Summary:

- Activist investor Elliott Investment Management is calling for changes to Texas Instruments’ business strategy.

- I find Elliott’s arguments unpersuasive.

- Texas Instruments has a long-term focus and should prioritize its core competencies and long-term strategic positioning.

- Shares seem fully valued for now, regardless of what happens with this activist campaign.

JHVEPhoto/iStock Editorial via Getty Images

I have been a long-time investor in Texas Instruments (NASDAQ:TXN). I first purchased shares in 2016, and I have subsequently added to my position several times.

As someone who has owned Texas Instruments stock for eight years now, I have great appreciation for management’s operational and capital allocation strategies.

I believe a key reason for Texas Instruments’ tremendous long-term returns has been the company’s contrarian investment approach. Texas Instruments has always been willing to buck the cycle, becoming defensive when other firms are spending aggressively while making bold investments at times when the market did not immediately reward such thinking.

For one example, Texas Instruments was one of the first prominent large tech companies to lever its balance sheet coming out of the 2008 financial crisis. Management realized that with interest rates at rock bottom levels, the company could borrow money at a significantly lower rate than its dividend yield. By borrowing to repurchase stock, Texas Instruments improved shareholder value while also increasing cash flows.

Unlike many companies, however, Texas Instruments doesn’t dogmatically repurchase stock at any price.

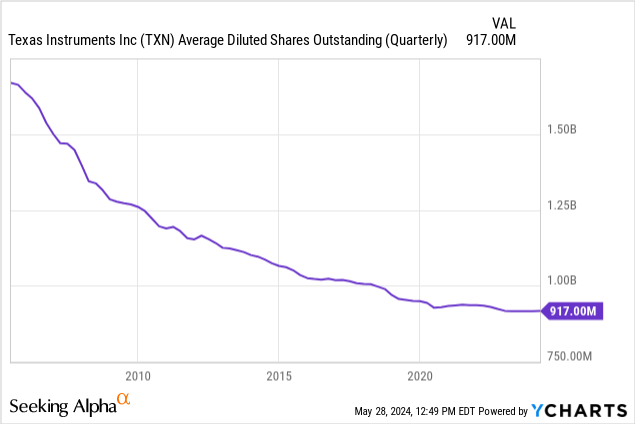

As the above chart shows, Texas Instruments has retired nearly half its outstanding stock since 2005, but there are both periods of aggressive repurchases along with times (such as now) when other items are prioritized rather than buybacks.

An Activist Investor Takes Aim At Texas Instruments

I start with this context because an activist investor has put Texas Instruments’ capital allocation strategy under the microscope.

Well-known fund management firm Elliott Investment Management sent a lengthy note to Texas Instruments’ Board of Directors on Tuesday.

Elliott has taken a $2.5 billion position in Texas instrument stock and is calling for changes to the company’s capital allocation approach.

Specifically, Elliott’s letter expresses disappointment that Texas Instruments has decided to invest more heavily in new chip foundries.

Texas Instruments has a firm commitment to increasing free cash flow per share. In fact, in the company shareholder manual, management explicitly lays out the growth of free cash flow per share as the central factor driving decision-making at the company.

Since 2022, Texas Instruments has decided to invest much more in new U.S.-based manufacturing facilities. In Elliott’s opinion, this is a stark departure from Texas Instruments’ longer running capital allocation approach. By reinvesting much of the company’s revenues and profits into property and equipment rather than using it for share buybacks or dividends, Elliott believes management is misallocating company resources.

Elliott also notes that the analog chip industry is currently in a downturn, with demand falling short of prior projections. As Texas Instruments is overwhelmingly reliant on the analog market for revenues, this is hitting the company’s bottom line. While the company’s most recent earnings report slightly beat expectations on both the top and bottom lines, the overall results were still sobering, with revenues falling 16% year-over-year.

Elliott uses this point as further evidence that Texas Instruments does not need to be spending so heavily on capacity expansion at this time.

If Texas Instruments were to adopt Elliott’s approach and deploy more capital to dividends and share buybacks, this would presumably lead to an increase in the price of TXN stock, at least in the short term.

To be certain, this is a fairly common activist strategy. Activists will come in and tell the company to reduce capital-intensive and/or marginally profitable investments, and instead return that capital to shareholders.

Elliott and other similar activist investors have run this playbook at numerous firms, often with significant success. There is merit to the idea of pruning off marginal or non-core investments and focusing on improved efficiency. However, sometimes, activists take this too far, urging companies to reduce their investments in core businesses and competencies for a short-term pop in the stock price.

I’d argue that’d be what happens here if Texas Instruments reduces investing in its core chip foundries to try to pop the stock price in the short term.

This Proposal Would Damage the Company’s Long-Term Strategic Positioning

Put another way, I entirely reject Elliott’s proposed strategy here. I believe Elliott’s proposals for Texas Instruments would be harmful for a variety of reasons. I’d urge management to make no changes whatsoever in response to this letter.

Why am I so adamantly opposed to Elliott’s proposals?

For one thing, Elliott seems to be downplaying the importance of the current political and economic backdrop in the semiconductor industry.

I’d highlight this key quote from Elliott’s letter:

“We believe the Company should pursue an alternative path, one that it has followed before, which draws upon TI’s own history of capacity investments during a period of significant shareholder returns and outperformance (and is an industry-standard practice) […]

[W]e believe TI should adopt a dynamic capacity-management approach and flex its capacity buildout in a manner consistent with its historical practices. By executing on this approach, we believe TI can generate $9.00+ per share in free cash flow in 2026 across a range of upside and downside revenue scenarios.

If TI can outperform on revenue growth and take additional market share (which we hope it does), TI should spend more capital to press its competitive advantage and ramp capacity as customer demand would warrant the incremental spend. Additionally, we believe this approach would align with the production commitments associated with a potential CHIPS Act grant.”

In the 13-page text of the letter, this is the only direct mention of the CHIPS Act. From reading, it’s unclear how Elliott thinks Texas Instruments would remain eligible for the government grant payments associated with the construction of domestic chip foundries if the company doesn’t actually build said facilities within a reasonable time frame.

Texas Instruments has a long history of successfully operating analog chip facilities in the United States. The U.S. government authorized more than $50 billion of assistance to semiconductor companies that build more domestic factories. If Texas Instruments is already skilled in this field and the government is giving out money to build next-generation facilities, why would it turn down this offer?

Elliott complains about the short-term drop in free cash flow per share associated with building new foundries. But the company would have to build new foundries eventually; chipmaking isn’t an industry where you can run with old designs forever. Texas Instruments should take advantage of the government grants and industry downturn to act now and improve its competitive positioning and market share while other players are on the defensive.

Elliott points to the near-term slowdown in the analog chip market as evidence that new capacity shouldn’t be built yet. I totally disagree. A new foundry’s lifespan can be measured in decades. Why would Texas Instruments deviate from optimal long-term capital allocation due to a couple of quarters hiccup in its end markets — and particularly so when the government is giving out extra assistance to make new foundries happen?

While I admire activist investors when they make real operational improvements at companies, I dislike this sort of meddling where companies are encouraged to cede ground on their core operational competencies in exchange for brief-lived financial engineering. A fund like Elliott can come in, get the stock price to pop, and make a quick gain over a span of months. But Texas Instruments could, in turn, find itself without that highly valuable next-gen foundry, potentially hurting the business for decades in exchange for this short-term stock price gain.

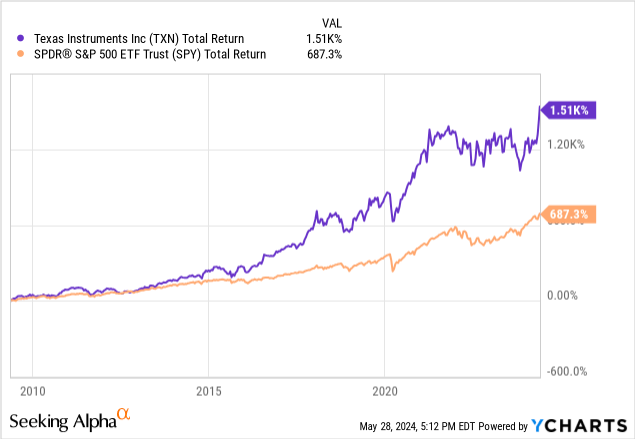

Texas Instruments has always been run with a long-term focus, and that has allowed it to achieve superior returns.

Out of all the companies in the U.S., Texas Instruments does not strike me as a firm particularly in need of an activist campaign.

Management’s long-term focus caused it to exit markets that were not structurally attractive — such as components for smartphones and other fast-moving consumer electronics. The company often gave up short-term revenues and profits with these sorts of strategic decisions. But in doing so, it built a much higher quality and more durable operation than the chip companies that prioritized short-term growth.

Frankly, I don’t think Elliott should have invested in TXN stock if they weren’t comfortable with management’s strategy. Texas Instruments has always run according to its own operating model and approach. If Elliott wants a company that only cares about quarterly earnings numbers and getting the best results over the next three to 12 months, there are plenty of semiconductor companies already taking that approach.

TXN stock is up more than 300% over the past 10 years, and shares are currently trading at all-time highs. That’s even with analog chips being in a slump right now and the company reporting soft earnings.

It’s a testament to management’s skill that the stock is trading up, and the multiple is expanding, given the analog space’s headwinds right now. It’s true, as Elliott points out, that TXN has underperformed other chip stocks over the past few years. And sure, Texas Instruments isn’t keeping up with AI chipmakers. But why should it? Selling electronic gear for vehicles, factories, and so on is a different business than AI chips for data centers. It’s unreasonable to expect Texas Instruments to equal the performance of firms competing in an entirely different vertical/end market.

At some point, the vehicle market, industrial automation and smart factories, internet of things applications and so on will return to growth and Texas Instruments’ numbers will pick back up. In the meantime, management has no reason or obligation to have to try to keep pace with Nvidia (NVDA) or other momentum stocks. Texas Instruments’ long-term track record speaks for itself.

The Bottom Line

My final issue with Elliott’s campaign is the timing. TXN stock notched a new all-time high this week. With the current dip in business, shares are going for 38 times forward earnings. Even using 2026 earnings estimates when analog chips will have (presumably) returned to normal demand levels, TXN stock is still selling at a not exactly dirt cheap 26 times projected earnings.

With interest rates elevated, what’s the rush to step up the share buyback program right now? And that’s doubly true when the U.S. government is handing out grants to firms that will build new domestic chip foundry capacity. I simply don’t see the logic behind this activist campaign whatsoever. And I don’t think I’m alone in that view.

For one example, Wells Fargo’s Gary Mobley suggested that Elliott’s requests may be “unrealistic” given that Texas Instruments expansion projects are already well underway, and it would make little sense to scrap these in-progress facilities at this point.

I view TXN shares as mildly overvalued today, and as such, I am sticking with a hold rating for now. And I see little reason to think this activist campaign will accomplish much — I hope management rejects the suggestions and proceeds with its normal expansion plans.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you enjoyed this, consider Ian’s Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.