Summary:

- Texas Instruments Incorporated is under-appreciated as a dividend stock.

- Along with buybacks, Texas Instrument has rewarded investors with a 3,000% dividend growth since 2006.

- The company operates in a highly cyclical environment and buying at the right price can enhance your overall returns.

- I predict the new quarterly dividend to be $1.32/share.

- CHIPS act should spur future growth, but the stock is a Hold given the current semiconductor cycle.

William_Potter

Texas Instruments Incorporated (NASDAQ:TXN), popularly known as “TI”, has just declared its quarterly dividend of $1.24 as Seeking Alpha has reported here. Why is this worthy of an article you may ask. Because this marks the 4th consecutive quarter that TI has paid the same dividend, which means to me that the company is likely to announce its annual dividend increase when it declares its next dividend in October.

But does that make the stock a buy here? Let’s find out while also predicting the new quarterly dividend. Before that, let’s take a quick look at the company’s history and its dividend history.

A Centenarian, Almost

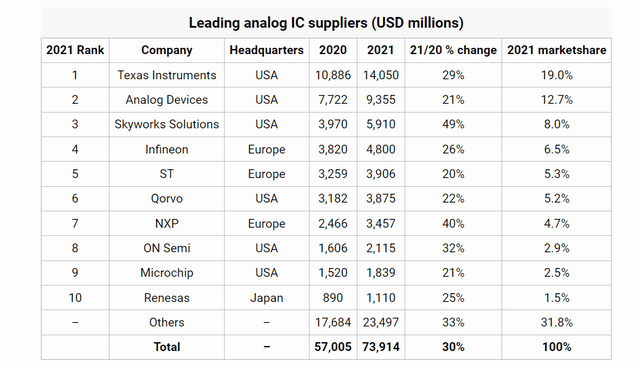

Texas Instruments was founded in 1930 and is headquartered in Dallas, Texas. A little bit of unsolicited information, but I went to graduate school in Dallas and remember driving past the TI headquarters a million times. TI was identified as “the calculator company” for a very long time before it made a niche for itself as a semiconductor company. TI is an analog company, which means its products are used for the not-so-fancy but real-world scenarios like regulating temperature, speed etc. vs. the more advanced digital semiconductor companies and products that deal with your smartphones and computers. Hence, it is no surprise that TI and likes don’t get as much fare as the digital companies.

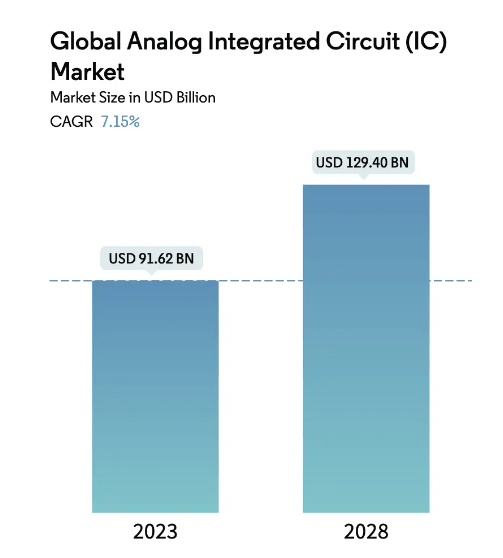

But as routine as it may seem, the analog market is estimated to be about $90 billion at present and expected to reach nearly $130 billion in 2028. TI is the undoubted leader in this space, and it won’t be a surprise if the company captures a sizeable part of the growth in the market between now and 2028 in my view. In addition, the CHIPS Act combined with the fact that a typical EV uses 10 times more chips than a typical car make things appear rosy over the long-term not just for TI but the entire sector.

Analog IC Market (mordorintelligence.com)

TI’s Dividend History

With that impressive company history out of the way, let’s now look at TI’s dividend history.

- According to Seeking Alpha and at least one other source, TI has been paying dividends since at least 1989.

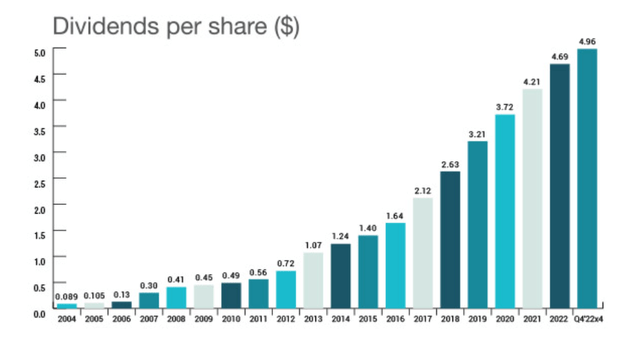

- As the company proudly states on its website, TI has been increasing dividends every year since paying an annual dividend of 9 cents in 2004, making it 19 consecutive years of dividend increases (according to TI’s data).

- Seeking Alpha’s data differs a little for the early years (2004 and 2005) but starts to match up with TI’s own since 2006. Rather than splitting our hairs over who has the accurate data, the larger point to focus on TI’s march towards dividend aristocrat status (25 consecutive years of dividend increases).

- In one of the most impressive dividend growth I’ve ever seen, TI’s quarterly dividend has grown from 4 cents in the 4th quarter of 2006 to $1.24 in the 4th quarter of 2022 when the company announced its dividend increase. That’s a 3,000% increase. Simply stunning.

- If history is any indication, September 2023 should mark the 20th consecutive year (or 18th if you go by Seeking Alpha’s data) where the dividend announced for the 4th quarter of the calendar year has gone up YoY.

TI Dividend Growth (investor.ti.com/)

Dividend Coverage

Now, all the above is in the rearview mirror. To estimate TI’s 2023 dividend increase, let us look at how much the company can afford.

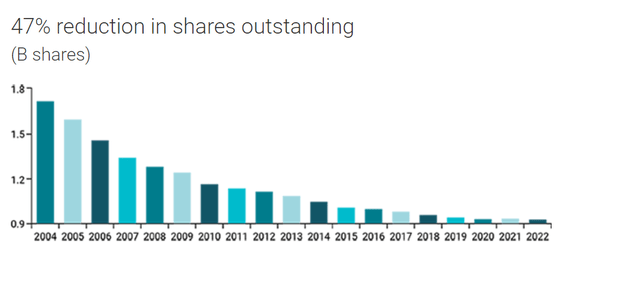

- Total shares outstanding: 907.97 million, which has gone down by 6% over the last 5 years.

- Current quarterly dividend per share: $1.24.

- Quarterly Free Cash Flow (“FCF”) required to cover dividends: $1.12 billion, which is 907.97 million shares times $1.24 dividend per share.

- Average FCF over the last five years: $1.36 billion

- Payout using five-year average quarterly FCF: 82% ($1.12 billion divided by $1.36 billion). That immediately concerns be a little, as I prefer payout ratios to be lower than 75%.

- Average quarterly FCF over TTM: ~$800 million, which is obviously below the required FCF level and is concerning, but being a cyclical company, this is also expected.

- Using forward EPS of $7.44, TI has a payout ratio of 66% based on current annual dividend of $4.96.

I am little surprised at the payout ratio based on FCF as I fully expected that to be less than 75% as well as the EPS-based payout ratio. For now though, I am feeling confident enough that the company knows what it is doing and what it can afford, as evidenced by their focus on FCF-based dividend payments below.

TI Dividend Policy (investors.ti.com)

Debt and Cash Situation

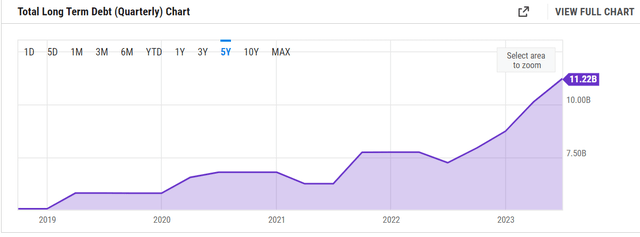

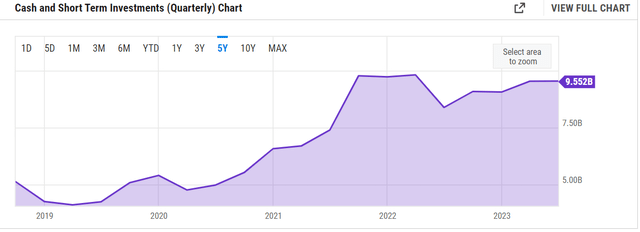

As strong as TI may be as a company, it is still prudent to ensure the company is not over-leveraged and has a robust balance sheet. And I am glad that I did because this sprung another surprise with TI’s debt more than doubling in the last five years.

However, the company’s cash and short-term equivalents too almost doubled in the same time period, with the cash on hand covering 85% of the long-term debt. In a nutshell, the company’s low debt-to-equity ratio of 0.69 alleviates immediate concerns about being over-leveraged, but I suggest investors to keep an eye on the debt trajectory in the current environment.

TXN Debt (YCharts.com) TXN Cash (YCharts.com)

New Dividend Forecast

So, what can investors expect from TI when it likely announces a dividend increase in September? I tend to go by recent history but only if that is supported by a company’s fundamentals at present. TI’s fundamental situation seems strong enough for now but with slight concerns over debt and FCF, I am predicting another 7% to 8% increase. That should place the new quarterly dividend at $1.32/share, giving the stock a near 3% yield based on current price of $178.

| Year | New Quarterly Dividend | Dividend Growth % |

| 2017 | 0.62 | |

| 2018 | 0.77 | 24.19% |

| 2019 | 0.90 | 16.88% |

| 2020 | 1.02 | 13.33% |

| 2021 | 1.15 | 12.75% |

| 2022 | 1.24 | 7.83% |

| Five-year Average | 15.00% |

But Does That Make The Stock A Buy?

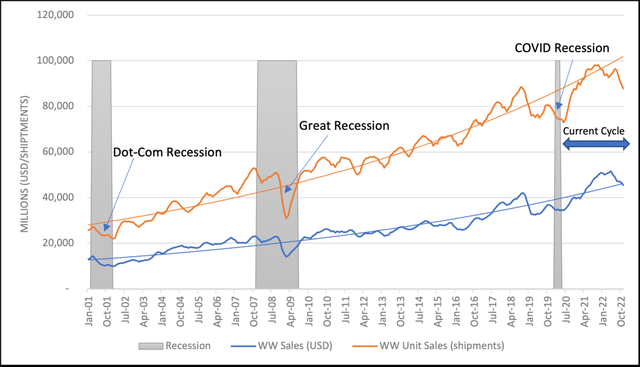

While I am fairly confident about the company’s ability to pay increasing dividends, there are a few risks associated with investing in this company. The most obvious risk is the cyclical nature of the semiconductor industry in general. As shown in the chart below (note the three recession troughs), the troughs tend to be really sharp.

Semiconductor Cycle (semiconductors.org)

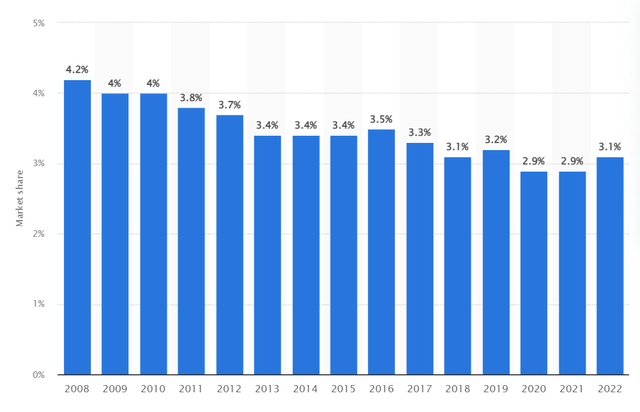

In addition to the overall demand pressure, TI is also not immune to competitive threats as the company’s worldwide market share has now flattened out to just about 3%. Competitive pressure and the supply chain worries have forced TI to invest heavily towards its future as seen by the $11 billion plant in Utah and a potential $30 billion investment in Sherman, Texas.

TXN Market Share (statista.com)

In short, I agree with the conclusions of this article on Seeking Alpha that while the long-term prospects of TI remain lucrative enough to invest at the right price, the turnaround is expected to be slow.

In the meantime, I think investors can be fairly assured that their dividends are not only safe but also likely to increase by high single-digit percentages over the next few years. In addition, TI also has a rich history of rewarding shareholders through buyback as shown below. As an intangible, the way TI has presented all relevant information to shareholders on their website is one of the best I’ve seen as an avid follower and investor in dividend stocks. That tells me the company places shareholders at the core of their interests.

However, as sincere as the company seems towards shareholders, at a forward multiple of 24x, the stock may be a little too rich to invest here, and I suggest waiting for a pullback towards a multiple of 20x, say around $150. However, if you have a position in the stock already, the stock is a “Hold” as you are likely to get increasing dividends along with buybacks that accelerate your overall returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.