Summary:

- Texas Instruments’ stock is at all-time highs despite a persistent semiconductor industry downturn.

- The company faces headwinds in its key automotive and industrial segments, making it harder to justify the current high valuation.

- The firm’s elevated P/E ratio will also dampen the effectiveness of its buyback program.

- I personally am holding my shares as I believe Texas Instruments will outperform over a long time horizon, but I have modest expectations for the next 24 months.

wellesenterprises

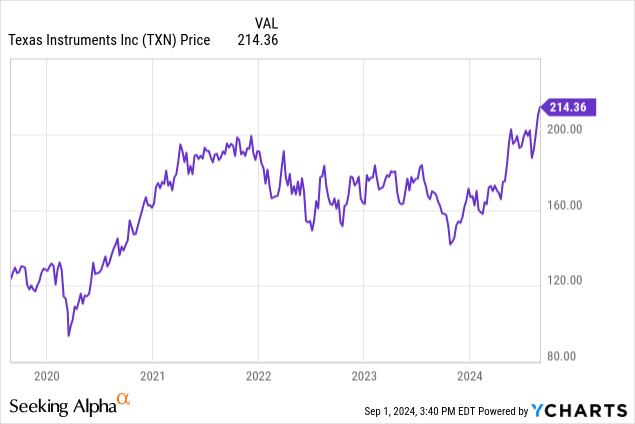

Chipmaker Texas Instruments’ (NASDAQ:TXN) shares continue to rally and made new all-time highs last week, breaking above prior resistance at the $200 mark:

This comes at an interesting time for the company. As I discussed previously, an activist investor, Elliott Investment Management, has taken aim at Texas Instruments, saying that the company is spending too much on new plants and equipment as opposed to returning cash to shareholders. I believe that view is misguided. Regardless, management is addressing these concerns, all while the overall semiconductor industry remains in significant downturn.

That may seem surprising given media headlines surrounding artificial intelligence and cutting-edge computing units needed to run AI and advanced data center operations.

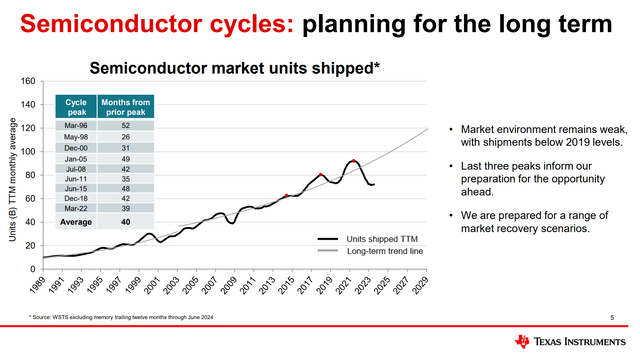

However, the semiconductor industry is far more than just the sorts of chips that go into those specific applications. In fact, as this slide from Texas Instruments’ most recent investor presentation shows, the overall industry remains in one of the biggest cyclical downturns that we’ve seen in decades:

Semiconductor industry demand (Corporate Presentation)

Texas Instruments produces analog chips and embedded computing systems. These are not those sorts of things that go primarily into AI, data centers, or other such glamorous uses that are getting all the attention lately. Rather, the majority of Texas Instruments revenues come from two segments, automotive and industrial. Both of these have shown weakness over the past year or two.

In automotive, there were record car sales early on in the pandemic. Consumers were flush with extra cash and interest rates were still low, making for a boom in vehicle sales. This boom was magnified thanks to supply chain shortages and disruptions in international trade and shipping. All told, this created a vehicle shortage which drove prices through the roof.

Automotive components makers, including the chip companies, enjoyed a tremendous demand picture as automakers replenished their inventories to recover from this historic disruption. But now, weakening consumer spending and higher interest rates have caused the automotive market to cool off and left firms with excess inventories of components including chip units. That has resulted in slow sales and margin pressure today.

Industrial is obviously a broad category and some niches within it are performing for Texas Instruments. But overall, there’s been a pullback in demand there as well. High interest rates and the mixed macroeconomic outlook have caused companies to be more reluctant on spending.

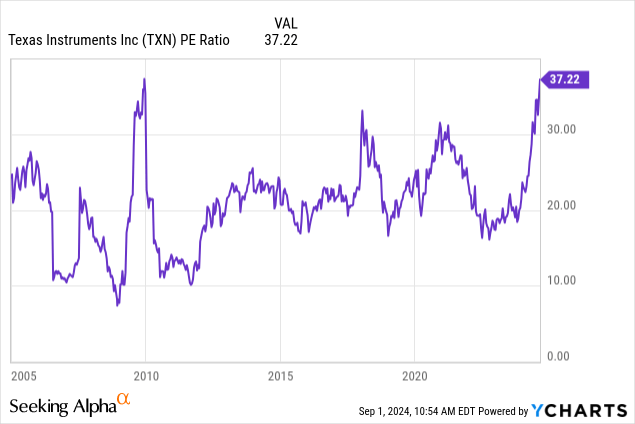

Put it all together, and Texas Instruments is not delivering particularly upbeat earnings results at the moment. Combine with the record high stock price, and you end up with a situation where Texas Instruments is now selling at more than 37 times trailing earnings and 40 times estimated 2024 earnings. This puts the stock near its highest valuation ratio in at least the past 20 years:

There’s certainly the argument for buying near the bottom of the industry cycle and paying a temporarily high P/E ratio for a company whose earnings are about to recover to more normalized levels. In this case, however, I don’t think that case really applies.

Instead, I believe the market is already pricing a recovery that will eventually happen but is still a fair bit off and comes with operational risk and macroeconomic risk.

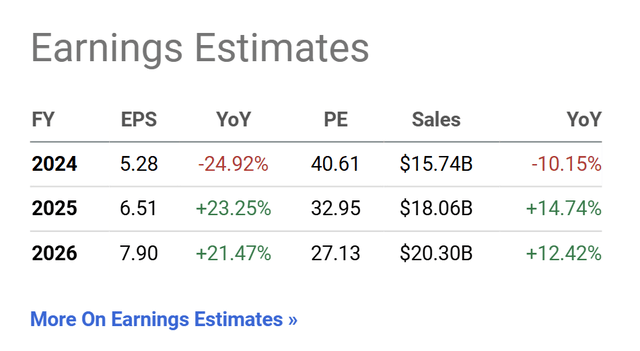

Analysts are currently modeling that Texas Instruments will generate $20.3 billion of revenues in fiscal year 2026 and generate $7.90 a share of earnings.

TXN earnings estimates (Seeking Alpha)

That would put the company’s revenues back at the same level that the company achieved in 2022 with earnings being slightly lower than prior peak levels.

Consider that the projected $7.90 of FY ’26 earnings assumes more than 20% annual earnings growth in 2025 and 2026 off of revenue growth of 15% and 12%, respectively. Thus, these earnings assumptions bake significant profit margin expansion into the mix to hit those current analyst targets. Additionally, even if they hit those targets which involve more than 20% annualized earnings growth over the next two years that still results in a stock at 27 times earning which is not particularly cheap either in isolation or compared to TXN stock’s historical average valuation.

High Valuation Amid Significant Near-Term Headwinds

There’s also the matter of execution risk around all the new manufacturing plants that Texas Instruments is opening. There could be growing pains or operational stumbles as these new facilities start operations.

Another concern is that Texas Instruments derives a significant portion of its revenues from the Chinese and Asian markets. If political tensions between China and the U.S. continue to worsen, it’s not inconceivable that you would see sales that used to go to Texas Instruments move to suppliers based out of other countries that would be viewed as more politically neutral.

There’s the possibility of a recession. Texas Instruments is a huge player in the automotive space, both for lighting/body electronics and vehicle advanced driver assistance system “ADAS”. For example, on average, there’s at least $350 of chip content including approximately 300 discrete chips per ADAS unit. According to Texas Instruments, the ADAS market has grown at an impressive 20% compounded annual growth rate between 2013 and 2023. However, a worldwide recession and resulting decline in vehicle sales would likely greatly hamper ADAS demand for the next couple of years.

There’s also another important market that is currently under pressure. Texas Instrument has been increasing its presence in the energy infrastructure space. Think here of solar panels, inverters, and storage units. These solar systems contain, on average, $350 in chip content per unit. The solar market is also in something of a downtrend now as there’s been some pushback around subsidies for the industry. Solar stocks have dropped dramatically from their highs, and elevated interest rates have made it more difficult to raise capital for new solar infrastructure projects. The election this fall could further complicate the outlook for the U.S. solar industry in future years.

On The Capital Allocation Question

This leads to the question of capital expenditures, which is where the dispute with activist investors is centered.

In a presentation in August, Texas Instruments’ CEO, Haviv Ilan, acknowledged the concerns around the firm’s capital spending and tackled the question directly. He pointed out that Texas Instruments is already more than 60% through its high-intensity capital spending cycle. The CEO made a slight adjustment to prior guidance, noting that 2026 will now be a flexible year for capital spending plans, with a potential cut in expenditures — versus prior expectations — depending on how quickly end demand picks back up.

Ilan said that the company’s current investments will give it a dominant manufacturing position for the next 10 to 15 years in low cost 300-millimeter capacity. This will ultimately allow Texas Instruments to meet the rapid growth of key markets such as ADAS, collaborative robots, and so on.

For example, factory automation has a high degree of analog chip intensity. Here’s Mr. Ilan describing the opportunity:

“For TI, this sector represented about $2 billion of revenue in 2023, growing about 10% per year since 2013. As one example, a collaborative robot or a cobot can often have more than $400 of TI content in one system for across more than 200 chips. This includes a mix of application-specific products such as vision processors, radar, C2000 real-time control and GaN as well as general purpose products such as Ethernet 5, data converters, isolation, amplifiers, Hall effect sensors and voltage regulators to name a few.”

However, given the extended downturn in the semiconductor market, TI is potentially dialing back some of its factory expansion spending from 2026 into future years. The CEO emphasized that Texas Instruments has scalability, its modular manufacturing design will allow it to incrementally add more capacity as needed rather than expansion being an all-or-nothing approach. Future module build out will only when there’s already customer demand in sight to use that additional capacity.

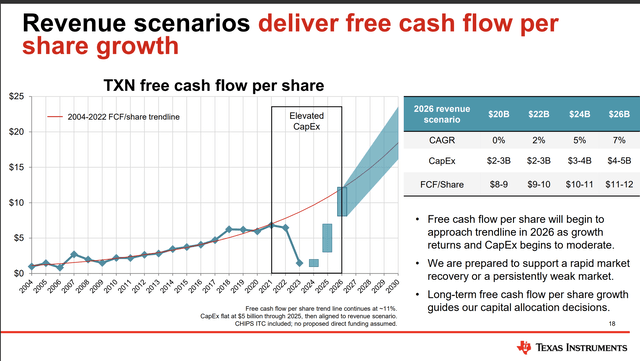

What’s this all look like in practice? Here’s the company’s forward-looking guidance for free cash flow per share, which is management’s leading key performance indicator for the company’s performance:

TXN free cash flow per share (Corporate Presentation)

Management believes it will earn between $8 and $12 per share in free cash flow in 2026. That range depends on how much revenue grows.

However, even toward the high end of the range, TXN stock is not particularly compelling at its current price even in the upside scenarios which reach toward $25 billion of revenues. And if the company only hits $20 billion of revenues in 2026, it’s hard to see how TXN stock would appreciate much from here over the next couple of years.

The upside case, however, is that the analyst consensus is only $20.3 billion for FY ’26 revenues right now, which is right near the bottom of management’s outlook. If the company’s forecast is right, revenues should be closer to the midpoint of its guidance ($23 billion), leading to considerable upside revisions to the Wall Street consensus. If the company can put up, say, $23 billion in 2026 revenues and $11 share in free cash flow, you can make a case for the stock being fairly valued today.

I’d reiterate that I believe the company has an exceptional management team. They have a proven capital allocation track record and treat their shareholders very well.

Texas Instruments is one of my favorite ways to benefit from the long-term growth of the semiconductor industry. I particularly like its exposure to factory robots and driver assistance technology. Both of these should be tremendous opportunities for Texas Instruments over the long term. And thanks to its recent investments, it will soon have the in-house manufacturing capacity to maintain its leadership in these fast-moving markets.

That said, the market is seemingly putting the cart in front of the horse in terms of the valuation here.

For the stock to work from this price, you need the 2026 recovery to happen according to plan and for the company to comfortably top the current Wall Street consensus. This could certainly happen, but it feels like you need to hit a better-than-expected outcome in terms of business performance simply for the stock to generate acceptable returns over the next few years.

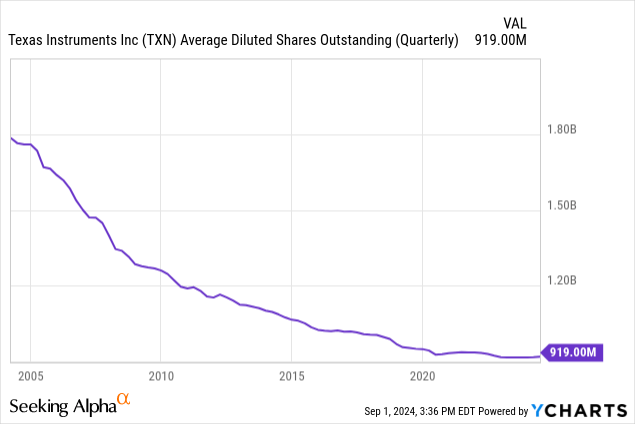

I’d also note that Texas Instruments has generated a huge amount of shareholder value over the past two decades through its continual stock buyback program.

Specifically, Texas Instruments has now retired nearly half of its outstanding share count over the past 20 years. But think back to the P/E chart above, TXN stock usually traded closer to 20x earnings on average in the past. With the stock now trading at a far higher P/E ratio, the share buyback will deliver far less bang for the buck going forward.

Even if we discount 2024 and 2025 as cyclical down years, the company is trading at a not-particularly-cheap 27x estimated 2026 earnings. And, based on Texas Instruments’ own guidance, it is selling for about 20x estimated 2026 free cash flow per share as well. I just don’t see much value here, particularly given the various macroeconomic and geopolitical concerns right now. I remain a shareholder in Texas Instruments stock (I’d held shares since 2016) but I see little reason why this would be a particularly good time to add to the position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you enjoyed this, consider Ian’s Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.