Summary:

- Texas Instruments has underperformed compared to the iShares Semiconductor index over the last five years.

- Management addressed key investor concerns in a recent meeting, presenting scenarios for FCF per share growth after an activist shared the concerns in a letter to the board.

- In this article, I go over the changes in TXN’s growth investment plan and why the shares have underperformed over the last five years.

- Shares are at an attractive IRR if we believe management’s estimates.

Monty Rakusen

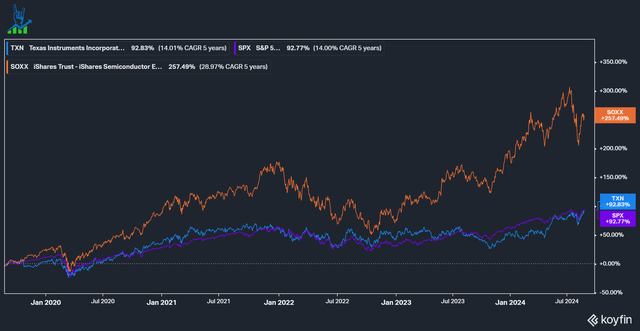

Texas Instruments (NASDAQ:TXN) is the oldest position in my stock portfolio, having owned it since mid-2020. Over the last five years, the company has not really impressed investors, matching the S&P 500 in total return, while the iShares Semiconductor Index (SOXX) more than doubled its performance (however, with higher volatility). TIs management scheduled an off-cycle capital management presentation last week (20th August 2024) to address a few key issues investors had with the company in recent years. They showed a few scenarios for their most important metric: FCF per share and how it will grow from now on. Let’s discuss Texas Instruments, the troubles of the last years and the road ahead.

Texas Instruments 5-year performance (Koyfin.com)

A bumpy road behind us

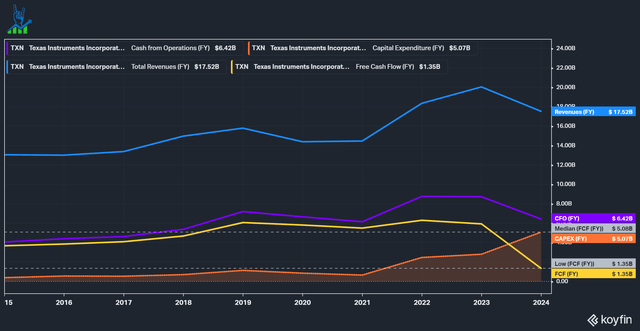

Below, we can see a 10-year chart of TI’s revenue and cash flows. The volatility in revenue growth immediately shows that it’s a cyclical company. Furthermore, we can see a pretty stable development of growing FCF and OCP from 2014 until 2021, moving in tandem, even though down-cycles occurred. In 2022, something happened: FCF and OCF diverged, while OCF stayed pretty stable, and FCF plummeted alongside rising CapEx. What happened?

Texas Instruments cash generation (Koyfin.com)

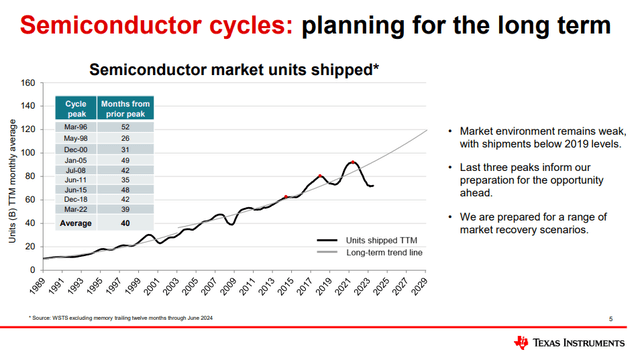

TI showed the following slide, highlighting the strong down-cycle since the peak in March 2022: Following the havoc caused in global supply chains by COVID-19, semiconductor shipments rose to all-time highs using every bit of capacity fabs could offer. As supply chains normalized, many distributors now had excess inventory, leading to a strong down-cycle.

Semiconductor cycle visualization (TXN Off-cycle Capital management call)

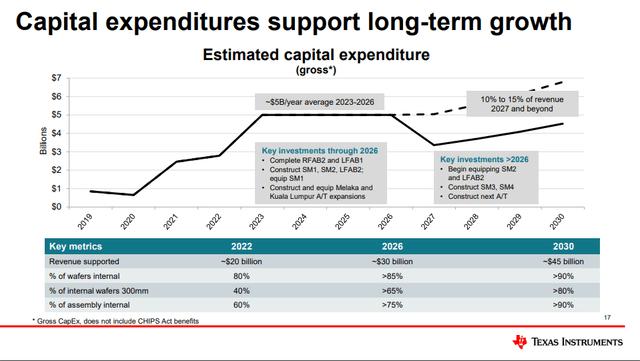

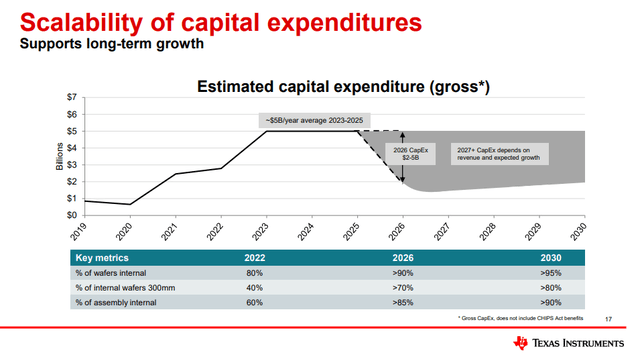

While the cycle was turning down, TI started its long-term growth investment cycle. Below is a slide from February 2024 showing that management expected to ramp CapEx to $5 billion and beyond for years to come to enable support for up to $45 billion in revenues. While this does sound good in the long term, it means that free cash flows, TI’s most important KPI, will stay depressed and even negative for a while. TI is a dividend growth stock, and many investors worried that TI would have to cut the dividend as it paid out $5.14 per share in the last twelve months, earning only $1.64 FCF per share.

Texas Instruments CapEx guidance as of February 2024 (TXN Capital management presentation February 2024)

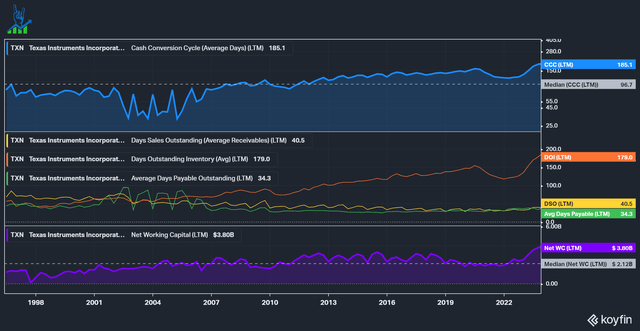

Another worrying development has been TI’s cash conversion cycle: we can see it increasing as the cycle turned down. While most companies tried to manage cash carefully and preserve FCF, TI decided to keep fab utilization at high levels and produce inventory they knew they couldn’t sell. TI mostly has small semiconductors that can be sold to multiple customers in several industries, so there isn’t a high risk of having to write down this inventory. They see a much higher risk in not having inventory ready to sell when the cycle turns.

TXN cash conversion cycle (Koyfin.com)

The cycle is turning

Let’s get back to the cycle: we are currently below 2019 levels, but the cycle seems to have bottomed and is moving up again. This can be seen in TXNs latest earnings: Earnings are down 16% year over year, but sequentially increased by 4%. Furthermore, TI sees sequential growth in Q3 as well. Rival Analog Devices (ADI) sees a similar development:

These favorable results, combined with improved customer inventory levels and order momentum across most of our markets, increased my confidence that our second quarter marked the cyclical bottom for ADI.

Vincent Roche on the ADI earnings call Q3 2024

In late May 2024, Elliott Investment Management sent an activist letter to TI’s board. The activist urged management to adopt a more flexible CapEx plan and to focus more on FCF per share, which has fallen considerably. They also estimated that TI can produce $9+ per share in 2026. Unlike most activist letters Elliott wrote, this one sounded very tame and highlighted the strengths of TI and was generally a lot more friendly than usual activist letters.

Surprisingly, TI acted on the activist’s request and shared its updated CapEx schedule during last week’s presentation. We can see that the picture shifted drastically from the February presentation. CapEx guidance went down a lot from $5 billion+ to a range of $2-5 billion based on the revenue and cycle development. Furthermore, TI expects to support a higher percentage of its wafers internally (95% vs 90%) due to better throughput thanks to newer generation systems:

look, this equipment that we are now installing in our past, we are discovering the efficiency and really the throughput that we can get out of the fab today versus the older used equipment we used to install in our factories, also the advancements of information data are allowing us to take the throughput numbers to a higher level, therefore, that helps on the capacity intensity moving forward.

Haviv Ilan on the TXN Off-cycle capital management call

Texas instruments updated CapEx guidance (TXN Off-cycle capital management presentation)

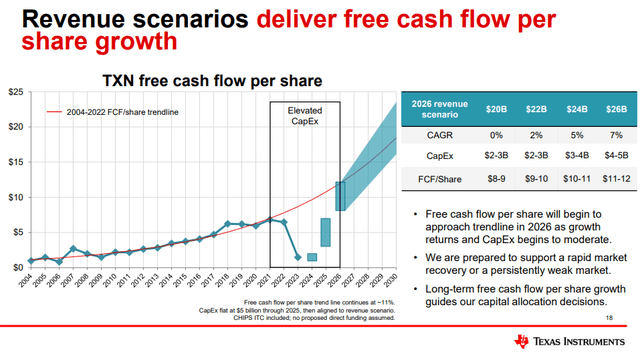

This all culminates in the following scenarios: we can see that management expects to reach between $20 and $26 billion in revenue in 2026 versus a consensus analyst target of $20.3 billion. The 2026 scenario would require a flat development caused by a recession or further supply chain disruptions. I believe the cycle will not be that depressed and that a healthy growth rate is realistic. After all, the secular tailwind of growing semiconductor content in everyday appliances did not change. Note that the CAGRs displayed are compared to the last cycle peak, something that management did not depict well here. So, the total revenue CAGR from today’s numbers is much higher. Based on how the cycle turns, management will invest in growth CapEx.

TXN FCF per share growth trajectory (TXN Off-cycle capital management presentation)

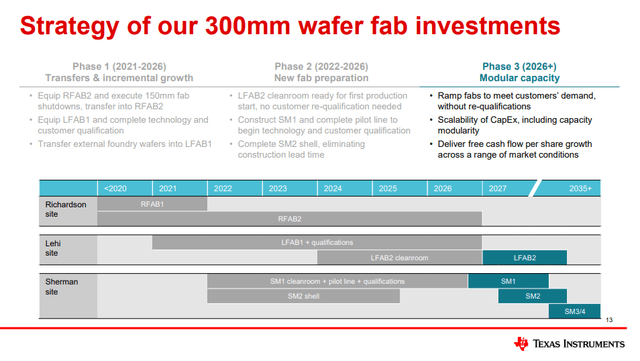

Management detailed its modular fab build-out plan, as can be seen below. TI is building, for example, just the shell for SM2 but won’t put the equipment inside until the demand arrives. The shell is the most time-consuming part, so this should enable a fast reaction to market demand. Overall, I’m impressed by management’s adaption to what the market expects of them, which gives us a better idea of their plan. Let’s see how this might end up working out in a valuation model.

TXN modular fab build-out (TXN Off-cycle capital management presentation)

Valuing Texas Instruments

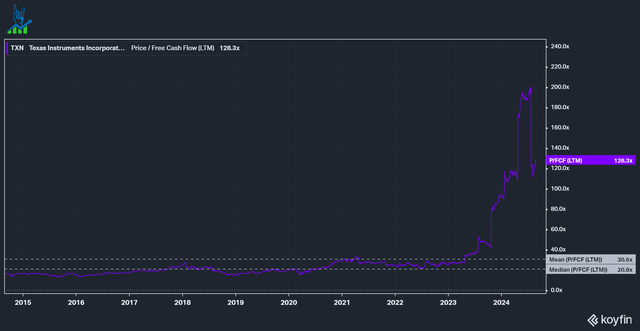

An inverse DCF doesn’t make much sense, given the depressed FCF figures, so I’ll refrain from using one. TI expects to reach between $8-12 FCF per share, translating to an FY26 FCF multiple between 17.5 and 26.25 times. Historically, the median multiple has been 20.8 times (although the last year has not been representative and might distort it upwards a bit), so I wouldn’t expect much multiple expansion from TI from this price point.

TXN P/FCF multiple (Koyfin.com)

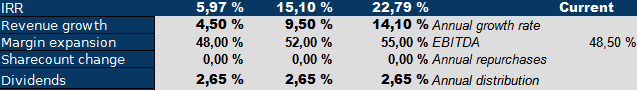

Let’s look at the other shareholder return drivers if we don’t get multiple expansions. Based on FY 2023 revenue of $17.5 billion, let’s see what total revenue growth through FY 26 might look like.

| FY 26 revenue | $20b | $22b | $24b | $26b |

| CAGR from FY 23 | 4.5% | 7.9% | 11.1% | 14.1% |

Let’s now look at a three-year IRR model. I used 9.5% as a base case, between 7.9% and 11.1%. I expect margins to improve from 48.5% in FY 2023 due to increased utilization of the fabs as the cycle turns. I don’t expect significant buybacks yet, but the company will continue to pay its dividend (I used a 25% tax rate for the dividend in the IRR calculation). Based on these estimates, we reach a strong IRR range between 6% and 23%.

On top of that, we must consider the CHIPS Act: TI always talked about gross CapEx, and that’s because they are getting subsidies from the CHIPS Act. They’ll receive $1.6 billion in direct grants with an estimated $6-8 billion in investment tax credits over the long run. I did not factor these payments in, but it should help cover the expansion costs. The tax credits will be spread over many years, and the $1.6 billion in direct funding will not move the needle. I wouldn’t expect it to improve IRR by more than a few percentage points.

TXN 3-year IRR model (Authors Model)

Conclusion

Texas Instruments has been a core holding of my portfolio for a while. The company is investing countercyclical and will reap the benefits of these investments over the next decade. From this cyclically depressed point onwards, revenues will grow at a decent speed and cash flows will grow disproportionally. However, TXN has already run up a bit since Elliott took its stake in the business. Texas Instruments is a high-quality, durable business that meets my IRR hurdle rate (12% on average). However, these are management estimates and while management has an excellent reputation and track record, we must take them with a grain of salt. A further deteriorating semiconductor cycle or an inability to meet the FCF per share targets could send the shares downward in the short term. TXN remains one of my top 10 positions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.