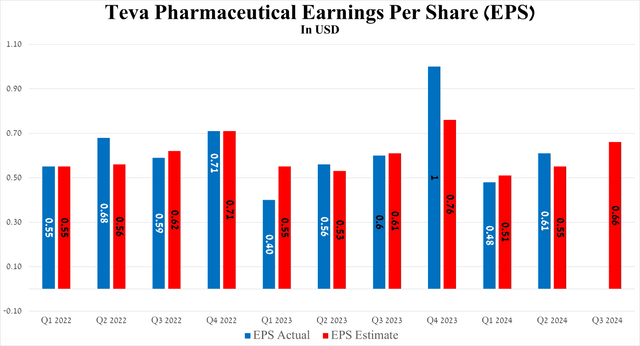

Meanwhile, the results of another equally important financial metric, namely earnings per share, were higher than I expected despite the increase in costs associated with conducting expensive clinical trials aimed at assessing the efficacy of its biosimilars and experimental drugs for the treatment of patients with neurodegenerative and autoimmune disorders.

Source: Teva Pharmaceutical

So, the Israeli company’s EPS amounted to $0.61 for the three months ended June 30, 2024, increasing by 27.1% quarter-on-quarter and beating analysts’ expectations by six cents.

Source: Seeking Alpha

What are the reasons behind Teva Pharmaceutical’s success?

To answer this question objectively, I believe it is necessary to analyze not only the impact of sales of individual medications, but also to dig much deeper, namely, to study how well its management copes with the development of each of Teva’s business segments.

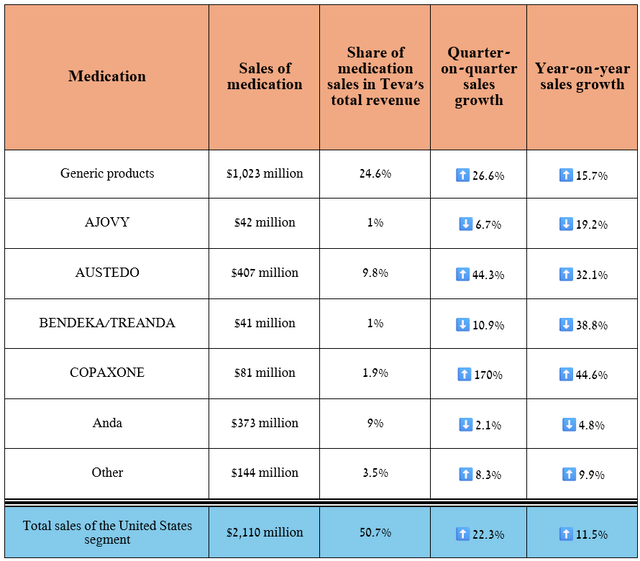

Let’s start our journey with its United States segment, which plays a major role in its financial position. So, its revenue amounted to $2.11 billion for the three months ended June 30, 2024, increasing by 11.5% year-on-year and by 22.3% quarter-on-quarter.

Source: table was made by Author based on 10-Qs and 10-Ks

First, Teva’s revenue and profit growth was driven by significant progress in developing its generics business despite increased competition from Viatris (VTRS), Dr. Reddy’s Laboratories (RDY), Perrigo (PRGO), and other players in the market.

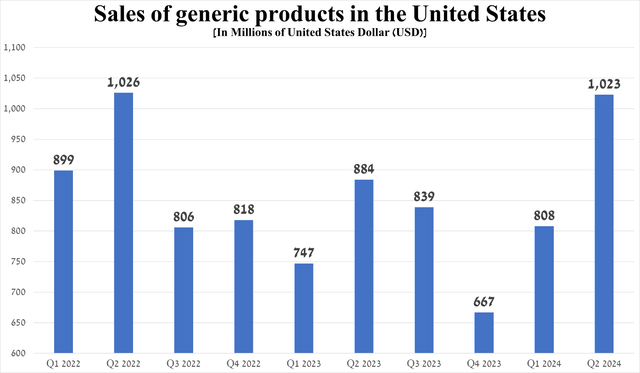

Total sales of generic products were about $1.02 billion in the second quarter, up 26.6% quarter-on-quarter.

Source: graph was made by Author based on 10-Qs and 10-Ks

What factors contributed to the recovery of Teva’s generics business?

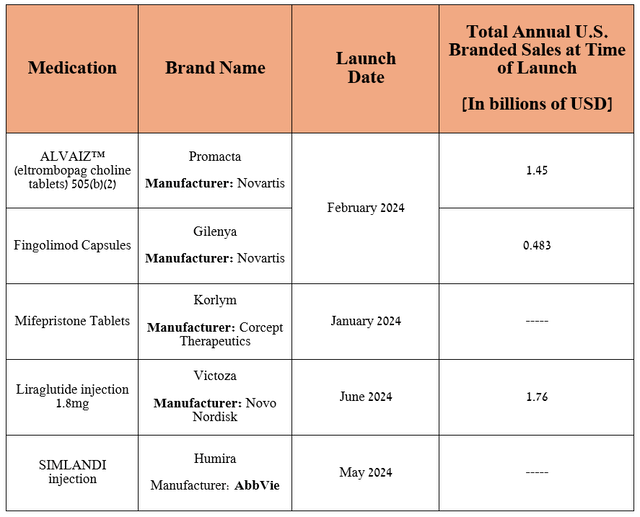

The improvement in Teva’s generics business in the U.S. was mainly due to the launch of the interchangeable biosimilar to AbbVie’s Humira (ABBV), growing demand for generic versions of Bristol-Myers Squibb’s Revlimid (BMY), a mega blockbuster medicine for the treatment of multiple myeloma, a generic version of Novo Nordisk’s Victoza (NVO), which in turn is a medication for the treatment of type 2 diabetes, and the expansion of its portfolio of drugs.

Source: table was made by Author based on Teva Pharmaceutical’s 10-Q

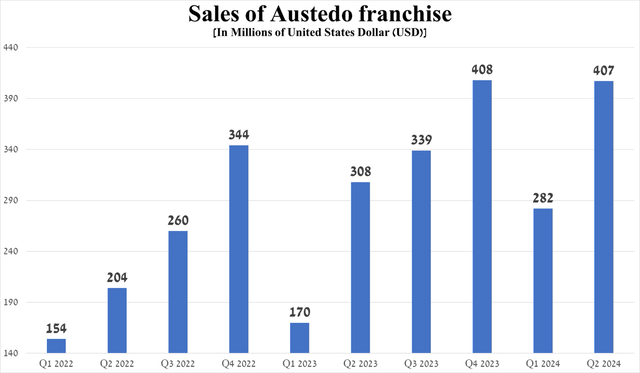

Also, alongside the skyrocketing Copaxone sales, Austedo, a detailed analysis of which I presented in my previous article, also pleasantly surprised me with the growing demand for it despite the increasing competition in the U.S. tardive dyskinesia therapeutics market from Ingrezza’s Neurocrine Biosciences (NBIX).

So, sales of the Austedo franchise were $407 million in the second quarter of 2024, up 32.1% year over year, driven by expanded access for patients and the FDA’s approval of Austedo XR in late May in four new tablet strengths, giving doctors more options to optimize treatment regimens for adults with tardive dyskinesia and Huntington’s disease-associated chorea.

Source: graph was made by Author based on 10-Qs and 10-Ks

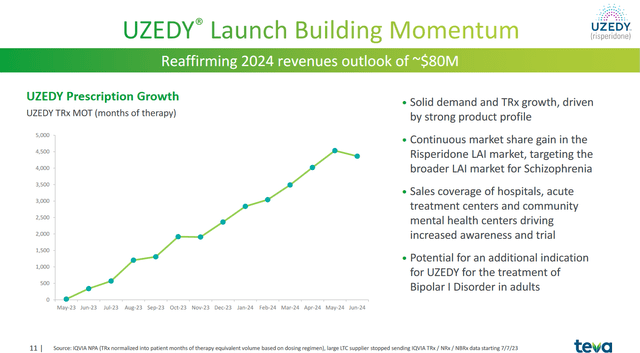

Additionally, I highlight Uzedy, a long-acting formulation of risperidone, as another driver of Teva’s revenue growth. Its launch took place in May 2023, but the company has yet to disclose sales of this drug, which is approved for the treatment of schizophrenia.

However, as you can see from the chart below, the total number of prescriptions written has been steadily growing month over month. Teva Pharmaceutical estimates its revenues will be about $80 million in 2024, which is about $25 million higher than my expectations.

Source: Teva Pharmaceutical

Also, on the quarterly earnings call, Richard Francis dispelled my concerns about the commercial prospects of Uzedy, which are caused primarily by the high competition in the schizophrenia therapeutics market, by stating the following.

Now, I’d like to move on to the newest member of our family, UZEDY, and we’re very pleased with the momentum that we have with UZEDY. What we’re seeing is this really favorable product profile continues to attract new physicians and excite them. And as I’ve mentioned before, from a patient perspective, the subcutaneous needle is obviously something they welcome versus the IM.

But also, what we’re not seeing is the practical nature of the administration, the fact that this product doesn’t have to be kept refrigerated, but most importantly, that this can be administered to a patient and they receive – get a therapeutic dose within eight to 24 hours, and physicians love that. And so, this is what is allowing us to compete very effectively and to take market share in the risperidone long-acting market. So, pleased with the progress we’re making there and confident for the rest of the year.

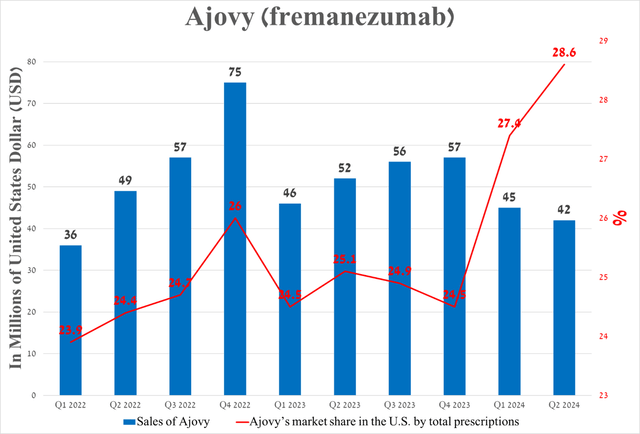

However, what upset me about Teva Pharmaceutical’s recent financial results was Ajovy’s sales in the US.

Why?

Despite continued growth in demand for this anti-CGRP medication used to combat migraines, its sales amounted to $42 million in the second quarter of 2024, down 6.7% quarter-on-quarter and 19.2% year-on-year due to a rise in sales allowances caused by a non-recurring item.

Source: graph was made by Author based on 10-Qs and 10-Ks

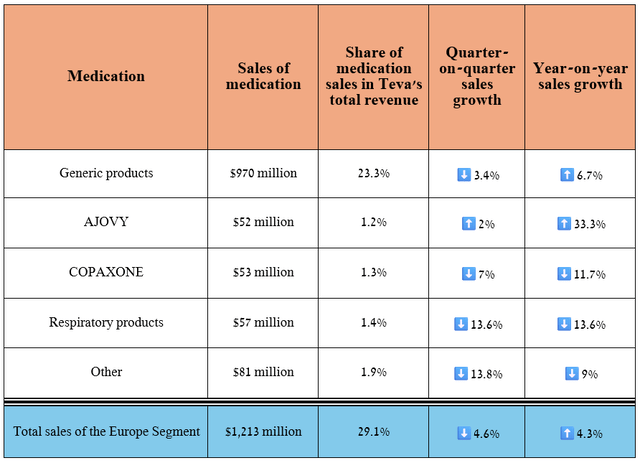

Let’s move on to discuss the company’s Europe segment, whose revenue is primarily generated through sales of generics and biosimilars.

Its sales were about $1.21 billion for the three months ended June 30, 2024, up 4.3% year-on-year, driven by new product launches as well as increased demand for Ajovy.

Source: table was made by Author based on 10-Qs and 10-Ks

On the other hand, sales of respiratory medications remain under pressure due to a decline in cold and flu cases. Also, as I expected, demand for Copaxone is weakening not only due to competition from generic versions but also from more effective drugs for treating relapsing forms of multiple sclerosis, including Bristol-Myers Squibb’s Zeposia, Roche Holding’s Ocrevus (OTCQX:RHHBY), and TG Therapeutics’ Briumvi (TGTX).

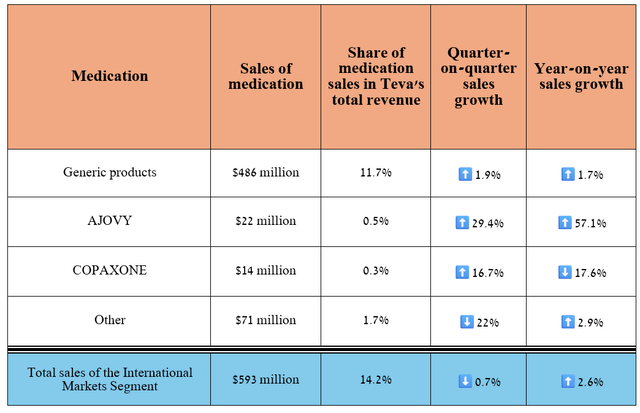

The last segment to discuss is the International Markets segment, which focuses on commercializing its drugs in 35 countries, including Canada and Japan. Its revenue was $593 million in the second quarter, up 2.6% year-on-year.

On the other hand, the segment’s profit was $73 million, down sharply quarter over quarter due to lower demand for Copaxone, higher R&D costs, and sales and marketing expenses related to Austedo’s distribution in China.

Source: table was made by Author based on 10-Qs and 10-Ks

The question arises, “Are there any positives?”

The short answer is yes.

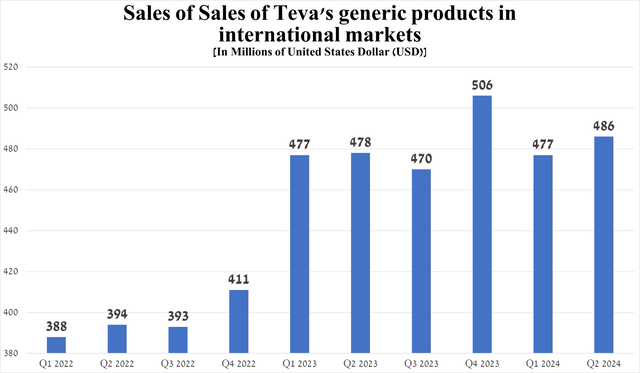

The company’s generic drug revenue has continued to grow in recent years, with the exception of the fourth quarter of 2023. So, it amounted to $486 million for the three months ended June 30, an increase of 1.9% quarter-on-quarter.

Source: graph was made by Author based on 10-Qs and 10-Ks

What is driving the sales growth?

Despite the weakening of foreign currencies, including the Japanese yen, the ruble, and the Chinese yuan against the US dollar, as well as other challenges, including increased competition in Japan and continued inflationary pressure on the pharmaceutical industry, Teva’s management copes with them well by expanding the portfolio of medications and raising prices for them.

Risks

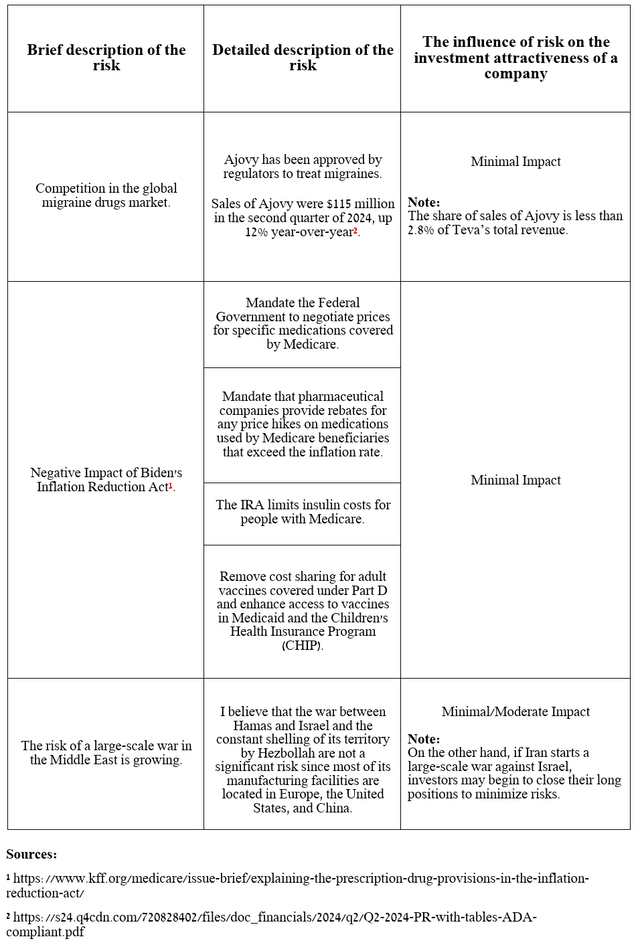

I would like to note the following risks that may negatively affect Teva Pharmaceutical’s investment attractiveness in the medium and long term.

Source: table was made by Author

Takeaway

At the end of July, Teva published financial results for the second quarter of 2024, which not only exceeded analysts’ expectations but, more importantly, strengthened confidence in the effectiveness of the business strategies implemented by Richard Francis.

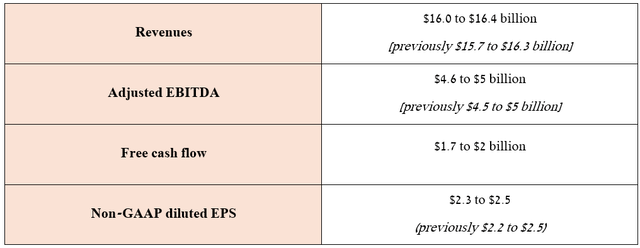

So, in addition to accelerating the recovery of the Tel Aviv-based company’s generics business, as well as stronger sales of Austedo and Uzedy and the launch of the biosimilar to Humira in May, Teva increased its full-year 2024 guidance.

Source: Teva Pharmaceutical

In addition to Teva’s P/E ratio [TTM] of 6.35x, which indicates it trades at a discount to the healthcare sector, I also highlight the reduction of its net debt by about $2 billion over the past 12 months, as well as its year-over-year growth in gross and operating profits as positive drivers.

The company has also accelerated the development of its product candidates as part of its “Pivot to Growth” program, which aims to strengthen its balance sheet and enhance its investment attractiveness by expanding its portfolio of biosimilars and bringing to market potential best-in-class drugs to combat cancer, neurological and autoimmune disorders.

As a result, I continue to cover Teva Pharmaceutical with a ‘Buy’ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.