Summary:

- Texas Instruments’ stock has lost momentum since 2021, and the company is now in a cyclical downturn.

- I have low expectations for both this quarter and the first half of 2024.

- Texas Instruments’ decision to build lots of new manufacturing capacity will be a key driver in whether the firm returns to strong growth in coming years.

- I am upbeat about the company’s long-term outlook but shares don’t seem attractive at today’s price given the prolonged industry slump.

wellesenterprises

Texas Instruments (NASDAQ:TXN) is the world’s largest analog semiconductor company. Through a combination of R&D, shrewd M&A, and new product launches, Texas Instruments has successfully navigated the changing tech landscape over the decades and generated market-beating returns for its loyal shareholders.

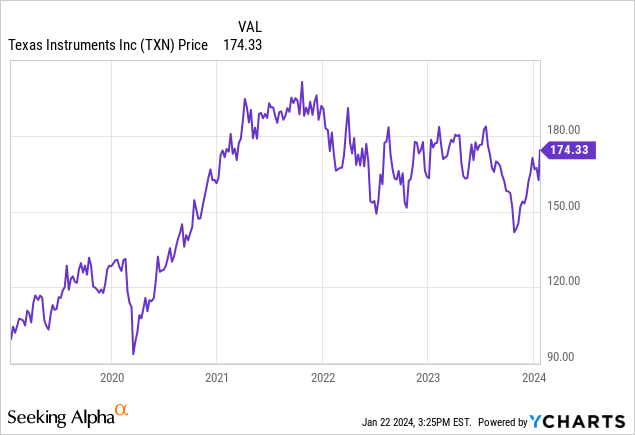

After a tremendous run in the 2010s, however, Texas Instruments’ stock has lost momentum in recent years. After hitting fresh all-time highs in 2021, the stock has largely traded sideways since then, and indeed, shares broke down rather sharply last fall before the recent bounce:

Texas Instruments finds itself at a fascinating position heading into its earnings report Tuesday afternoon. From a technical perspective, shares have just rallied after a prolonged period of sideways chop, leading traders to wonder whether this is setting up to break out higher.

And on the fundamentals side, Texas Instruments has changed its business strategy a bit in recent years. After a long-time focus on capital light operations, the company has recently invested heavily in building additional fabrication units in the United States.

This decision has brought about some controversy. Analysts have long appreciated Texas Instruments for its high profitability metrics and impressive capital return program. Investing tens of billions of dollars in new manufacturing capacity is a decided turn from that.

Analog semiconductors have a reputation of being less expensive and less cutting-edge than most other kinds of chips. A good analog chip design can remain in the marketplace for many years and analog R&D tends to earn predictable returns on investment. Texas Instruments is skilled at managing its R&D and intellectual property, whereas a heavy push into manufacturing adds more uncertainty to the firm’s potential outcomes over the next 5-10 years.

Throw in the deep downturn in key end markets such as automotive, and Texas Instruments has made a big investment push at a seemingly less than auspicious time.

Expecting Soft Earnings For This Quarter And Into 2024

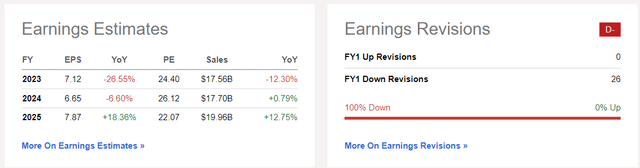

The analyst consensus heading into this quarter is quite negative:

TXN Earnings Outlook (Seeking Alpha)

The company is set to see revenues drop about 12% for fiscal 2023 with that leading to a 27% or so full-year EPS decline. Q4’s numbers will not end up effecting the overall result for 2023 all that much, as a soft year has been baked into expectations for a long time now.

What is worrisome, however, is the trajectory for 2024. Analysts now see the firm growing revenues by less than 1% in 2024, while looking for another 7% drop in earnings per share as gross margins decrease. Notably, 26 different analysts have cut their estimates for the company recently. With the downturn in automotive and other industrial markets that are vital to Texas Instruments’ business, it is not surprising that the outlook is pointing in the negative direction.

Also, several other analog semiconductor firms had downbeat earnings and guidance in their most recent quarters as well, suggesting that the whole category is in a continued slump. Microchip (MCHP), for example, just warned that its next quarter’s revenues will be down about 22%, which will come in well below its prior guidance. All signs point to Texas Instruments seeing its recent earnings slump continuing both in this quarter and into 2024.

Investing Through The Cycle

It’d be easy to look at the above information and conclude it’s all bad news for Texas Instruments. However, I’d urge investors to consider the bigger picture. Global semiconductor industry revenues slid 11% last year, even amid all the AI-related excitement. It was a tough year for the majority of firms in the industry. Semiconductors are a cyclical business, and Texas Instruments is in a down part of the cycle. However, I have confidence that management will stay focused on the long-term and not make rash decisions during this challenging period.

In the company’s investor overview, Texas Instruments starts off with some general principles that guide its decision-making:

• “We run the company with the mindset of being a long term owner.

• We believe that growth of free cash flow per share is the primary driver of long-term value.

• Our ambitions and values are integral to how we build TI stronger; when we’re successful in achieving these ambitions, our employees, customers, communities and shareholders all win.

• Our strategy is comprised of a great business model, a disciplined approach to capital allocation and a focus on efficiency.

• Our business model is built around four sustainable competitive advantages: manufacturing and technology, broad product portfolio, reach of our market channels, and diverse and long-lived positions.

• After accretive investments in the business to grow free cash flow for the long term, the remaining cash will be returned over time via dividends and share repurchases.”

I love the explicit focus on the growth of free cash flow per share. It is free cash, after all, that is the clearest driver of how much the company can reward its shareholders via dividends and share repurchases.

For many years, Texas Instruments prioritized a capital-light approach that outsourced much of its work to foundries. This allowed Texas Instruments to reinvest more capital in areas where it had stronger competitive advantages along with returning lots of cash to shareholders.

More recently, however, Texas Instruments has announced massive investments in new manufacturing facilities in the United States. As the final point in the overview states, all remaining cash after accretive investments will be returned to shareholders via dividends and share repurchases. Now, the company believes it can generate a higher growth rate in free cash flow through internal reinvestment rather than aggressively buying back stock. Whether management has made the right call here or not will be crucial to whether TXN stock outperforms over the next five years.

I am curious to see in this earnings report — and throughout 2024 — how management views its more capital-intensive approach. There has been some rising skepticism around the CHIPs Act and the government’s commitment to supporting the domestic semiconductor manufacturing industry. Other firms like Taiwan Semiconductor Manufacturing (TSM) have seen delays in some of their new U.S. manufacturing facilities.

What’s the outlook for Texas Instrument’s new investments? And will the company’s approach change at all as interest rates have seemingly peaked for this cycle and have started to drop once again in recent months? Keep in mind that it’s an election year and semiconductors are a hot-button issue as politicians debate the best approach to handling cybersecurity, relations with China, and geopolitical concerns around Taiwan. I will be watching to see how Texas Instruments and other chip firms see the landscape and how implementation of the CHIPs Act is coming along.

TXN Stock Bottom Line

I’d love to be more bullish on the company’s shares, given my confidence in the management team and its long-term shareholder value-building approach. That said, I can’t get past the idea that shares have already rallied sharply despite the actual business not yet showing any sign of escaping its downturn.

For example, last week, UBS upgraded Texas Instruments from hold to buy and raised its price target from $170 to $195. According to Seeking Alpha, UBS upgraded the company because:

“TXN should be among the first to see orders inflect higher given less reliance on distribution (for TXN there is very little lag time between orders and revenue turning higher) and the company also has cleaner comps and fundamentals as it was one of the few companies not to employ supply agreements during the peak.

The stock trades on orders and Free cash flow, or FCF, both of which look set to inflect positively, the analysts added.”

The issue here, however, is that this sort of analyst action has sparked some optimism heading into this report. Now, if Texas Instruments does report an uptick in order activity, that will be in-line with UBS’ recent call. Whereas if Texas Instruments merely reiterates prior guidance let alone cutting it, that could set the stage for disappointment. Given trends we’re seeing in key markets such as autos, it’s hard to believe guidance will be particularly upbeat for the first half of 2024.

Texas Instruments shares have bounced from a 52-week low of $139.48 to $175 over the past quarter. This jump seems to be mostly inspired by general market movement and improving investor sentiment around the tech and semiconductor industries.

However, there’s very little specific to Texas Instruments’ business or end markets that would suggest that the first half of 2024, if not longer, is going to meaningfully improve.

As such, I am at a hold rating on TXN stock today. I believe shares are about fairly valued and are worth keeping for long-term investors, and indeed I continue to own Texas Instruments shares in my buy-and-hold portfolio. However, given the weak industry outlook for at least the next few quarters, I see no compelling reason to rush into TXN stock at today’s price.

I suspect much of the support for Texas Instruments shares has come because it is a significant component of the VanEck Semiconductor ETF (SMH) and other funds which track the chips industry. These funds have, understandably, attracted a great deal of capital as folks look to play emerging themes such as artificial intelligence and augmented reality. However, for many semiconductor companies, including Texas Instruments, there is little reason to think AI will have a particularly meaningful impact on near-term earnings. To the extent that Texas Instruments shares have rallied because of industry-wide AI excitement, I don’t see that valuation bump being sustainable.

As a standalone company, Texas Instruments is a great operator with a wonderful approach to shareholder returns. However, 2024 looks like it will be another challenging year for analog chipmakers as their customers are not looking to build inventory or raise production levels at the present time. TXN stock at close to 25 times forward earnings isn’t a particular bargain given the macroeconomic context. Unless earnings come in far stronger than expected, I’d be waiting for a dip toward $150/share to add to my position in Texas Instruments stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you enjoyed this, consider Ian’s Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.