Texas Instruments: Q3 Earnings Offered Few Surprises (Rating Downgrade)

Summary:

- Texas Instruments Incorporated’s Q2 results and Q3 guidance have led to a downgrade in rating to “Hold,” due to a recovery in the analog chip market taking longer than anticipated.

- The company’s management appears to be navigating the downturn effectively, focusing on long-term growth strategies.

- The outlook for the semiconductor industry, particularly the analog market, remains promising, and Texas Instruments is well positioned to benefit from future growth.

- The company’s strong position in the analog chip market, North American focus, and commitment to technological progress are expected to bolster future prospects, despite short-term weakness.

William_Potter

Investment thesis

I lower my rating on Texas Instruments Incorporated (NASDAQ:TXN, “TI”) to a hold and update my revenue and EPS estimates following the company’s Q2 results and a somewhat negative Q3 guidance by management. A recovery in the analog chip market appears to take even longer than already anticipated, requiring analysts to lower the near-term expectations. Meanwhile, the company remains committed to its capital allocation strategy, solidifying its long-term growth prospects.

The semiconductor industry has been facing a challenging environment, impacting TI’s top-line performance. In addition, as the company continues to heavily invest in its long-term growth plans, this causes margins to decline significantly, driving a more meaningful decrease in EPS.

However, management’s focus on long-term growth and capital expenditure plans to increase capacity and market share is commendable. While short-term weakness may persist, TI’s strong position in the analog chip market, its North American focus, and its commitment to technological progress bode well for its future prospects. The company’s robust margin profile, even amid declining margins, remains the best among its peers.

The outlook for the semiconductor industry, especially the analog market, is promising, with projected growth rates supporting TI’s potential for future growth. Also, TI’s geographical focus on North America makes it a primary beneficiary of the US Chips Act, further enhancing its potential for market share gains. As a result, I estimate the company to grow its top line by high-single-digits to low-double-digits from FY24 onward and to grow EPS at an even faster pace due to margin improvements.

In this article, I will take you through the latest developments and financial results and update my estimates and view on the company accordingly.

TXN quarterly review – “steady as she goes”

Texas Instruments reported its Q2 earnings earlier this week, on July 26. The company managed to beat the analyst estimates as both revenue and EPS came in at the high end of its own guidance. Yet, despite the earnings beat, the share price fell by close to 6% on the next day. The report was not well received by investors, while it contained very few surprises. The largest negative was the somewhat negative outlook, which was below the consensus at the midpoint of the provided range.

The Q2 financial numbers from TI continue to show an overall challenging environment as the demand for analog semiconductors remains under pressure, meaningfully impacting the top-line performance of TI. Yes, the earnings report contains little to be enthusiastic about, but this is part of the cyclical nature of the industry and the company. Management is dealing with this cyclical downturn well as it remains focused on its long-term growth trajectory and Capex spending plans to increase capacity and expand its market share. As a result, I remain enthusiastic about the company’s long-term prospects and recommend long-term investors to look through the near-term weakness.

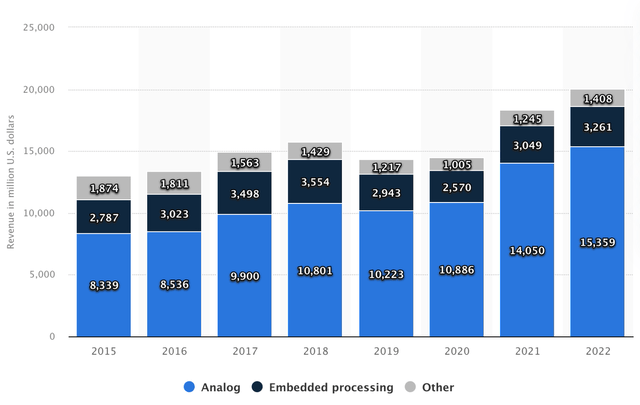

TI reported revenue of $4.5 billion, at the high end of its guided range and beat analyst estimates by a meager $160 million. Still, this is a significant 13% YoY decrease in revenue, also showing a negative acceleration from the 11% decline last quarter, despite a positive 3% sequential increase. This decline was mainly fueled by the analog segment, which reported a decrease of 18% and, crucially, is by far TI’s largest segment, with a 73% share of revenue as of 2Q23.

TXN revenue by segment (Statista)

Meanwhile, the embedded segment performed better as revenue increased by 9%. This outperformance is most likely the result of TI’s focus in recent years to improve the product offering for this segment which has seen positive customer reaction. Meanwhile, the segment is also helped by greater supply constraints in recent years, which are now finally alleviating, driving up revenue for this segment. Finally, the “other” segment revenue declined by 10% YoY.

TI also continued to see weakness across most of its end markets, with Automotive being the one exception. This one reported positive growth in the low-single digits sequentially as demand remains resilient, driven by an increasing number of technologies in each car. Growth from the industrial end market remained flat sequentially, as demand remained mixed. Positively, the personal electronics end market saw a low-single-digit increase for TI sequentially after multiple quarters of deep red. Just last quarter, this one reported a sequential decline of 30%, showing that the bottom for this segment might be in. Finally, communications equipment and enterprise systems continued to decline heavily, with mid-teens and mid-single-digits drops, respectively. Yet, both are showing that a bottom might be close, as the rate of decline is slowing.

The overall picture that I am taking away from the earnings is that most end markets are potentially bottoming out and could start showing improved growth over the next several quarters as demand starts to increase again. Yet, I do not expect any form of significant sequential increase before the first quarter of FY24. The second half of FY23 will remain challenging, as demand remains low due to continued inventory corrections for TI customers.

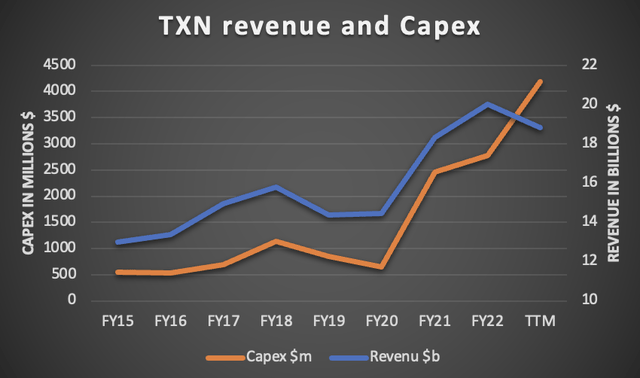

Moving to the bottom line, TI reported a gross profit margin of 64%, down 100 basis points from last quarter and down a whopping 540 basis points YoY. That overall margins have decreased is mainly due to the fact that TI remains committed to its Capex growth, while the revenue base continues to fall. Capex over the last 12 months increased by a staggering 49% while revenue decreased by 13%. This then drags down margins and results in a rapidly declining EPS number.

Still, I do not view this as a massive negative or a point of worry for investors. The margin decline is not a fundamental problem, but rather the result of a cyclical downturn. The fact that the company remains committed to investing in growth and technological progress is something I view as very positive, as it operates in an industry where the company with the most advanced technological products and largest capacity tends to end up on top. Through these continued investments, TI makes sure that it holds its leadership position in the analog chip market, which, as of 2021, stood at 19%, far ahead of second-place Analog Devices (ADI) with 13%.

By Author

Moreover, the margin profile of TI remains best in its class, even as margins have been declining over the last several quarters. These even still sit relatively in line with the 5-year average for most profitability metrics. The company still reported an operating profit of $2 billion or 44% of revenue, down 28% YoY. This resulted in EPS of $1.87, which was at the high end of management’s guidance, and beat Wall Street estimates by $0.10. Finally, free cash flow did come in negative due to the significant increase in Capex to grow capacity and declining revenue. Still, the TTM free cash flow (“FCF”) stands at $3.2 billion.

Despite a decreasing number in FCF generation, TI has a strong balance sheet with plenty of cash to fund its Capex plans and to keep rewarding shareholders. As of Q2, the company holds $9.6 billion of cash and short-term investments on the balance sheet against a total debt position of $11.3 billion. During the quarter, the company issued $1.6 of debt and repaid $500 million.

As for shareholder returns, TI returned $1.2 billion in Q2, primarily in the form of dividends as its share repurchases slowed down significantly. Shares currently yield a very respectable 2.67% on a payout ratio which fluctuates around 60% as the company’s cash flows have decreased over the last year. Still, the dividend should be perfectly safe, as the current slowdown is cyclical and cash flow generation should improve over the next year or so.

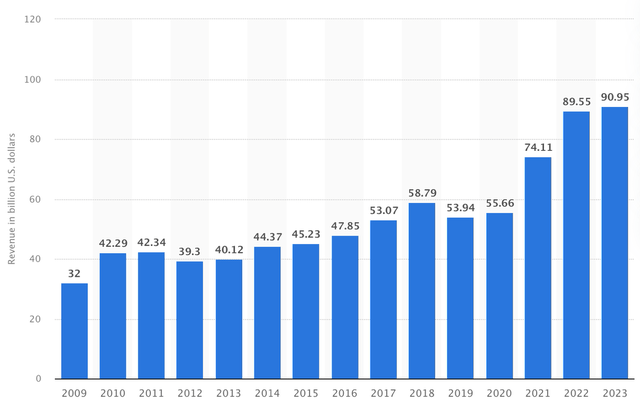

Moreover, despite this cyclical downturn impacting the company today, and through the company’s significant financial size advantage compared to peers, its already strong market share in analog semiconductors, and its geographical focus on North America, I believe it remains perfectly positioned to benefit from the overall growth in the semiconductor industry. For example, the analog semiconductor industry is projected to grow at a CAGR of 8.22% through 2027 after already showing impressive growth over recent years. From FY24 onwards, this CAGR should sit comfortably above 10%.

Analog semiconductor market size (statista)

In particular, the company’s geographical focus on the North American continent should benefit it in the long run as companies are increasingly looking to decrease their Asia exposure. In addition, this makes the company a primary beneficiary of the US Chips Act, which should allow it to decrease capex or grow capacity more rapidly. By building more fabs in the US, including a $30 billion fab in Sherman, Texas, the company should meaningfully benefit from the 25% tax credit for qualifying assets in the U.S. Following the passing of this new regulation, TI plans to increase its capacity in the 45- to 130-nm technology nodes over the next several years in order to increase its competitive position and take more market share. This is what management stated during the Q2 earnings call regarding its capacity expansion plans:

That’s going to enable growth by adding that internal capacity, which, as Dave alluded to earlier, that is geopolitically dependable capacity.

We’re putting as many as four Fabs in Sherman, two in Richardson, two in Lehi in Utah. And then assembly test facilities in Asia, primarily Malaysia and Philippines, for example. So — so that’s going to put us in a really great position to grow the top line for a long time.

TXN worldwide manufacturing sites (Texas Instruments)

Outlook & TXN stock valuation

For the third quarter, TI guides for revenue in the range of $4.36 billion to $4.74 billion, down 13% at the midpoint and up 1% sequentially as a recovery stays out. Management expects no significant change in the end markets so we should expect automotive to remain an outperformer, flat sequential growth for industrial applications, and all other segments to be down sequentially. Yet, I believe we could see a better-than-expected performance in personal electronics.

EPS is expected to be in the range of $1.68 to $1.92, down 27% YoY at the midpoint of the guided range.

As for the health of the overall semiconductor industry, TSMC, an excellent proxy for the industry, guides for a double-digit decline in FY23, but with a gradual recovery in the second half of the year and into FY24. The World Semiconductor Trade Statistics shares this view and projects 11% YoY growth in FY24 as demand returns and inventories normalize. Still, this is no explosive V-shape recovery as macroeconomic issues remain.

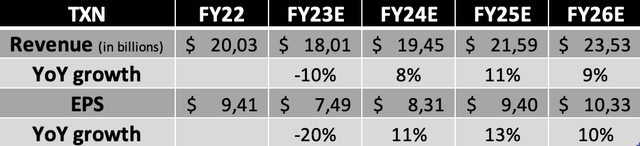

Following this guidance from management, my own expectations, and the company’s Q2 financial performance, I now project the following revenue and EPS performance through 2026.

Financial estimates until FY26 (Author)

(I expect Q3 revenue of $4.62 billion and EPS of $1.87.)

Shortly explaining these estimates, I now expect TI to report FY23 revenue of $18.01 billion, which is marginally up from my previous expectation. While the semiconductor industry should start to recover slightly in the second half of the year, this will be primarily driven by advanced semiconductors, with analog gradually recovering from FY24. This is why revenue will decline by 10% and will show a limited recovery of 8% in FY24.

Meanwhile, EPS will decrease significantly this year as margins fall due to a lower revenue base and continued growth in Capex to ensure a strong long-term outlook. Following the guided EPS range for next quarter, I have slightly lowered my EPS expectation for FY23. Yet, top-line growth in FY24 should allow for margins to recover more aggressively and drive stronger EPS growth. Therefore, I have upgraded my EPS estimate for FY24 and the years that follow.

Long-term, I remain very bullish on the semiconductor industry, including the analog market. With this one recovering and seeing strong demand due to the growth in electronic devices, I believe that TI, in combination with further market share gains, should be able to report high-single-digit to low-double-digit top-line growth and even faster EPS growth due to further margin improvement and continued share buybacks.

Moving to the valuation, this one has moved a bit higher than when I last covered the company in Q1, as the share price has increased by 8.5% and my bottom-line estimates for FY23 have come down. Shares are currently valued at a forward P/E of close to 24x, which sits 5% above its 5-year average and is in line with the sector median. The company generally tends to trade at a premium to peers due to its massive size, little geopolitical risk, in-house manufacturing capabilities, and incredible margin profile. Of course, no investment is ever “risk-free” but TI seems to be as de-risked as they come.

Honestly, I do not have much to argue against this and do believe this company deserves to trade at a premium to its peers and sector medium, also in part due to its excellent capital return policy. Yes, it is going through a rough cyclical downturn, but as the company remains fundamentally strong, I absolutely see no issue for long-term investors. It will bounce back stronger over the next several years.

In my previous article, I claimed that a 22x forward P/E is fair for this high-quality company, but as the focus on local manufacturing increases, the outlook for the analog market has improved, and the company remains committed to its strong capital allocation strategy, I believe a 23x P/E would be fair today. Based on this belief and my FY24 estimate, I calculate a target price of $191 (up from a previous $182), leaving an upside of 6%. (Please note, this target price is solely based on its forward P/E and is only for indicative purposes.)

Conclusion

Texas Instruments’ Q2 earnings report demonstrated both strengths and challenges. Despite beating analyst estimates, the share price declined, reflecting a cautious response from investors due to concerns about the somewhat negative outlook and the cyclical downturn in the analog semiconductor market. However, the company’s management appears to be navigating the downturn effectively, focusing on long-term growth strategies and capital expenditure plans to increase capacity and market share. While the short-term weakness may persist, TI’s strong position in the analog chip market, its North American focus, and its commitment to technological progress should bode well for its future prospects.

I believe TI deserves a premium valuation due to its fundamental strength, robust capital return policy, and minimized geopolitical risks. Though currently facing a cyclical downturn, long-term investors are advised to look past the near-term challenges and consider the company’s potential for growth and increased shareholder returns in the coming years.

Considering a price target of $191, leaving an upside of 6%, I recommend waiting for a better entry point to start a new or increase an existing position. Going with a yearly return of 7% (close to 10% when including dividends), I believe shares are a buy below a fair value share price of $172 as this should provide better long-term returns and an improved margin of safety.

Therefore, I downgrade my rating on Texas Instruments from buy to hold. While I have kept my outlook largely intact, the higher share price and slight EPS downgrade have made shares slightly less attractive than three months ago. Meanwhile, fundamentally, the company remains in excellent shape, so there is also absolutely no reason to sell for existing shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.