Summary:

- Texas Instruments is the world’s largest analog chip manufacturer, with a market share of nearly 20%.

- The company follows a vertical integration model and expects to manufacture 90% of its production in its own factories by the end of the decade.

- Texas Instruments has competitive advantages including economies of scale, cost advantage, a wide range of products, high switching costs, and product longevity.

SweetBunFactory

Founded in 1930, Texas Instruments (NASDAQ:TXN) is the world’s largest analog chip manufacturer (nearly 20% market share). The company does not follow a fabless model, unlike its main competitor Analog Devices (ADI), which outsources production. Texas Instruments manufactures 80% of its current production in its own factories, but thanks to the expansive Capex cycle we will discuss later, they expect this to reach 90% by the end of the decade. Despite this, and thanks to operating in the analog semiconductor business, it is much less capital-intensive (10-15% of sales in a normalized year) than other digital semiconductor manufacturers, such as Taiwan Semiconductors, which spends 44% of its sales in Capex.

Business Model

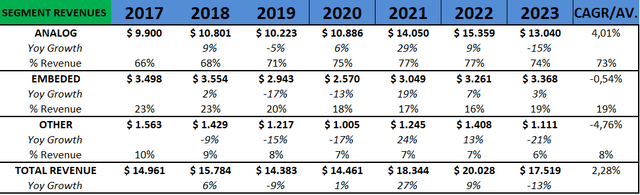

Texas Instruments have a product portfolio of approximately 80,000 products, which are reported in 3 different business segments.

Analog Semiconductors: Analog semiconductors shape real-world signals and manage power in electronic devices, playing a crucial role in converting, conditioning, and distributing electrical energy for various applications, including industrial, automotive, and personal electronics, amidst the ongoing digitization of electronics. It is worth noting that they are also very inexpensive, costing around 50 cents, some even as low as 4 cents.

Embedded Processing: These are products that power electronic devices, from simple microcontrollers to complex systems like motor control, widely used in industrial and automotive sectors. There is an important characteristic in these kind of semis. “Our customers often invest their own research and development to write software that works with our products. This investment tends to increase the length of our relationships with customers because many customers prefer to reuse software from one product generation to the next.” Texas Instruments Annual Report.

Inside the “other” segment are items that do not represent a significant amount of sales and cannot be reported in any of the other two segments.

Source: Author’s Representation

They are responsible for converting signals from the real world into binary language. They work with direct electric current, not in binary, like digital semiconductors. For example, they are used for measuring the outside temperature, the pressure of a car’s tires, the oil level of the engine, or the airbag sensor. Some of the most well-known clients of Texas Instruments include: Apple, Samsung, Intel, Qualcomm, Tesla, Boeing, Lockheed Martin…

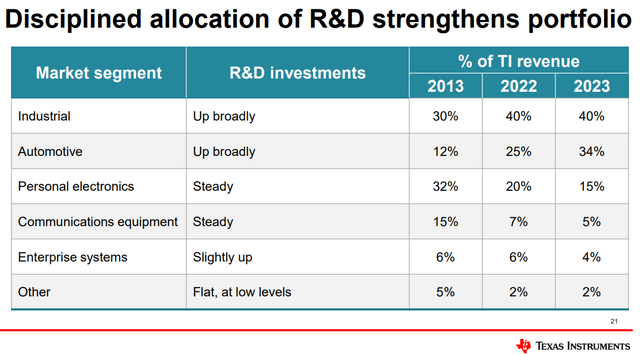

Thanks to the necessity of these analog chips, Texas Instruments is able to ride many macrotrends, such as car electrification, industrial automation, and the rise of IoT (Internet of Things). The company has been pivoting its product portfolio over the years to better position itself to surf these trends more effectively.

Source: Capital Management Presentation. Slide 21

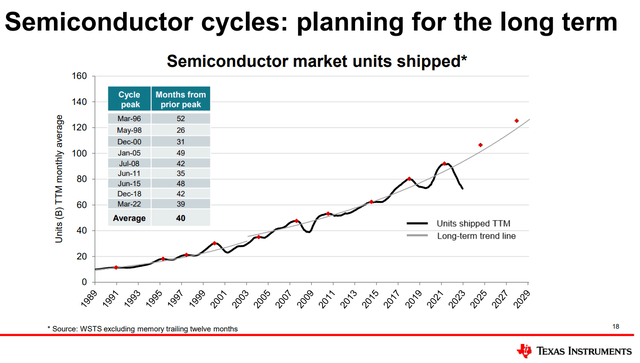

Despite being exposed to all these macrotrends, we cannot forget that the analog semiconductor industry is cyclical. These cycles typically last around 40 months, although the current one they are experiencing is extending. The fixed cost structure (more appealing for the long term and customer trust) makes it suffer more on the bottom line when sales decline. It suffers from operational deleveraging. For example, in 2023 sales dropped a 12.5% but Net Incomed decreased a 25.6%. Something that reassures me is that the management is aware of this, but still remains focused on the long term, as it should be. ” And again, our focus is on the opportunity ahead. I think it’s still very large. Secular growth is still there. We can look at the boards and the platforms, the architectures of these EVs and these robots and these test and measurement systems towards the end of the decade, and they’re exciting. There are more parts on the board. And the cycle it will play out. Our focus is getting prepared to what’s behind it.” Haviv Ilan. Texas Instruments CEO in the Morgan Stanley’s Technology, Media & Telecom Conference 2024, Mar-06-2024.

Source: Capital Management Presentation. Slide 18

Competitive Advantages

Economies of scale: Within the sector, TI is the only company that manufactures almost all of its chips internally. To achieve this, it has had to invest capital to build immense factories. The ones they are currently developing to have an approximate cost of $5 billion each. Considering they have more than a dozen, no company is capable of replicating their scale.

Cost advantage: On one hand, TI has a fixed-cost policy, allowing for significant margin expansion as the company grows and covers the expenses of the huge factories. On the other hand, they currently manufacture over 40% of their chips on 300mm wafers, which saves an 8% margin compared to the more commonly used 200mm wafers in the industry. Additionally, 80% of the wafers and over 60% of the chips are manufactured internally, saving on the costs of outsourcing.

Wide range of products: It is very difficult to match TI’s range of 80,000 products. In general, it’s an industry where companies have tens of thousands of products, so growing through acquisitions isn’t as optimal since there are duplicates in many product types. Texas Instruments develops them all through its internal R&D, although the necessary expenditure is much less than for more advanced digital semiconductors.

High switching costs: We mentioned earlier that analog chips are very inexpensive, costing just a few cents. Imagine if a competitor offered a chip that is 10% cheaper. If the customer wants to switch suppliers, they have to change part of the electronic system, which is much more expensive than sticking with TI’s chip. Moreover, with their wide range of products, customers generally have several TI chips in their circuits (dozens or even hundreds), so saving a couple of cents on one chip when you have 10 from TI is not profitable.

Product longevity: Analog chips are subject to much fewer technological advances. They have products that can be used for over 30 years after manufacturing, so the risk of obsolescence is very low. Today, they still sell very old chips with gross margins exceeding 80%. On one hand, this allows them to have very long-lasting relationships with customers. On the other hand, thanks to owning the factories, in times of low demand when others have no production capacity, TI continues manufacturing, increasing inventories, and taking advantage of low obsolescence. When demand returns, they are able to satisfy it, growing faster than competitors and gaining market share.

Sales channels: For a few years now, TI has been selling a large portion of its products through online sales channels. This, combined with their product range, allows any customer to have any chip they need within one or two days. This not only increases margins but also differentiates them from competitors. TI.com already accounts for 72% of the company’s sales.

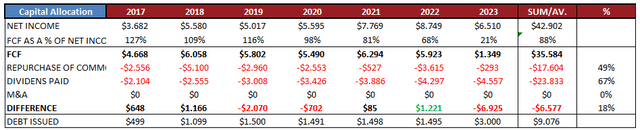

Capital Allocation and Corporate Culture

Texas Instruments has always had a fantastic capital allocation focused on returning value to shareholders through buybacks and dividends. M&A are not optimal due to the reason stated above. Right now, it is in an expansive Capex cycle, so its free cash flow has been severely impacted. This year, it has fallen by 77% compared to last year. They expect to spend around $5 billion per year until 2026, and around 10%-15% of sales from there on. Thanks to the Chip Act, there will be a 20% subsidy, so it can be modeled with $4 annual billion in capital expenditures instead of $5 billion.

Source: Author’s representation

This Capex is being allocated to the construction of new factories. These factories will enable the company to secure long-term growth for the next 10 to 15 years. The company expects each factory to meet a demand of between $5 billion and $6 billion, so it is very likely that revenues will increase by more than $15 billion in the coming years. Considering that each factory costs about $5 billion and has high margins, the returns on capital are very high. Additionally, they are very long-lived assets. The factories are capable of operating for several decades, as is their equipment, which undergoes heavy depreciation in the first 5 years but continues to operate for many more.

The first lines seen on their website and in many of their presentations are: “The best measure to judge a company’s performance over time is growth of free cash flow per share, and we believe that’s what drives long-term value for our owners”. This statement already gives us clues about the outstanding corporate culture that these people have. Furthermore, if you read the documents on their website, they never tire of talking about enduring, competitive advantages, terminal value, capital allocation, cost efficiency, entrepreneurial mindset, and owning the business for decades. This is something I place a lot of importance on, and I am glad it continues even after Rich Templeton stepped down as CEO in April 2023 and Haviv Ilan took his place. The corporate culture of a company extends beyond individuals, and this is a prime example of it.

Financials

Until now, the growth in free cash flow per share had come in the form of opportunistic buybacks or margin improvements, but there comes a point where this becomes challenging. With this expansive Capex cycle, they aim to ensure that future FCF growth comes in the form of increases in topline, ensuring that this is the way to maximize FCF per share over the next 10–15 years. To give an example of what I mean, sales have grown at 7% annually since 2016 to 2022, but FCF at 13.7%, and FCF per share at 15.3%. This is a great example of the operational leverage achieved by TI, in part thanks to the 300mm wafers. TXN expects to have 8 factories capable of manufacturing these wafers in the coming years. They spend around 8% of sales on R&D and usually release about 500 new products per year.

Source: Author’s representation

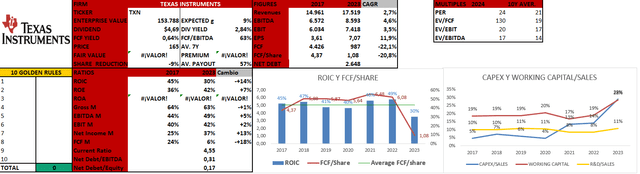

On the other hand, despite being a capital-intensive business, both its returns (30% ROIC in 2023, although averaging 43% over the last 7 years) and its margins (37% net income margin, although it reached 44% in 2022) are very high. Additionally, the company has almost no debt (0.31 Net Debt/EBITDA), greatly reducing the risk of bankruptcy. I believe these figures will improve once demand starts to pick up again, and thanks to owning its factories, this means it has strong operating leverage potential. Additionally, it has been building up inventory for when this happens, so there should not be any issues in meeting the increase in sales. It is important to note that we are currently in a downturn in the semiconductor demand cycle. However, a company’s financial statements are not static, and TI’s figures will improve significantly when the cycle rebounds.

Valuation

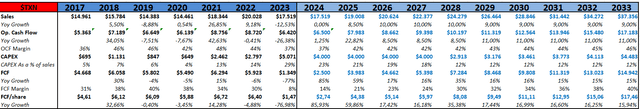

The case of Texas Instruments is an interesting one because, if management team predictions are correct and future demand is not affected by the Chinese competition, which will be discussed in the risks section, the company’s growth rates for the next decade will likely surpass those of the current. This leaves us with a somewhat unique scenario, as in the DCF model, we may need to input higher growth rates starting from year 5, unlike what is typically done.

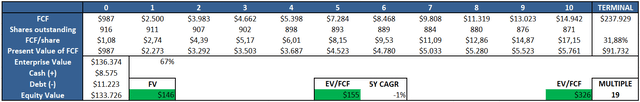

I have created the following model with some projected figures for Texas Instruments in the future. However, there is a lot of uncertainty surrounding Texas Instruments, and these growth rates could end up being very distorted by future reality. The Capex in the first few years is $4 billion because I estimate that the Chip Act will finance 20% of the costs.

Source: Author’s representation

Once we have the FCF projected, we can use a DCF. Using a discount rate of 10% and a terminal growth rate (TGR) of 3.5%, following the free cash flow obtained in the model, the fair value I get is $146. Given that it currently trades at $175, I rate Texas Instruments as a hold. Despite the potential overvaluation of the stock according to the model, I usually do not like rating quality stocks as a sell because they are the type of company best positioned to overcome challenging times.

Source: Author’s representation

Risks

The biggest risk for Texas Instruments is competition from China. Unable to compete with leading-edge technology, they are focusing their efforts on trailing-edge technology. This could potentially flood the market with supply, leading to a future price war. This would jeopardize Texas Instruments’ margins and returns, and therefore, its terminal value. However, we can also see it from another perspective. We must trust the experience and expertise of the management team, which is solely focused on the long-term success of the company. If they are investing on expansive Capex cycles to increase production and therefore top-line growth, it means they do not see that much risk. If things go wrong, and China really poses a threat to the company’s terminal value, the investment thesis could be broken, as they would face huge new fixed costs that would not operate at full capacity, damaging margins and returns. But the fact that they are focusing on this, instead of continuing to optimize the company and return money to shareholders, directly contradicts this narrative. The management team is very skilled and knows much more than we do about the industry. If they did not believe that demand would be higher in the future (given all the tailwinds we have already seen), despite the shadow on the horizon from China, they would not be doing all of these investments and would continue with share buybacks and dividend payouts. We can only wait and see if this is more than a rumor, although it is indeed a dangerous and well-founded concern

Furthermore, the fact that Texas Instruments has a vast product portfolio, as well as long-standing relationships with customers who buy dozens of chips, makes it highly unlikely for them to lose customers over saving a few cents on some chips. If any company has been working with TI for many years and trusts them as a supplier, I do not think there are many incentives to switch to a Chinese competitor. Additionally, thanks to Texas Instrument’s high profitability, it could engage in a price war without incurring losses, forcing competitors to operate below break-even.

Conclusion

We can say that Texas Instruments operates in a market with multiple tailwinds. It also enjoys many competitive advantages, as well as a shareholder-focused management with a long-term approach. Like any company, it is not free of risks, and Chinese competition can threaten the company’s terminal value, although I have mentioned several arguments to consider otherwise.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.