Summary:

- Texas Instruments is a leading semiconductor manufacturer, specializing in analog and digital semiconductors, microcontrollers, and processors.

- The Analog segment accounts for 77% of revenue and has wide profit margins. This faces less risk of technological disruption and has fewer competitors compared to the digital semiconductor sector.

- The company has a plan to invest $20 billion in the next few years through 2026, which could improve margins and quality considerably.

- I like the company, and the management has proven to be competent, but the potential return does not seem attractive enough to me.

SweetBunFactory

Investment Thesis

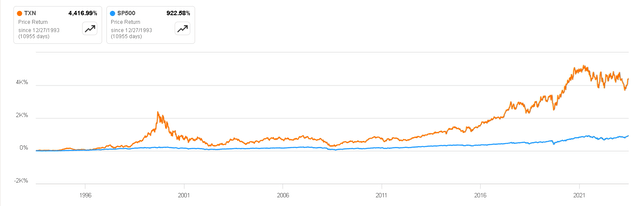

Texas Instruments (NASDAQ:TXN) is a company you should be familiar with if you’re interested in the semiconductor sector because the majority of its revenue comes from analog semiconductors, which possess qualities that reduce the risk of technological disruptions. It’s not coincidental that since 1993, the company has far surpassed the S&P 500 despite having a product that is essentially cyclical.

In this article, we will analyze the business model of this company and touch on some of the risks frequently discussed today in relation to Texas Instruments. Additionally, I will provide a projection of the Free Cash Flow to explain why I believe the expected return is not attractive enough to justify an investment in the company; thus, I have decided to assign a ‘hold‘ rating.

Price Return vs S&P500 (Seeking Alpha)

Business Overview

Texas Instruments designs and manufactures semiconductors and various integrated circuits, and it is one of the largest semiconductor manufacturers in the world. Products manufactured by Texas Instruments include analog and digital semiconductors, microcontrollers, and processors. The company’s products are used in various applications such as industrial, automotive, communications, and consumer electronics.

The company’s revenue is composed of three segments: Analog Semiconductors, Embedded Processing, and Others.

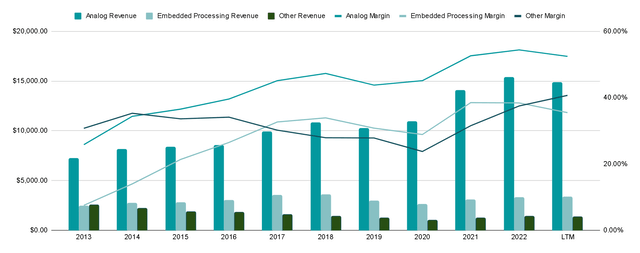

Author’s Representation

Analog Semiconductors

Analog accounted for 77% during FY2022, and its EBIT margins are the widest of the three segments, standing at 54% over the past year. Due to its significant weight in revenue, I want to focus on explaining this segment and its benefits.

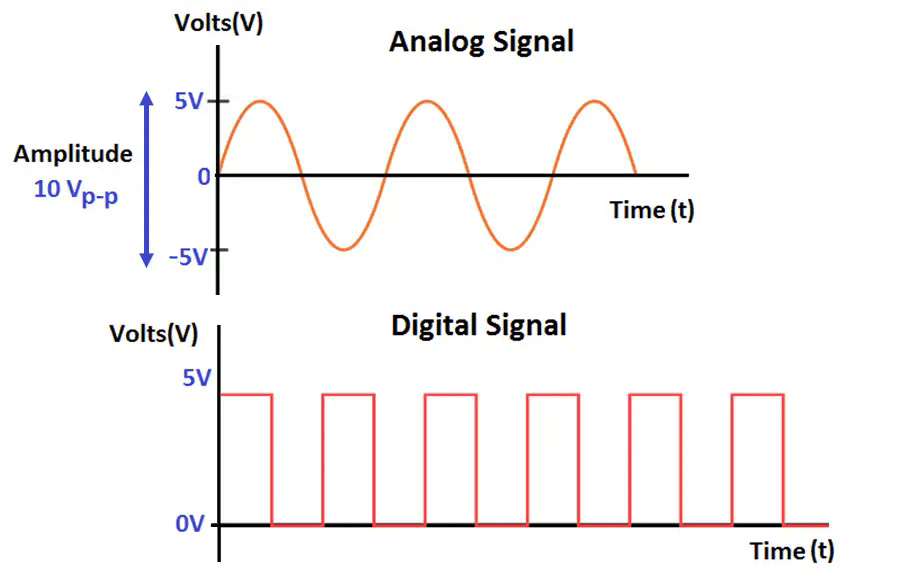

As its name implies, in this Analog segment, the company manufactures and sells analog semiconductors, which can take any value within a certain range. These analog semiconductors are often used to represent real-world phenomena, such as sound, temperature, or voltage, in a continuous manner. This is in contrast to digital semiconductors, whose signals are represented using binary code only (0s and 1s). While digital semiconductors are extremely useful for data processing, storage, or digital signal processors, they also have limitations, which analog semiconductors address. That’s why both components are often used together to leverage the strengths of each technology in a complementary fashion.

Analog vs Digital Signal (Instrumentation Tools)

An example of how these components complement each other in real life is in digital cameras. In this scenario, analog components, such as the image sensor, focus on accurately capturing the analog signals from the scene, while the digital components take on the task of enhancing and storing the digital representation of the image.

Moore’s Law: A Shield of Disruption

Although both semiconductors are complementary and not substitutes, there are some nuances that make analog semiconductors seem more interesting to me as an investment.

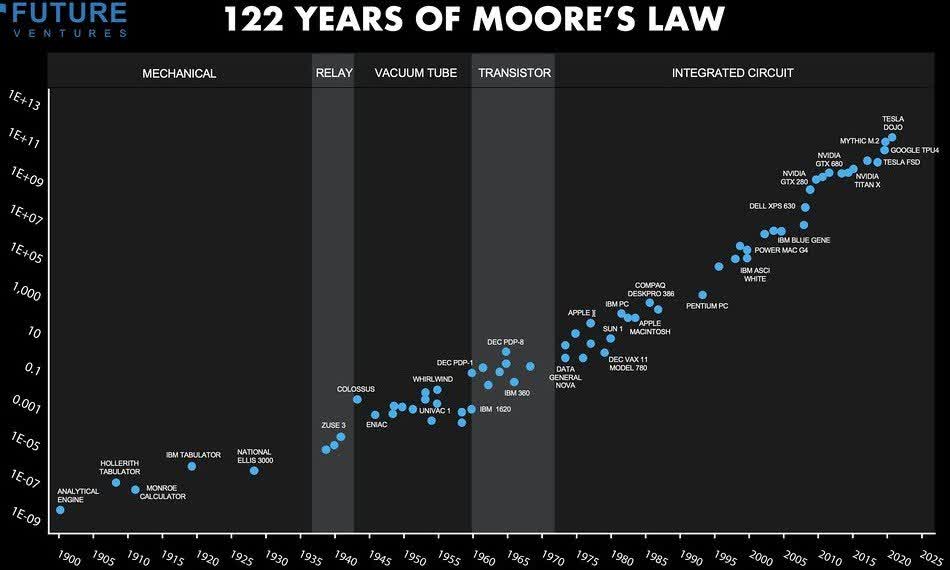

First, if you are investing in semiconductors, you must understand Moore’s Law, formulated by Gordon Moore in 1965. Originally, it stated that the number of transistors on a microchip would double approximately every two years, leading to an exponential increase in computing power and a decrease in the cost of electronic devices. This observation held true for digital integrated circuits and has driven the rapid advancement of digital technology.

Moore’s Law (Future Ventures)

However, Moore’s Law does not directly apply to analog semiconductors because these circuits are often more complex than digital circuits. They deal with continuous signals and require precise control over voltage, current, and other parameters, making the miniaturization process more challenging. Also affected is the fact that analog semiconductors are designed for a wide range of applications with diverse requirements, such as audio amplification, sensor interfaces, and radio-frequency applications. This diversity makes it challenging to create a one-size-fits-all solution.

Competition

This complexity and lower risk of technological disruption means that components often have longer product lifecycles compared to digital components and the risk of technological disruption is drastically reduced.

This is very important if we consider that in the Digital Semiconductors sector, there are competitors such as Intel, AMD, NVIDIA, QUALCOMM, or Broadcom. On the other hand, Texas Instruments’ competitors would be Analog Devices, ON Semiconductor, or NXP Semiconductor, good competitors, but less ‘powerful’ than those in digital semiconductors.

Analog Semiconductors Companies (Mordor Intelligence)

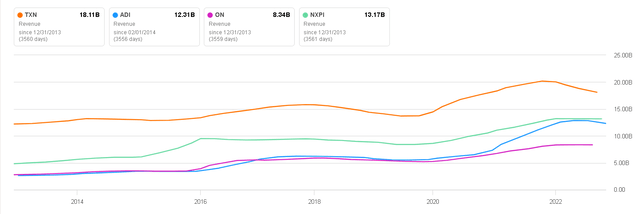

In conclusion, the company is in a semiconductor division that is just as necessary as the digital one, but that faces less risk of technological disruption coupled with fewer competitors. Furthermore, if we look at the revenue of four publicly traded competitors, we can immediately notice that TXN (orange line) sells almost 40% more than the closest second, giving us an idea of the scale it has already gained in the sector.

Revenue (Seeking Alpha)

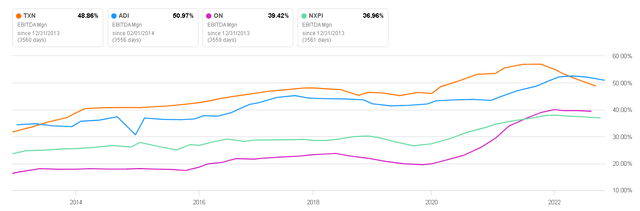

This greater scale ends up being directly reflected in the company’s margins, which until the last quarter, had been the highest in the sector. This status of one of the lowest-cost producers has been achieved thanks to the operating leverage achieved thanks to the fact that it has managed to keep its costs fixed through a vertical integration where it owns much of its manufacturing capacity.

Because we own much of our manufacturing capacity, a significant portion of our operating cost is fixed. As factory loadings increase, our fixed costs are spread over increased output and, absent other circumstances, our profit margins increase.

Again, in the orange line, you can see the EBITDA margins of Texas Instruments, which in the last twelve months were 48.9%, and those of Analog Devices were 51%. Except for this quarter, the company previously maintained the status of the best margins in the sector.

EBITDA Margins (Seeking Alpha)

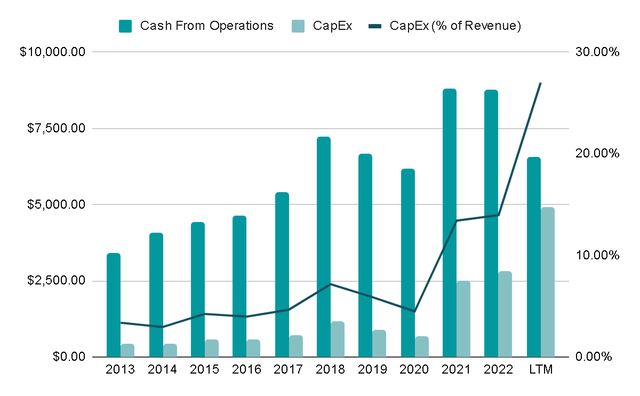

Achieving this scale and competitive position is not a simple accomplishment. The company has been the one that invested the most in Capital Expenditures (CapEx) in the last decade, and this difference in investment has increased in recent months.

Author’s Representation

In the last twelve months, the company has invested $5 billion in Capital Expenditures, equivalent to 27% of revenue. This has temporarily depressed the Free Cash Flow margin. Despite this substantial investment, the company remains Free Cash Flow positive. Although analysts constantly inquire whether the company plans to cut CapEx spending, management’s responses are resolute:

We are going to enable revenue growth for the company for the next 10 to 15 years. Okay. So that’s how we’re thinking about it. And that’s why we’re making this investment on CapEx, in particular, about $5 billion per year for the next four years, and we are committed to those investments.

We’re excited to making those investments regardless of the short-term fluctuations of revenue and of course lower revenue means lower operating cash, which now with the CapEx, that’s why you’re seeing on the free cash flow is not unexpected.

This strong investment will be a matter of trust in management. If it does not go according to plan, a significant amount of Cash Flow could be sacrificed in the short term, potentially harming the company‘s, for now, debt-free financial position.

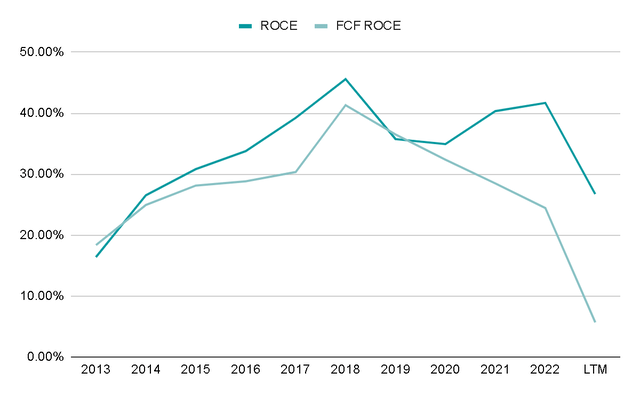

However, I find reasons to trust in management’s ability to generate value. The company has a top-notch business culture that has focused on the generation of long-term free cash flow. Over the last decade, the Free Cash Flow Return on Invested Capital (FCF ROCE) has averaged 30%, demonstrating a clear ability to create value.

Ultimately, our objective and the best metric to measure progress and generate value for owners is a long-term growth of free cash flow per share.

Author’s Representation

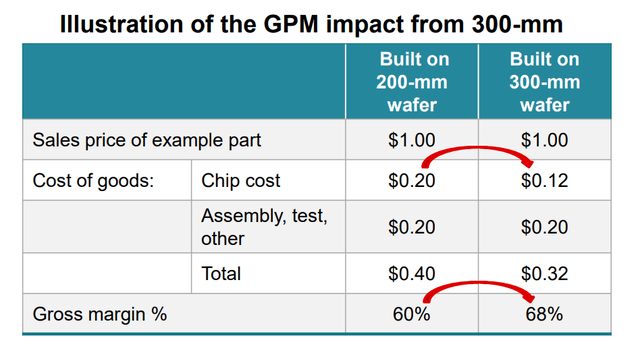

The idea behind investing so much in CapEx is to ensure that 90% of the 300-millimeter wafers are assembled in-house. According to management, 300-millimeter wafers are 40% less expensive to manufacture than 200-millimeter wafers. So, if these investments go well, the company should take full advantage of the next semiconductor economic cycle, becoming more profitable than ever.

Texas Instruments Capital Management Presentation

Valuation

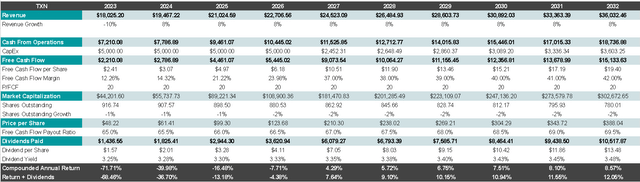

Usually, when I make projections, I consider the next five years. However, in the case of Texas Instruments, it seems to me that it would miss a large part of the picture because, in the short term (let’s call it the next three years), they will be investing heavily in future growth. Therefore, I am interested in having a projection for the next ten years once the investments in CapEx have been ‘digested’.

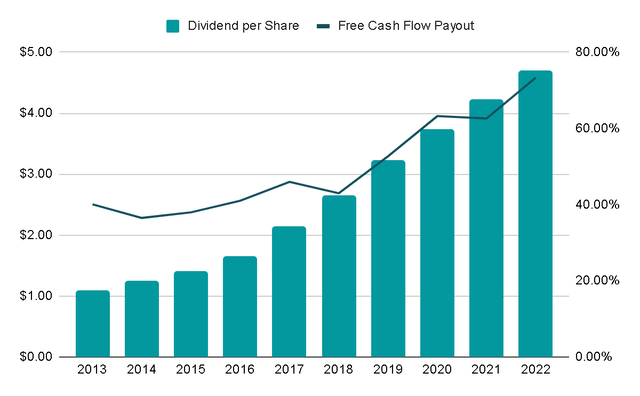

Furthermore, an important aspect when valuing TXN is the dividends. In the last decade, the company has distributed an average of 50% of Free Cash Flow in dividends, and each year this percentage has increased. During FY2021, 63% of FCF was distributed. This has caused the dividend per share to increase by 18% annually in the last decade. I will also consider this in my estimation.

Author’s Representation

So, for the next few years, I estimate that they will allocate $5 billion annually in CapEx, according to what management said in the Q2 conference call. Subsequently, this figure will be 10% of revenue, according to what was discussed at the Capital Management Meeting in November 2023. This investment should yield revenue growth in the coming years, so I will estimate an 8% average annual growth (it does not mean that exactly each year will grow 8%).

This implies a Free Cash Flow of $15 billion within 10 years, a growth of 26% in Free Cash Flow per share (management’s objective is between 25-30% in the long-term). If we assume that they will buy back 2% of the shares annually, according to what they have done in the past, and pay almost 70% of the Free Cash Flow in dividends, the annualized return with dividends included would be around 12%.

Author’s Representation

Risks

The first most obvious risk is the giant investment they will be making in the coming years, which will strongly impact Free Cash Flow. If you do not fully trust the management, it would be best to wait and see the results of all this investment. Texas Instruments currently has little debt, so it shouldn’t be a problem in the short term.

The second risk, and one of the most controversial issues, is Chinese competition. As is usual in recent years, in any aspect related to technology, China is usually heavily involved, and thanks to subsidies from the Chinese government, they can often enter into price wars to corner the market and expel as many competitors as possible. While this is a real risk, I think Texas Instruments’ vertical integration makes it highly resistant to a price war (although it could erode its margins). More importantly, we’re talking about TXN’s products sometimes costing less than $1, so I don’t see much sense in a client of Texas Instruments, such a recognized and reliable player in the sector, taking a risk with a Chinese competitor to save maybe $0.05. I don’t see it as feasible.

Related to this risk is the fact that 25% of the company’s end customers are located in China. Here I do see a greater risk that they will choose products manufactured in their own country, and a quarter of Texas Instruments’ revenue would be at risk of being replaced.

Final Thoughts

Once we understand the positive aspects of the business model, how excellent the management is, how clear its shareholder-friendly capital allocation is, and the risks that exist in the business, my very personal conclusion is that it is best to wait and see.

This is because although competition does not seem to be an imminent risk, we are currently in a period where the company is investing almost a quarter of its revenue in CapEx. These two factors seem risky to me, and I do not consider that the valuation offers a sufficient margin of safety to assume the risk/reward ratio. The company was recently at $140, where according to my valuation, one could have expected an annual return of 14% with dividends included something slightly more attractive.

So, while I understand those who are comfortable entering a fairly high-quality company, with a lower risk of technological disruption than other semiconductor sectors and with excellent management, in my case, a ‘hold‘ rating seems more optimal unless the valuation offers a greater margin of safety.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.