Summary:

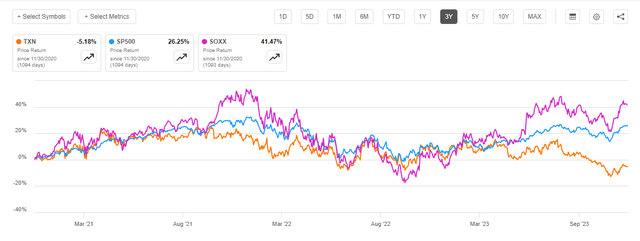

- Texas Instruments has underperformed the market, down 12% while the S&P 500 climbed 15%.

- The company has faced challenges with negative growth, volatile cash flow, and operating deleverage.

- Cash flows, inventories, and competition from China are major concerns.

- Looking ahead, the stock looks attractively priced once the cycle turns.

kynny

Texas Instruments (NASDAQ:TXN) has widely underperformed the market this year after showing good strength in the sideways market in 2022. The stock is down 12% since my last article, while the S&P 500 climbed 15%. Despite the current headwinds and challenges, I believe the stock presents a buying opportunity for a great business. Let’s get right to it.

TXN recent underperformance (Seeking Alpha)

Challenging times

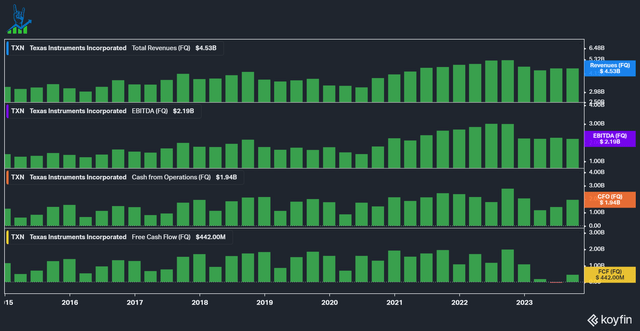

As shown below, TXN has witnessed a series of quarters with negative growth and, in one, even negative Free Cash Flow. While the company managed to keep revenue and EBITDA steady, cash flow has been more volatile and weaker. Overall sales are down double digits, with profits and operating cash flow down around 27% due to operating deleverage.

TXN quarterly results (Koyfin)

I want to address three major challenges:

- Operating deleverage

- Cash Flows and inventories

- China competition

Operating Deleverage

As we’ve seen above, results were declining disproportionally between revenue and profits. This has a few reasons.

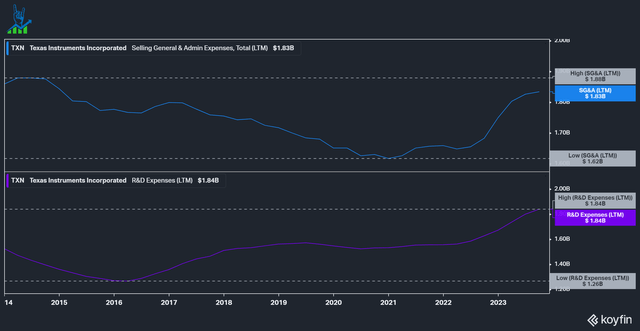

First, Texas Instruments has a very lean cost structure that stayed consistent over the years. We can see that SG&A and R&D have stayed within a channel for the last decade. 2017-2021 saw operating expenses (OpEx = SG&A + R&D) of $3.2 billion consistently, with an uptick of $3.4 billion last year and $3.7 billion this year. While this uptrend is not particularly concerning, especially given the focus on R&D investment, it does hit the bottom line.

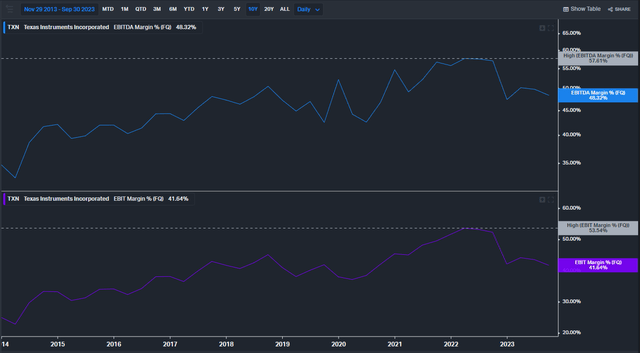

Due to its manufacturing with large fixed costs and smaller incremental costs for additional chips, Texas Instruments has significant operating leverage inherent in its business model. While this is a tailwind as production ramps up, it does work as a headwind as production shrinks. We can see this in the margin development, dropping from an EBITDA margin of 57% to 48% in the last quarter. It is even more pronounced on EBIT margins, dropping from 53% to 41%. The large impact on EBIT is that Depreciation is increasing rapidly right now, while TXN spends CapEx for its new fabs, which do not contribute to sales yet. This is all accounting, but how does this impact cash flow?

Cash Flows and inventories

We don’t optimize for gross margins. We’re optimizing for free cash flow growth over the long term, just like you would in any personal investment, right?

Rafael Lizardi, TXN CFO at UBS global technology conference

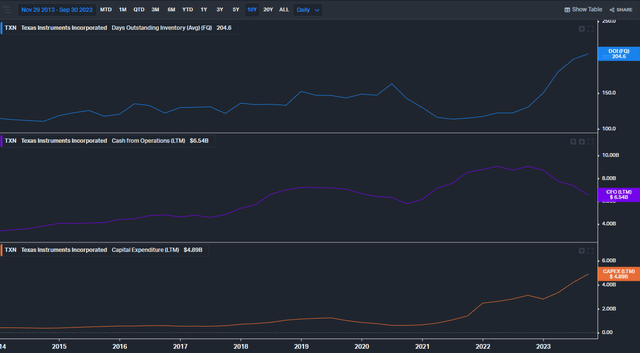

TXN invests for cash flows, so the increased Depreciation and resulting lower gross and operating margins are not of concern. It is just accounting, after all. We also see some large effects on cash flows, though. Due to its vertically integrated manufacturing, TXN can decide how much inventory it wants to keep. TXN produces about 80,000 products for 100,000 customers in several end markets, with most products being able to be sold to customers from different end markets. This considerably reduces inventory’s obsolescence risk and leads management to continue producing chips, even if the demand isn’t there right now. It is better to have the chips ready when demand comes back than to ramp up production. We can see the insane growth in inventory days outstanding over the last years from the trough during the shortage. TXN has reached its upper limit and won’t aggressively build inventories anymore. Increased inventory hurts cash flows but keeps utilization of the fabs high. The fixed costs stay the same, so you want to keep the machines running as much as possible.

Due to this effect and the operating deleverage from reduced sales, operating cash flow declined from $9 billion to just $6.5 billion. On top of that, TXN stays committed to investing aggressively in CapEx for its new fabs (I talked more about this in my previous article). This led to FCF drying up, contrary to its mission to grow FCF per share.

We must remember that this is a self-inflicted wound, at least partially. TXN could reduce CapEx to please Wall Street and keep FCF more stable, but management would instead seize the opportunity to build fabs that they’ll be able to use for decades to come. Remember that these fabs are depreciated over five years, much below their useful life.

Another concern investors raise is that TXN won’t be able to sustain its dividend of $4 with a low FCF of 5 billion a year. While I would prefer a dividend cut and focus on buybacks and growth CapEx, we need to consider the excellent credit rating (A+) and balance sheet (0.3x net debt/EBITDA) of Texas Instruments. They can afford to take on debt to make these investments for a time and once the cycle turns, as it always does, they are ready to benefit from it.

Some competitors like Analog Devices (ADI) recently saw operating declines similar to TXN, lagging behind. This was in part due to their usage of long-term agreements (LTA), a business practice that TXN doesn’t use for the following reasons:

Our contention is that, that doesn’t create demand. That just makes customers mad because now you’re forcing them to take parts they don’t need.

Rafael Lizardi, TXN CFO at UBS global technology conference

China competition

The newest bear case for TXN is the increased competition from China. Increased global tensions and the ban on selling advanced equipment from companies like ASML (ASML) into China are pushing these companies to invest in mature nodes instead and thus compete with TXN. There is a valid argument here, as these Chinese players probably get subsidies from the Chinese state. While investors need to keep this development in mind, I wouldn’t sweat it too much. TXN has a cost advantage as a vertically integrated manufacturer with a global scale on 300mm wafer production, compared to small niche fabless players focused on a few products. The one-stop-shop approach also holds a lot of value, as customers don’t want to have the headache of having dozens of suppliers when they can have it all with one big and reliable partner. Actual Chinese demand is around 20% of TXN revenue, and I doubt that most of it is at risk due to this.

A compelling long-term outlook

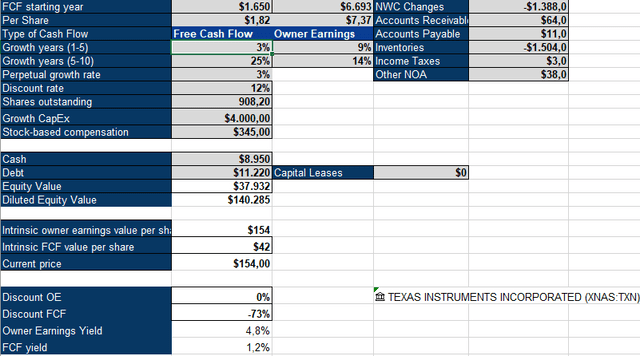

To value TXN, I’ll use an inverse DCF model with a 12% discount rate to account for the higher risk of investments over a few years. I use Owner Earnings to account for changes in NWC, stock-based compensation, and especially growth CapEx. TXN spent around $5 billion on CapEx over the last year, with the majority invested in building new fabs. I assumed a slower ramp-up with 9% growth over the next five years, followed by 14% growth. As the cycle turns, we should see operating leverage kick in and increase margins and thus cash flows. TXN expects to support revenues of $45 billion by 2030 with even higher in-house manufacturing and, therefore, higher operating margins. This would mean around a 14% revenue CAGR plus upside from operating leverage. If TXN can execute its plan and build the capacity it wants, it should be attractively valued for the return of demand. However, over the short term, things could get ugly. There are a lot of assumptions right now with the fact of low current cash flows. I remain a buyer of TXN stock for the long hold, aware that it might get bumpy along the road.

Texas Instruments Inverse DCF (Authors Model)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN, ASML either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.