Summary:

- TXN and ADI have hinted at the recovery of the analog chips market, with the next quarterly earnings call likely to bring about QoQ top-line improvements.

- However, this also means that TXN has pulled forward most of its upside potential through 2026, with it appearing to be expensive at current levels.

- While the geopolitically dependable capacity is commendable, the intensified capex has also triggered its deteriorating balance sheet and moderating shareholder returns.

- With the wider market and many other semiconductor stocks also pulling back from recent heights, we believe that there may be more uncertainty in the near term.

- With TXN set to report their FQ2’24 earnings call on July 23, we highlight a few key metrics for readers to look out for.

trait2lumiere

TXN’s Investment Thesis Remains Expensive Here – No Margin Of Safety

We previously covered Texas Instruments (NASDAQ:TXN) in January 2023, discussing its robust profit margins and expanded R&D returns due to the mature nodes’ longer product life cycle of up to 15 years.

Combined with the potential benefits from the Chips Act, tempering some of the $30B Capex headwinds, we had believed that it offered a compelling diversification thesis for those looking to buy semiconductors stocks.

Even so, we had recommended investors to wait for a moderate retracement to the previous support levels of $150 before adding, attributed to the softening demand for analog chips in the industrial and automotive segments.

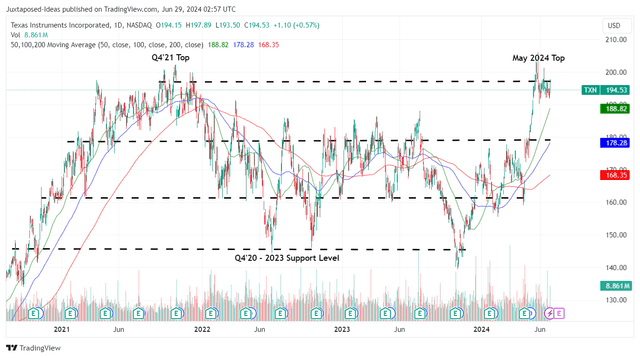

2Y Stock Prices

Since then, TXN traded sideways before retracing dramatically to $140s (below our recommended entry point of $150s), before rallying tremendously by +34.6% since the October 2023 bottom of $139.48 and hitting a new peak of $206.

With the company set to report their FQ2’24 earnings call on July 23, 2024, we shall be highlighting a few key metrics for readers to look out for, with it underscoring the health of its businesses along with near-term prospects.

1. FQ2’24 Performance With The Industry End-Market Potentially Bottoming

For reference, TXN reports 40% of its FY2023 revenues through Industrial applications (+4 points from FY2019 levels), 34% through Automotive (+13 points from FY2019 levels), 15% through Personal Electronics (-8 points from FY2019 levels), 5% through Communications (-6 points from FY2019 levels), 4% through Enterprise (-2 from FY2019 levels), and 2% through others (-1 points from FY2019 levels).

With the Industrial end markets still impacted, and new Automotive purchases deterred by the high borrowing costs, it is unsurprising that the management has reported an underwhelming FQ1’24 performance.

Even so, TXN has offered a relatively promising FQ2’24 revenue guidance of $3.8B (+3.8% QoQ/ -16.1% YoY) and adj EPS of $1.15 (-5.7% QoQ/ -38.5% YoY) at the midpoint.

These numbers imply that there may be a sequential improvement in its top-line performance, reversing the pessimistic QoQ/ YoY downtrend observed since the FQ3’22 peak, which naturally explains why the stock has rallied as it has after the FQ1’24 earnings call in April 2024.

Based on TXN’s relatively flattish bottom-line guidance, it appears that we may see its gross margins stabilize near the 57.1% reported in FQ1’24 (-2.6 points QoQ/ -8.3 YoY/ -6.5 from FY2019 levels of 63.6%) as well.

This is especially since the management has hinted at the Industrial market’s near bottom, with it lending strength to the FQ2’24 guidance above:

So we have got some of the later-cycle sectors that are continuing to decline and declining at double-digit rates. But there are some that are beginning to — begin to slow in the declines and even a couple that grew sequentially…. But even inside of last quarter, as we looked at it inside of industrial, there obviously were some customers that are nearing the end of that inventory depletion cycle. (Seeking Alpha)

The same has been reported by its analog peer, Analog Devices (ADI), in the FQ2’24 earnings call:

We believe inventory rationalization across our broad customer base is stabilizing, clearing a path for us to return to sequential growth in the third quarter. This, coupled with improving new orders, gives us optimism that we are at the beginning of a cyclical recovery. (Seeking Alpha)

It is apparent that the analog market correction will not last forever, with generative AI edge computing likely to drive demand for IoT devices and the electrification recovery likely to be aided by potential EV price parity from 2026 onwards.

The same has been observed in the Memory market, with Micron (MU) already guiding “record revenue and significantly improved profitability in fiscal 2025,” as it increasingly qualifies its SSD and HBM offerings in the data center end market, after the supply glut and painful correction in 2022.

As a result, while TXN does not break down their end-market revenues on a quarterly basis, readers may want to keep a look-out to the management’s commentaries and FQ3’24 guidance ahead.

2. Geopolitically Dependable Capacity Against Balance Sheet Health

As the world gets exuberant surrounding the prospects of generative AI with it buoying Nvidia’s (NVDA) stock prices thus far, readers must note that a geopolitically secure chip supply is also important, as observed in Taiwan Semiconductor Manufacturing Company Limited (TSM) ongoing ramp in Japan, the US, and the EU.

The same has been observed in TXN’s strategic focus on a “geopolitically dependable capacity that we’re putting in place that our customers are clamoring for” – one that is particularly noteworthy since TSM generally focuses on leading-edge nodes compared to the former at mature nodes.

This also explains why TXN has intensified their R&D/ SG&A expenses at $3.7B (+5.7% sequentially) and capex at $5.3B (+60.6% sequentially), with it likely to be top/ bottom-line accretive once demand returns while awaiting further news on the Chips Act Grant.

The same diversification has also been observed in the company’s FQ1’24 revenues, with China only comprising 17% of its revenues (-2 points QoQ/ -3 YoY/ -33 from FY2019 levels of 50%), insulating its future prospects from the ongoing trade war.

On the other hand, readers must note that these efforts have contributed to TXN’s growing net debts at -$3.79B in FQ1’24, up from the -$2.64B reported in FQ4’23, -$0.59B in FQ1’23, and -$0.42B in FY2019.

While only $1.35B of its debts will be due through 2025, we urge readers to monitor its balance sheet health prior to the recovery of industrial and automotive end markets, especially given the impacted LTM Free Cash Flow generation at $940M (-78.6% sequentially) and LTM shareholder returns at $4.8B (-36% sequentially).

3. TXN Is Expensive Compared To Its Historical Averages & Analog/ Digital Chip Peers

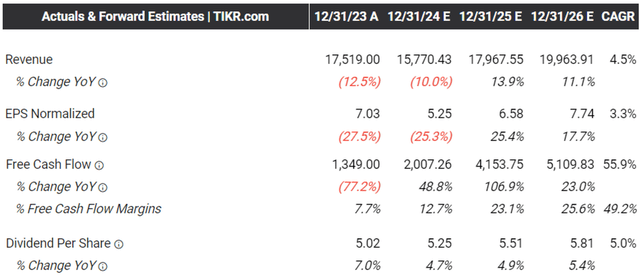

The Consensus Forward Estimates

With the analog chips market showing early signs of recovery, it is unsurprising that the consensus expects FY2024 to be a trough year with things potentially recovering from FY2025 onwards, depending on TXN’s upcoming FQ2’24 performance.

However, with the May 2024 CPI still mixed, it is uncertain when the Fed may pivot, especially due to the “prolonged artificial intelligence enthusiasm” and intensified “enterprise IT spending and stock price gains.”

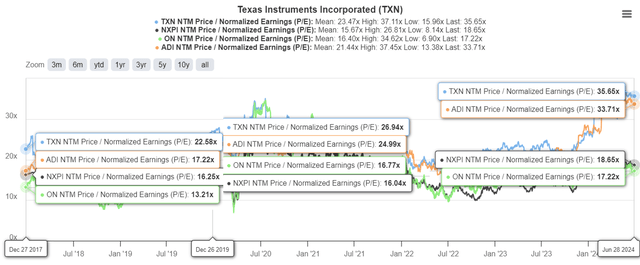

TXN Valuations

The same over optimism has also been observed in TXN’s expensive FWD P/E valuations of 36.65x, compared to its 1Y mean of 27.68x, sector median of 23.88x, and 5Y mean of 24.33x.

The same premium has been observed in its analog chip peers as well, such as ADI at FWD P/E valuations of 33.71x, and to a smaller extent, in ON Semiconductor (ON) at 16.95x and NXP Semiconductors (NXPI) at 18.93x, compared to their historical means.

This is especially since TXN is only expected to chart a top/ bottom-line growth at a CAGR of +4.5%/ +3.3% through FY2026, or at a normalized CAGR of +4.1%/ +8% between FY2016 and FY2026, respectively.

The same may be observed when comparing to its peers, such as ADI at -0.8%/ -0.4% through FY2026, ON at +2.4%/ +4.8%, and NXPI at +4.5%/ +8.3%, respectively.

Lastly, when compared to NVDA’s well-deserved FWD P/E of 45.75x and consensus top/ bottom line estimates at +44.7%/ +47.9% through FY2027, it is evident that TXN is currently unreasonably priced based on the underwhelming top/ bottom line growth.

So, Is TXN Stock A Buy, Sell, or Hold?

TXN 4Y Stock Price

For context, we had offered an intermediate term price target of $180.45 in our previous article in January 2023, based on TXN’s projected FY2024 EPS of $8.46 and LTM P/E of 21.33x.

Since then, the stock has already hit $194s at the time of writing, while running away from its 50/ 100/ 200 day moving averages.

Based on the LTM adj EPS of $6.40 (-29.8% sequentially) and the 5Y P/E mean of 24.23x, it is apparent that the TXN stock is trading at a notable premium of +25.5% compared to our fair value estimates of $155.

Based on the consensus FY2026 adj EPS estimates of $7.74 and the same P/E mean, we believe that there is a minimal margin of safety to our long-term price target of $187.50 as well.

At the same time, while TXN has raised their quarterly payouts by +4.8% to $1.30 by late 2023, the recent rally has also triggered a relatively underwhelming forward dividend yield of 2.69%, compared to the US Treasury Yields of between 4.38% and 5.35%.

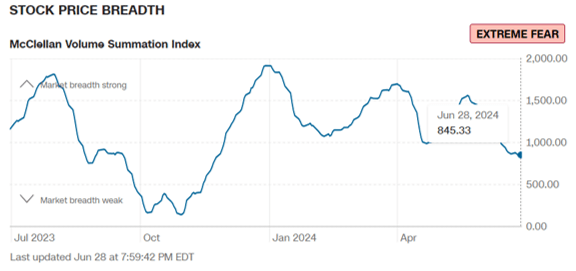

McClellan Volume Summation Index

CNN

Readers must also note that the McClellan Volume Summation Index has consistently declined to 845.33x by June 28, 2024, below the neutral point of 1,000x, with the negative number implying an increasingly bearish sign in the stock market.

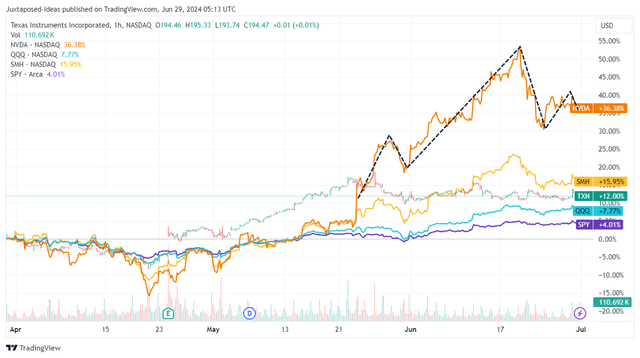

Semiconductor Pullback

This is on top of the head and shoulder pattern observed with multiple semiconductor stocks and ETF, triggering potential volatility in the near-term. As a result of the unattractive risk/reward ratio at current levels, we prefer to prudently maintain our Hold (Neutral) rating for the TXN stock.

There is a minimal margin of safety here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN, MU, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.