Summary:

- Texas Instruments will report its Q1 2023 earnings today after market close, which follows a subdued Q4 2022 quarter in its previous earnings call.

- Texas Instruments’ strong 49% of revenue exposure in China will propel the company’s power management sector for EVs in 2023.

- Texas Instruments has a leading market share position in the $98 billion analog semiconductor market but lost share to major competitor Analog Devices in 2022.

- Texas Instruments’ expansion plans with several new 300mm fabs, which offer a cost advantage over ADI’s 200mm fabs, and represent long-term growth.

Rawf8

Texas Instruments (NASDAQ:NASDAQ:TXN) (“TI”) is scheduled to announce Q1 earnings results Today, April 25th, after market close.

At the previous Q4 earnings call on Jan. 24, TXN reported Q4 GAAP EPS of $2.13, beating estimates by $0.15. Revenue of $4.67 Billion was down -3.3% YoY but topped consensus by $40 Million.

Consensus for this quarter is worse, EPS estimate is $1.81 (-15.0% QoQ) and the consensus revenue estimate is $4.37 Billion (-6.4%).

TI is a Market Leader in “Analog” ICs

TI is a market leader in “analog” ICs. Analog chips from TI and others are used to transition between the analog world and the digital world, converting continuous signals or waveforms to ones and zeros. TI’s products include data converters, amplifiers, radio frequency (“RF”) technologies, embedded processors or digital signal processing (“DSP”) ICs, power management, and interface products.

Sales of its analog products generated about 77% of its revenue in 2022. The other 23% of revenues are for Embedded Processing, and its chips vary from simple, low-cost microcontrollers used in applications such as electric toothbrushes to highly specialized, complex devices such as motor control. Embedded Processing products are used in many markets, particularly industrial and automotive.

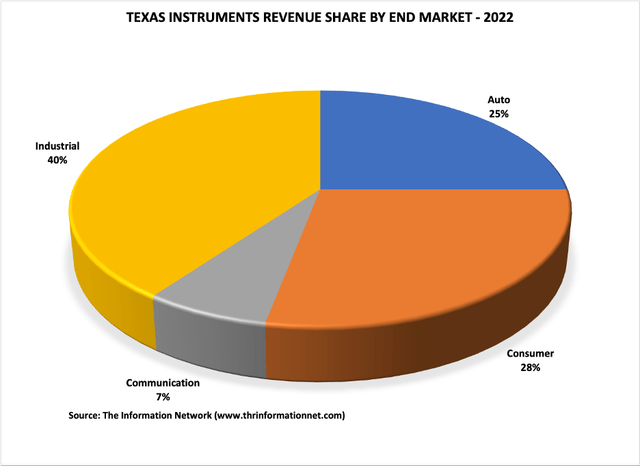

Chart 1 shows that in 2022, the largest end applications of its products are Industrial at 40% (down from 41% in 2021) and Automotive at 25% (up from 21% in 2021).

The Information Network

Chart 1

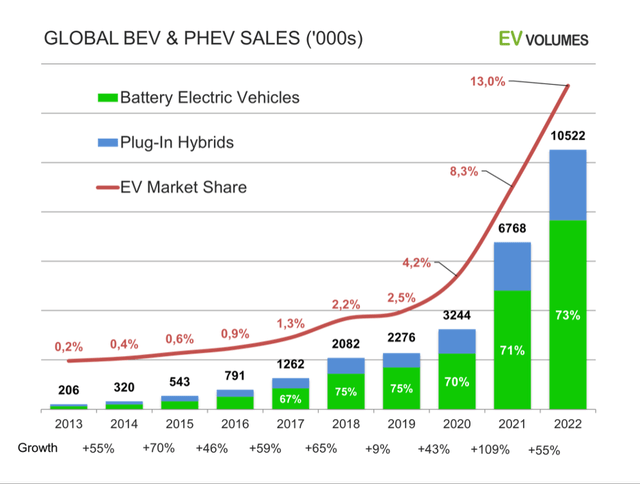

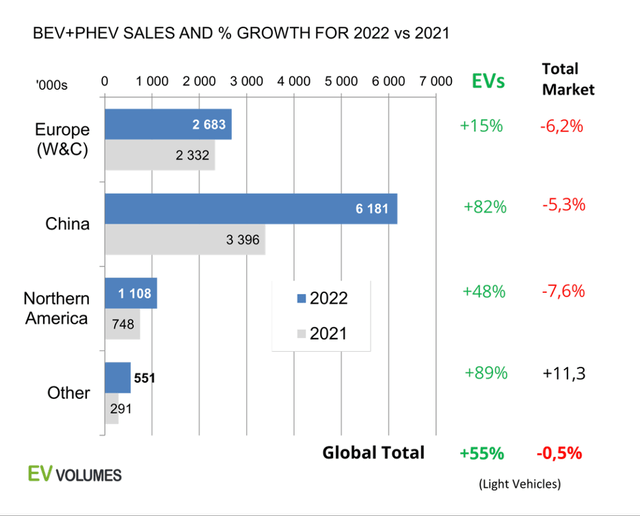

TI’s positive headwind comes from the strong growth in EVs as shown in Chart 2. A key product focus for TI is for battery management sensors. At the 2023 CES, TI announced a new suite of sensors named BQ79718-Q1 and BQ79731-Q1, which live within battery packs and the individual cells they contain. These sensors measure remaining charge inside the cells with far more accuracy than current sensors. By increasing accuracy here means the car can make far better use of its total capacity, charging closer to full when plugged in and running closer to empty when on the road. TI said these sensors could boost effective range without any other changes to a car or its batteries.

EV-Volumes

Chart 2

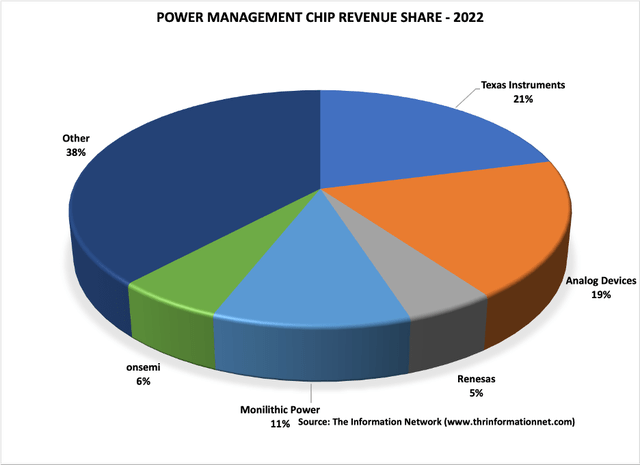

Chart 3 shows that TI enjoys a 21% share of the $23 billion market in 2022, which has grown at a CAGR (compound annual growth rate) of 12% in the past five years.

The Information Network

Chart 3

TI’s Dominance in Analog

The Analog IC sector represented 77% of TI’s revenues in 2022. But current macroeconomic factors combined with strengthening competition, is presenting a headwind for TI.

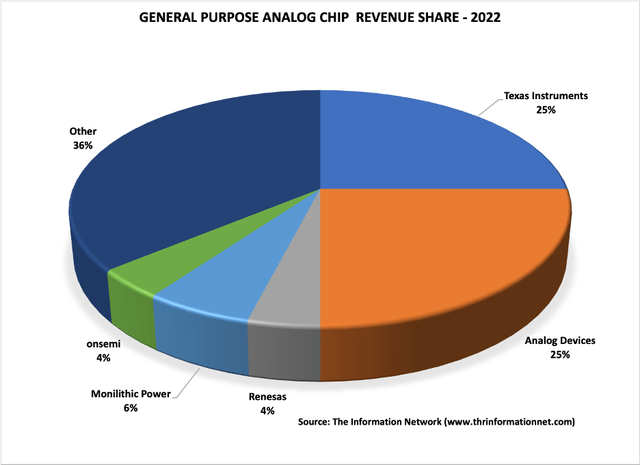

General-Purpose Analog ICs include not only Power Management chips, but also Data Converters, Amplifiers, Switches, and Low-Power RF. That may not mean much to investors, but the key is that TI holds a 25% share of the General Purpose Analog IC market, as shown in Chart 4.

The Information Network

Chart 4

The $36 billion General-Purpose Analog ICs market in 2022 has grown at a CAGR (compound annual growth rate) of 10% in the past five years.

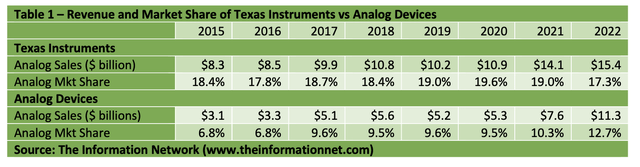

However, if we include what’s called the “Application Specific” Analog market valued at $53 billion in 2022, then TI is in trouble. Table 1 shows that the TI has lost market share to competitor Analog Devices (ADI) in 2022 in the $89 billion Total Analog IC market.

Here we see that TI’s market share started declining in 2021 to 17.3% in 2022. ADI’s growth has enhanced by its acquisition of Maxim Integrated Products in August 2021.

The Information Network

Macro Factors Impacting Analog Growth

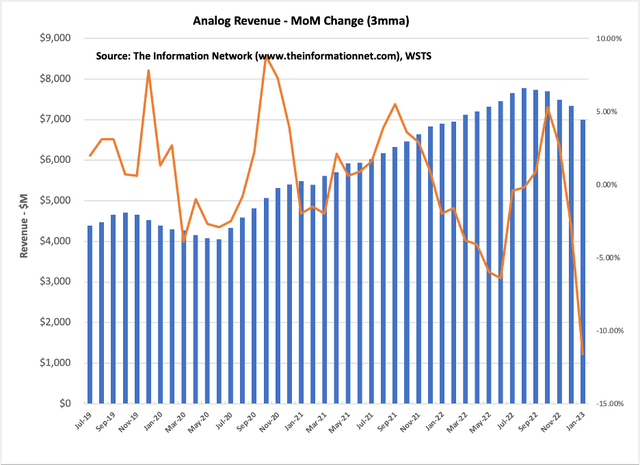

In Chart 5, I show that the global analog REVENUE growth has been negative in the past 5 months, peaking in August 2022. The orange line shows the plunging MoM change in revenues, according to our report entitled Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts.

The Information Network

Chart 5

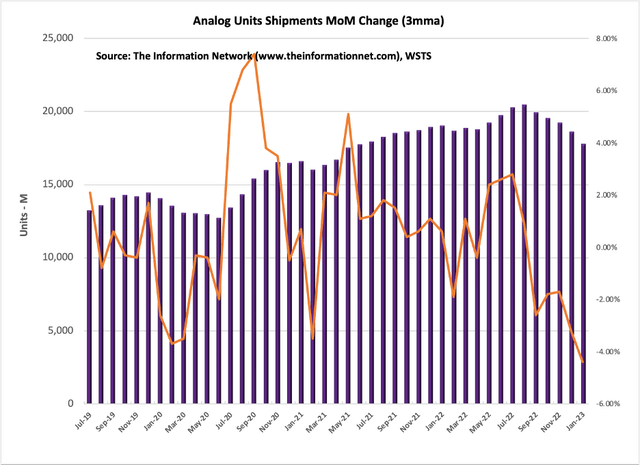

In Chart 6, I show that the global analog shipment growth has also been negative in the past five months, peaking in August 2022. The orange line shows the plunging MoM change in revenues.

The Information Network

Chart 6

Sales by Region

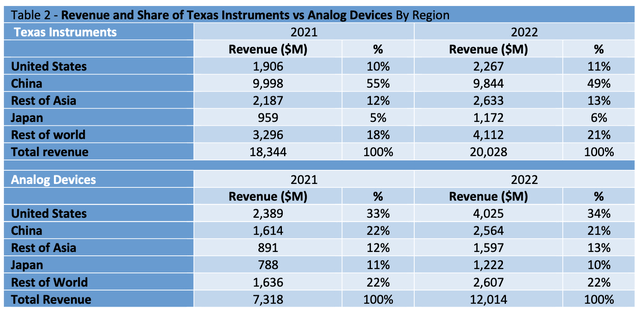

Table 2 shows Revenue and share of revenue generated by TI and ADI by region for 2021 and 2022. I don’t see any negative issues from U.S. sanctions on China impacting the analog market. In fact, China may prove a strong tailwind for Texas Instruments, which generated 49% of its revenues from chip sales to China in 2022. While own from 55% in 2021, that drop is attributable to COVID lockdowns through much of 2022, primarily in Shanghai.

In 2023 we see a strong recovery in China. According to the International Monetary Fund, GDP growth in China in 2023 is forecast at 5.2% compared to just 1.6% in 2022. This bodes poorly for ADY, which generated 34% of its revenues from sales in the U.S. in 2022.

Company Reports

The large exposure of revenues to China are also beneficial for TI’s automotive business. Chart 7 shows EV sales in China in 2022 grew to 6.2 billion units compared to just 1.1 billion in the U.S.

EV-Volumes

Chart 7

Strong Fab Expansion for TI

Rafael Lizardi COF of TI noted in the company’s Q4 2022 earnings call that while capex estimates for new fabs do not consider any grants from this government program, but the firm indicated that $10 billion of grants are available for trailing edge chip manufacturing, which is the node size of TI’s analog chip design. TI will also receive an investment tax credit of 25% from 2023 to 2026 or $16 billion out of TI’s estimated $20 billion of capex over the next four years. This will translate to a $4 billion cash inflow to the company.

So despite no direct Chips Act funding for fabs, TI expects to bring new chip-producing plants online over the next year, including its RFAB2 in Richardson and LFAB in Lehi, Utah. It sees additional capacity from those plants helping meet demand in the near term. The recently announced Sherman campus, which could potentially house as many as four chip plants, will provide additional capacity for 2025 and beyond.

Investor Takeaway

TI reported revenue of $4.7 billion in Q4 2022, a decrease of 11% sequentially and 3% from the same quarter a year ago. Results reflect weaker demand in all end markets with the exception of automotive.

However, TI’s drop came from the meltdown of consumer electronics products such as PCs and smartphones. The personal electronics segment was down mid-teens and communications equipment was down about 20%.

Its enterprise systems segment was also down about 20% as hyperscalar companies were reducing excess inventory at the data center.

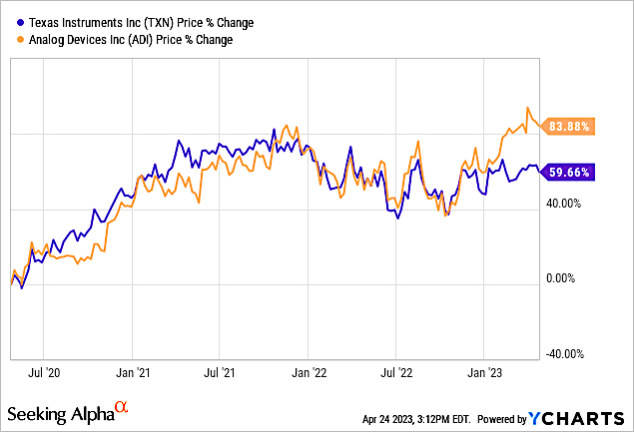

As a result, Chart 8 shows that share price has been flat since the Q4 earnings call, underperforming ADI. Prior to the last quarter, share prices for both companies over the past three years were comparable.

YCharts

Chart 8

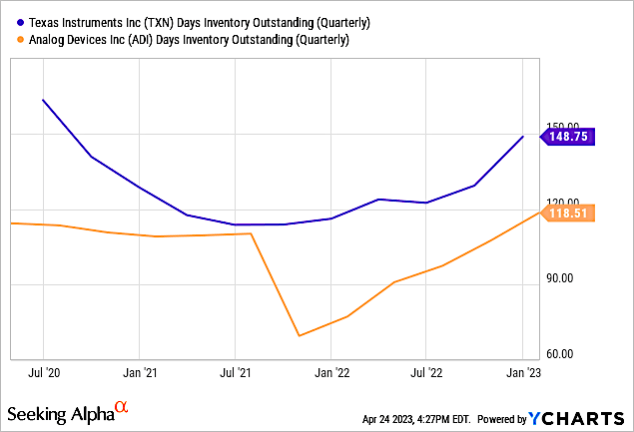

On the inventory issue, Chart 9 shows that days of inventory rose to 149 days for TI compared to 117 days for ADI.

YCharts

Chart 9

The entire semiconductor industry has been in a down cycle on macro and geopolitical uncertainty. Thus, it is not surprising that TI provided weaker guidance.

The company expects first-quarter revenue to be between $4.17B and $4.53B, compared to the consensus estimate of $4.42B. Earnings are forecast to be between $1.64 and $1.90, with the midpoint below the $1.87 analysts expect.

Revenues decreased in every segment in Q4 except automotive, and its strong 49% of revenue exposure to leading EV region China will propel the company in 2023

A benefit of TI’s capex plans on building 300mm fabs is that product cost is reduced compared to a 200 fab, such as those used by ADI. A large expansion program is underway:

- Construction of its 200mm Lehi fab will start later in 2023.

- TI is building four new 300 mm wafer fabs in Sherman, Texas.

- TI currently operates the existing LFAB in Lehi and DMOS6 in Dallas and RFAB2 and RFAB2 in Richardson, Texas, all devoted to 300 mm wafers.

These are positives for the company. On its heals is ADI and the company is generating market share not only by organic growth, like TI, but also by acquisitions.

While long-term prospects are strong, near term I rate the company a Hold based on strong macro factors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This free article presents my analysis of this semiconductor sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here.