Summary:

- Texas Instruments Incorporated reported its Q1 results last week and beat both the top and bottom line consensus, despite a challenging macroeconomic environment.

- Revenue is under pressure following lower demand as customers are seeing inventory corrections and this is expected to continue going into the second quarter.

- While the near-term outlook does not look great, I believe investors do not have much to worry about with management committed to continued investments which will pay off once demand returns.

- I remain bullish on the long-term outlook of Texas Instruments Incorporated as it looks well positioned and has shown in the past that it can deliver great shareholder returns through economic cycles.

- Following the latest financial results and outlook, I have lowered my FY23 expectations and target price for Texas Instruments Incorporated.

Sundry Photography

Investment Thesis

I upgrade my rating on Texas Instruments Incorporated (NASDAQ:TXN) (“TI”) from hold to buy and update my revenue and EPS estimates following the company’s Q1 2023 results which beat the consensus. However, the quarterly results and the outlook for the next quarter show continued weakness due to macroeconomic pressure and inventory corrections among clients, which have been driving the TXN share price lower.

The deteriorating economic outlook, customer inventory corrections, and a significant slowdown in the semiconductor industry dominated the first quarter for Texas Instruments. Yet, all of those aspects are temporary and should not be a reason for concern to long-term investors. The company has shown in the past that it can deliver excellent returns to investors through economic cycles. And while the second quarter outlook is not quite showing a deceleration in the falling trend yet, peers like Taiwan Semiconductor Manufacturing Company Limited (TSM) (“TSMC”), Intel Corporation (INTC), and ASML Holding N.V. (ASML) are already guiding for an improvement in the second half of 2023. I expect the same for TI as inventory corrections should ease, followed by boosted demand.

Despite the challenging near-term outlook for the company, I do remain bullish on the long-term prospects of the company, driven by its impressive moat, excellent exposure to fast-growing end markets, its control over both manufacturing and design, the longevity of its offering, and the great shareholder returns. Therefore, I believe this slowdown in itself should not spook investors. Moreover, I believe shares are currently trading near fair value, and with the company still having a great long-term outlook, it could be fair to pay fair value for this semiconductor giant.

In this article, I will take you through the latest developments and financial results and update my estimates and view on the company accordingly. I will also dive into its moat and growth drivers to better understand the company’s long-term outlook.

Let’s dive in!

Another quarter impacted by lower demand and inventory corrections for TXN

Texas Instruments released its Q1 results on April 25 and reported revenue and EPS that came in above the Wall Street consensus and illustrated the ability of TI to outperform. To put this into perspective, the company beat EPS estimates every time in the last 20 quarters while only missing revenue estimates 4 times.

Q1 2023 was no different, as TI reported revenue of $4.38 billion, roughly in line with the consensus. Yet this did represent an 11% YoY decline, which is a further deterioration from the 3% YoY decline it reported in 4Q22, reflecting weak demand in most end markets for TI. Yet, this did not come as a surprise. Texas Instruments has seen some pressure on business performance over the last few quarters, followed by downward revised expectations from analysts. TI remains a company that is sensitive to the economic sentiment and this is once more confirmed in its latest financial results which show broad-based weakness. Industrial saw flat sequential growth, Communications equipment was down mid-teens, and Enterprise was down about 30% sequentially. Personal electronics was down by 30% sequentially, which is not surprising as we have seen a severe fall in personal electronics sales following the fall in consumer spending, resulting in inventory corrections for TI customers.

Still, despite a weakening macroeconomic outlook, high inflation, and weakening demand resulting in a drop in revenue, TI still managed to report impressive margins, which shows the financial flexibility of the company and the ability to deal with a cyclical downturn, in part due to its in-house manufacturing which provides excellent production flexibility and, above all, less dependence on third-party manufacturers like Samsung Electronics Co., Ltd. (OTCPK:SSNLF) or TSMC, but more on that later.

TI reported a gross margin of 65%, which is truly impressive considering all circumstances. Also, while this is a decrease from peak gross margins a year ago (down 480 basis points), this is roughly in line with the 5-year average for TI and close to 50% above the technology sector average. A similar thing can be seen in its operating profit margin of 44%, which was nevertheless down from peak profit margins a year ago when semiconductors were still in much higher demand. As a result of these margins, net income was $1.7 billion, translating to $1.85 per share, which is $0.07 above the estimates from analysts. Yet, EPS did include a $0.03 benefit that was not included in the previous guidance.

During the quarter, TI paid $1.1 billion in dividends and repurchased $100 million worth of shares. This brings the total last 12 months’ return to $7.5 billion, which is significantly above the $4.4 billion the company generated in free cash flow, which was down by 32% compared to the previous 12 months. This can be largely attributed to the lower revenue levels over the last six months while capital expenditure in the last 12 months still grew by 28%. Obviously, this does not bode well for free cash flow generation. Yet, again, investors need to consider that this is only temporary. Historically, TI has shown its ability for significant free cash flow generation as illustrated by its 5-year average free cash flow margin of above 27% which is quite impressive.

And even now with free cash flow down today, TI’s strong balance sheet and cash position allows it to continue paying its dividend without any worries. TI holds a total cash position of $9.5 billion in combination with $10.2 billion of debt, of which $1.4 billion was issued last quarter.

As for the dividend, shares currently yield a very attractive 2.97%, which is a very solid base for dividend investors. Also, dividend growth has been impressive for TI as it has been growing the dividend at a 5-year CAGR of 16.37% and still only has a payout ratio of around 50%, despite the significant decrease in revenue and free cash flow. Therefore, I believe there is absolutely no risk of a dividend cut and investors can expect continued dividend growth. However, growth will most likely be somewhat lower for the next couple of years until free cash flow has fully recovered.

There is plenty of reason to remain bullish on the long-term outlook of TXN

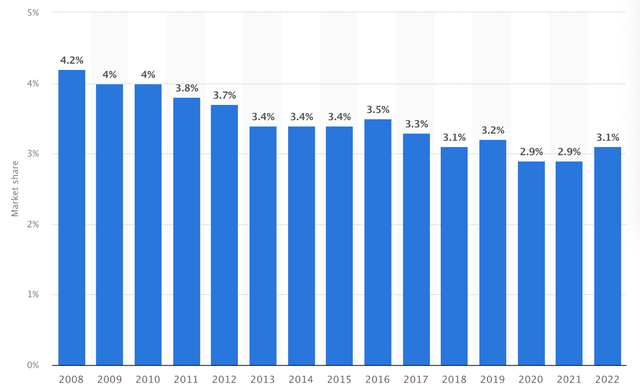

Despite a challenging near-term outlook and deteriorating financials, I do believe there is still plenty of reason to be bullish on TI. The company has shown in the past its ability to grow revenues and profits over time, despite a cyclical downturn every few years. And with the outlook for TI’s end markets and semiconductors generally looking strong, I believe it is poised for solid long-term financial growth. For example, the global semiconductor industry is expected to grow at a 12.2% CAGR until 2029, driven by the emergence of AI, IoT, and ML technologies, as well as the growing overall demand for digital solutions. Texas Instruments held a 3.1% market share in the overall semiconductor industry as of 2022, and while this has been decreasing from 4.2% back in 2008, primarily due to the increase in GPU and CPU sales, this is still an impressive position that has remained steady over the last five years.

TXN market share in the semiconductor industry (Statista)

Turning to the more TI-specific industries, the analog semiconductor market is expected to grow at a 5% CAGR until 2027 and the Embedded Processor market size is expected to grow at a slightly faster 8.2% CAGR until 2030, both driven by the increase in demand for digital solutions and new technologies such as AI and IoT, which also require these analog and embedded solutions to enable high-performance digital chips to perform their functions.

Of course, GPU and CPU development always seem to catch more headlines from the likes of Nvidia Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD), but these are useless without the addition of analog chips. In addition, while digital chips can only recognize binary code, analog chips can process and interpret more complex data, such as speech and video signals. Essentially, analog chips serve as a crucial connection between the digital and physical worlds. Therefore, these semiconductor segments will remain just as critical, which will bode well for TI as a leader in this space. Also, analog and embedded processors account for 80% of TI’s revenue.

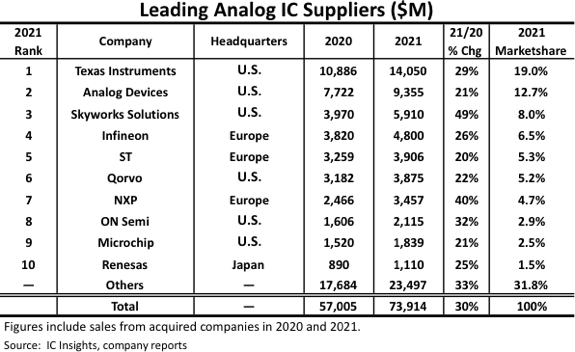

IC Insights

TI holds a 19% market share in the analog IC market, far ahead of second-place Analog Devices, Inc. (ADI), which holds only 12.7% as of 2021. TI has maintained its market share of around 19% for several years already. With the company continuously expanding its capacity and portfolio of solutions, I believe it will continue to maintain this market share going forward.

Getting a bit more into its moat, management identified some important advantages that it focuses on to hold onto this market share and boost future growth. The first of these is the massive size of the company and the reach it has of market channels, meaning that the size and product offering of the company gives it an advantage over competitors when it comes to customer engagement and long-term relations. Competitors simply can’t match the sheer size of TI’s offering and its moat in the industry.

And speaking of its product offering, management also believes in its excellent longevity and diversity. TI is not overly dependent on any particular industry as it has exposure to multiple end markets. In addition, management has been focusing the business on certain end markets for which it sees great future growth while it has been decreasing its exposure to lagging end markets up to the point where it has completely removed certain product segments. The past has shown that TI has the ability to focus on the right end markets to drive above-industry growth, and I see no reason why this won’t continue going forward. This is also reflected in its currently largest end markets which are industrial and automotive, which both have great growth outlooks. For example, the automotive semiconductor market is expected to grow at a CAGR of 8.4% until 2029, driven by autonomous driving technology and the transition to electric vehicles.

Finally, investors should consider the benefit of ownership and control of both technology and manufacturing by TI. The company controls its manufacturing through its own fabs. Currently, TI has 15 of these fabs worldwide, with many centered in the U.S., as seen below.

TXN fabs (Texas Instruments)

And the ownership and control of both manufacturing and design bring with it many advantages. This includes cost savings as TI can better control its supply chain, allowing it to improve efficiency and respond quickly to a cyclical downturn. Yet, the most considerable upside to this is most likely the independence it provides. Many fabless manufacturers depend on TSMC or Intel to produce their chip designs, making these fabless companies incredibly dependent on technology progress at these manufacturers.

In addition, the geopolitical risk poses a problem for TSMC and Taiwan and therefore threatens all semiconductor companies that depend on manufacturing at TSMC. Yet, this is no problem for TI as it controls its own fabs (TI has some fabs in Taiwan as well but the impact of a potential Chinese invasion would not be huge). Therefore, I believe TI offers great exposure to the growing semiconductor industry but is one of the only companies not highly dependent on third-party manufacturing and geopolitical risks. This should ensure that the company keeps up production, no matter the geopolitical circumstances.

Furthermore, with TI controlling its own fabs primarily located in the U.S., it is also a primary beneficiary of the U.S. Chips Act. In a previous article on TI, I wrote the following regarding this:

The chips act directs $280 billion in spending over the next 10 years. $200 billion of this total will go to scientific R&D and commercialization. $53 billion is for semiconductor manufacturing, R&D, and workforce development. The other $24 billion is destined to tax credits for chip production. TI will be a direct beneficiary of this legislation since it is already aggressively expanding its presence in American semiconductor manufacturing. As stated above, there will be funds available for both design/ R&D and manufacturing. TI is a strong player in both.

Texas Instrument plans to increase its capacity over the next couple of years in the 45- to 130-nm technology nodes, focusing on high-growth areas. To realize this, the company builds a new fab in Sherman, Texas (requiring a $30 billion investment), which will in part be funded by the 25% tax credits provided by the U.S. government with the goal of expanding semiconductor manufacturing in the country.

During the latest earnings call, management briefly mentioned the Chips Act benefits the company is seeing so far, which includes a $200 million benefit during the latest quarter, on top of $400 million last year. Management believes this will gradually keep increasing over the next couple of years, as the company benefits from the 25% tax credit for qualifying assets in the U.S. This shows TI as a primary beneficiary of the U.S. chips act, partially offsetting Capex spending by the company or allowing for additional investments.

Outlook & TXN stock valuation

After a downbeat and deteriorating first quarter of the year, TI now guides for Q2 revenue in the range of $4.17 billion to $4.53 billion (versus a consensus of $4.46 billion), which shows a further deceleration from last quarter as this translates to a 16.5% decrease YoY. In addition, EPS is expected to be in the range of $1.62 to $1.88 (versus a consensus of $1.87), down 28.6% YoY. These lower growth estimates illustrate the expectation from TI management of continued inventory corrections in the second quarter.

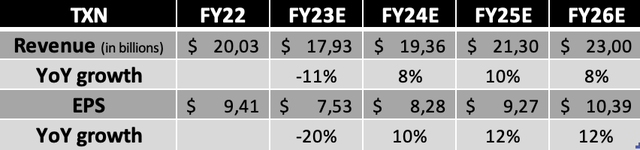

Following these quarterly results, the small earnings beat, and the guidance issued by management, I now arrive at the following expectations until FY26 for Texas Instruments.

Shortly explaining these estimates, I now expect TI to report a drop in revenue of 11% YoY for FY23 (compared to a 9% drop before) as the economic deterioration has come in somewhat worse than previously anticipated and this has resulted in a slight downgrade for FY23. Yet, I still expect the situation to improve in the second half of the year as inventory corrections ease and TI starts seeing somewhat renewed demand and improved growth rates, although still negative. EPS will be hit harder this year as the lower revenue basis combined with continued investments will drive down EPS. Still, TI has shown its flexibility and ability for cost savings and therefore I upgrade my EPS estimate from a previous -21% for FY23 to -20% today.

For the following years, I expect TI to report above-industry growth rates as the company is well-positioned to benefit from secular growth trends in the industrial and automotive end markets. Also, I expect EPS to grow slightly faster, driven by margin improvements, continued share buybacks, and a higher revenue base. Still, EPS is not likely to be above 2022 levels before FY26.

So, what does this mean for the valuation today? Based on a current share price of $167 and my EPS projection for FY23, shares are currently valued at a forward P/E of 22x, which is far from cheap and roughly on par with its 5-year average valuation. In addition, it is trading at a premium compared to most of its peers, with Analog Devices trading at a P/E of around 16x. Still, TI has shown in the past that it deserves a premium valuation, driven by its low-risk profile compared to peers, in-house manufacturing, exposure to fast-growing industries, and shareholder returns. Therefore, I believe TI still deserves to be valued at a premium and believe it is trading around its fair value today, despite a challenging near-term outlook. In my previous article on the company, I said the following:

With the company projected to grow its EPS by low double digits for the years after, I believe a 22x P/E is warranted for TI considering its business strength, industry dominance, and cash generation and return.

My opinion remains unchanged today, and I still believe a 22x P/E is fair for Texas Instruments. Based on this multiple and my FY24 EPS estimate, I calculate a target price of $182 (down from a previous $187), leaving investors with an upside of 9%. (Please note, this target price is solely based on its forward P/E and is only for indicative purposes.) For comparison, Wall Street analysts currently maintain a price target of $182, combined with a hold rating.

Conclusion

Despite a challenging near-term outlook, I remain bullish on Texas Instruments as I believe its long-term growth drivers are still very much intact and the company is well-positioned to show sustained growth in the long term.

Therefore, I believe TI is still an excellent long-term investment and a great pick in the semiconductor industry, driven by its independence, control over both manufacturing and design, low geopolitical risk, impressive moat, excellent exposure to fast-growing end markets, and great shareholder returns of the company.

That is also why I believe that paying its fair value is not that bad. The company has a history of outperforming and driving impressive shareholder returns in the long run and as a result, it rarely trades cheaply. At a current forward P/E of around 22x, I believe shares are trading around fair value and offer a decent opportunity to build a position in this 3% yielding semiconductor giant.

I do downgrade my price target from a previous $187 to $182 today as the macroeconomic environment is putting pressure on financial results and the near-term outlook. Yet, with the share price down 4.5% since my previous article in which I rated shares a hold, I believe now could be a decent moment to start slowly building a position. Therefore, I rate Texas Instruments Incorporated a buy at a share price of around $167.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.