Summary:

- Texas Instruments Incorporated’s Q3 results clearly show the company isn’t out of the woods anytime soon and will continue to face weak demand for at least another couple of quarters.

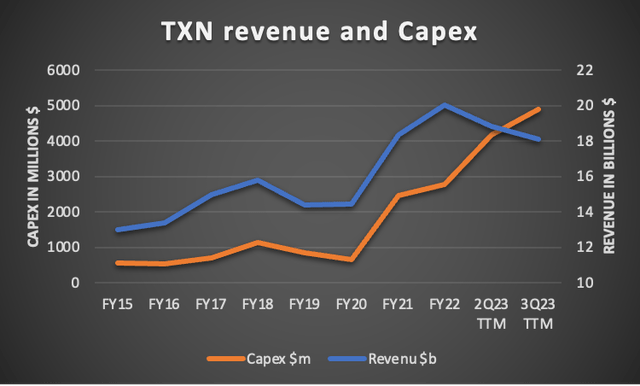

- Capex almost doubled YoY and on a TTM basis was up 57% YoY, continuing the uptrend in Capex growth, even as revenue falls.

- Fundamentally, the business remains in excellent shape, and management is committed to its long-term growth targets.

- Despite short-term weakness, Texas Instruments is expected to return to single-digit growth by the end of the first half of FY24, making it a good long-term investment.

- I am comfortable once again increasing my position in Texas Instruments stock from these incredibly favorable levels and considering the limited downside.

William_Potter

Investment thesis

I moved my rating on Texas Instruments Incorporated (NASDAQ:TXN) from Hold to Buy following the company’s Q3 results, which came in below my expectations as the company is impacted by a prolonged downturn in the semiconductor industry, leading to lesser demand for its products. However, while I lower my near-term outlook, I remain bullish on the company’s long-term prospects and believe the current share price offers an attractive entry point for long-term investors, with most of the downside now priced into the shares.

I last covered TXN back in July following its Q2 results. I downgraded my rating from Buy to Hold as I saw the recovery in the analog chip market take longer than previously anticipated, leading to more downside potential.

However, while I saw more room for downside in the near term, I sure did not expect the stock to fall close to 20% in the three following months. This also allowed the valuation of TXN shares to come down significantly, falling from a P/E of 24x in July to below 20x today.

Important to understand when discussing TXN is that while the company operates in the highly cyclical and volatile semiconductor industry, it is known for its stability and reliability, highlighted by a beta of 1.14, far lower than that of the semiconductor index (SOXX) of 1.52.

This reliability, in combination with management’s excellent capital allocation abilities and the company’s incredible growth and innovation track record, has allowed shares to trade at a premium to many of its peers, highlighted by a 5-year average P/E of close to 23x, meaning shares are now trading at a discount of over 12% to this average.

Meanwhile, TXN has a mighty growth track record, growing its free cash flow per share at an 11% CAGR from 2004 through 2022. Furthermore, while revenue over the last decade grew at a CAGR of just 5%, significant margin improvements through scale and cost-saving initiatives and the fact that the company bought back a substantial portion of its outstanding shares meant it grew EPS at a CAGR of 20% over the same period of time.

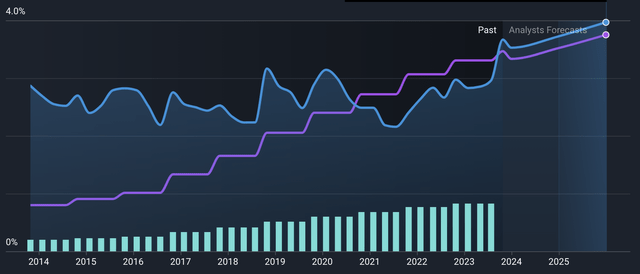

Furthermore, it is hard to find a better allocator than TXN when it comes to shareholder returns. The company has been growing the dividend for 20 consecutive years now and has done so at a dividend growth CAGR of 25%. As a result, shares today yield a very impressive 3.67% following a recent 5% dividend increase despite the significant near-term headwinds it is facing. Also, this marks the highest yield investors can receive from TXN shares in over a decade.

TXN dividend yield development (Simply Wall St)

Moreover, the dividend remains exceptionally well covered by a 64% payout ratio, although that is based on depressed earnings. Once the operating environment improves and TXN returns to growth, and earnings recover, this payout ratio will likely fall comfortably below the 50% mark again, leaving TXN with a sustainable dividend with plenty of growth ahead.

And while we should not expect a 25% growth CAGR over the next 20 years, I believe it is likely to grow in line with earnings in the high single digits. This makes TXN one of the best companies out there for dividend growth investors.

And that is not even all in terms of shareholder returns. In addition to paying a strong and growing dividend, the company also consistently buys back its own shares, which has resulted in its retiring 47% of its shares since 2004 and 20% over the last decade, boosting its EPS growth.

I assume it’s clear by now that I am a huge fan of this company, which is why, despite the short-term weakness and temporary hold rating, I remained bullish on the company’s long-term prospects:

Management’s focus on long-term growth and capital expenditure plans to increase capacity and market share is commendable. While short-term weakness may persist, TI’s strong position in the analog chip market, its North American focus, and its commitment to technological progress bode well for its future prospects. The company’s robust margin profile, even amid declining margins, remains the best among its peers.

The outlook for the semiconductor industry, especially the analog market, is promising, with projected growth rates supporting TI’s potential for future growth. Also, TI’s geographical focus on North America makes it a primary beneficiary of the US Chips Act, further enhancing its potential for market share gains. As a result, I estimate the company to grow its top line by high-single-digits to low-double-digits from FY24 onward and to grow EPS at an even faster pace due to margin improvements.

An important factor in my bullish thesis on TXN is the company’s focus on the U.S. for its manufacturing capacity. The majority of the company’s manufacturing sites are located in the U.S., and of those located in Asia, only two are located in China.

Texas Instruments manufacturing facilities (Texas Instruments)

Why is that important? Well, it is no secret that Western technology companies are increasingly trying to limit their dependence on Asia or China in particular. Just look at the efforts Apple is making to move production out of China and to countries like India and Vietnam. Meanwhile, competitors like NXP Semiconductors N.V. (NXPI) or Analog Devices (ADI) have a larger percentage of their manufacturing located in Asia and China. From this standpoint, TXN is favorably positioned.

Furthermore, with a significant portion of its activities located in the U.S., TXN is also a primary beneficiary of the U.S. Chips Act, allowing it to decrease capex or grow capacity more rapidly. By building more fabs in the U.S., including a $30 billion fab in Sherman, Texas, the company should meaningfully benefit from the 25% tax credit for qualifying assets in the U.S. Through these tax incentives, TXN is able to invest more into building out capacity and already plans to meaningfully increase capacity in 45- to 130-nm technology nodes in the next couple of years to win market share. This further fuels my bull case for TXN.

Now, I wanted to start with these incredible statistics and the company’s favorable positioning to highlight that while the company is facing significant pressure in the near term from a cyclical downturn in the industry, fundamentally the business remains in excellent shape. TXN should be able to drive incredible returns for many more decades as demand for its products grows further.

However, its Q3 results cloud this excellent long-term outlook, confirming what I had already warned about after the Q2 results, which is a prolonged period of weakness in the analog chip market, impacting TXN’s short-term performance and requiring a downgrade of short-term expectations. On that note, let’s dive into the Q3 results.

TXN’s Q3 results show continued weakness and no clear bottom

Texas Instruments reported its Q3 earnings earlier this week and delivered results roughly in line with the consensus. Revenue of $4.53 billion was down 13.5% YoY, slightly worse than the 13% decline it reported in Q2, which was ultimately the result of a weak demand environment, similar to what we have seen over the last twelve months.

Looking at the end markets, on a YoY basis, all markets remained down significantly, apart from automotive, which was up 20% YoY, as this industry remains resilient due to secular tailwinds like electrification and digitalization. Yet, this industry is expected to weaken going into Q4.

The largest end-market in terms of revenue (40% in FY22) – Industrial – saw broadening weakness, with this one down mid-teens YoY and mid-single digits sequentially. As this one weighed heavily on the overall performance, this was bad news for TXN overall and painted a grim picture for Q4.

At the same time, the communications equipment and enterprise systems end market continued to present the most significant weakness with these down 50% and 40%, respectively, while also down sequentially.

On a positive note, the personal electronics segment saw a robust sequential increase of 20%, although from a very low base, as the industry is seeing the first signs of improving demand and healthier inventory levels. Nevertheless, this was still down around 30% YoY.

Moving to the bottom line, management remains very much committed to its Capex plans despite the significant slowdown in sales. Capex almost doubled YoY and on a TTM basis was up 57% YoY, continuing the uptrend in Capex growth, even as revenue falls.

This is mainly the result of management’s commitment to building capacity, which I very much appreciate as a shareholder. Management acknowledges the importance of these investments and is very much willing to sacrifice near-term cash flows for them, all to support long-term growth and market share gains. This is why management, despite the depressed cash flows, once again confirmed its Capex goals through 2026, including $5 billion annually to be spent on Capex, which sits above the TTM Capex costs of $4.9 billion.

When asked the question whether a Capex cut was on the table, management was very clear in its response:

We’re very pleased with the progress on our manufacturing expansion. They will provide geopolitically dependable capacity to support customer growth for the coming decade. And as you know, semiconductor content continues to increase. And to provide us the ability to grow at that 10% growth rate that we talked about at the last capital management call, if the market requires that, we’ll continue to make those investments. So, we continue to expect $5 billion of CapEx per year in 2023, 2024, 2025, and 2026. So you should count on that.

Meanwhile, operating expenses also increased by 7% YoY as expected, resulting in an operating income of $1.9 billion, reflecting a margin of 42%, down 910 basis points YoY. The gross margin was also down YoY by 690 basis points to 62%, primarily due to lower revenue and higher manufacturing costs. As a result, EPS was also down 25% YoY to $1.85, even as this included a $0.03 benefit not included in previous guidance.

Finally, free cash flow (“FCF”) in Q3 was a meager $442 million, again the result of decreasing sales and growing investments. On a TTM basis, FCF is now down 72% YoY as the FCF margin dropped from 29.3% one year ago to just 9.1% over the last twelve months.

As a result, FCF didn’t fully cover shareholder returns, as these totaled $1.17 billion. However, positively, management barely bought back any shares in Q3. While this might sound strange, I prefer management to save the cash for Capex investments and to maintain its healthy balance sheet.

We should expect share repurchases to return strongly once sales growth returns and the operational environment improves, as this will result in a quick rebound in its cash flows. On the note of the balance sheet, this one remained solid with $8.9 billion in total cash and $11.3 billion in debt.

Crucially, while the quarterly results might not be looking any good with cash flow dropping significantly and top line growth remaining weak, it is important to acknowledge that this is purely the result of short-term economic weakness hitting semiconductor demand. Fundamentally, the business remains in excellent shape, as discussed before, and management is committed to its long-term growth targets.

Yet, the weakness clearly is more severe than I expected earlier, partially explaining the 20% share price drop over the last three months, and it is also expected to persist longer than anticipated. Let’s see what to expect in the next couple of quarters.

Outlook & TXN stock valuation

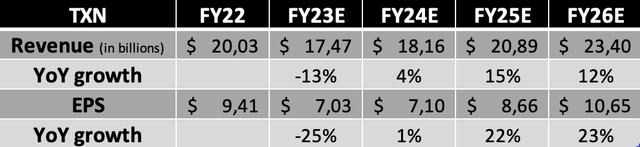

TXN management guides for Q4 revenue in the range of $3.93 billion to $4.27 billion and earnings per share to be in the range of $1.35 to $1.57. This reflects the expectation of a continuing weak operating environment and a revenue decline of 12% at the midpoint, showing little recovery in terms of growth rates. Meanwhile, as top-line growth remains weak, EPS is projected to be down 31.5% YoY.

However, while this guidance is incredibly weak and below the street expectations and my own prior estimates of $4.57 billion and $1.90, I do expect this to be the bottom for TXN and to return to single-digit growth by the end of the first half of FY24.

Furthermore, while the company might be facing near-term headwinds, forcing me to lower my near-term outlook, I remain of the belief that TXN is an excellent long-term investment. Based on an estimated growth CAGR of 7.61% (down from 8.22%) for the analog semiconductor industry, which TXN continues to lead in terms of market share, and my expectation of the company to further win market share over the next decade, I believe the company should be able to grow sales at a mid-to-high-single-digit CAGR until the end of the decade and to grow EPS at a faster rate of high-single digits to low-double digits.

Taking everything into consideration, I now expect the following financial estimates. These include the lower guidance for Q4, now reflecting the expectation for revenue of $4.12 billion and EPS of $1.46. Furthermore, I have meaningfully lowered my FY24 outlook as I expect weaknesses to persist through the first half of the year and to only drive single-digit growth in the second half of the year as the industry gradually recovers. Meanwhile, looking at FY26 and onward, my expectations remain largely unchanged as I remain bullish on the company’s long-term prospects.

Financial projections (Author)

As already discussed earlier in this article, the valuation has come down significantly over recent months with shares now trading at a share price of $144 at the time of writing, meaning shares are valued at approximately 20.5x my FY23 EPS estimate or 10% below their 5-year average.

The company usually trades at quite a premium to its peers and the industry, and rightfully so due to its massive size, little geopolitical risk, in-house manufacturing capabilities, and incredible margin profile. Of course, no investment is ever “risk-free,” but TXN seems to be as de-risked as they come.

Considering the long-term outlook, I expect shares to return to a valuation multiple closer to the 5-year average once it returns to growth and current weakness passes. Considering the growth outlook and management’s shareholder-friendly approach, I believe an earnings multiple of 22x is more than appropriate here.

Based on this multiple and my FY25 EPS estimate, I maintain my $191 per share price target. Based on this target and the current share price of $144, I expect annual returns exceeding 13% through 2025.

Is TXN stock a buy, sell, or hold?

I started this article by pointing out the company’s incredible track record, significant focus on returning cash to shareholders, great dividend growth outlook, and my overall bull case. With most downside now seemingly priced into the shares, I believe investors should start to look past the near-term weakness and toward the long-term opportunity ahead.

Now, Q3 results clearly show the company isn’t out of the woods anytime soon and will continue to face weak demand for at least another couple of quarters, but I do not see many more downside surprises ahead as visibility in the industry improves. According to the likes of Taiwan Semiconductor (TSM) and ASML Holding (ASML), we could expect a bottom in the industry by the end of this year, with a gradual recovery heading into FY24. As a result, I am comfortable once again increasing my position in TXN from these incredibly favorable levels and considering the limited downside.

Therefore, I move my rating to buy from hold on the belief that current prices offer the potential for excellent double-digit returns, exceeding 13%, while facing limited further downside as near-term headwinds seem to be priced in.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.