Summary:

- I maintain a Hold rating for Texas Instruments due to its current overvaluation despite anticipated strong financial growth in 2025.

- Q3 is expected to be weak, driven by declines in the Analog and Embedded Processing segments, but the Personal Electronics and Communication Equipment segments show strength.

- TI’s high inventory levels and manufacturing expansion pose risks of overcapacity, though they help to mitigate supply chain disruptions.

- Despite robust long-term prospects, TI’s valuation is inflated, and I foresee a potential contraction in enterprise value by late 2025.

Henrik Sorensen

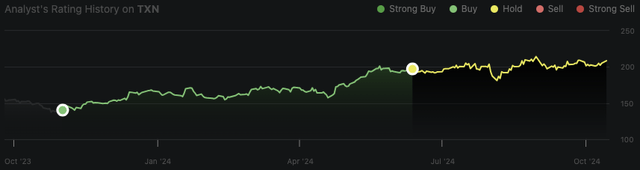

In my last analysis of Texas Instruments (‘TI’) (NASDAQ:TXN) (NEOE:TXN:CA) in June, I assigned a Hold rating. Since then, the stock has delivered a total return of 1.4%. With Q3 results approaching, I think investors should prepare for another weak quarter, which would make for an excellent time to buy based on growth expected in 2025, but the market is already ahead of this. At the current valuation, I believe most investors allocating now will generate a loss over the next couple of years.

Oliver Rodzianko’s TXN Rating History

Q3 Earnings Preview: The Last Sign of Weakness

TI is expected to announce its Q3 earnings results on October 22, and management has guided for revenue between $3.94 billion and $4.26 billion and GAAP earnings per share of $1.24 to $1.48. In TI’s Q2 earnings call, management highlighted key areas of weakness that are important to monitor in Q3. Its Analog revenue declined 11% year-over-year, and Embedded Processing was down 31% year-over-year. This was primarily due to weakness in the industrial market stemming from global economic uncertainties and associated reduced capital expenditures by industrial clients, but also the automotive sector’s weakness, influenced by factors such as supply chain disruptions and reduced demand for new vehicles. I attribute a large part of the weak demand environment to high interest rates and inflation, which have severely impacted non-essential investments for most businesses in the last few years. As most of TI’s customers are not Big Tech firms like those supplied by NVIDIA (NVDA) and AMD (AMD), it is less recession-resistant, given that the budgets of its clients are more constrained.

Despite this weakness, Q3 should be marked by continued strength in Personal Electronics and Communication Equipment, both sectors of TI’s portfolio that have shown growth recently. This could mark a subtle shift in TI’s overall balance of demand among its operating segments. However, we should also remember that with a lower interest rate environment and a strong upcycle anticipated for 2025, the current demand constraints in its core Analog and Embedded Processing segments will ease. Therefore, I perceive Q3 as the last quarter the company will face a major year-over-year decline before strong growth in Q1 2025.

Another element I believe deserves attention is that TI noted 20% sequential growth in its China business in Q2, which could be a significant driver of overall performance in Q3 amid Western macroeconomic weakness. China is one of TI’s most important markets, with a large customer base and an extensive manufacturing ecosystem. Management is expanding its manufacturing presence in the region, including doubling the capacity at its Chengdu plant. There’s certainly weight to the thesis right now that Asia could become a more dominant revenue generator for TI in the future if its economy continues its industrial rise as it has been.

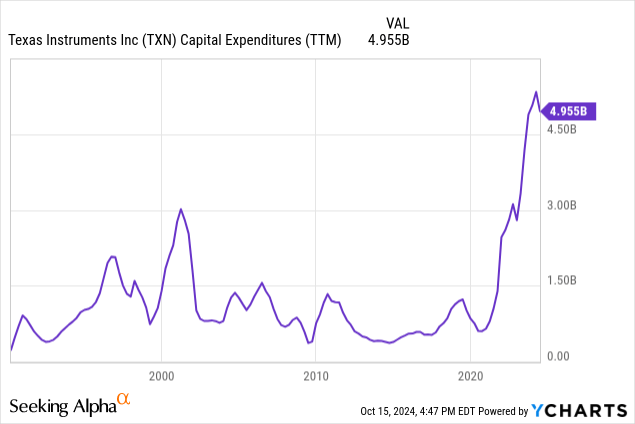

Management has not only been focusing on China. The Q3 earnings call may also highlight the broader manufacturing expansion that management has undertaken. It has plans to almost triple its production capacity by 2030. It is making significant investments in 300-mm wafer fabrication facilities, which are crucial for producing analog and embedded processing products efficiently. This is so much of a focus for TI at the moment that its capital expenditures reached 29% of revenue in 2023 and are expected to rise to 32% in 2024. Management aims to build the world’s largest U.S.-based 300-mm analog semiconductor capacity. This raises valid concerns about too much inventory and too much manufacturing capacity. Based on my research, it’s quite likely that its projected capacity could exceed demand.

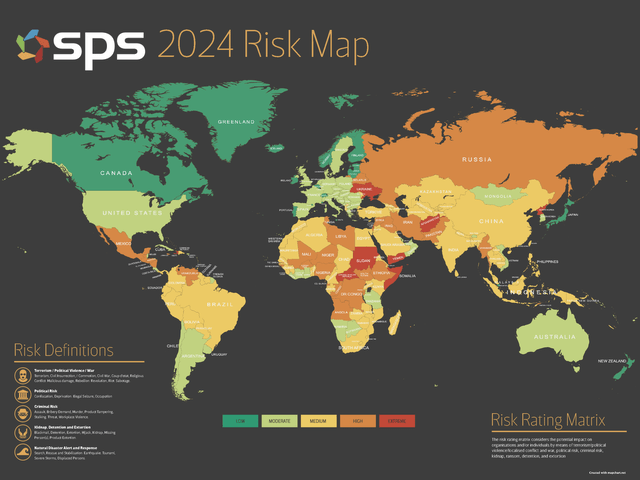

Looking directly at inventory, as of Q2, the company held around 229 days of supply, or inventory worth approximately $4.1 billion. This is arguably too much, but its products, particularly simple analog chips, have long shelf lives and are not subject to rapid obsolescence. The company is holding higher levels of inventory because it allows it to better control its supply chain, ensuring product availability and timely delivery. With such a robust inventory stack, the company is less prone to supply chain disruptions, which is a real threat right now, given the tense geopolitical climate in Asia, the Middle East, and Eastern Europe.

SPS

Valuation Analysis

I think 2025 will be a very strong year for TI. President Trump and the Republican Party have mentioned a very strong isolationist stance, as opposed to Vice President Harris and the Democrats, so the outcome of the election could have an impact on TI. While the outcome of this dead-heat election is still speculative, TI’s formidable inventory position is not. Look for strong reinforcements of this in Q3, as it is one of the core elements underpinning my 27.5% normalized EPS year-over-year growth estimate for TI in 2025. In addition, I expect year-over-year revenue growth of 15% for the year.

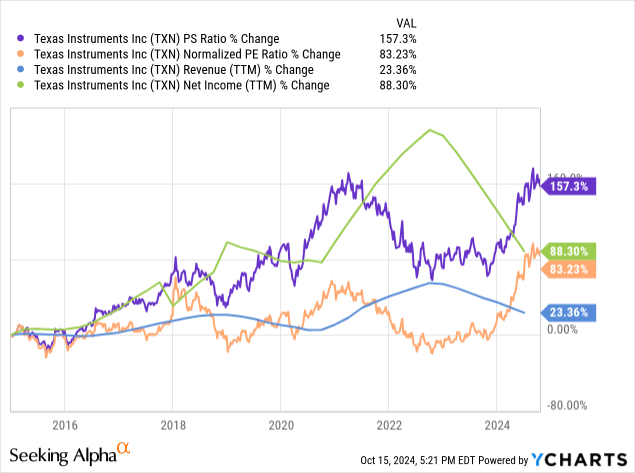

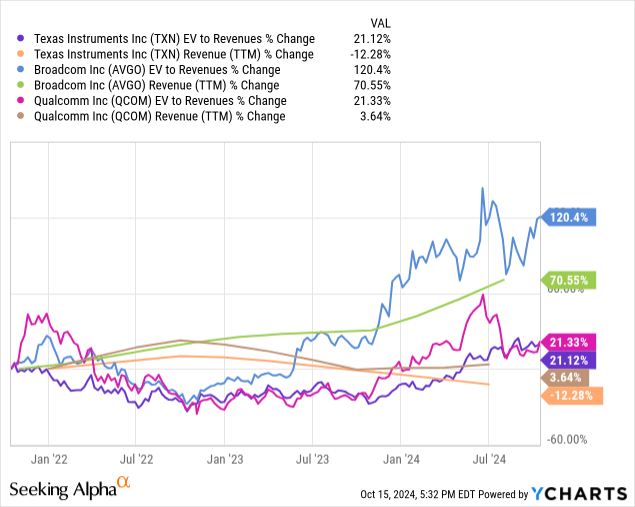

However, just look at the chart below to see how the market has already massively overvalued the stock on expectations of strong growth in 2025. This is a clear indication that now is a bad time to invest in TI.

For further validation of why the company is overvalued, consider that TI’s forward P/E non-GAAP ratio represents an increase of over 50% above its five-year average. Furthermore, its forward P/S ratio is approximately 30% higher than its five-year average.

On a revenue basis compared to peers Broadcom (AVGO) and QUALCOMM (QCOM), there’s also little reason why TI should be trading at such a rich valuation right now.

| Texas Instruments | Broadcom | Qualcomm | |

| Forward EV-To-Sales Ratio | 12.4 | 17.7 | 5.2 |

| 2025 Revenue Growth Estimate | 15% (independent) | 17.4% (consensus) | 9.2% (consensus) |

Based on this data and my broader analysis, I consider TI’s fair EV-to-sales ratio to be approximately 9. If the company trades at this ratio in late 2025, I forecast it will have an enterprise value of approximately $162.63 billion, given my estimate of total revenues for the year of $18.07 billion. This is a 16.5% decline from the current enterprise value of $194.71 billion. Therefore, while I consider TI’s long-term prospects strong, my current rating is a Hold.

Risks Review

- TI is likely to face a weak Q3. However, the market seems to care little about this, focusing more on the high growth expected in 2025. That being said, readers should be careful about allocating at the present valuation. While the company’s significant financial growth anticipated in 2025 has yet to begin, the stock price already more than reflects it.

- TI is subject to higher constraints from macroeconomic weaknesses like high inflation and interest rates. With a lower interest rate environment on the horizon in 2025, the company will benefit. But if this leads to further inflation and a period of stagflation, TI will likely be hit harder than other semiconductor players, who have demand from Big Tech companies to cushion them.

- TI has secured itself from supply chain disruptions through a high level of inventory. However, this might exceed demand, and its capacity increase also runs the risk of overextending the company. This means its investments might not yield the best returns and may not be entirely efficient given the current industry dynamics.

Conclusion

TI is a stable company, but I believe its current valuation is not. While 2025 is likely to deliver robust growth for the business, I expect we could see a contraction in its enterprise value toward the end of the year. Maintaining the current valuation will require sustained high growth rates, which is unlikely given the cyclicality of the semiconductor industry. I see little upside left for TI in the next 12 to 18 months, so my rating is a Hold despite its operationally strong business model and management team.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.