Summary:

- Similar to many other semiconductor companies, Texas Instruments has to report declining sales.

- Not only is Texas Instruments a high-quality business with a wide economic moat, it is also investing heavily in its future.

- The stock might be slightly undervalued, however, the chart should make us cautious.

matejmo/iStock via Getty Images

In my last article, I called Texas Instruments Incorporated (NASDAQ:TXN) “fairly valued” – although I still saw some downside risk for the stock. At the time of publication, the stock was trading for $154 and right now the stock is trading for a similar price but since July 2022 the business could have improved further (revenue might be higher, free cash flow might be higher) and a stock can grow into its valuation and be undervalued despite trading for the same price we saw it as being overvalued before.

And with my last article about Texas Instruments being 15 months old it makes sense to provide an update and answer the question once again if Texas Instruments could be a good investment.

Quarterly Results

I wrote above that a stock could in theory grow in its valuation over time. However, when looking at the second quarter results for fiscal 2023 this does not seem to be the case for Texas Instruments. Revenue declined from $5,212 million in Q2/22 to $4,531 million in Q2/23 – resulting in a 13.1% year-over-year decline for the top line. Operating income declined even 27.6% year-over-year from $2,723 million in the same quarter last year to $1,972 million this quarter. And earnings per share also declined 23.7% YoY – from $2.45 in Q2/22 to $1.87 in Q2/23.

Texas Instruments Q2/23 Earnings Release

When looking at the different segments, “Analog” (which is responsible for the biggest part of revenue) saw its revenue decline 17.9% YoY to $3,278 million with operating profit also declining from $2,226 million in the same quarter last year to $1,463 million this quarter. “Embedded Processing” however could increase revenue 8.9% YoY to $894 million with operating profit being almost the same ($318 million this quarter vs. $324 million the previous quarter). “Other” generated revenue of $359 million (compared to $399 million in the same quarter last year).

Long-term Growth

In the last few quarters, semiconductor sales have been declining – not only for Texas Instruments. Many other semiconductor companies also had to report lower sales – only NVIDIA seems to be the exception.

The semiconductor industry is a cyclical industry as many end products for which the chips are used – computers, smartphones, or cars – are discretionary products and considered non-essential. The purchase of these products can be postponed when customers have doubts about the economic future (for example due to the outbreak of another war) or have less disposable income as the salary is not keeping pace with inflation. And economic uncertainty will lead to heavily fluctuating demand for semiconductors.

To make matters worse, not only is the demand for semiconductors declining right now, but Texas Instruments also must invest heavily in advanced 300-mm capacity to gain a competitive advantage and generate cost advantages. This leads to high capital expenditures for the business which has a negative effect on free cash flow. And management is expecting the high capital expenditures to last at least until 2026.

Texas Instruments Q2/23 Presentation

To make the short-term picture even worse I still expect the U.S. economy – and many other advanced economies around the world – to hit a recession, which might have an additional negative impact on semiconductor demand. However, these expectations are just for the next few quarters – long-term I am optimistic for Texas Instruments as well as the overall economy. And we can be quite confident that Texas Instruments is planning for the long-term, which is a good thing.

Texas Instruments Q2/23 Presentation

And while the massive investments and high capital expenditures will have a negative impact in the short term, the investments should have a positive impact in the long run. Management is optimistic that units shipped in the semiconductor market will continue to follow the long-term trendline.

Surprising Consistency for Semiconductor Company

And it is quite clear that Texas Instruments constantly must invest, and that the semiconductor industry is cyclical by its nature. In this world, Texas Instruments however seems to be a positive outlier. When looking at the past results, we see high growth rates in the last ten years. While revenue increased with a CAGR of 4.56% in the last ten years, operating income increased with a CAGR of 14.49% (due to margin expansion) and earnings per share increased even with a CAGR of 20.08% (due to additional share buybacks).

But Texas Instruments is not only growing a at high pace in the last ten years, it is growing with a high consistency – and that is an important aspect for any long-term investment. It is also rather surprising for a semiconductor company.

Texas Instruments Revenue and EPS (Author’s Work)

When looking at revenue and earnings per share in the last few decades we of course see some fluctuations (and declining revenue in several years). We should not forget that we are still dealing with a semiconductor company. However, Texas Instruments was profitable in almost every year in the last four decades and the company could grow earnings per share with a solid pace – and little fluctuations – in the last two decades.

Texas Instruments: Margins and Profitability (Author’s work)

When looking at the last ten years, Texas Instruments has continuously improved its margins, which is a good sign for a high-quality business. And aside from margins improving, Texas Instruments could report impressive returns on invested capital metrics in the last ten years. On average, RoIC was 29.75% in the last ten years – a truly impressive number for any business.

Finally, when looking at the stock price since the 1970s, Texas Instruments clearly outperformed the S&P 500 (not including dividends). When combining these aspects, we can call Texas Instruments a high-quality business and a company that has most likely a wide economic moat around its business.

Dividend and Share Buybacks

Texas Instruments is also an interesting business for dividend investors. When looking at the different semiconductor companies – which usually don’t have high dividend yields – Texas Instruments is one of the more interesting companies for dividend investors. Recently, Texas Instruments raised its dividend from a quarterly dividend of $1.24 to a quarterly dividend of $1.30. This is resulting in an annual dividend of $5.20 and a current dividend yield of 3.3%.

Of course, in a time where the 10-year U.S. treasury is yielding 4.8% and the 2-year U.S. treasury is even close to 5.1% a dividend yield of 3.3% is not so impressive. However, Texas Instruments has not only grown its dividend for 17 years – in the last five years the dividend grew with a CAGR of 14.87%. And when looking at Texas Instruments’ dividend history, the current dividend yield is one of the highest in the company’s entire history. The current dividend yield is even higher than during the Great Financial Crisis and the early 1990s.

Of course, when comparing the dividend paid in the last four quarters ($4.87) to the earnings per share in the last four quarters ($8.42), we get a payout ratio of 58% which seems acceptable. On the other hand, when comparing the dividends paid in the last four quarters ($4,424 million in total) to the generated free cash flow in the last four quarters ($3,182 million) Texas Instruments paid out more than it generated in free cash flow. Of course, we should point out that the last few quarters were rather an outlier and usually Texas Instruments generated more free cash flow than necessary for dividend payments.

Aside from paying a quarterly dividend, the company is also constantly repurchasing shares, and the number of outstanding shares has been declining for almost 20 years in a row. And although the company has only repurchased shares for $2,026 million in the last four quarters, the number of outstanding shares decreased from 1,101 million to 916 million – resulting in a CAGR of 1.8%.

Intrinsic Value Calculation

Considering the high quality of the business, it is not surprising that Texas Instruments is not trading for extremely low valuation multiples. When looking at the P/E ratio, Texas Instruments is trading for 18.9 times earnings right now and this is below the 10-year average of 22.42 and actually rather close to the low of 15.55 (the lowest P/E ratio in the last ten years).

While the P/E ratio might indicate that Texas Instruments is at least fairly valued (or maybe even undervalued), the price-free-cash-flow ratio is speaking a different language. Right now, Texas Instruments is trading for 45.3 times free cash flow, which is not only clearly above the average P/FCF ratio of 21.62 but also an extremely high P/FCF ratio for almost any business. The main reason however is the declining free cash flow of the last few quarters (due to the high investments we mentioned above).

Therefore, simple valuation metrics like the P/FCF ratio might not show the real picture of the business. Instead, we use once again a discount cash flow calculation which enables us to make different assumptions for free cash flow in the years to come. For starters, we are calculating with 916 million diluted outstanding shares and – as always – with a 10% discount rate (as this is the minimal annual return we like to achieve). And now we must make several assumptions.

Let’s be cautious and assume cash from operations around $7.5 billion – more or less in line with the past four quarters. And then let’s be optimistic about growth and assume 9% annual growth for the next 10 years followed by 6% growth till perpetuity.

When calculating with these assumptions we get an intrinsic value of $180.01 for Texas Instruments. By the way, in my last article, I calculated a very similar intrinsic value for the stock ($179.23). As a result, we can see Texas Instruments as slightly undervalued at this point, but I would be cautious nevertheless – among other reasons due to the chart.

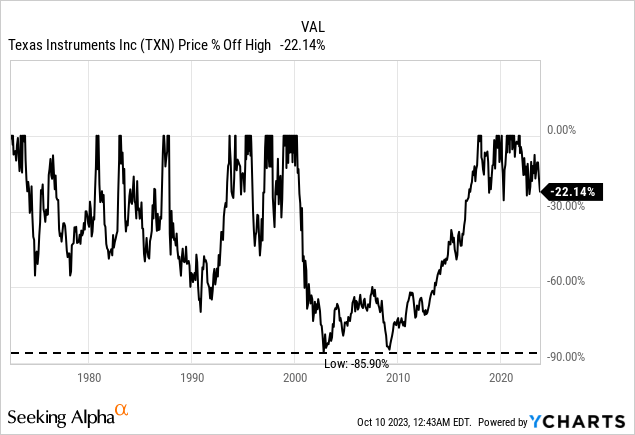

Technical Picture

Looking at the chart of Texas Instruments I don’t think now is the time to buy the stock. We are seeing the stock in a corrective phase. In the last two years, the stock was more or less in a sideway range between $145 and $190 and as the stock is rather close to the lower end of the sideway range it might seem well supported and a potential buy.

However, Texas Instruments recently broke a long-term trendline (white) which has been in place since 2009 and at the same time the company broke the 200-week simple moving average. Both indicators combined create some downside risk for Texas Instruments and therefore I would not buy the stock at this point.

Texas Instruments Weekly Chart (TradingView)

In my opinion, it seems likely for the stock to decline to its next support level around $130 and I would wait at least for that price level before opening a position. It also seems like a possibility for Texas Instruments to drop to the range between $90 and $100 where we find previous lows. Assuming that the economy might hit a potential recession in the coming quarters and also assuming a steeper correction for Texas Instruments the price range around $90 seems like a realistic target. This would imply the stock losing a little more than 50% of its previous value – a scenario we have seen several times in the past. Aside from previous lows, we also find the 38% Fibonacci retracement of the last upward wave (beginning in 2009) at that price level. But when talking about a potential decline to $90 we should not forget that I calculated an intrinsic value of $180 above, which would imply a deeply undervalued stock. However, I might be wrong with my calculated intrinsic value and the market is not always reasonable.

Conclusion

Overall, Texas Instruments is one of the better semiconductor companies and a stock I like to own. But in the current situation, I would like to wait for lower stock prices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.