Summary:

- TXN is structurally advantaged to gain market share and margins within one of the fastest growing analog semiconductor markets.

- Fab ownership makes TXN’s supply chain one of the safest among peers, allows it to better control costs and maximize returns on investments.

- Superior distribution will catalyze margin growth and market share gains, especially with smaller accounts.

Ismed Syahrul

I expect Texas Instruments (NASDAQ:TXN) to experience accelerating top-line growth above peers coupled with margin expansion from competitive advantages hardly replicable and specific to its long-term strategy.

Business Overview

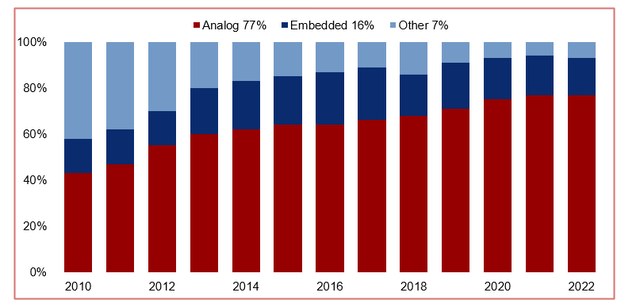

Texas Instruments (“TI”) designs, manufactures and sells analog and embedded semiconductors. An increasing majority TI’s business comes from analog semiconductors (77% of revenues from 43% in 2010). Compared to digital chips, analog semiconductors’ PLC is often decades long and require much less CAPEX as they are built on older and more stable node technology.

Effects of End Market Focus

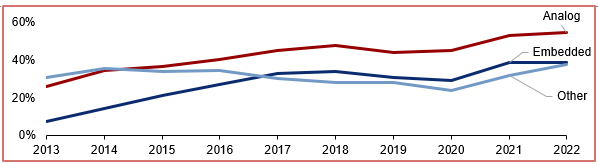

TI’s management will be the first to let you know about their focus on industrial and automotive customers. 65% of revenues were from these two segments as of the latest filing, up from 42% in 2013, and management aims to continue increasing their share in the coming years. While this is well known, I believe that TI’s advantage over both small and large competitors in these markets is not fully understood.

1) Market Growth

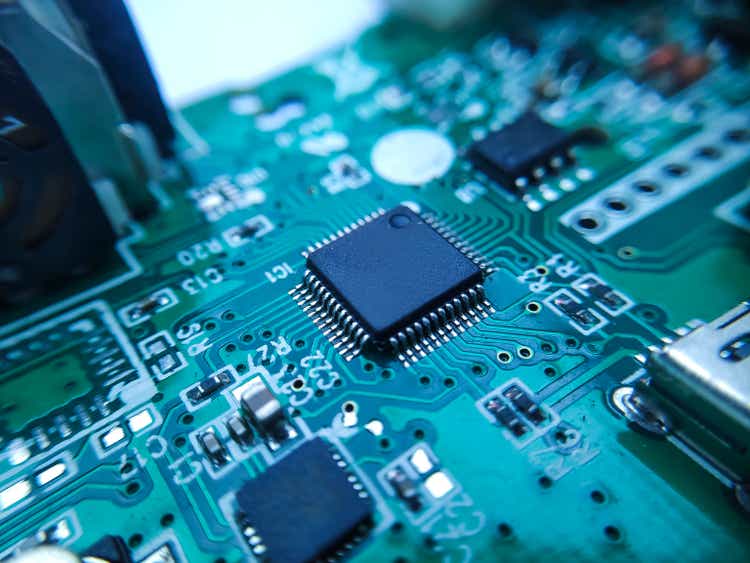

Automotive and Industrial are leading in growth expectations due to secular trends that are not likely to be supplanted by any technological change or similar disruptive technology in the near future:

CAGR of Semiconductor Demand by End Market (to 2030) (McKinsey)

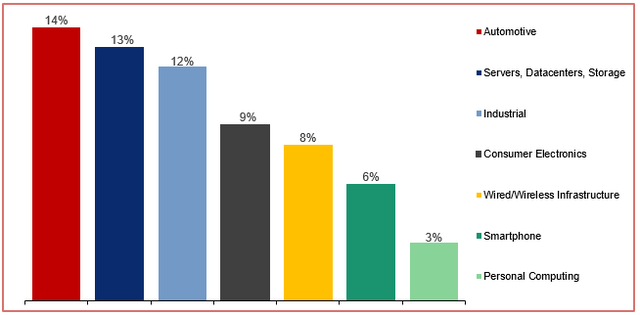

Vehicle electrification and advanced driver-assistance systems (ADAS) are expected to be the main drivers of chip content per vehicle increasing more than threefold from 2019 to 2030. In fact, the chart below from McKinsey shows the chip content per vehicle forecasted by node size. The leading edge chips (currently <28nm nodes) are a minority of expected demand and TI is well-positioned relative to the highest demand areas: it is investing primarily in 45nm to 130nm.

Automotive Semiconductor Demand Forecast by node size (McKinsey)

2) Margin Expansion

These two markets consume products within TI’s highest margin segment.

In their latest earnings call, TI mentioned that their “[…] industrial and automotive customers are increasingly turning to analog and embedded technologies to make their end products smarter, safer, more connected and more efficient” which can help explain the following trend:

Share of Revenues by Segment (Company Filings Formatted by Author)

The rising share of TI’s revenues coming from analog therefore coincides with their end market focus. As seen in the figure below, analog profitability for TI is well above other product segments.

Operating Margin per Product Segment (Company Filings Formatted by Author)

I expect analog product’s superior profitability to endure for the following reasons:

- Decreased R&D Expenses

Longer design cycles (5-7 yrs.) for auto/industrial implies reduced R&D expenses related to design cycle product development and increases earnings visibility

- Higher Price Insensitivity from Customers

According to a former director of product management, during TI’s transition from personal electronics to automotive in the early 2010s, it could sell chips to auto/industrial clients for 5x what Apple paid with minimal reengineering. Reliability, supply chain safety and technical value are more relevant for customers in these segments than price. Not only can TI answer to all, it can also compete on price as well due to scale, scope, and vertical integration of production (to be discussed later).

- Volume Pricing Opportunities

TI’s Industrial customer base is their most fragmented. Through volume pricing, TI can get 80% margin on low-volume orders vs. <50% for the larger accounts (~10% of Industrial revenue)

3) Market Share Gains

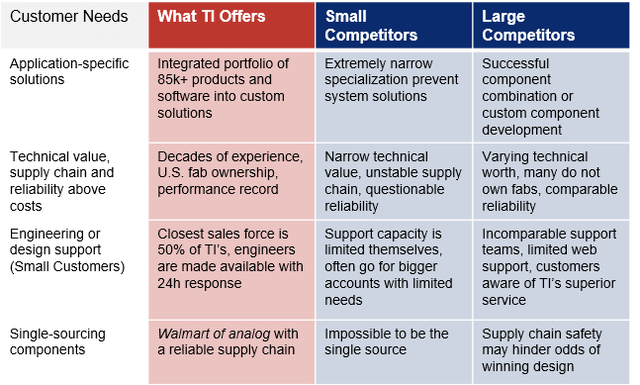

Strategically organized to better serve these two markets’ needs, I expect TI to successfully gain market share through organic growth.

The table below considers why through the customer needs in these markets and how TI compares to both large and small competitors. I expect the only significant near-term competitive threat to come from large players, against which TI has several advantages valuable to customers.

Comparison of Product and Services (Tegus, Company Filings Formatted by Author)

Small competitors are most competitive when they offer a highly specialized product with technical value to a customer that is willing to multi-source. TI continues to carefully spend in R&D, so any generalized loss of market share could only come from poor capital allocation and not lack thereof.

Foundry Ownership: Long-term Value

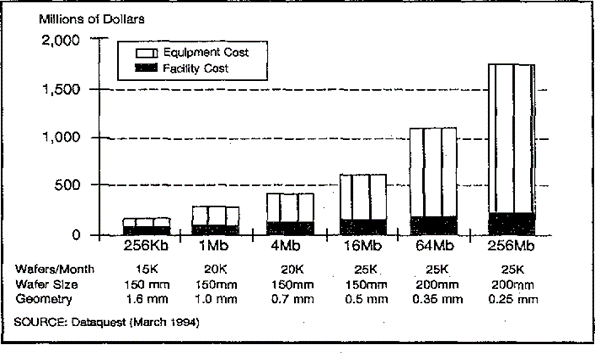

By the mid-1980s, most semiconductor companies were vertically integrated in both design and manufacturing. Nowadays, the industry is separated between design pure-plays (AMD, NVDA, QCOM) foundries or integrated manufacturers which have internal manufacturing capabilities (TSM, INTC, TXN).

This change can be traced back to the rate of increase in specialization and fixed costs necessary for fabrication. As seen in the figure below, fixed fab costs skyrocketed as wafer sizes increased.

Semiconductor Production Costs (Dataquest)

Texas Instruments remains one of the only of its competitors with majority of production in-house (80%+) compared U.S.-based direct competitors Analog Devices (ADI) outsourcing 50%+ of manufacturing and Microchip (MCHP) 60%+.

I expect TI’s integrated manufacturing strategy to enable market share and margin gains at a higher rate than competitors.

1) Market Share Gains

Not only are most of TI’s production activities internal, they are concentrated in the U.S.

The last years’ supply difficulties have increased customers’ awareness of supply chain risks, so I expect TI’s more controlled and domestic supply activities to be a catalyst for market share gains.

Most of TI’s competitors deal with fab partners in southeast Asia leaving them more exposed to geopolitical supply chain risk than TI, which enjoys a more diverse production footprint.

TI’s fab ownership also affords it a flexible production model preventing inventory lockups. While fabless competitors may need to fight for a third-party manufacturer’s capacity in times of high demand (often over other competitors), TI can strategically allocate production to prioritized products without external influence.

In early 2020, this control enabled them to increase manufacturing in anticipation of an upcoming demand increase, which obviously served them well, but a decision fabless competitors could not dictate to manufacturers.

This elevated supply chain control should enable TI to further leverage its market position as customers become more conscious than ever of the worth of supply chain safety. It will also protect it from inflationary pressures by reducing exposure to external middlemen with significant pricing power. In fact, a quick production cycle turnover is one of TI’s hallmarks, sourcing more than 75% of products from multiple sites to speed up delivery time.

2) Margin Expansion

Without going to in-detail regarding silicon wafer production technology, the wafer is a critical component of semiconductor manufacturing. By increasing its size, the number of die per wafer increases; using the same number of steps will produce more dice than before. A larger wafer size also improves the production yield (the number of functional chips per total chips produced).

TXN is opting for wafer transition from 200mm to 300mm due to overall cost benefits. In terms of percentage increase in wafer area, the transition from today’s 200mm (8 inch) wafers to 300mm (12 inch) will increase the silicon area by 125%.

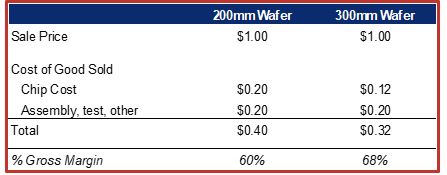

Reduction in cost per chip will drive most of the cost saving, whereas labor cost, materials use, and emissions should be comparable. As seen in the figure below, the cost per chip is reduced by ~40%.

Quantified Savings (Company Filings formatted by author)

Currently accounting for 40% of internal wafer production, management expects 300mm production fabs to reach 80% of total capacity by 2030.

A Note on the CHIPS and Science Acts

I expect the CHIPS Act not only to boost TI’s domestic footprint but to increase profitability by expanding free cash flow and reducing net CAPEX. TI is best poised to capitalize on the act due to their fully vertically integrated US domestic value chain — unlike fabless competitors like Qualcomm, NVIDIA, Broadcom.

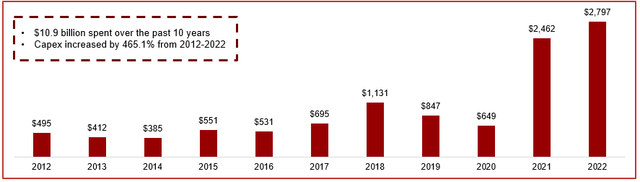

The company expects to spend around $5 billion in CAPEX annually from 2023 to 2026. Then, capex should find themselves at about 10%-15% of revenue. This is a significant amount compared to previous years:

TXN’s historic CAPEX (Company Filings formatted by author)

The bill appropriates $54.2 billion for subsidies to build chip plants in the U.S. and support U.S. chip research and development. Another $24.3 billion is forecast to come from a 25% tax credit awarded to U.S. chip plant construction and equipping.

As part of the CHIPS for America Fund, US government settled aside $39 billion to build, expand, and modernize domestic semiconductor fabrication facilities, which is the section directly applicable to TI.

The CHIPS Act prioritizes American companies like TI which already handles nearly all its fabrication and manufacturing in the US.

Subsidies for CAPEX investment are distributed on a first-come, first-serve basis. Since TXN was one of the first to request assistance, the magnitude of subsidies would amount to $7.5 billion for the plant completed in 2025.

TXN will be a fast-mover because of their robust pipeline for US domestic manufacturing development over the next 5 years, with blueprints for the $30B mega-plant in Sherman, Texas already drafted.

Unique Distribution Model

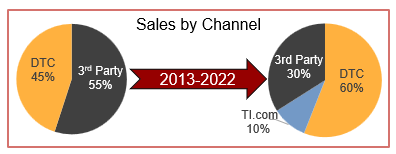

TI has invested significantly over the past decade in reducing its reliance on third-party distributors, as can be seen by the figure below.

Distribution Evolution (Company Filings Formatted by Author)

While DTC has many advantages over 3rd Party distribution for many reasons, what differentiates TI from competitors is the emphasis it puts on its sales through TI.com, its online DTC platform.

TI’s successful commitment to superior customer service is well recognized, as one former director of product management puts it:

8 out of 10 times, you would hear the complaint that the level of support we get from Analog Devices, or some other company is not the same as TI

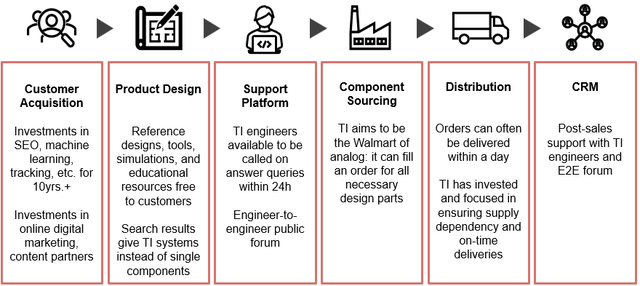

While most of TI’s DTC distribution is not done online, they have invested over the past ten years to entice customers to adopt this channel. Below, I’ve attempted to condense the most relevant steps in a customer’s order process on TI.com including some of the channel’s specific capabilities.

Customer’s Standpoint (Tegus, Company Filings, Formatted by Author)

Here is how I expect this unique distribution model to provide durable value for shareholders.

1) Market Share Gains

Smaller customers can lack internal development capabilities. With its E2E forum, on-call engineers, design tools, references simulations, and educational resources, TI.com offers these customers a level of service only rivalled by a dedicated sales team which they would otherwise not get as their level of business cannot justify it for their supplier.

Further, smaller customers can struggle to multi-source components due to the complexity of their sourcing or integration. TI.com answers this preference by selling solutions and not single components, understanding what the engineer is building, it can recommend entire TI-built systems and software to cross-sell and up-sell customers.

Online distribution also allows for dynamic pricing to displace specific competitors by ensuring TI’s price is lower than it where cost counts most for clients.

2) Margins Increasing

The usefulness of TI.com’s tools and technology clearly creates tremendous value for small customers, which as mentioned above do not otherwise have access to a dedicated sales team. I expect TI.com to increase the share of low-volume/high-margin customers.

Based on simple volume pricing, TI has the highest margin with smaller orders (up to 80% gross margins).

TI.com should also be expected to reduce TI’s reliance on its sales force. While I expect it to remain as large for large account servicing, we should expect with time a shift of some small-to-medium sales support to online as it will reduce TI’s costs and provide equally valuable service for customers.

Finally, successfully increased cross-selling and up-selling opportunities on the web should also increase profitability through basic operating leverage forces, although this is likely to be the least impactful of the margin drivers in this category as it is not reported by TI and therefore not measurable.

Why this is a Defensible Position

Building an online DTC distribution channel which rivals TI’s requires;

- A huge product catalogue of complementary components to maximize value offered to small clients and cross-selling opportunities

- DTC distribution capabilities, which has been a major area of investment for TI including warehousing automation

- A rivaling E2E support platform and design resources. This is out of the question for TI’s small competitors who are much leaner.

- Requires a focus on small customers. DTC online distribution will not be a means of acquiring OEM contracts competitors such as Analog Devices or Infineon (OTCQX:IFNNY) are focused on.

Based on the above, the most credible strategic replication threat would come from a large competitor with the means to invest and build such a platform.

However, ADI, as a case example of TI’s larger competitors, is focused on acquiring large accounts, is focused not on component systems but customized application-specific circuits not profitable when sold to smaller customers, and has always been far behind in terms of customer support level.

Their product strategy does not lend itself as well to putting the same amount of focus on an online DTC channel. Therefore, I expect TI to dominate online DTC market share.

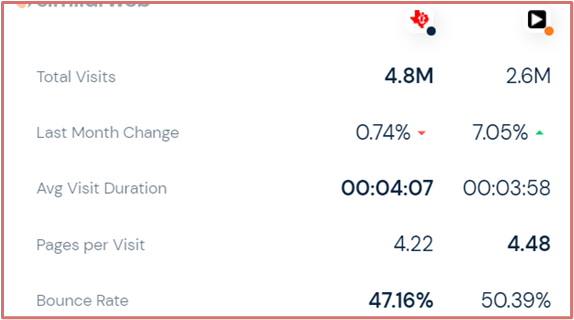

In fact, here are their latest monthly website traffic comparison as a superficial approximation of market penetration:

TXN vs. ADI: Latest monthly website traffic data (SimilarWeb)

Risks and Mitigants

1) CEO Succession Risk

TI’s management has undoubtedly been one of its key strengths through the past decades. However, following a failed CEO change in 2018, TI’s CEO since 2004 Rich Templeton is set to step down in April 2023. If TI’s new choice for CEO, Haviv Ilan, turns out negatively, it is unlikely that Rich Templeton would be willing or available to come back a second time.

It is worth noting that the 2018 resignation of Brian Crutcher six weeks after assuming the position were said to be due to personal code of conduct violation. Therefore, I do not expect a similar situation to arise, although it could signal that the board of director’s CEO selection process is prone to mistakes.

2) Downcycle

A well discussed risk in the semiconductor industry is the likely downcycle in demand. Here are two key reasons why TI would be less negatively impacted than the broader semiconductor index:

- Analog chips have years of shelf life so an inventory build-up is not likely to go to waste.

- Analog chips’ decades long PLC ensures that they will still be in demand without knowing when a downturn would occur or for how long.

Even more, a downcycle would offer TI the opportunity to expand their capacity to smaller node sizes. As a former director of engineering at TI explains:

As everybody moves to 5-nanometer, 3- nanometer, then the 14- and 10-nanometer equipment might start becoming available. They will go if they can, it’s not a good market now, but there will be a downturn. They will go and buy that equipment at super low prices and upgrade their capability in those areas. That’s been an MO of theirs for as long as I can remember.

3) Analog Devices’ ASICs Strategy

I previously mentioned that I believe loss of market share would be the result of poor capital allocation and not lack thereof.

One way time where TI missed the boat was their passive reaction to Arm-based microcontrollers. One of their former product and marketing director said the following on the topic:

Arm became a disruptor in the space. They came out with a new 32-bit architecture versus a 16-bit that TI had been using. Manufacturers hopped on the Arm train whereas TI doubled down on its proprietary 16-bit architecture and gave up a ton of share between 2000 and 2015, 70%, 80% down to maybe 15%. TI for whatever reason did not want to expand beyond Arm.

While such technological changes cannot be predicted (and neither can TI’s response), I have identified one risk area where it could reoccur.

ADI is focusing growth on application-specific integrated circuits (ASICs), not new individual components. ADI’s ASICS are lower margin, require a longer, expensive development, and not easily tweakable like TI’s component combination approach to custom solutions. ADI’s organizational divisions are built to be inter-connected for efficient ASIC development. One of TXN’s former directors of product management explains their difference well:

One chip has a lot of integrated functionality. [ADI] tries to sell this to key car companies. Except the margin goes down on these chips. It takes years to make them and a lot of R&D resources.

This approach does not currently have a broad market potential due to its cost and time to develop. However, should ADI succeed in producing and marketing ASICs in a way rivalling TI to both large and small customer acquisition, it would enjoy a much broader competitive advantage and leave TI to play catch-up.

Conclusion

I believe Texas Instruments is well positioned to benefit from the result of decades of strategic investments and product positioning. Through distribution capacity, manufacturing control, and specific end market focus, I expect TI to generate returns on its capital at higher rates than its peers.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.