Summary:

- Texas Instruments is a hold for now due to macroeconomic headwinds and pain in its revenue segments, but it has strong financial health for long-term holding.

- The automotive industry has been a saving grace for semiconductor companies, with potential growth in self-driving cars and the Chinese market.

- Texas Instruments has a solid balance sheet, impressive efficiency and profitability, and a decent competitive advantage, making it a good long-term investment once market volatility subsides.

wellesenterprises

Investment Thesis

With further pain in many of the company’s revenue segments still ahead, coupled with macroeconomic headwinds, Texas Instruments (NASDAQ:TXN) is a hold for now. However, the company’s impressive financial health means that once the volatility subsides and the demand for its revenue segments comes back, the company will be on a great long-term hold. According to my model, TXN stock is fairly priced.

Outlook

The company went nowhere for the last year, which could mean that it’s due for a run-up like many other companies. I believe that the reason that it has gone nowhere is because of the negative sentiment towards the semis industry, coupled with high inflation, and upcoming macroeconomic headwinds. The company in latest quarter reported a massive 480bps or 4.8% contraction in gross margins. The two main revenue segments performed slightly better than in the previous quarter. Industrials were flat, compared to -10% in Q4, while automotive has continued to grow at mid-single digits as it did last quarter. Personal electronics continued their slide and were down 30% in the latest quarter, while in the previous quarter, this segment was down around 15%, so it looks like it’s accelerating.

Automotive

In the past, I’ve covered other semiconductor companies and I can see a similar story with all of them. The automotive industry has been the saving grace for most of them, with personal electronics dragging revenues down.

There has been a huge demand for self-driving cars in recent years and is expected to grow at around 12.7% CAGR for the next 7 years. This is getting closer and closer to becoming a new norm as artificial intelligence is gaining so much traction that in the next couple of years, I wouldn’t be surprised to see many cars on the roads driving themselves. Well maybe not in a few years but definitely within the decade. And by the way, the company hasn’t even hopped on that AI hype train yet.

Re-opening of China is going to be very beneficial going forward for TXN as China represents around a quarter of its total revenue according to the 10-K. Since lifting the zero-covid policy, the Chinese economy is expected to grow at 5.4% in ’23, compared to 3% in ’22. The government has set a 5% target, which I think is a little modest.

On the other hand, April data came in below expectations, which could signal that the pent-up demand has not been as powerful as many have thought. So, there are a lot of mixed feelings. The vehicle industry is very strong in China. Although it is projected to grow at only around 4% until ’30, China accounts for around 32% of total vehicle production worldwide. There is certainly plenty of market share to be captured by TXN here.

The Rest of the Segments- Not Much Growth

The only positive I can see in terms of catalysts is the automotive industry. As I mentioned earlier, personal electronics seems to be going down further while industrials are starting to see a turnaround, however, as many management teams of other semiconductor companies mentioned in their quarterly/yearly reports, they see demand picking up in the back half of the year while they keep reducing their inflated inventory levels to align better with sales.

I believe that automotive alone will continue to be positive for the next couple of quarters, after that, the bottom in personal electronics will set in and will start to come back up also, while industrials seem to be at the bottom now and can only go up from now, unless it was just a fluke, in that case, we will have to wait for a trend over the next few quarters to appear.

Financials

While I was building my model for the company, I noticed that the company has a very solid balance sheet, just like many other semiconductor companies out there.

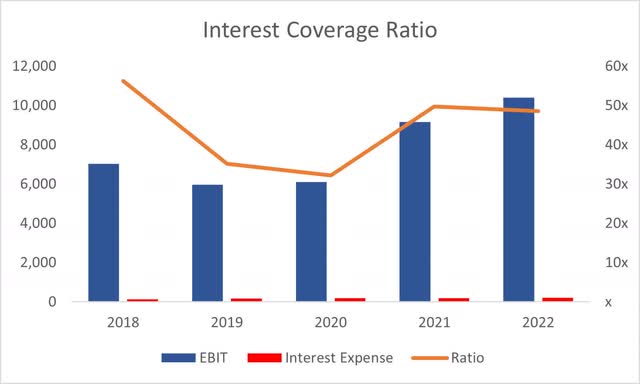

The company had around $4.4B in cash and $5B in short-term investments, essentially having around $9B in liquidity against $9B in long-term debt. This is a really good position to be in, especially since the interest rate on the debt is quite decent, the management is saying its around 3.2% on average, which is lower than what the company is making on their short-term investment because, in the latest quarter, income from short-term investments was higher than the interest expense on debt. Just by this alone, I can tell that the leverage the company has will be no issue in the long term. If we look at the company’s interest coverage ratio, we can see that EBIT can easily cover the annual interest expense and I don’t see this changing anytime soon.

Interest Coverage Ratio (Own Calculations)

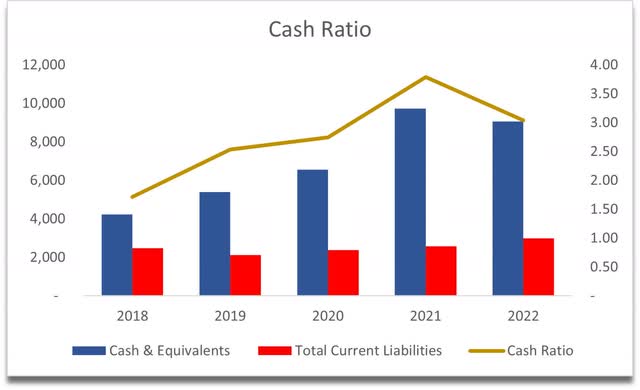

If we look at the company’s liquidity further by looking at the cash ratio, which is a more stringent metric than the current ratio because it takes into account only cash and equivalents to see if the company can pay off its short-term obligations, the company can easily cover current liabilities.

This has been a common theme with other major semiconductor companies also, which is quite rare in many other companies besides the semiconductor ones. It is safe to say the company has no liquidity issues and will no doubt weather the macro headwinds with ease. Even during the pandemic, the company showed some impressive metrics.

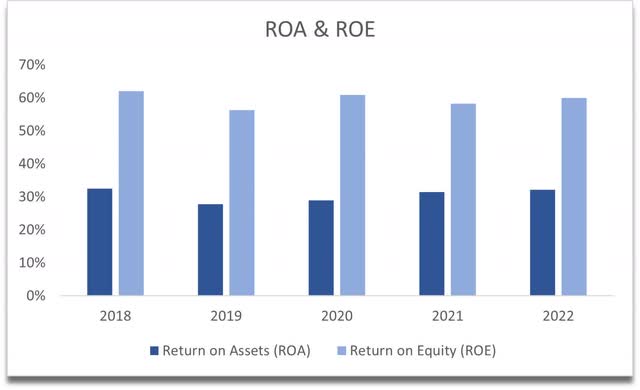

In terms of efficiency and profitability, Texas Instruments is being operated very efficiently and is creating value for shareholders. ROA and ROE have been outstanding and very stable over the last 5 years. The management is utilizing assets and shareholder capital very efficiently.

ROA and ROE (Own Calculations)

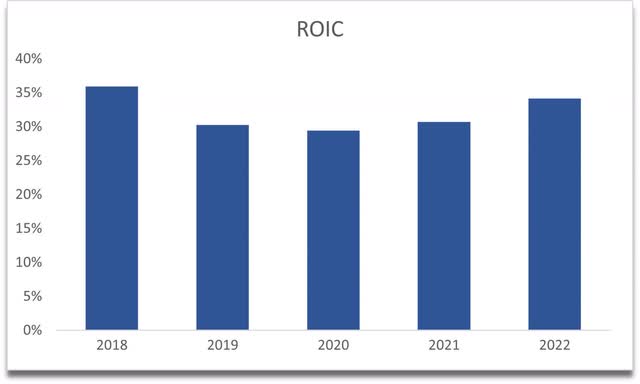

Return on invested capital is also very impressive, which suggests that the company has a decent competitive advantage and a strong moat. These are the types of companies I like to invest in for the long haul.

I wouldn’t be surprised if we see a slight dip in ’23 due to many negative factors, however, even during the pandemic ROIC was well above my minimum of 10%.

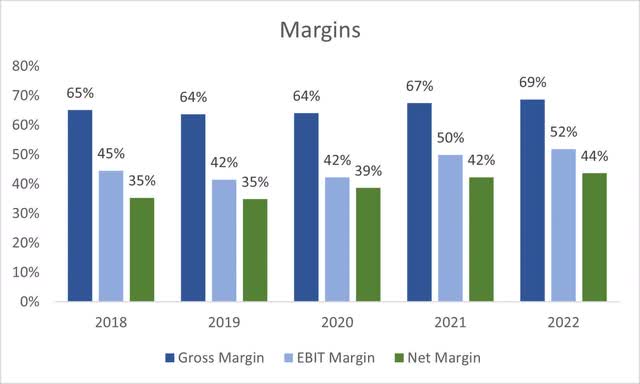

In terms of margins, these were very healthy too, up until the end of ’22. We now know that gross margins have seen a decent hit in the latest quarter, so I wouldn’t be surprised if margins come in slightly lower than at the end of FY22.

Overall, there is a lot to be liked about how the company’s being operated by the management. Efficiency and profitability are fantastic. I would be willing to pay a premium for a company that’s being run so efficiently. So, the question is, what am I willing to pay for it? Let’s have a look.

Valuation

Gartner is projecting around an 11% decline in semiconductors in ’23, followed by around an 18.5% increase in ’24. Analysts project around a 10.4% decline in revenues for TXN in ’23, followed by 8% in ’24. I will trust these numbers, however, after ’24 these become less reliable as the analyst number drops significantly.

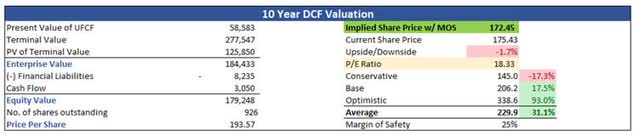

I decided to grow the company’s revenues by around 6.5% over the next decade for the base case. I feel like this is reasonable growth, seeing that the company grew at around 6% over the last decade. For the optimistic case, I decided to go with 10.3% CAGR, while for the conservative case, I went with 4.5%.

In terms of margins, for the base case, I modeled a 400bps contraction in gross margins in ’23, followed by a linear improvement to where the gross margins are about 100bps better than at the end of FY22. On the operating margins, I improved margins by 100bps over the next decade.

For the conservative case, I left margins as they were in FY22, while for the optimistic case, I improved them slightly compared to the base case scenario, with 75bps on gross margins and 50bps on operating margin in each period.

On top of what I believe are quite conservative estimates, I added a 25% margin of safety to the final intrinsic valuation. So, what I am willing to pay for TXN stock is around $172.45 a share, which implies the company is pretty much valued fairly.

Intrinsic Value (Own Calculations)

Closing Comments

I only give the company a hold rating for now because of the macroeconomic headwinds that are supposedly coming very soon. I will also wait for at least the next quarterly report to see what the management is seeing in terms of the demand for industrial and personal electronics. I believe that the automotive segment will continue on the same path as it has in the past, so I am looking for better numbers to come in on the first two segments.

Overall, the company is very strong financially and it wouldn’t be a bad time to start a long-term position in my opinion. I feel that there will be more volatility in the markets, especially with the quantitative tightening that’s about to kick in after the Senate approves the debt ceiling. We’ve enjoyed quite a rally in the first half of the year, and I feel like a slight correction is due, so I will be patient for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.