Summary:

- Despite current financial headwinds and high P/E, I remain bullish on Texas Instruments for its long-term potential, competent management, and dividend growth.

- Q3 2024 results showed some positive results in automotive, personal electronics, and enterprise systems.

- Based on the dividend discount model, I find TXN’s fair value at $183.33 per share, making it overvalued compared to the current share price.

J Studios

Introduction

Trust is very important when it comes to investing. This basically means reliance on the strength, ability and also integrity of a company and its management.

Having trust in management is an important part of my own investment thesis in Texas Instruments Incorporated (NASDAQ:TXN).

It’s been a while since I wrote about TXN. On the 29th of January, I gave the company a BUY rating. For those who would have bought then, this would mean a total return of 31.5%. If you’re interested, you can read the article via this link.

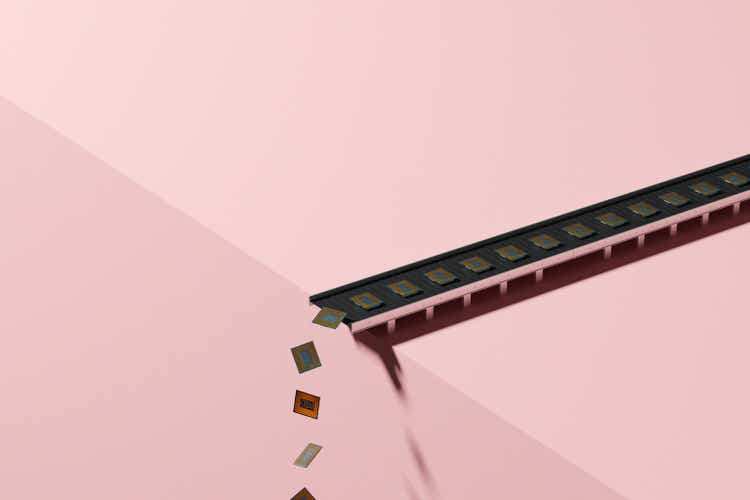

The past few weeks, I saw plenty of reactions from people who don’t understand why people can still be bullish about TXN. The price has risen considerably in recent months. In addition, the company also has a very high PE and the company’s financial results have actually been bad for a long time.

PE ratio development (YCharts)

A high PE in combination with bad financial results seems like a recipe for disaster. However, with cyclical stocks, this principle can work the other way around. A high PE ratio can also be an indication that a stock is cheap!

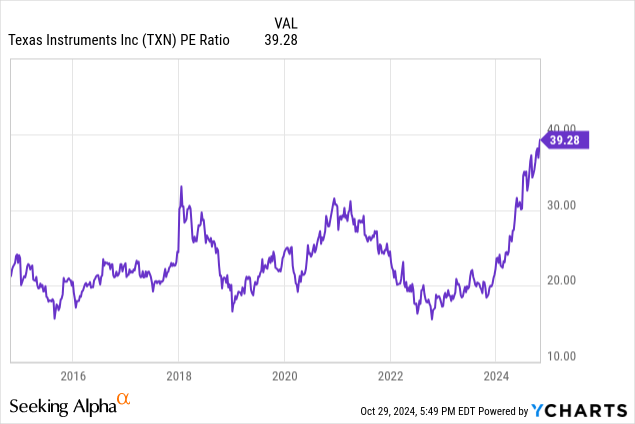

I still see TXN as a solid compounder in my dividend growth portfolio. Despite the financial headwinds, TXN has increased its dividend by 5%. This is of course not in line with its 5Y and 10Y dividend growth CAGRs, but in my view this is very logical, because of its current financial results.

Dividend growth track record (TXN investor relations)

I would like to take this opportunity to update my investment thesis with the latest results to determine whether it is currently attractive to invest in TXN.

The reasons to be bullish

No matter how you look at it, TXN is still a market leader when it comes to analog and embedded chips.

Almost every electric device needs analog chips in order to function. These chips have different functionalities, for example, the ability to measure signals of the environment to allow information to be transferred or converted for further processing and control.

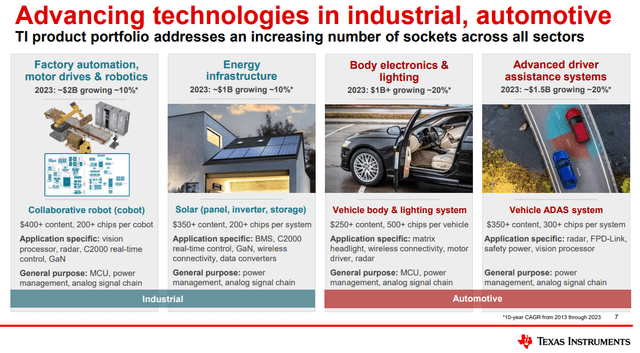

These functions are essential in automotive and the industrial segment, which are long-term growth drivers for TXN. The trigger for new growth is also a potential increase in chips per application, which will allow TXN to sell more.

TXN growth drivers (Capital management presentation)

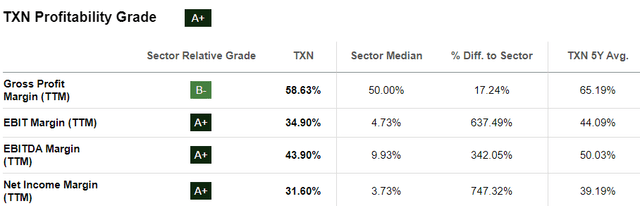

TXN’s competitive advantage lies in 300mm wafer production. These are 40% cheaper compared to the 200mm wafer, which are mainly used by their competitors. TXN also does many of its testing internally, which also benefits its margins. As seen below, TXN scores well on profitability.

TXN profitability metrics (Seeking Alpha)

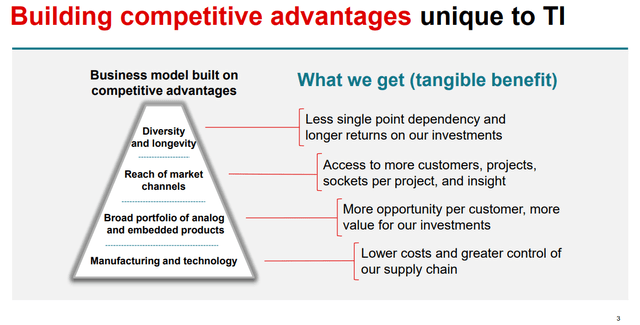

One of the competitive advantages is therefore economies of scale. This applies to both the large-scale production of analog chips, but also the size of the total product portfolio. The total portfolio of +80,000 products is also a pleasant addition for customers.

Competitive advantages (Capital management presentation)

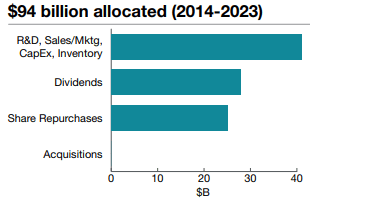

TXN is also extremely clear and disciplined in the way it allocates its capital.

So let me wrap it up and with what we’ve said previously, at our core, we are engineers and technology is the foundation of our company, but ultimately, our objective and the best metric to measure progress and generate value for owners is the long-term growth of free cash flow per share. While we strive to achieve our objectives, we will continue to pursue our three ambitions. We will act like owners, we will own the company for decades.

Haviv Ilan, CEO, Q3 2024 earnings call transcript.

The picture below is how they have allocated their capital over the past 10 years, and it seems like a nice blueprint for a dividend growth investment.

TXN capital allocation (Investor overview)

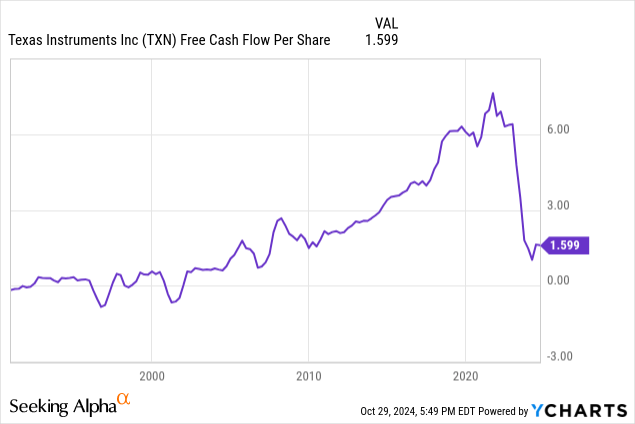

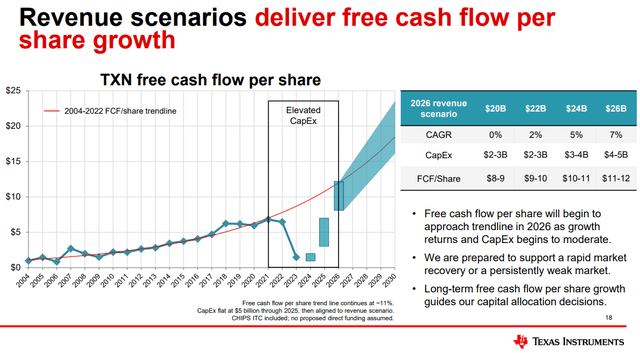

This capital allocation should ultimately lead to an increasing FCF per share. I like to see that FCF per share is the most important metric for the company. They have always put this on the front page of their investor relations. Unfortunately, the company removed it from the website, as the FCF per share has really been in free fall.

FCF per share development (YCharts)

How does TXN think it can regain its path to growth?

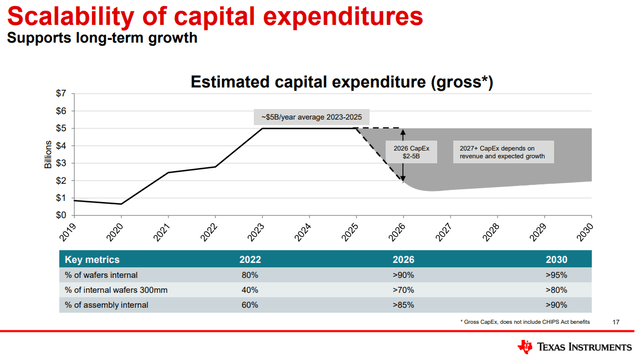

They invest a lot in manufacturing capacity and technology to keep the benefits of lower costs and control of the supply chain compared to peers. This allows TXN to maintain their competitive advantage.

TXN Capital expenditures (Capital management presentation)

However, the CapEx can be considered high if we compare it to the profitability of the company. I think it is strong that the company continues to invest against the current in order to achieve its goals in the long term.

TXN mostly invests in organic growth, which I think is a plus, since growth via acquisitions does not always lead to significant value creation.

Dividend

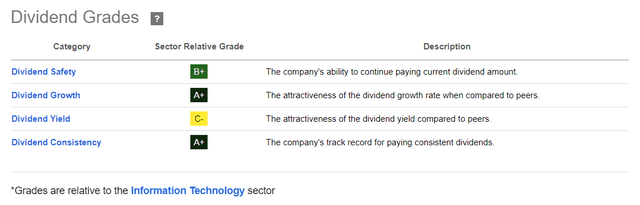

TXN is on its way to becoming a dividend aristocrat. The company scores very well on various metrics on the dividend scorecard of the Seeking Alpha website.

TXN Dividend Grades (Seeking Alpha)

TXN is a great mix in terms of yield and growth. The current TTM dividend yield is 2.53%, which is still quite a bit above its 5Y average of 2.06%.

TXN dividend yield development (Seeking Alpha)

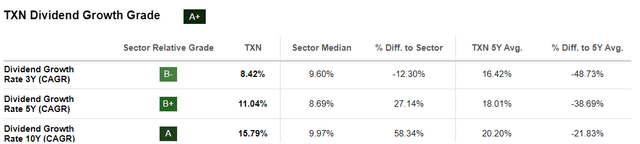

However, there is a clear slowdown in dividend growth in recent years.

TXN dividend growth (Seeking Alpha)

TXN still gets an A+ score when it comes to growth, but I don’t agree with that. Especially if we look at the short term, I don’t expect a lot of dividend growth and definitely not in line with the 5Y dividend growth CAGR of 11.04%. I expect the dividend to grow in low single digits as they want to maintain their dividend growth streak, and the rate of dividend growth will pick up again as the FCF picks up again.

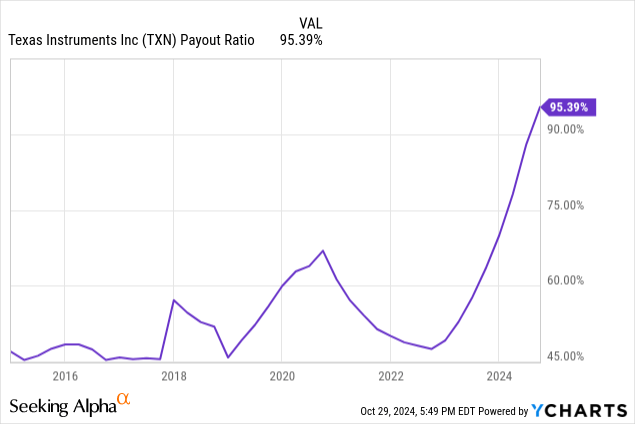

If we assess the dividend safety with the payout ratio, it does not look good at the moment.

TXN dividend safety (YCharts)

TXN is also unable to pay the dividend from its FCF, which I find an unpleasant observation.

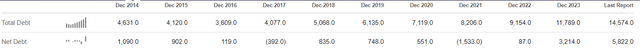

Fortunately, the company has a strong balance sheet that allows them to continue paying the dividend.

Debt development (Seeking Alpha)

However, this should not become a regular thing, as this is normally a red flag for me as an investor. The net debt is quite manageable at the moment, but is clearly moving towards a negative trend, which is certainly something to keep an eye on in the future.

Q3 2024 results and future prospects

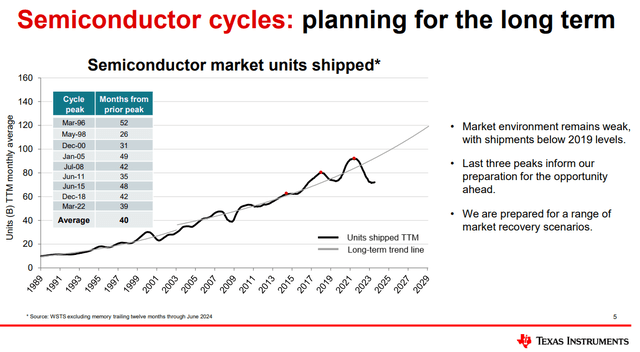

Lower dividend growth, higher payout ratio, a balance sheet that is becoming increasingly weak and a collapsing FCF per share. Not much to be excited about if I sum it up like that. I think in this situation, it is important to look through the cycle to see the positives again.

This semiconductor cycle seems to be moving more extreme compared to previous ones.

Semiconductor cycle volatility (TXN capital management presentation)

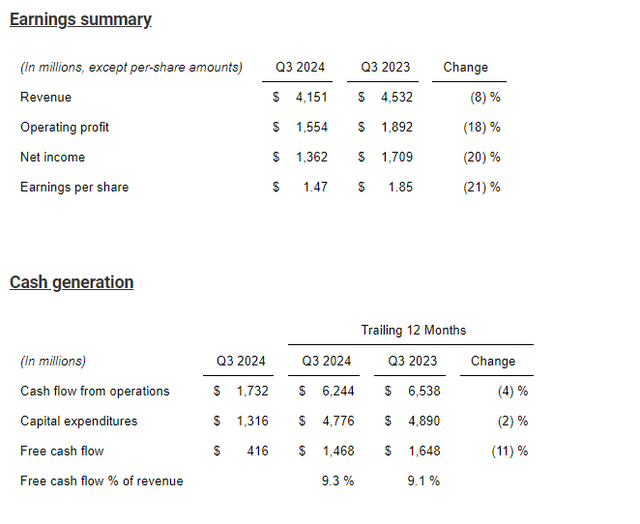

There is still a long way to go, but nevertheless the market reacted positively to the latest quarterly results.

Earnings summary (TXN Q3 2024 results)

Looking at these numbers it doesn’t seem good, but if we are evaluating the results on a sequential basis, things are looking better.

Personal electronics grew 30%, Enterprise systems was up 20% and communication equipment was up 25%. Despite the relative growth, the absolute figures remain well below par. To put it into perspective, personal electronics is still 20% below the level of the 2021 peak.

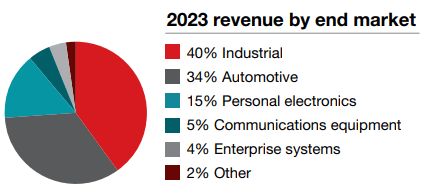

Looking at the bigger picture, these three segments are not the most important ones, since they are a small part of the mix compared to automotive and industrial.

Revenue by end market (TXN investor overview)

The automotive segment increased in upper single digits compared to the Q2 2024, due to a strong Chinese market. In fact, the China automotive revenue is at an all-time high. However, the rest of the automotive market is in less good shape and there is still less demand considering several profit warnings from major car brands such as: Mercedes-Benz Group (OTCPK:MBGAF), Stellantis N.V. (STLA), Aston Martin (OTCPK:AMGDF) and Volkswagen AG (OTCPK:VWAGY). In my opinion, this will not change in the short-term, since I think it is likely that the automotive market has not yet bottomed out. The long-term trend, on the other hand, is good for TXN, as cars contain more and more technology and therefore require more analog chips.

Industrial is still heavily affected by the economic headwinds. In concrete terms, revenue is still 30% lower than its peak in 2022 and TXN has faced eight quarters of decline. Comparing Q2 2024 to Q3 2024, the industrial market was down low-single digits as customers continue to reduce their inventory. Management indicates that several sectors in this segment have reached their bottom, but also remain hovering at that bottom. They also indicate that they expect recovery, but they cannot estimate this at a quarterly level.

What is also striking is the increase in inventory, and this trend has been going on for quite some time.

TXN inventory development (Seeking Alpha)

Several questions were asked about inventory levels in the last earnings call, and management said the following:

Just to comment a little more on the inventory, we have detailed plans by device at the finished goods level, at the chips level, and those plans are grounded on purchasing behavior and expected demand and this inventory is very low-risk. It sells to many, many customers and it has a long life cycle. So we feel really good, really good about that.

Rafael Lizardi, CFO, Q3 2024 earnings call transcript.

In short: contrarian thinking and moving against the cycle. TXN has known times in the past when there was too little inventory. They want to get ahead of this and be fully ready for the next up cycle.

Management attaches great importance to the long term and is prepared to make significant investments in a downturn in order to benefit from this later on.

Long term free cash flow growth (Capital management presentation)

Based on the quarterly results, we can see that there are several positive signals in various segments. In the short term, it is difficult to predict the exact moment of the upturn in the automotive and industrial segments. Management is sticking to its strategy to get off to a good start when times are getting better.

I think management is doing great things. Firstly, the interest of management aligns perfectly with the shareholder, due to the fact that the focus is on the FCF growth per share in the long term. Secondly, management is willing to give up short-term profits and prioritizing the long-term opportunities. And finally, they have an excellent track record when it comes to capital allocation, and they have always been clear about their actions.

Valuation

I used the dividend discount model to make an estimate of TXN’s fair value. This model fits the company greatly, because of their dividend growth policy and track record.

In FY 2024 TXN will pay $5.26 per share in dividends. My estimated dividend increase of 3-5% has therefore come true.

For the new calculation, a new estimate of the total dividend in FY 2025 will have to be made. In my opinion, it will heavily depend on how the cycle will behave next year. However, the CapEx will still be around $5 billion, and I therefore expect another dividend increase of approximately 5%.

This will result in a total dividend of $5.50 (3 quarters of $1.36 and 1 quarter of $1.42). I used a relatively high personal hurdle rate of 12.5%. Although I have confidence in management, the potential downside could be significant if the CapEx cannot be translated into FCF.

I think a dividend growth rate of 9.5% is still achievable, but I think this growth rate will be achieved when the CapEx becomes lower (in 2026) and profitability increases again.

If we do the math, this results in a fair value of $183.33 per share, which means the stock is currently overvalued.

Conclusion

I’m still bullish on TXN for the long term, and the company could be an excellent addition for the investor who seek a combination of a solid dividend yield and dividend growth. Despite that, I certainly don’t think TXN is cheap at the moment. I am also not considering selling my position, as I see the long-term potential of the company. On the other hand, I am not willing to pay an exorbitant price for TXN.

The big question is whether you have confidence in the choices that management makes. Maybe TXN is taking too much risk with its investments in future growth, and perhaps the high CapEx will not lead to the desired value creation.

Another important risk to mention applies to the semiconductor space in general, as geopolitical tension may lead to reduced growth. A concrete example of this is the possibility of China related trading restrictions. Based on the numbers from the 2023 annual report, the revenue from China is approximately 20% and the restrictions or competition from companies in China itself can have a painful impact on TXN’s business performance.

Taking all considerations into account, I currently give TXN a “HOLD” rating. Personally, I will gradually increase my position as the share price gets closer to my fair value.

Happy investing everyone!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.