Summary:

- Texas Instruments is a leading player in the semiconductor industry, positioned for long-term growth through advanced manufacturing and diversification of its product portfolio.

- The company has a history of dividend increases and share buybacks, but the forecasted decline in EPS and high valuation present uncertainties.

- Notable risks include global economic weakness, supply chain disruptions, and market demand volatility. Overall, Texas Instruments is rated as a HOLD.

da-kuk

Introduction

The semiconductors industry within information technology is fascinating. I analyzed Texas Instruments (NASDAQ:TXN) a year ago and found it to be a HOLD. A year following that analysis, the company underperformed the broader market, and it is time for me to return and analyze one of the positions in my dividend growth portfolio. If the company is a BUY, I may add to my position. The semiconductor industry enjoys a mega-trend of growth, and leading players will benefit from it in the long term.

Seeking Alpha’s company overview shows that:

Texas Instruments designs manufactures, and sells semiconductors to electronics designers and manufacturers in the United States and internationally. It operates in two segments: Analog and Embedded Processing. The Analog segment offers power products to manage power requirements across various voltage levels. This segment also provides signal chain products that sense, condition, and measure signals to allow information to be transferred or converted for further processing and control. The Embedded Processing segment offers microcontrollers in electronic equipment, digital signal processors for mathematical computations, and applications processors for specific computing activity. This segment provides products in various markets, such as industrial, automotive, personal electronics, communications equipment, enterprise systems, calculators, etc.

Fundamentals

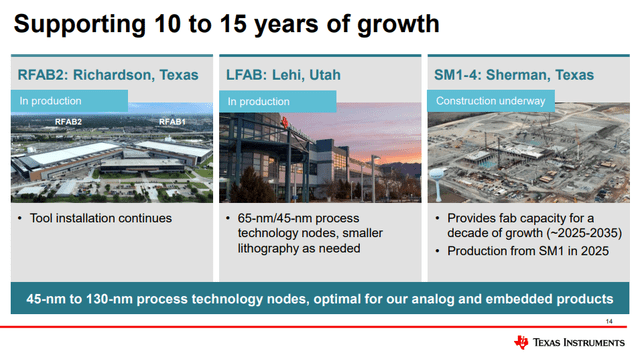

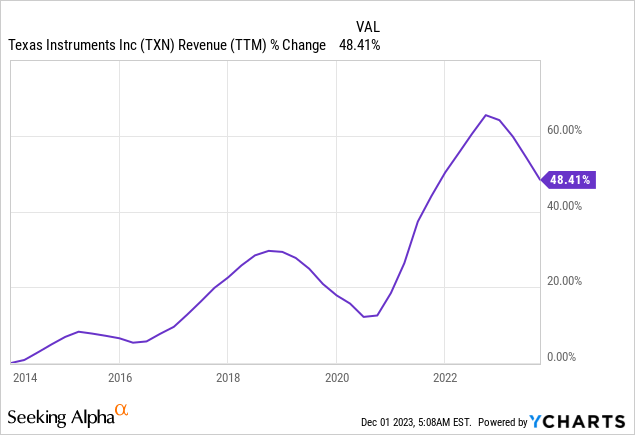

The revenues of Texas Instruments have increased by almost 50% over the last decade but have suffered from decline over the previous several quarters. The graph below shows that the business is very cyclical, yet the company grows following every cycle. The company focuses on organic growth and has built new factories to increase scale. Two are already online, and a third will be online in 2025. In the future, as seen on Seeking Alpha, the analyst consensus expects Texas Instruments to suffer from flat sales in the coming three years. Following a decline in 2023 and increases in 2024 and 2025, sales are expected to stay around $20B.

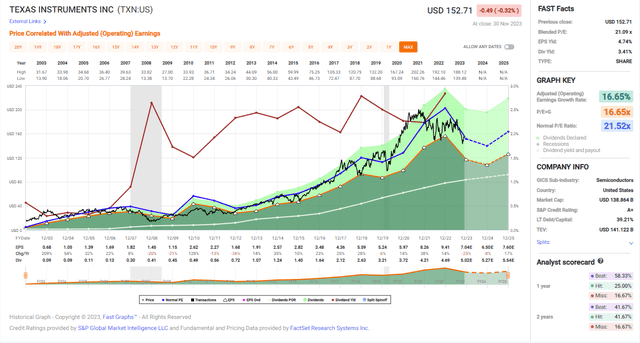

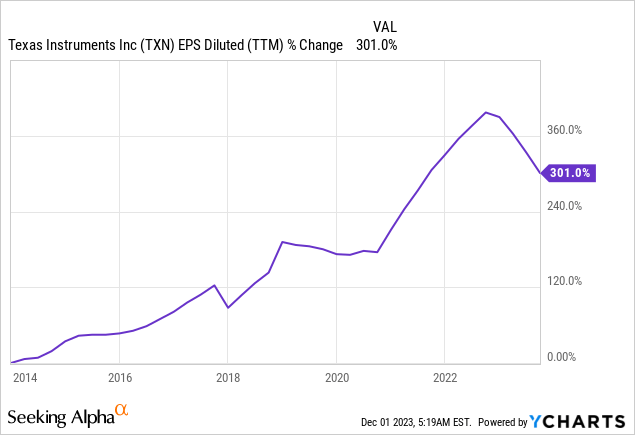

The EPS (earnings per share) of Texas Instruments has increased much faster, with a 300% increase, meaning that the company has more than quadrupled its sales. During that decade, the company enjoyed a steep rise in operating margins from 22% to 50%. That, together with sales increases and buybacks, supported EPS growth. In the future, as seen on Seeking Alpha, the analyst consensus expects Texas Instruments to suffer from an 18% decline in the next three years. 2023 and 2024 are forecasted to see declining EPS. The recovery is expected in 2025.

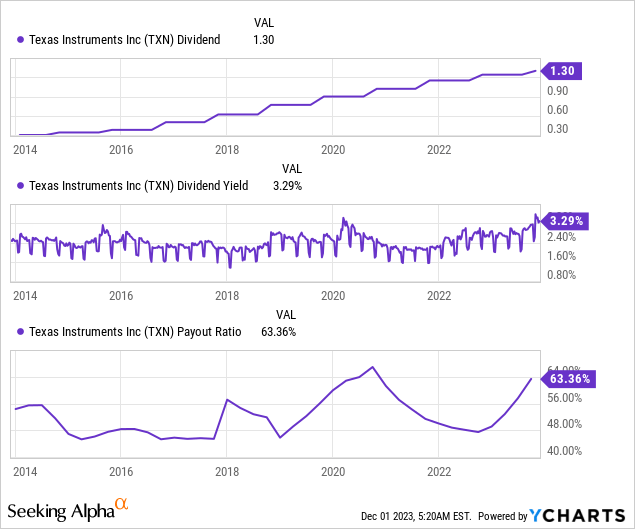

The company has increased the dividend annually for almost twenty years, with the latest 5% increase in September. The current dividend yield is attractive at 3.3%, and while the payout ratio is a bit high, it is still manageable at 63%. However, investors should not expect high dividend increases since the payout ratio is higher. With the weakening EPS and the current payout ratio, we will likely see low-single digits increases.

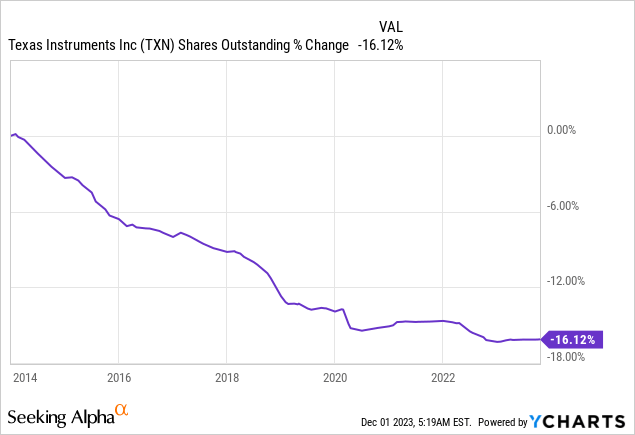

In addition to dividends, the company returns capital to shareholders via buybacks like many other profitable blue chips. Buybacks are highly efficient when the share price is low, as each dollar buys more. These share repurchase plans support EPS growth by reducing the number of outstanding shares. Over the last decade, the company has repurchased 16% of its shares. Since the pandemic, the company’s buybacks have slowed down.

Valuation

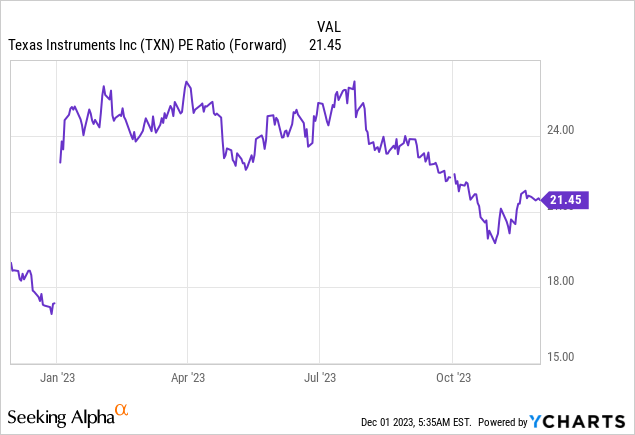

The P/E (price to earnings) ratio of Texas Instruments stands at 21.5 when using the 2023 EPS estimates. This is a significantly higher valuation than we saw a year ago when I analyzed the company. Paying 21 times earnings for a company that suffers from negative growth due to the cyclicality of the business seems too high. The current valuation looks too high because there are also higher interest rates, which imply better, safer alternatives.

The graph below from Fast Graphs also emphasizes that the valuation of Texas Instruments is too high. The average P/E ratio of Texas Instruments over the last two decades stood at 21.5, which is in line with the current one. However, the company enjoyed an annual growth rate of 16.65% per year during that period. Thus, buying the shares at the current valuation during the challenging business environment seems too expensive.

Opportunities

Expansion in Advanced Manufacturing is the most promising opportunity. Texas Instruments envisions substantial growth through investments in advanced manufacturing technologies. This strategic initiative involves staying at the forefront of cutting-edge manufacturing processes, continuously enhancing efficiency and product quality. It will continue investing in its competitive advantages, manufacturing, and technology, fostering sustained growth through efficiency and product quality advancements.

“Our unwavering focus on manufacturing and technology remains a pivotal driver for long-term growth, as we persistently invest in advanced processes that not only bolster efficiency but also elevate the quality of our product offerings.”

(Rafael Lizardi- Senior VP and CFO, Q3 2023 Conference Call)

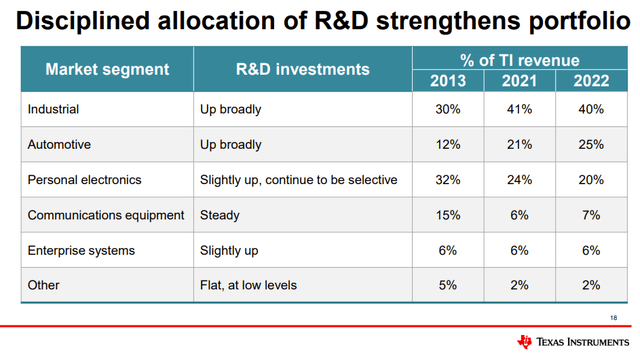

Diversification of the product portfolio is another opportunity. Texas Instruments is strategically positioning itself for growth by emphasizing the diversification of its product portfolio. This involves not only expanding into emerging markets, but also dedicating resources to the development of innovative solutions that address evolving market demands. A broad product portfolio, the reach of its channels, and diverse and long-lived positions are critical competitive advantages that position the company for future growth, with industrial and automotive leading the way.

“Our steadfast commitment to maintaining a broad product portfolio positions us strategically for growth, particularly as we explore opportunities in emerging markets and deliver innovative solutions to meet the evolving demands of our diverse customer base.”

(Rafael Lizardi- Senior VP and CFO, Q3 2023 Conference Call)

Strategic capital allocation is another opportunity. Recognizing the paramount importance of efficient resource utilization, Texas Instruments sees strategic capital allocation as a central growth driver. The company is committed to reinforcing its competitive advantages through disciplined capital allocation, channeling resources into endeavors that promise the most significant returns. The company plans to continue strengthening these advantages through disciplined capital allocation and focusing on the best opportunities. The company will do so by committing to dividends and occasional buybacks. Therefore, the company can keep improving margins, focusing only on the most attractive endeavors.

“Disciplined capital allocation remains a top priority, enabling us to concentrate on the most promising opportunities and ensuring sustained growth in free cash flow per share through prudent and strategic investment decisions.”

(Rafael Lizardi- Senior VP and CFO, Q3 2023 Conference Call)

Risks

Global economic weakness is a significant medium-term risk. Despite its growth ambitions, Texas Instruments remains aware of the potential impact of a weak global economic environment on its performance. With a cautious outlook, the company highlighted that in the fourth quarter, it expects its revenues to be $3.93 billion to $4.27 billion as it continues to operate in a weak business environment, acknowledging the prevailing challenges in the broader economic landscape. In this situation, achieving growth may be highly challenging in the next 2-3 years.

“The persistent weakness in the global economic conditions poses a considerable risk to our near-term performance, as reflected in our cautious revenue outlook for the upcoming quarter, showcasing our vigilance in navigating the uncertainties of the current economic climate.”

(Rafael Lizardi- Senior VP and CFO, Q3 2023 Conference Call)

Supply chain disruptions are another challenge. Texas Instruments faces inherent risks associated with supply chain challenges, impacting manufacturing processes and inventory levels. The company noted in its reports that inventory at the end of the quarter was $3.9 billion, and days were 205, down two days sequentially, underscoring the ongoing efforts to adeptly manage supply chain disruptions that have become a significant industry-wide concern. Considerable inventory is expensive and exposes the company to write-down if it cannot sell or use its inflated inventory.

“Managing the complexities of supply chain disruptions continues to be a dynamic challenge, influencing our inventory levels. We are actively addressing these challenges to mitigate potential adverse effects on our operational efficiency and customer commitments.”

(Rafael Lizardi- Senior VP and CFO, Q3 2023 Conference Call)

The long-term challenge is the volatility of market demand. Acknowledging the unpredictable nature of market demand, Texas Instruments recognizes the impact of fluctuations on its revenue projections. It’s clear that the company is cyclical, but it cannot know when the cycle will begin or end. When sales are cyclical, revenues in Q4 are more complex to predict, and the general reliability of predictions is lower. The company must adopt a proactive approach to adjusting to the dynamic market conditions.

“Volatility in market demand remains a notable risk, and our revenue outlook for the fourth quarter is a responsive measure to the ever-changing dynamics of the market, illustrating our adaptability to address and mitigate the impacts of demand volatility on our business operations.”

(Rafael Lizardi- Senior VP and CFO, Q3 2023 Conference Call)

Conclusions

To conclude, Texas Instruments, a leader in the semiconductor industry, has established itself through decades of experience and innovation. With a focus on advanced manufacturing, a diverse product portfolio, and strategic capital allocation, the company positions itself for long-term growth. Despite recent cyclical challenges in the semiconductor market, Texas Instruments maintains resilience through its commitment to organic growth and operational efficiency. However, there are notable risks, including the impact of global economic weakness, supply chain disruptions, and market demand volatility.

The company actively addresses these challenges. While the company has a robust history of dividend increases and share buybacks, the forecasted decline in EPS and the current high valuation present uncertainties. Therefore, considering the potential challenges and the current market conditions, I rate Texas Instruments as a HOLD, awaiting further clarity on its ability to navigate the industry’s inherent complexities.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.