Summary:

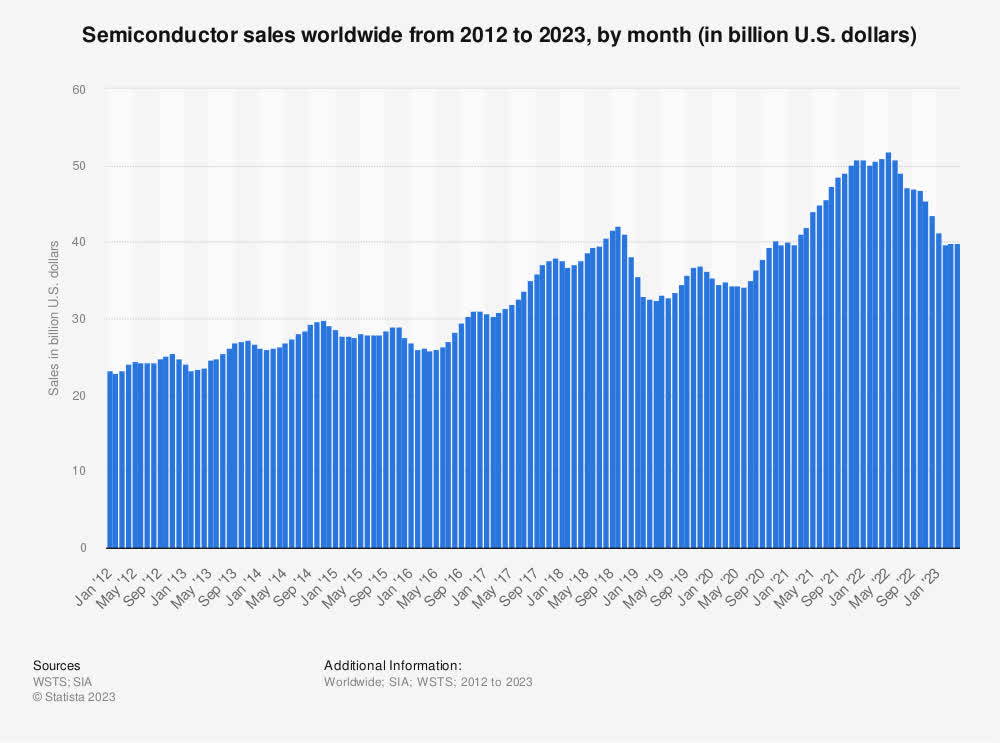

- Semiconductor companies’ sales doubled from 2012 to 2022 due to the rising demand for digital products.

- Semiconductor industry experiences economic cycles, but we’re approaching the bottom of the current one, setting the stage for the next supercycle between 2024-2026.

- Texas Instruments is primed to benefit from the increasing chip demand in the next decade, boasting industry-leading margins and vertical integration.

- TXN is what I consider a dream stock for dividend growth, offering a 3.16% yield, a 10-year DGR of 17.6%, and a secure payout ratio.

- TXN is anticipated to achieve a 12% annual EPS growth from 2024 to 2027, suggesting a potential total ROI of 17.5% annually.

SweetBunFactory

Investment thesis

At the heart of the digital revolution lies Moore’s Law, a fundamental principle that has shaped the modern world. Simply put, it states that the number of transistors on a computer chip doubles every 2 years. This doubling effect enables the continuous miniaturization of our electronic devices while significantly boosting their processing power.

Thanks to Moore’s Law, our smartphones have become sleeker, more efficient, and capable of performing complex tasks at lightning speed. Computers have transformed from clunky machines to powerful tools that fit in our pockets, all within a remarkably short span of time.

Moore’s Law has become the engine behind innovation, propelling advancements in artificial intelligence, data processing, and countless other fields.

It’s the reason why each new generation of technology outshines its predecessor, ushering in an era of unprecedented connectivity and efficiency.

As long as Moore’s Law continues to hold true, the future promises even more astounding technological marvels, being driven forward by companies like Texas Instruments (NASDAQ:TXN), QUALCOMM (QCOM), Broadcom (AVGO), NVIDIA (NVDA), and many other.

As our society advances, our hunger for technology products grows exponentially. Just think about it: the average person on Earth utilizes about 120 chips in various devices.

Take a typical car, for instance; it could employ anywhere from 50 to 150 chips, depending on its level of digitalization. Now, consider electric vehicles—they can incorporate up to 3,000 of these chips.

Can you grasp the potential here?

Our lives are becoming increasingly digitalized, from multiple computers in households to smartphones and digital household appliances.

These trends will only accelerate in the future. It’s no wonder that semiconductor sales worldwide more than doubled between 2012 and the end of 2022, reflecting our insatiable demand for new technologies.

Semiconductor Sales by Quarter (Statista)

Semiconductor sales have experienced a dip from their peak its 2022, it’s clear that the industry is subject to economic cycles, but always recovering within the next 12-18 months.

In my opinion, we’ve reached the bottom of the cycle in 2023, and the situation should improve moving forward, ushering in a new super cycle for semiconductors.

Let me demonstrate why a company like TXN could be a promising investment during the next cycle.

TXN’s Past was Impressive, but the Future is even more Promising

TXN is a global semiconductor company known for designing and manufacturing analog and embedded processing chips.

Their chips are crucial components in various devices, including smartphones, cars, industrial equipment, and consumer electronics, enabling functions like power management, data conversion, and signal processing.

Keep in mind, companies like TXN have a unique advantage—they handle both the design and manufacturing of their chips, ensuring a tight grip on quality and customization. While Companies like Broadcom and NVIDIA depend on external manufacturers like TSMC (TSM) to bring their designs to life, which adds risk and complexity to the supply chain.

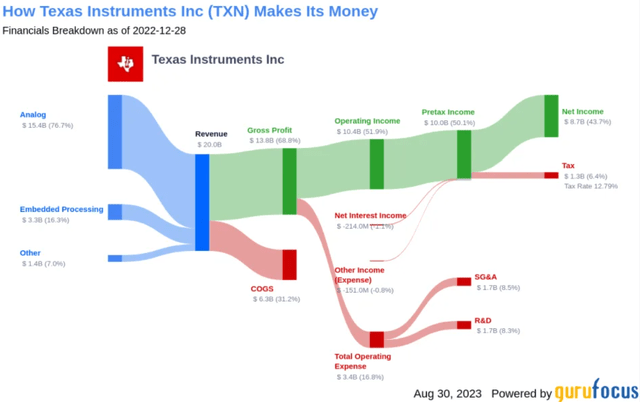

To get a clearer picture of how TXN makes money, let’s look at their product segments. Analog products make up the largest chunk, contributing 77% to the total revenue, followed by Embedded Processing at 16%, and Other products at 7%.

Being a semiconductor company, TXN manages its expenses quite effectively. The manufacturing and operating costs aren’t overly burdensome, allowing a significant portion of the Gross Profit to translate into Net Income. This points towards a highly profitable business model for TXN.

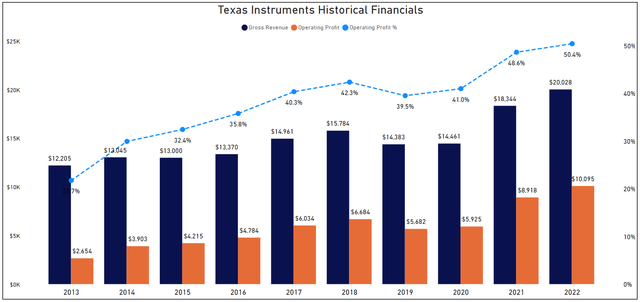

Having a look at the historical financials, it’s clear that TXN has experienced significant growth. Since 2013, their revenue has surged from $12.2 billion to over $20 billion by the end of 2022—a remarkable 64% increase, averaging around 6.4% annually.

But what truly catches the eye is the expansion of their Operating Margin. It has seen a substantial 28.7% increase since 2013, and they’ve managed to boost their Operating Income by more than 3.8 times. These figures underline not just growth, but a strategic and financial evolution that sets TXN apart.

TXN Historical Financials (Author’s Graph (Data SA))

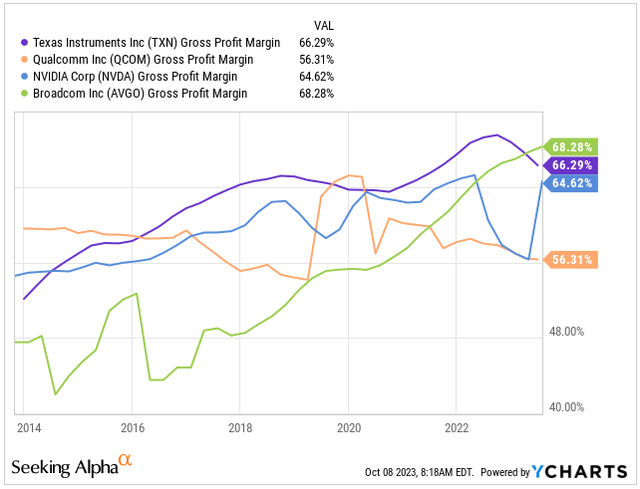

From my perspective, the boost in the operating margin can be credited to the company’s vertical integration, a strategy that has made them exceptionally efficient in comparison to their competitors. This is further reinforced by their consistently high Gross Margin, standing at 66.3%, outshining their peers for several years.

It’s interesting to note that Broadcom, since 2016, has made significant strides in expanding its margins and has recently taken the lead in this area.

TXN has seen historical success, but the looming question remains: what lies ahead in the face of increased economic uncertainties and soaring interest rates?

Looking ahead for TXN, the road is marked with uncertainty amidst economic challenges and soaring interest rates.

The current slowdown stems from a mix of factors, including inflation, global tensions, and the ongoing impact of higher rates squeezing people’s spending power.

This situation has led to widespread uncertainties in the economy, resulting in reduced consumer expenditure and erratic demand for semiconductors.

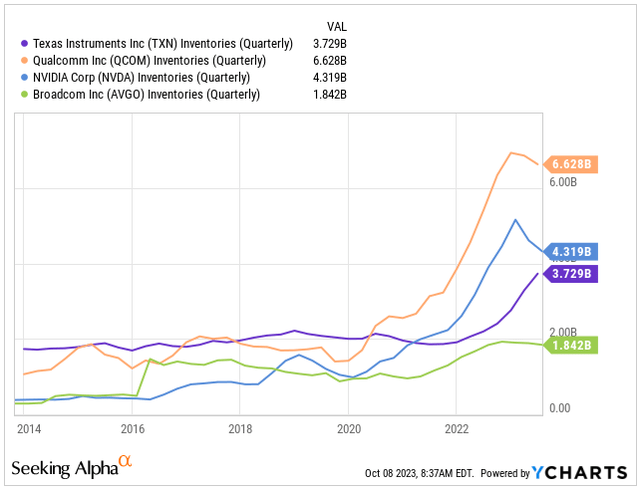

Consider the world of discretionary products – PCs, smartphones, and cars. As people cut back on these purchases, the demand for the chips fueling these devices has dwindled, leaving companies with excessive inventories.

High inventories pose a significant risk for semiconductor companies; older chips quickly become outdated due to rapid technological advancements, forcing firms to sell them at hefty discounts or, in the worst-case scenario, write them off.

Despite these challenges, there’s a glimmer of hope. Many companies are already reporting a decline in their inventories, hinting at a positive turn. I’m optimistic that TXN will follow suit, especially considering the upcoming release of their Q3 earnings report.

Remember the old saying: when in doubt, zoom out.

Stepping back from the short-term ups and downs in demand, have a broader look at the long-term trend spanning the last two decades within the semiconductor industry.

The sector has demonstrated consistent growth. To put it in perspective, annual sales surged from $139 billion in 2001 to a remarkable $573.5 billion in 2022, marking a staggering 313% increase.

Alongside this, unit sales of semiconductors also saw a substantial rise, increasing by 290% during this period.

This surge reflects the escalating demand for semiconductors across various sectors of the economy.

In fact, a study conducted in 2020 by SIA and the Boston Consulting Group projected a 56% increase in global demand for semiconductor manufacturing capacity by 2030, underscoring the industry’s robust trajectory.

The Dream Stock for Dividend Growth Investors

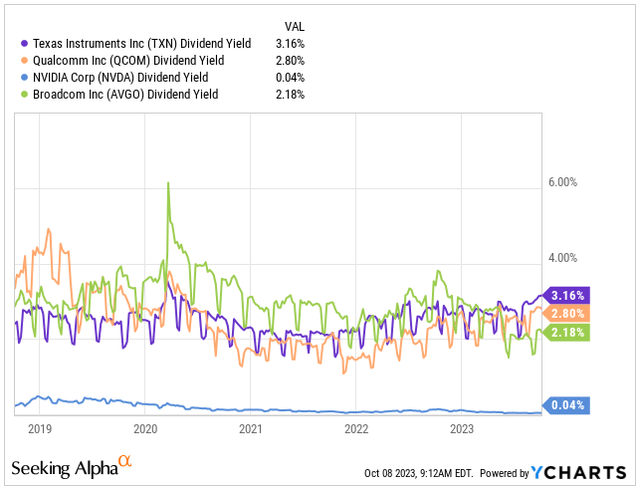

I can’t stress this enough: TXN is the dream stock for dividend growth investors. Right now, it offers a substantial dividend yield of 3.16%, far surpassing its competitors who currently pay dividends below the 3% mark.

What’s even more intriguing is TXN’s 4-year average, which sits at 2.57%. This means the company is currently paying dividends well above its historical norms, indicating that it might also be undervalued at this point.

Dividend Yield (Seeking Alpha)

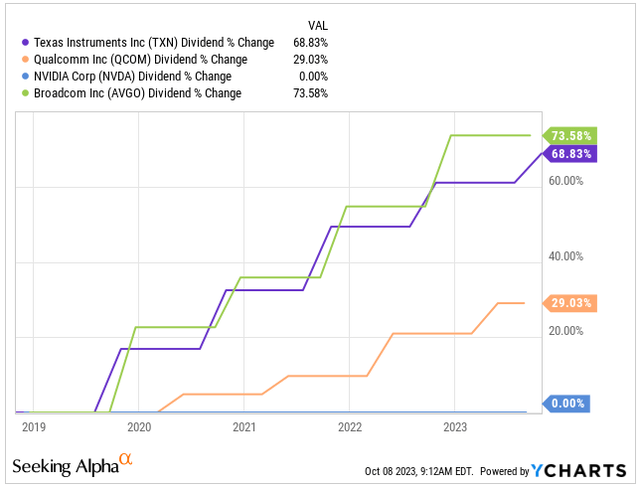

When comparing dividend growth among the four companies I’ve analyzed, only Broadcom has managed to outdo TXN’s impressive 69% or roughly 14% growth over the past 5 years.

To put it in perspective, the sector’s median CAGR for dividends over the last 5 years was 8%, and over the last 10 years, it was 8.7%, according to Seeking Alpha.

But even these figures fall short of TXN’s remarkable 10-year annualized dividend growth rate of 17.6%.

This is precisely why I regard TXN as a superior dividend growth stock, one that should be a cornerstone in every dividend-focused portfolio.

Dividend Growth (Seeking Alpha)

Rest assured, despite the substantial dividend growth, there’s no need for concern about the safety of the dividend.

Over the past decade, the company’s payout ratio has consistently ranged between 45% and 65%, with the upper limit hitting only during the peak of the COVID-19 pandemic in 2020. Typically, the company maintains a secure 55% payout ratio.

In addition to the impressive dividend growth and yield, TXN has been actively buying back its shares. In fact, they successfully reduced their outstanding shares by 16.8% over the last 10 years, showcasing a diversified approach to enhancing shareholder value.

Slightly Undervalued with Promising Future Ahead

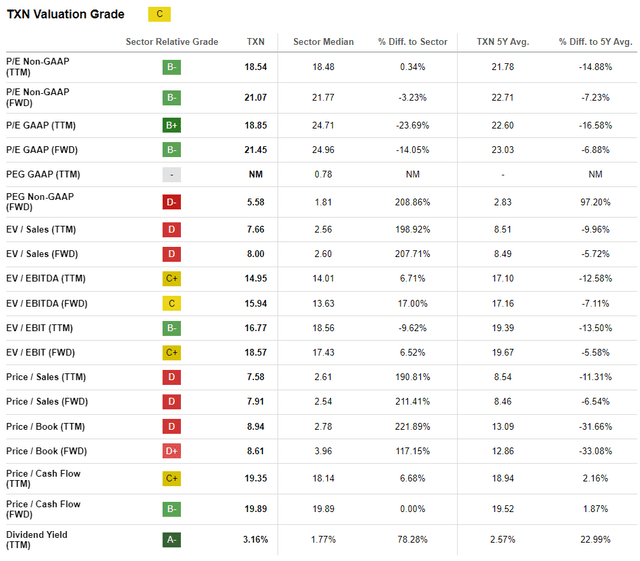

Currently, TXN appears to be slightly undervalued based on several key metrics.

Its PE Ratio for FY23 earnings is 18.54x, lower than its 5-year average of 21.78x, indicating a 15% undervaluation.

Looking ahead to FY24 earnings, the Forward PE Ratio is 21.07x, compared to the 5-year average of 21.71x, suggesting a 7% undervaluation.

Additionally, the EV/EBITDA stands at 15.94x, down from the 5-year average of 17.16x, indicating a 12.5% undervaluation.

When considering these figures, the company is trading on average at 11.5% below its 5-year averages.

However, it’s essential to factor in the impact of rising interest rates and the FED’s stance of “higher for longer“, even though I personally disagree with it and expect it to be unsustainable.

Nevertheless, following the rhetoric of officials, TXN’s cost of capital would likely be affected, making it improbable for the company to maintain the more elevated valuation levels seen during the past decade of low interest rates.

While I wouldn’t classify this as a definitive value pick at the moment, I believe there’s still a significant margin of safety for value investors to explore by adding TXN to their portfolios.

However, primarily, this pick is tailored for dividend growth investors given the company’s strong dividend track record.

Valuation Grade (Seeking Alpha)

When we look past the current challenges in the semiconductor industry, analysts are painting a promising picture for TXN’s future.

Despite a notable dip in its EPS in 2023 compared to the previous year, projections indicate a robust growth rate of 12% annually between 2024 and 2027. If this trend holds, the EPS could reach $12 by the close of 2027.

This projection feels quite realistic, especially given the anticipated bullish cycle for semiconductors between 2025 and 2026. If things unfold as expected, the stock might be trading around $246 by the end of 2027.

It’s important to note that this scenario accounts for a slight contraction in the company’s valuation. In this context, we can anticipate a stock price return of approximately 14.25%. When factoring in dividends, the total return could hit around 17.5%, surpassing the anticipated performance of the broader market represented by (SPY) over the next decade.

| Fiscal Year | 2023 | 2024 | 2025 | 2026 | 2027 |

| EPS | $7.45 | $8.18 | $9.17 | $10.75 | $12.00 |

| EPS Growth | -23.1% | 9.8% | 12.1% | 17.2% | 11.6% |

| Forward PE | 21.1 | 20.5 | 22.0 | 21.0 | 20.5 |

| Stock Price | $ 157 | $ 168 | $ 202 | $ 226 | $ 246 |

Conclusion

The past year has been quite a rollercoaster ride for semiconductor companies. With the end of a super cycle driven by the pandemic-induced demand, some companies have seen their stocks stagnate. Meanwhile, those closely tied to AI have experienced exponential growth.

For a lack of a better classification, TXN falls into the more traditional group of semiconductor companies, and it faced a decline in its EPS.

However, as a new bull cycle for semiconductors emerges, fueled by the growing demand for chips in EV vehicles, smartphones, and various industrial applications, TXN is primed to seize this opportunity.

Trading at a relatively fair or slightly undervalued price and boasting a unique dividend growth profile, TXN presents an attractive option for dividend growth portfolios, especially considering the expected EPS expansion between 2024 and 2027.

If the growth I anticipate materializes, we could see TXN reaching around $246 by the close of 2027, indicating an impressive 17.5% annualized total return.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.