Summary:

- Texas Instruments is popular in the dividend growth community due to its long-term performance in share price appreciation and dividend growth.

- The company is participating in a strong growth trend, has an excellent balance sheet and disciplined capital allocation.

- Due to economic headwinds and high capital expenditures, the dividend isn’t fully covered by its FCF, which will result in slower dividend growth in the short term.

- Based on the dividend discount model, the fair value of TXN is $175, which is 6.6% undervalued compared to the current share price.

- Don’t expect too much from TXN in the short term, but those who are willing to wait can expect a rebound in dividend growth.

SweetBunFactory

Investment thesis

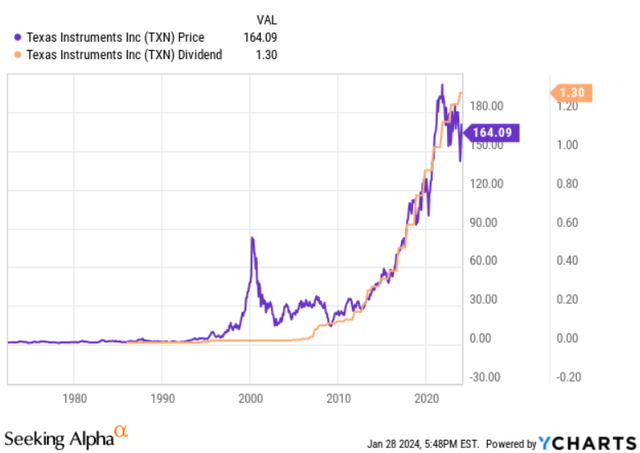

Texas Instruments Incorporated (NASDAQ:TXN) is very popular in the dividend growth community. This is not surprising, given the long-term performance when it comes to share price appreciation and dividend growth.

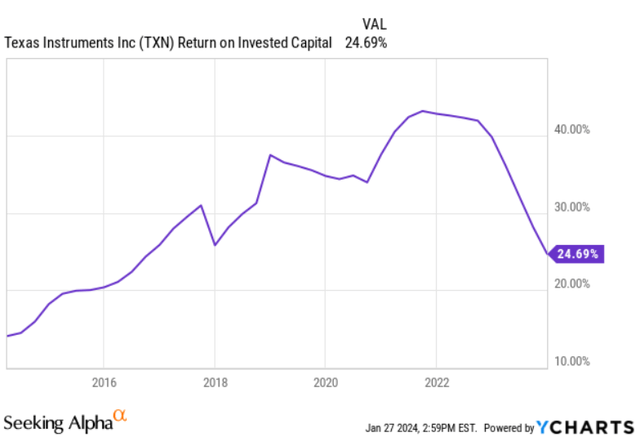

TXN dividend and share price development (YCharts)

Personally, I really like this chart, because the annual dividend paid follows the share price almost perfectly. This just shows the beauty of dividend growth investing. If companies are able to grow their business in a sustainable way, they can also grow their dividend sustainably and there is also enough capital left to finance further growth.

TXN has proven that it can do this very well.

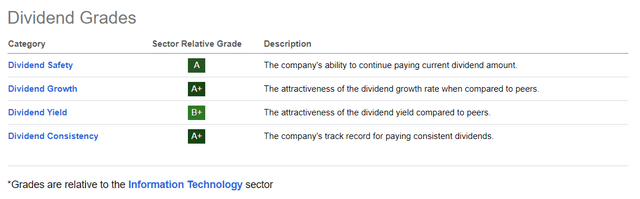

Dividend grades (Seeking Alpha)

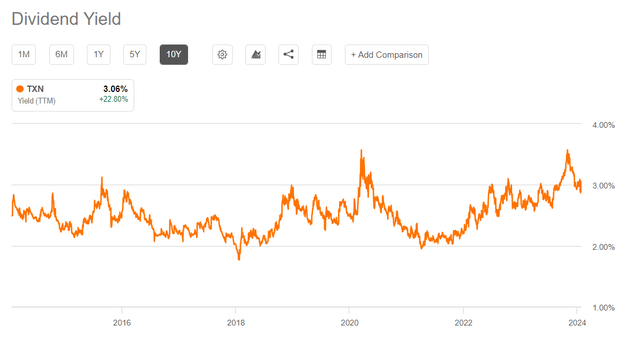

The dividend grades from the Seeking Alpha website are looking perfectly fine. If we combine the TTM dividend yield of 3.06%, with its 5Y dividend growth CAGR of 13.80%, the dividend would compound nicely in the years to come. In recent months, the dividend yield has even been at historically attractive levels.

TXN dividend yield (Seeking Alpha)

However, past results do not always have to say something about the future. In August 2023, I wrote an article about TXN with the title: short-term pain for long-term gain. This really seems to be the case at the moment, as the last quarterly results were worse than expected. The results are clearly reflecting increasing weakness in the industrial and automotive segment. At the same time, the company is investing heavily into future growth. The combination of high CapEx and weakness in the mentioned business segments put their FCF under pressure. Even in such a way that the dividend isn’t fully covered.

On September 2023, TXN has increased its quarterly dividend from $1.24 to $1.30 per share, which implies a 4.8% increase and marked 20 years of dividend hikes. However, their latest increase was significantly lower compared to its 5Y average.

Do current developments have a significant effect on the investment thesis? Is their dividend at risk? Let’s find out!

Why invest in TXN?

If short-term results are disappointing, in my experience it is always good to look at the bigger picture. Let me summarize why I think it is worth considering investing in TXN.

Megatrends

The semiconductor industry is subject to a long-term growth trend.

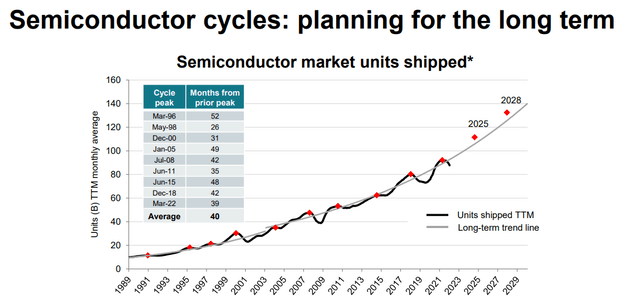

long-term trendline (TXN investor relations)

TXN is the market leader in the analog and embedded chip segment. The company is mainly focused on the automotive and industrial segments, which are also growing ones. Their customers are increasingly turning to analog and embedded technologies. It is likely that the long-term trend results in higher amounts of chips per application, which should drive faster growth.

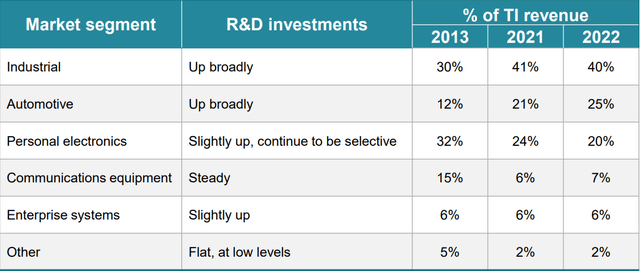

TXN operating segments (Capital management presentation 2023)

Based on the latest numbers, the revenue distribution is now as follows:

- Industrial 40%

- Automotive 34%

- Personal electronics 15%

- Communications equipment 5%

- Enterprise systems 4%

- Other 2%.

As you can see, the top two segments are becoming increasingly important for TXN and this is where the company invests the most in terms of R&D.

Competitive advantages

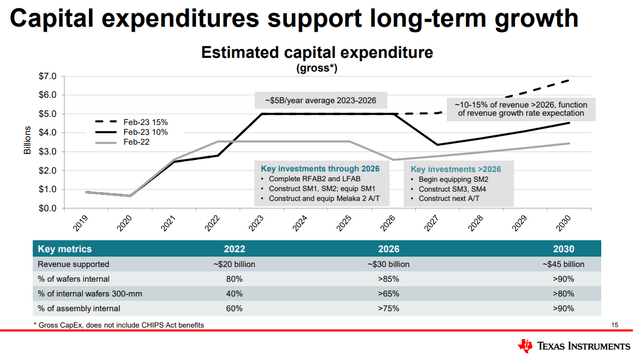

TXN has some important competitive advantages compared to its peers. The most important one is the 300-mm wafer production, which is about 40% less expensive compared to the 200-mm wafer, which is used by most of its peers. In addition to this, they do a lot of assembling and testing internally, which leads to even higher margins. This is also the main reason for the company to further invest in 300-mm manufacturing assets and inventory.

CapEx roadmap (Capital management presentation 2023)

Given the size of the company, it can benefit from economies of scale. The company has more than 80,000 products in its portfolio and operates through many sales channels.

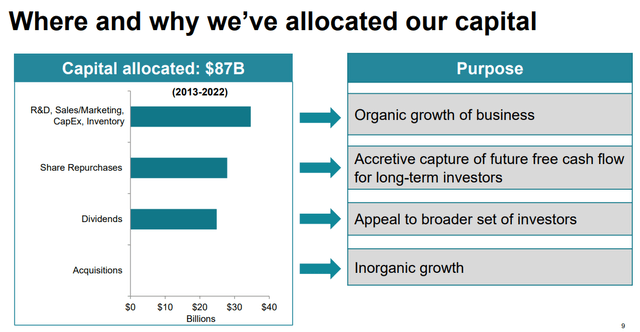

Disciplined capital allocation

The company allocates its capital really well and has a long-term mindset. TXN believes that a growing FCF per share is the most important metric when it comes to long-term value creation, which I personally agree with. It has an excellent track record of increasing its FCF per share with a CAGR of 11% from 2004 to 2022.

Capital allocation strategy (Capital management presentation 2023)

The emphasis is clearly on future growth and enough cash has been returned to shareholders in the form of a growing dividend and share buybacks.

In the past 10 years, they have also been able to significantly increase their ROIC. However, since 2022, the ROIC has fallen due to a decrease in profitability.

Balance sheet

Besides the fact that TXN has spoiled its shareholders for decades, the balance sheet is very healthy. The company enjoys an A+ S&P global credit rating, which means it can easily meet its financial commitments. The high-class balance sheet forms an ideal safety cushion to enable future investments.

Based on the latest numbers, TXN has $2.9 billion in cash and equivalents and $5.6 billion in short-term investments.

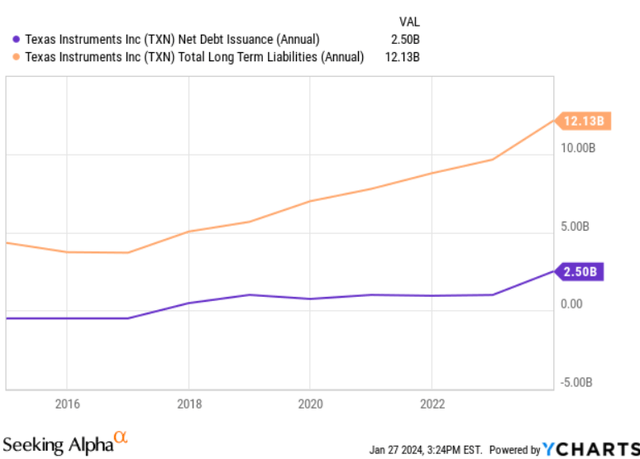

However, it must be mentioned that the balance sheet has been in better shape at times. Both net debt and their total long-term liabilities have increased over time.

Long-term and net debt (YCharts)

Current situation & quarterly results

So is the investment thesis still intact? There are some critical points to mention:

- The most important performance metric of TXN, the FCF per share, will drop in the short term, given the large amounts of CapEx and the possibility of persistent economic headwinds.

- It is likely that in the short-term dividend growth will not be as high as their 5Y average.

- It is likely that the balance sheet will get weaker in the short term, given the large investments they make in combination with their dividend growth policy.

These points are not entirely new, as management has been transparent about their actions. However, the latest quarterly results were disappointing, which puts even more pressure on their profitability.

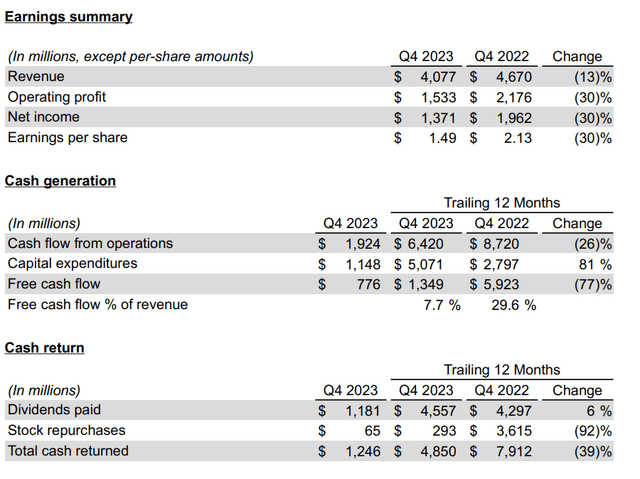

Q4 2023 earnings TXN (TXN investor relations)

Due to the continued weakness in the industrial and automotive segments, the results were worse than expected. Compared to last year the total revenue was 13% lower and in terms of profitability (operating profit, net income, and EPS) metrics were down 30% year-over-year.

In terms of cash generation, the TTM FCF was 77% lower compared to the previous year due to higher CapEx and significantly lower cash flow from operations.

During FY 2023 TXN returned $4.85 billion in the form of dividends ($4.5 billion) and share buybacks ($293 million), which was clearly more than their total FCF ($1.3 billion). In order to continue their current policy, they will have to take on more debt. This will worsen their balance sheet in the short term, but if investments lead to significant value creation in the future this will not be a problem. I do expect the dividend to continue growing, but this will depend on how the cycle will behave itself. I don’t expect them to cut CapEx in the coming years, this was also clearly reflected in the Q4 earnings call.

Rafael Lizardi

In fact, CapEx came in as expected $5.1 billion, and we’ve been talking about $5 billion per year. So it was right on target. And you should expect, and we expect, to continue running at about $5 billion per year through 2026 as we complete the investment plans that we’ve been talking about.

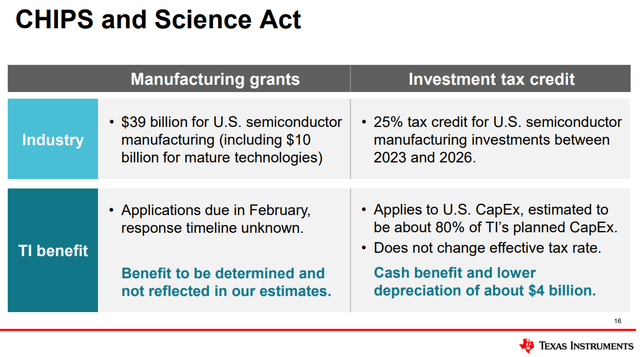

Luckily TXN can benefit from the Chips Act when it comes to CapEx and CFO Rafael Lizardi said the following about this:

So the ITC investment tax credit 25% on CapEx or manufacturing in the United States. We have accrued to-date over the last year and a half or so $1.4 billion. We expect to get about $500 million of that later this year, probably in fourth quarter as far as the current law and regulations stipulate. And we’ll get the rest further down the road, mostly the following year and then after that.

Chips Act benefits (Capital management presentation 2023)

I see this as a good sign and will likely result in cash benefits for TXN.

Based on their latest report, it can be concluded that despite the disappointing earnings, management continues to make large investments to achieve future growth. This corresponds with the long-term vision of the company.

Valuation

In my first article about TXN, I used the dividend discount model to calculate the fair value. This model fits the company very well because it has an existing dividend growth policy and a meaningful dividend growth track record.

The dividend discount model requires the following inputs:

- The expected annual dividend per share for the next year.

- The required rate of return.

- The dividend growth rate.

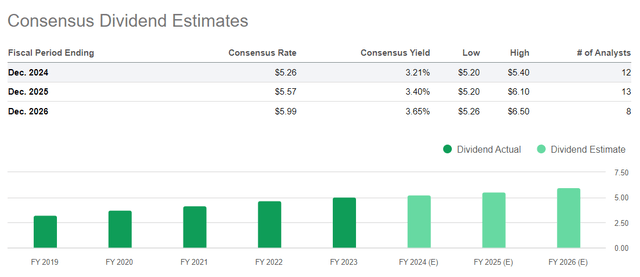

In FY 2023, TXN has paid an annualized dividend of $5.02 per share. At the end of FY 2024, I expect a dividend hike between 3-5%. I used 4% in my calculations, so this comes down to an expected annual dividend of $5.25 (3 quarters of $1.30 + last quarter of $1.35). This is very close to the consensus dividend estimates on the Seeking Alpha website.

Dividend estimates (Seeking Alpha)

From my personal investment perspective, I want a minimal rate of return of 12.5% annually. I assume that the dividend growth in the short term will be lower than its own 5Y (13.8%) or 10Y year CAGR (16.7%). However, I think that a long-term dividend growth of 9.5% is achievable. However, it must be taken into account that there will be high CapEx until 2026 and that this will have an impact on dividend growth in the short term.

If we do the math this results in a fair value of $175 per share, which means the stock is 6.6% undervalued compared to the current share price of $164.09.

Conclusion

In my opinion, TXN is still a high-quality business. However, there has been considerable pressure on the company’s profitability due to persistent economic headwinds. Due to high CapEx and lower profitability, the dividend isn’t covered by its FCF. I don’t think this will cause problems for the company and the dividend is still safe. Do not expect dividend growth in line with their own 5Y and 10Y average in the short-term (until 2026) and they may need to leverage up their balance sheet in order to grow their dividend. I’m not a fan of this, but given TXN’s capital allocation strategy, it is expected that they will continue to grow the dividend. The company wants to be well prepared when the movement of the cycle will be more in its favor. It is difficult to predict how the cycle will behave as it can be different every time. However, if growth occurs, TXN is in a good position to generate healthy FCF again. With this higher FCF, the desired capital allocation strategy can be resumed and they can reduce debt if necessary.

Large investments can also involve risk and there is always a chance that their CapEx will not deliver meaningful value creation. In this situation, it is important that you, as an investor, have confidence in TXN’s management. I think management deserves some credit here as they have shown in the past that they are doing great when it comes to value creation and capital allocation.

Personally, I opened a position recently, as the correction in share price has offered a great opportunity. I don’t expect much from TXN in 2024. Why don’t you wait before buying then? Because it’s very difficult to time the cycle and I think the company is still attractively priced at the moment. I will therefore expand my position through DCA and if share price pressure arises again, I will buy more.

At the moment, investing in TXN is short-term pain for long-term gain. Of course with some extra short-term pain, but if you are willing to be patient, I expect solid long-term dividend growth. I will continue to closely monitor TXN’s progress and I am very curious about the “Capital management review 2024” on February 1st.

All in all, I give TXN a “BUY” rating and in my opinion, it certainly deserves a place in a diversified dividend growth portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.