Summary:

- Texas Instruments faces declining demand in most sectors, except for automotive.

- The company’s financials are concerning, with consistent margin declines and increased debt.

- A discounted cash flow analysis suggests that TXN’s current market valuation may not align with projected growth.

Dilok Klaisataporn

Texas Instruments (NASDAQ:TXN) has experienced a bullish streak over the last five years since my last buy recommendation in May 2018. During this time frame, the stock has yielded a total return of 94%, surpassing the S&P 500’s return of 69%. However, recent developments suggest a shift in the situation, with TXN appearing overvalued at the moment due to changing growth narratives, declining margins, and a deteriorating balance sheet.

Future growth: the company sees weak demand in all its segments except automotive

Texas Instruments faces a concerning challenge as it experiences a decline in demand across most of its segments, except for automotive. This was explicitly mentioned during the recent Q2 2023 earnings call when the company stated that “…this last quarter we saw weakness across the board in our markets with the exception of automotive.”

The exceptional strength of the automotive segment, boasting a remarkable 20% year-on-year growth, is definitely good news. However, the concern arises from the asynchronous behavior of TI’s segments; while automotive thrives, other markets continue to falter. In turn, the automotive segment accounted for only about 25% of TI’s revenue in 2022, which means even sharp increases in this revenue segment cannot offset the weakness in others. The company also anticipates a lack of significant improvement in its end-markets for the upcoming third quarter, further highlighting the challenges faced in sustaining growth.

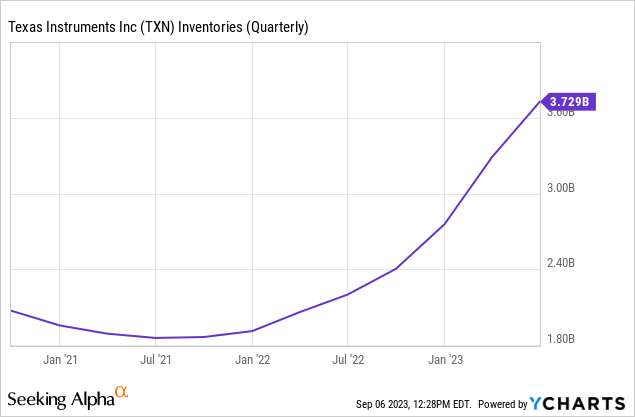

As a result, TI’s inventories went up by a substantial 13% QoQ and dramatic 70% YoY, as the company tried to adapt to these shifting market dynamics. The stockpiling of inventory in anticipation of future demand challenges raises concerns about potential overstocking. Moreover, this fluctuation in demand dynamics has placed immense pressure on the company’s margins.

Financials: the margins hit a ceiling and the company had to raise new expensive debt

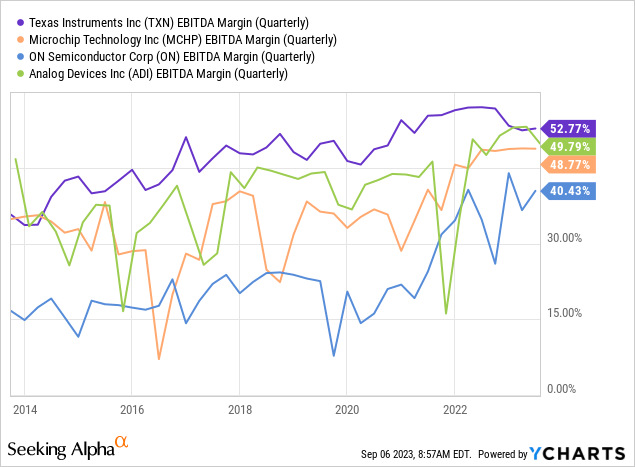

TI’s margin troubles are a growing concern, as the company has witnessed a continuous decline in its gross and earnings margin for the past five quarters. This trend raises questions about the sustainability of the company’s profitability in the face of weakening demand in most segments.

Although TXN still maintains some of the industry’s strongest EBITDA margins, there is noticeable contrast between its performance and that of competitors. While TXN faces margin contraction, many of its rivals are experiencing growth.

The persistence of this margin challenge is likely tied to the high levels of inventories that the company has accumulated. With inventories at elevated levels, the likelihood of a quick turnaround in margins becomes even more remote. TXN must grapple with this situation as it strives to find a path to regain its competitive edge in a market where competitors are advancing.

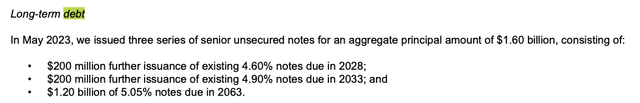

Additionally, even though TI’s balance sheet remains relatively safe, the dynamics are concerning. In Q2, the company raised a substantial $1.6 billion in debt, leading to a notable increase in long-term debt, which surged from $8.2 billion at the end of 2022 to $10.9 billion by the close of Q2 2023. The interest burden on this debt is relatively high, standing at around 5%, which could potentially weigh on the company’s future financial performance.

10-Q Q2 2023

Furthermore, TI allocated a significant portion of its resources to dividend payments, with approximately $2.25 billion disbursed in just one quarter (Q2 2023). While dividends are an important part of TXN’s financial strategy, this substantial payout amidst margin declines and increased debt raises concerns about the company’s overall financial health. These financial aspects make TXN a more risky stock than it might seem at first.

DCF analysis: TXN is overvalued based on the market projections

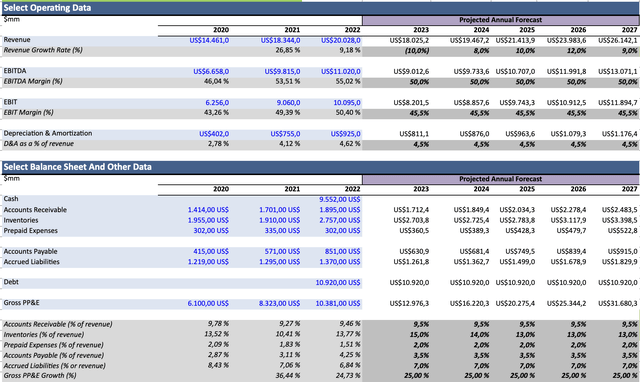

To strengthen the analysis, I use discount cash flow model to value the company.

My analysis is based on the following assumptions:

1. The average annual revenue growth over the horizon period of five years is estimated to be around 5.8%, with a 10% decrease in 2023 and 8-12% growth between 2024 and 2027, based on analysts’ earnings estimates.

As we mentioned above, it remains to be seen whether the company’s efforts on the automotive market will help the corporation return to grow in the coming years.

2. EBITDA margin will remain on the level of 50% throughout 2027. Notably, TI has been able to consistently increase its margin over the last three years from 46% in 2020 to 55% in 2022. However, as discussed earlier, this trend is likely to change in the medium term.

3. The operating tax rate is estimated to be 15%. Here, the projections are taken from the latest quarterly report.

4. Then goes the WACC.

The after-tax cost of debt is 4.2%. The cost of equity capital (13.2%) is calculated using CAPM, with 1.02 beta, 4.3% risk-free rate, which is the current U.S. 10-year bond yield, and 9% market premium. The WACC is, therefore, estimated to be around 12.6%.

Here is the operating and balance sheet data used in the modeling:

The author’s DCF model

As a result of these calculations, TXN’s fair price range is about $130-139, which is up to 23% lower than the current stock price.

Now, this does not mean that the stock will go down to these levels any time soon, as the market might price in different assumptions and many investors will still continue buying the stock at least for the dividend yield. However, for a long-term value investor, TXN provides no margin of safety, which means it should rather be avoided at the moment, at least until we see a turnaround in inventory level, margin expansion, and return to sales growth.

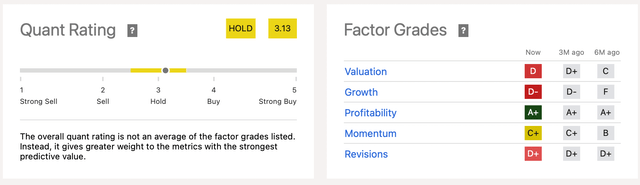

Notably, the conclusion is supported by Seeking Alpha quant rating, which rates TXN extremely low on valuation, growth, and earnings revisions.

Seeking Alpha

Key takeaways

Texas Instruments faces hurdles as it deals with declining demand in most sectors, balanced only by the automotive sector’s strength. Although automotive growth is promising, it only makes up a portion of TXN’s total revenue, insufficient to offset other sector declines.

Moreover, TXN’s financials are a concern. Consistent margin declines over recent quarters raise doubts about the company’s long-term profitability levels. Accumulating high inventories makes margin recovery even harder. TXN’s decision to increase borrowing, adding to long-term debt and incurring high interest costs, compounds these problems. Coupled with generous dividend payments amidst these financial pressures, TXN seems a riskier investment than it was 5-6 years ago.

A discounted cash flow analysis indicates TXN’s current market valuation might not align with projected growth. While some short-term factors like dividend appeal may support the stock, long-term value investors may find little margin of safety in TXN’s current financial and market conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.