Summary:

- Texas Instruments is a safer investment than TSMC due to geopolitical risks surrounding Taiwan and growing US-China tensions.

- Texas Instruments focuses on analog and embedded processing chips, selling to various end markets.

- TSMC has a larger product and service portfolio and a significant advantage in research and development, but geopolitical risks pose immediate downside risk.

- My investment thesis proposes Texas Instruments is a Buy and TSM a Hold.

Annabelle Chih

There’s nothing like Taiwan Semiconductor Manufacturing Company (TSM). But, Texas Instruments (NASDAQ:TXN) is a better investment at current due to geopolitical risks surrounding Taiwan, and growing US-China tensions. While both companies are significantly different from each other in operational capacity, TSMC being a semiconductor foundry and Texas Instruments focusing on its own semiconductor products, Texas Instruments is the more compelling semiconductor investment based on my analysis of geopolitical security.

Operational Analysis of TXN & TSMC

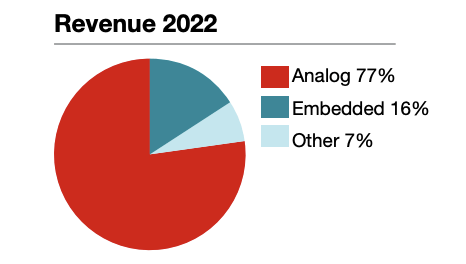

Texas Instruments focuses predominantly on analog and embedded processing chips.

TXN Revenue Sources 2022 (Texas Instruments Investor Overview White Paper)

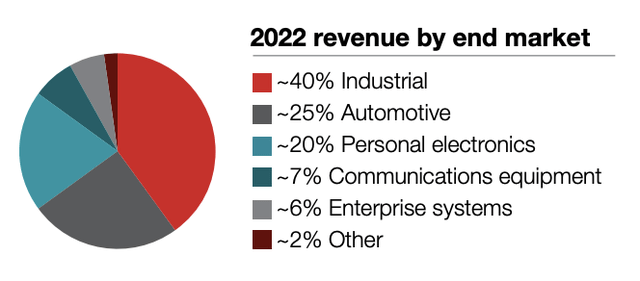

These products are sold to a range of end markets. As of 2022, the largest are industrial, automotive, and personal electronics.

TXN End-Market Revenue 2022 (Texas Instruments Investor Overview White Paper)

As noted in TXN’s Investor Overview White Paper, the company has a ‘portfolio of approximately 80,000 products’. They also state this is bigger than their competitors’ portfolios. Another stressed highlight is that ‘most customers’ applications use tens, if not hundreds of chips, in each system’.

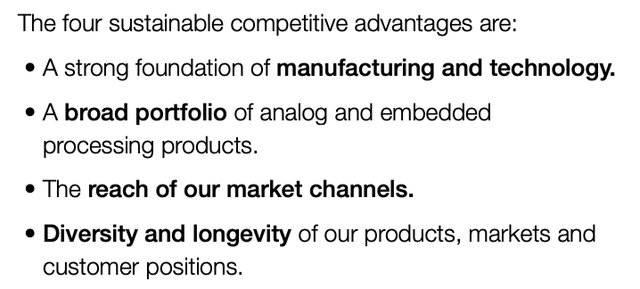

TXN’s operational strategy has been broken down into four succinct ‘competitive advantages’, which I believe are particularly useful for Seeking Alpha readers:

TXN Four Sustainable Competitive Advantages (Texas Instruments Investor Overview White Paper)

I have seen immense stress on long-term outcomes, and I have also noticed in the Overview White Paper, a high value on shareholders, which is evidenced by their generous forward dividend yield of 3.63% as compared to TSMC’s 2.09% trailing-twelve-month yield.

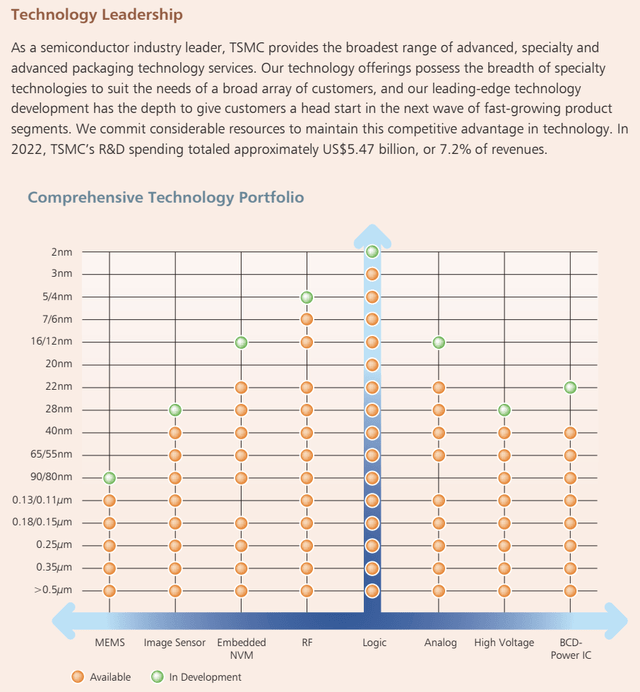

TSMC’s product and service portfolio is, however, unmatched. This is made evident in the company’s 2022 Business Overview.

TSMC Technology Portfolio 2022 (TSMC 2022 Business Overview)

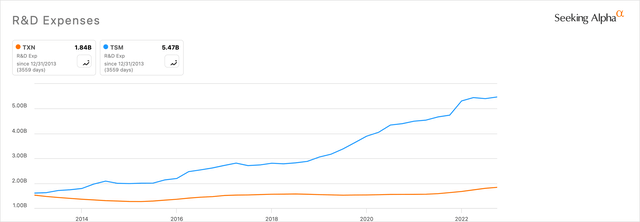

To put TSMC’s growth advantages against Texas Instruments, I’ve compared the two organizations on R&D expenses, which is an indicator of how quickly each company will continue to assume operational and market advantages in their prospective sectors.

Seeking Alpha

As is made evident, TSMC has a massive advantage in research and development, which signifies its continued leading place as the world’s most advanced semiconductor company.

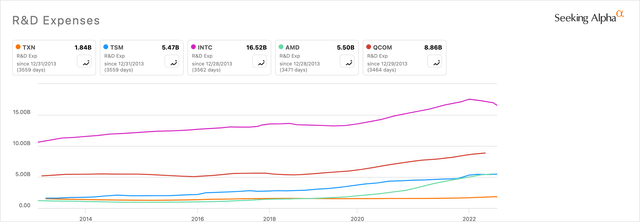

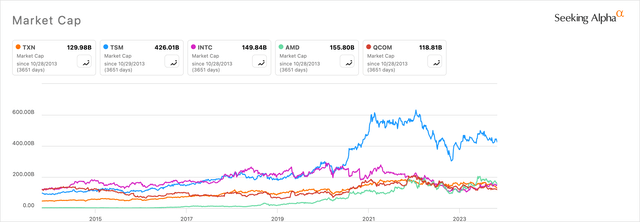

This is further evidenced when we compare R&D expenses across a wider range of peers, and then perform the same peer comparison based on market cap. Of course, Intel and Qualcomm are notably more diverse businesses, so higher R&D can be associated with other domains of revenue.

Seeking Alpha

It is a spectacle to see TSMC’s market cap dominance in its industry and a relatively low R&D expense related to a wider set of peers than just Texas Instruments.

Seeking Alpha

TSMC has stressed ‘leadership and differentiation’ associated with its $5.47bn R&D expense in its 2022 Business Overview. I think that succinctly captures the essence of a TSMC investment based on intrinsic business operations, which is a league-of-its-own semiconductor company with an immense technological moat around it.

Geopolitical Analysis of TSMC

The current geopolitical tensions between China and the US related to Taiwan are very difficult to price into TSMC stock. I do not think that the current share price of $86 is adequately representing the potential for immense volatility following an invasion of Taiwan by Chinese forces.

I have studied meticulously the nature of the brewing tensions and have found concrete evidence of China’s stance on Taiwan, which does not bode well for the US interests of TSMC, culminating in either an agreement between the US and China on Taiwan’s status as an ‘inalienable part of China’s territory’ (as stated in their 2022 statement by the Ministry of Foreign Affairs of the People’s Republic of China) or a hot war.

The first instance is much more favorable for TSMC shareholders (and the world), as production and delivery could largely go on unimpeded. The real cost would fall on America’s long-term standing in the global order. The second scenario is an awful picture for TSMC stock price as output would be largely distraught at a frightening pace. The outcome of such a hot war is relatively unquantifiable at the investment analysis level and also is relative to the scale such a war pertains. What is for sure is that a TSMC investment in the current geopolitical landscape holds an immense amount of immediate downside risk from a Taiwan-centered US-China conflict.

To give readers the full extent of China’s seriousness surrounding the Taiwan concern, the well-documented Chinese military drills reported around the country on August 19 by world media outlets powerfully evidenced a battle-ready China fully aware of Taiwan’s significance on the global stage.

Investors such as myself looking for exceptional companies have to resist analyzing the company on a purely operational and financial basis, for TSMC is a powerful target in international political world order.

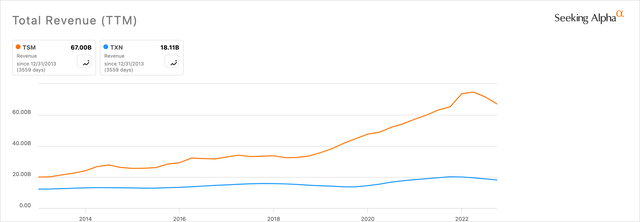

The temptation lies in the incredible growth metrics, such as revenue growth, especially when compared to my semiconductor favorite, Texas Instruments:

Seeking Alpha

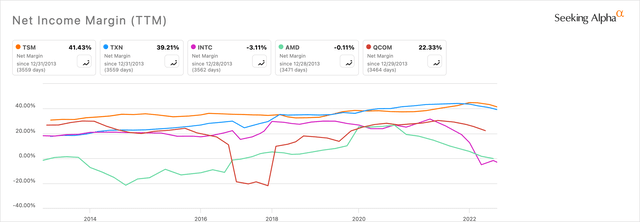

Or even the industry-leading net margins, where TXN also shines:

Seeking Alpha

However, where I am really impressed is TSMC’s valuation, which is what makes it such a compelling investment for me even given the geopolitical risk. However, when analyzing it against Texas Instruments, I’ve found TXN to be the more reliable and still competitive long-term candidate. The defining factor is Texas Instrument’s domestic production on US soil, protecting it powerfully from the same volatility a TSMC investment may entail.

Valuation Analysis of TSMC & TXN

I’ve decided to compare TSMC & Texas Instruments using a discounted cash flow analysis on an earnings per share without non-recurring items basis.

Using TSMC’s 10-year average growth rate of 16% for this metric for a 10-year growth stage, a following 10-year 4% growth terminal stage, and an 11% discount rate, the fair value of the stock is $144.20. With a share price of $85.99 at the time of this writing, which provides me with a margin of safety of 40.37%, which is very favorable.

When comparing Texas Instruments by the same method, except with a 10-year average growth rate of 19.10%, and all other parameters being the same, the outcome is a fair value of $226.52. With the current share price at $143.15, that positions my investment in the company with a margin of safety of 36.80%.

Those readings come close enough to each other to warrant an emphasis on how well Texas Instruments is performing on discounted cash flow analysis whilst also being on US soil.

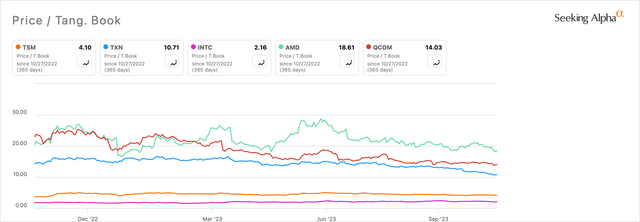

I’ve also compared the dataset of five competitors I’ve used throughout this article on P/E ratio and price-to-tangible-book value:

AMD & INTC removed due to negative readings (Seeking Alpha)

Seeking Alpha

My findings show me that Texas Instruments has a relatively high P/E ratio comparatively, but an average price-to-tangible-book value. TSMC, on the other hand, is relatively favorable on both fronts.

I’ve also looked at the forward GAAP P/E ratios for both TXN and TSMC, which are 19.90 and 17.56 respectively. That shows a higher valuation on the horizon for both companies. That signals a caution that investors like myself need to be aware of; ever-growing attention on semiconductors as investment vehicles could render current favorable valuations fleeting.

The TSMC Quant Ratings show us a valuation grade of C-, down from C+ six months ago. TXN also has a C- Quant Rating, the same as six months ago. The comparative ratings support my analysis that, on valuation measures, considering an investment in TXN over TSMC is a prudent move when pricing in the geopolitical safety that a TXN investment includes.

Q3 2023 Earnings Considerations

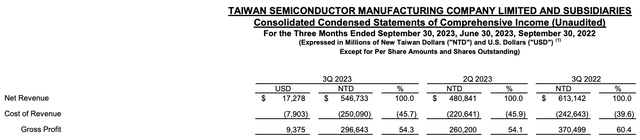

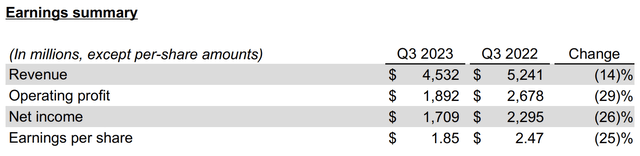

Both companies have seen a considerable decline in revenues and financial performance across the board in Q3 2023 earnings. This signifies a larger slowdown in demand for computers, smartphones, and AI market instability, which I project will stabilize once macroeconomic factors improve and US domestic and global spending increases. Current conditions continue to provide investors like me with an opportunity to purchase shares at a considerable discount.

TSMC Q3 2023 Earnings Release

Texas Instruments Q3 2023 Earnings Release

It’s worth noting that TSMC did beat estimates and consensus supports the notion that the semiconductor industry is positioned for recovery and a strong growth year lays ahead. Part of the increased demand will be for AI chips as the industry becomes more commercially dominant. This is an area where TSMC’s advanced capabilities will continue to shine.

If we look at current prices in relation to recent earnings, we can see the opportunity here. Prices for TXN are currently down 29.23% since the September 2021 all-time high.

Seeking Alpha

Conclusion

Texas Instruments is by and large the safer and more prudent investment than TSMC. I own shares in both companies, but TSMC carries a significant amount of macroeconomic risk unlike any other market-leading company in the world right now. I’m astute enough not to be tempted by the meticulously positioned financials and operational dominance when the wider geopolitical environment spells potentially heavy price volatility and significant downside risk. Texas Instruments offers compelling operational positioning, strong financials, and a relatively equal valuation measure to TSMC, whilst also providing US-domestic production and hence much less downside risk related to Taiwan.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.