Summary:

- Texas Instruments excels in semiconductors, focusing on design and manufacturing, but lacks a moat like TSMC or Nvidia. Its niche in analog makes it a compelling investment despite strong competition.

- TI has the highest net income margin among peers over 5 years, driven by analog profitability. Though recently lagging in revenue and EPS growth, its future growth prospects are strong.

- TXN stock appears overvalued with a -48% margin of safety in my analysis. However, considering historical valuation multiples, it may be less overvalued over the long term.

- TI must avoid being outcompeted by TSMC and Nvidia. Specializing in analog offers potential, but high manufacturing capex reduces agility and limits the ability to capitalize on market trends.

benedek

I last covered Texas Instruments (NASDAQ:TXN), also known as TI, in November 2023; at the time, I put out a Buy rating, and since then, the stock has gained ~38% in price. I believe my analysis in the first instance was lacking in certain critical insights; it was a comparative piece comparing TI on geopolitical risk to TSMC (TSM), arguing that Texas Instruments offered more protection from this with similar upside potential. However, on feedback and my ongoing research over the last seven months, I think that an invasion of Taiwan by China is unlikely, particularly because it would destabilize the entire global economy, including having long-term detrimental effects on China itself. In this analysis, I look at Texas Instruments as a standalone investment, and I consider that the stock might be moderately overvalued at this time despite the strong growth the company is likely to deliver from 2025 onwards. Despite my favorable opinion of the long-term prospects of TXN, I downgrade my rating to a Hold based on the unappealing valuation in the short term.

Future Operations Outlook

For readers who are not acquainted with TI, it is a semiconductor company that is well-known for its efficient manufacturing strategy, which includes the use of 300mm wafers that reduce production costs per chip. The company’s investment in its own production facilities allows it to maintain control over its manufacturing and scale production without much dependence on external foundries. In my opinion, the greatest future growth drivers for TI are in the automotive and industrial markets and the Internet of Things (‘IoT’). TI’s operational resilience, which is supported by its manufacturing and supply chain, is a significant advantage, especially in an industry prone to supply chain disruptions.

In my investment analyses, I like to get an understanding of the competitive landscape. This is not to say that I do not believe many companies can succeed alongside each other, but it is important to recognize that some may be more successful than others and also to notice if there are certain companies that could take market share from TI. These are the four companies that I believe are the biggest competitive threat to Texas Instruments over the next 5-10 years:

| Analog Devices (ADI) | ADI is perhaps the most direct competitor to TI, with a strong presence in analog, mixed-signal, and power management sectors—all core areas for TI. |

| Qualcomm (QCOM) | Qualcomm dominates in wireless technologies and has been strategically positioning itself in IoT and automotive, positioning it as a critical threat to TI, particularly in telematics and infotainment systems. |

| STMicroelectronics (STM) | STM competes with TI in several areas, including sensors, microcontrollers, and power semiconductors. Backed by developments in SiC and GaN technologies, STM is pursuing advancements in automotive and industrial markets. |

| Broadcom (AVGO) | Broadcom has a broad portfolio of communication devices acting as long-term competition for TI in networking, broadband, and wireless communications. |

Texas Instruments has a lot going for it alongside these competitors, including its focus on analog ICs and embedded processors and a strong presence in high-growth markets like automotive and industrial. Its efficient manufacturing processes and supply chain strengths shouldn’t be underestimated, but Texas Instruments isn’t positioned for a “one of a kind” moat, such as being consolidated by Nvidia (NVDA) and TSMC. Instead, Texas Instruments is one of the prominent semiconductor firms among many, which is likely to be a beneficiary and core driver, but not own a monopoly, in AI and its associated infrastructure.

Texas Instruments has a strategy of diversification, positioning itself across core markets like automotive, industrial applications, Internet of Things (‘IoT’), power management and renewable energy, and healthcare. However, some of the weaker areas for TI include that it is dependent on specific markets, and while it is diversified relatively well, it is not as extensively risk-mitigated in this regard as some other semiconductor firms. TI may not gain as much exposure to new and advanced fields like AI and robotics as it is focused so significantly on analog solutions, and also because it is already well invested in certain key markets like automotive and industrial, its exposure to AI and robotics could become more limited to these core markets, rather than the extensive exposure that Nvidia may be able to capitalize on from its vast ecosystem facilitating AI development and deployment.

Financial Analysis

To begin this financial analysis, it is worth first comparing Texas Instruments to the four competitors I outlined above:

| _____________________________ | TXN | ADI | QCOM | STM | AVGO |

| FWD Revenue Growth 5Y Avg | 3.25% | 11.03% | 12.32% | 9.83% | 10.82% |

| FWD Diluted EPS Growth 5Y Avg | 5.63% | 8.98% | 20.54% | 19.85% | 13.82% |

| FWD Free Cash Flow Growth 5Y Avg | -1.74% | 16.2% | 25.04% | 31.06% | 15.32% |

| TTM Net Income Margin 5Y Avg | 39.32% | 22.79% | 22.99% | 15.77% | 23.99% |

| Equity-to-Asset Ratio | 0.49 | 0.72 | 0.46 | 0.68 | 0.4 |

| FWD P/E GAAP Ratio | ~38.5 | ~77.75 | ~25 | ~20.5 | ~75 |

| FWD P/S Ratio | ~11.5 | ~12.5 | ~6 | ~2.75 | ~13.25 |

All figures are historical and present data, not future forward estimates. For the data in the table, I have bolded the items I consider relatively strong and italicized the items I consider relatively weak.

Texas Instruments has delivered notably low revenue, EPS and free cash flow growth over the last five years. This can be attributed to a multitude of reasons, many of which are macroeconomic and affecting the whole peer group, revealing some inherent weakness in the business model of TXN in particular recently. This could be a result of its shift to analog and embedded processing products, which have longer product life cycles, but lower growth rates compared to other semiconductor segments.

TI very promisingly commands the highest net income margin of the set of peers, 39.32% compared to Broadcom in second place at 23.99%. TI generally enjoys higher margins because it is highly invested in analog chips, which tend to be more profitable than digital chips. There is also typically less price competition in analog. Additionally, TI does a lot of its manufacturing in-house, so it can control production costs and supply chains, decreasing the risk of disruptions.

In my opinion, of the set of peers I have outlined, STM is the most appealing. It offers very compelling growth rates along with a reasonable valuation at the time of this writing, arguably fairly valued, while many of the other companies are slightly or more significantly overvalued. While future growth is expected to be promising for TI, with analysts expecting on consensus EPS growth of around 26% in 2025 and around 18% in 2026, the valuation still seems slightly too high at the moment for me to consider the stock worth a Buy rating at present levels.

Valuation Analysis

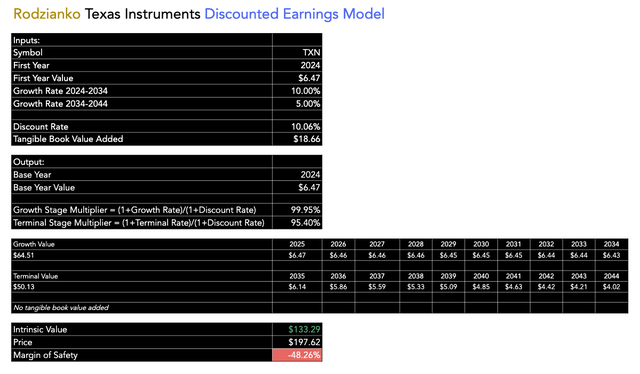

As Texas Instruments manages a lot of its own manufacturing, it has high capex and, as a result, significantly less free cash flow than other companies that operate with a fabless model, such as Broadcom. Therefore, I have decided to assess Texas Instruments for its intrinsic value based on discounted earnings rather than discounted cash flows. This should give an understanding of the true worth of the company based on future earnings potential without it being distorted by the capital intensity of the business.

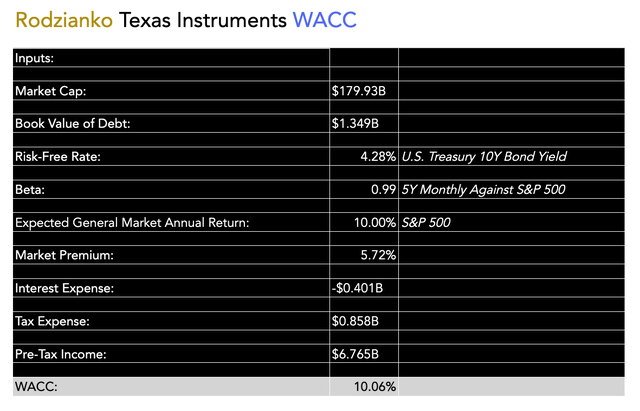

For the discount rate, I used Texas Instruments’ WACC, of which I provided my inputs below. I forecasted 10% annual EPS growth over the next decade and 5% annual EPS growth for the 10 years after that. It should be noted that this is optimistic and perhaps too high, but it is considered a reasonable outcome based on a favorable long-term future for the firm as advanced automotive and industrial applications continue to scale around the globe. I also add the tangible book value per share because TI is very involved in manufacturing and, therefore, has significant intrinsic value in its manufacturing plants. My result is a margin of safety of approximately negative 48%.

Author’s Calculation Author’s Model

While this makes Texas Instruments look significantly overvalued, in reality, it is likely slightly less overvalued than this due to the market sentiment, which remains constant for TXN shares. For example, its median P/E GAAP ratio over 10 years is ~22, and at this time, the stock is trading at a ratio of ~31 (TTM, not FWD). In principle, that indicates a premium of ~30% from historically accepted valuation multiples over the long term by the market.

Risk Analysis

While Texas Instruments has carved out an extremely strong niche for itself, particularly in analog, there is still some concern that it will be further competed out of the moat that has been developed by firms like TSMC and, recently, Nvidia. TSMC has the broadest client base, including most major big tech companies, and the most advanced manufacturing capabilities in quite some way. Nvidia has developed leading AI systems, GPUs, and other systems to facilitate high-demand future technology tasks. TI’s position is slightly more nuanced, and its future success will be highly dependent on its continued innovation in analog; however, it has to make sure that it can open up revenue streams in emerging technologies to stay relevant and competitive for its long-term clients.

In addition, while Texas Instruments’ in-house manufacturing capacity is admirable and protects it from supply chain disruptions, it is also highly capital intensive, which affects free cash flow and can reduce operating income over time, providing less capacity to expand and acquire businesses as capital is taken up in maintenance of pre-existing plants and systems. In essence, this makes TI less agile than competitors like Broadcom and Nvidia, which act without fabs and hence can redirect strategically with current trends, capitalizing more rapidly and arguably more sustainably over the long term.

Key Elements

Texas Instruments is well-positioned in semiconductors, with a focus on both design and manufacturing. Its core competitors include ADI, QCOM, STM, and AVGO. It does not command a moat-like TSMC or, more recently, Nvidia. However, its niche exposure and capabilities in analog make it a compelling investment.

Texas Instruments has the highest net income margin amongst its peers over the past 5 years, although Nvidia takes the top spot based on present data. TI’s success in this is due to high profitability in analog chips, where there is also less price competition. While its revenue, EPS, and growth have been lagging behind peers recently, its growth over the next two years is set to be much stronger.

TXN stock is significantly overvalued in my discounted earnings analysis, with a negative 48% margin of safety. However, considering its historical valuation multiples accepted by the market over the long term, the stock is likely less severely overvalued.

Texas Instruments must be careful that it doesn’t get more aggressively outcompeted by major firms like TSMC and Nvidia. It is crucial that Texas Instruments operates in specialized segments, particularly around analog, where there is less focus and more room for success. However, its high capex from manufacturing makes it less agile and potentially less capable of capitalizing on moving market trends.

Conclusion

In my opinion, Texas Instruments is likely to perform very well over the long term. However, I think the stock is presently overvalued, both against intrinsic value and historical market sentiment factors. I think investors would be wise to hold off from allocating to TI at this time and instead look for fairer-valued semiconductor companies that still offer high future growth potential, for example, STM and Infineon (OTCQX:IFNNY).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.