Summary:

- Texas Instruments has a strong balance sheet and impressive margins but faces risks from high valuation and technological changes impacting product life cycles.

- The stock trades at a high P/E ratio, suggesting potential overvaluation, despite strong dividend growth and solid financial health.

- Competition and overseas revenue exposure could pressure margins, making it crucial to monitor financial performance closely.

- I rate Texas Instruments a hold, recommending waiting for a better entry level due to current high prices and uncertain future returns.

kuriputosu

My education background was chiefly mathematics and hard science. Because of this, for me and my fellow students, Texas Instruments (NASDAQ:TXN) was absolutely a household name. Almost everybody had advanced TI calculators, and they were known for being the reliable standard for people taking these sorts of classes really seriously.

Today, I want to look at Texas Instruments stock, of course recognizing the company is a lot more than just 1990s graphing calculators. They make a lot of products, and are heavily involved in both the industrial and automotive business. They’re also a potential income play, having just this month raised their quarterly dividend by almost five percent. That’s a good sign, but there’s a lot more to understanding a company this size.

Balance Sheet – Large But Manageable Debt

|

Cash and Equivalents |

$2.7 billion |

|

Inventories |

$4.1 billion |

|

Total Current Assets |

$16.8 billion |

|

Total Assets |

$35.0 billion |

|

Total Current Liabilities |

$3.6 billion |

|

Long-Term Debt |

$12.8 billion |

|

Total Liabilities |

$17.8 billion |

|

Total Shareholders’ Equity |

$17.2 billion |

(source: most recent 10-Q from SEC)

Texas Instruments has a solid balance sheet with a fairly flexible amount of cash and an excellent current ratio of 4.67. They have a not-insubstantial amount of long-term debt, but as they point out in their financial filings, there is no reason to think that they won’t be able to continue to service a debt this size.

Their industry is known for trading at a pretty substantial premium to book value. The present sector median price/book is 3.22. That’s a lot, but Texas Instruments kind of takes this to an extreme at current prices, trading at 10.87 times their current book value. That to me screams of a risk of overpaying for what the company is.

The Risks

Texas Instruments has an admirable array of technologies to bring to bear in their various offerings. That’s part of the appeal of the company at any level, but the company has warned that rapid technological changes that we’re seeing recently are shortening their product life cycles. That could mean worsening margins and the end of an era when a math student could expect to get a good 5-10 years out of a TI calculator without worrying about being obsolete.

Profitability is important, and if Texas Instruments has to invest too much into research and development to keep their products top of the line, there is a risk that weaken margins could impact the bottom line going forward.

Competition is a huge matter for a semiconductor powerhouse like Texas Instruments, and it’s not just the traditional domestic competition. In 2023, roughly 65% of the company’s $17.5 billion in revenue came from overseas. That’s great if they can remain strong overseas, but that exposure also is a potential problem, as once again, the margins could be particularly under pressure if the overseas economies don’t support purchasing at present levels.

Good Margins If You Can Keep Them

|

2021 |

2022 |

2023 |

2024 (1H) |

|

|

Revenue |

$18.3 billion |

$20.0 billion |

$17.5 billion |

$7.5 billion |

|

Gross Profit |

$12.4 billion |

$13.8 billion |

$11.0 billion |

$4.3 billion |

|

Gross Margin |

67.7% |

69.0% |

62.8% |

57.3% |

|

Operating Income |

$9.0 billion |

$10.1 billion |

$7.3 billion |

$2.5 billion |

|

Operating Margin |

49.2% |

50.5% |

41.7% |

33.3% |

|

Net Income |

$7.8 billion |

$8.7 billion |

$6.5 billion |

$2.2 billion |

|

Diluted EPS |

$8.26 |

$9.41 |

$7.07 |

$2.42 |

(source: most recent 10-K and 10-Q from SEC)

For me, the big feature of this statement of operations is that Texas Instruments, at least the Texas Instruments of 2022, was commanding very impressive margins. That’s huge as they deliver strong products, which are always under pricing pressure from competition. If they can sustain that sort of margins, it would be very good news for the company going forward. That’s not necessarily what we’re seeing.

Though the margins aren’t disastrously lower, they’ve clearly been trending downward in the last couple of years. That is likely at least in part a function of the rapid change in technology and the ever-present competition. Clearly, Texas Instruments can make quite a bit of money even at these somewhat lower margins, but it is not as strong as they once were.

Competition has also bitten into the revenue in recent years, so Texas Instruments isn’t growing at the rate that I would like to see from a company with these sorts of multiples. Again, it’s not a devastating drop, but does seem a bit of a rough patch.

Estimates expect things not to be too dissimilar going forward, with expectations of revenue this year down to $15.74 billion and next year a rebound to $17.97 billion. That’s fine as far as it goes, but the earnings per share are $5.29 this year and $6.51 next, both a bit on the weak side.

What this means is that the company will be at a P/E ratio of 38.76, quite a bit higher than the sector median of 23.73. I can see justifying the premium if the company was growing, or simply by virtue of them being a blue chip company with high margins. Ultimately, though, it seems a bit excessive to me.

The dividend is a bit better news. As I mentioned earlier, they recently raised the dividend to $1.36 per quarter, which brings their yield to 2.65%. That’s higher than the sector median in this case, and so long as earnings remain strong, there is plenty of room to grow that dividend going forward.

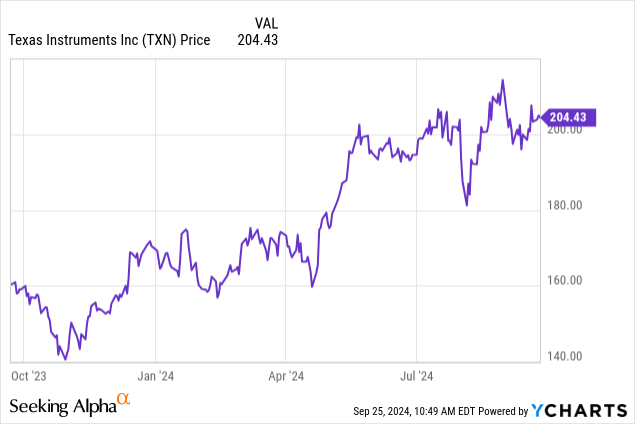

A Nice Company But Needs a Better Entry Level

Texas Instruments is trading at the high end of the 52-week range, and while I really like the company and their products, I just don’t like the price we’re being asked to pay right now. I have to rate this a hold, looking for a better entry level.

At the right price, Texas Instruments could be a nice dividend play for buy and hold investors. We’ve seen those prices earlier this year, but right now, there are just too many questions to think we’re going to get a solid return on our investment.

For investors, I would advise keeping a very close eye on the gross margin and operating margin of the company in the next few quarters. If margins continue to be under pressure, that could be very dangerous to the bottom line, and a sign they may not be handling the current environment as well as they might.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.