Summary:

- Texas Instruments leverages economies of scale by mass-producing versatile products, reducing inventory obsolescence, and differentiating itself with fast order fulfillment and customer accessibility.

- Despite an 8% YoY revenue decline in Q3 2024, TXN met Wall Street expectations, showing stabilization with uneven performance across end markets and geographies.

- TXN’s valuation appears high given its ill-defined growth drivers, despite benefiting from macro-trends like factory automation, automotive electrification, and IoT.

- China’s automotive sector growth, driven by feature-rich EVs, presents a significant opportunity for TXN’s microchips, contrasting with sluggish performance in other regions.

hapabapa

Investment Thesis

Texas Instruments (NASDAQ:TXN) sells tens of thousands of different microchips to thousands of different customers across dozens of industries. Their miniaturized integrated circuits are used in everything, from toys to fighter jets.

TXN is able to maintain this expansive product portfolio because many of its products share a common technological platform. For example, an analog-to-digital converter can be modified to fit different applications, each counting as a standalone product. A microcontroller in a toy train could very well be used in a fridge or a ceiling fan.

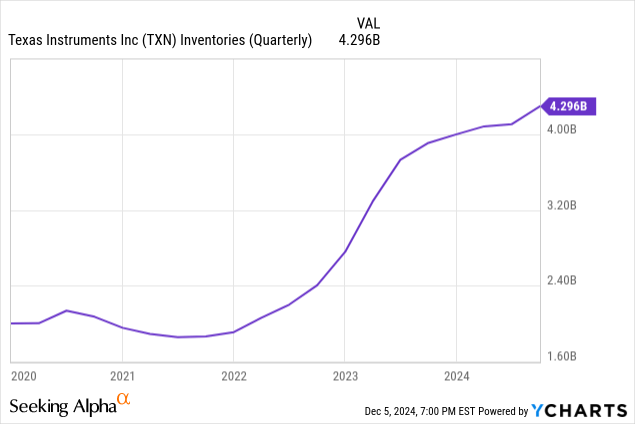

Now, this brings us to a very important point touching on TXN’s strategy. TXN can mass-produce certain products, benefiting from economies of scale, while reducing the risk of inventory obsolescence. This is exactly what it is doing. Inventory was up $190 million in Q3 2024, reaching $4.3 billion, a continuation of an upward trajectory since the 2022 market slowdown.

Last week, I stumbled upon an interesting press release about TXN’s new automated distribution center in Germany, which will be stocked with inventory, allowing fast order fulfillment within 15 minutes of a customer’s order. TXN views this as simply good service. But this strategy isn’t as common as one thinks. Competitors like ON Semiconductor (ON) tout their long-term sales agreements “LTSA” that bind customers to specific volumes, allowing them to manage working capital according to planned orders. TXN is differentiating itself by being more responsive to its customers by holding inventory at its own warehouses awaiting customers’ orders.

I think TXN is an interesting company, but its valuation certainly falls at the upper bound of the industry range, with ill-defined short-term growth drivers, notwithstanding broader digitalization trends such as factory automation, automotive electrification, and IoT. But such trends benefit everyone in the sector, and TXN, at least in my view, doesn’t have a defined differentiation that warrants its valuation premium, despite its unique approach to market and inventory management strategy.

Mixed Signals

TXN reported $4.2 billion in sales last quarter, down 8% YoY, but still matching Wall Street’s expectations. Sequentially, that’s an 8% sales growth over Q2, suggesting some sort of stabilization. Nonetheless, performance across end-markets has been far from even, or, in the words of TXN’s CEO, showed “asynchronous market behavior.”

Personal computers ‘PC’, communication equipment, enterprise systems, and automotive were up 30%, 25%, 20%, and 8% YoY, while industrial sales, which constitute a significant portion of total sales, were down. Even within the same industry, sales varied by region. For example, while automotive sales in China showed spectacular 20% growth, this was offset by sluggish performance in Europe and North America.

There were a lot of positive and negative surprises during the quarter that eventually balanced out. China’s continued automotive double-digit growth was one, but also the 27% decline in embedded device sales.

TXN’s PC sales were also an exception among peers reporting sluggish PC sales. TXN noted that PC sales, while up YoY, are recovering from a trough and remain considerably below their peak, suggesting that this growth is attributed to the normalization of its market share in the PC market, which means there is still more room for further growth. Remember, TXN’s customers don’t have the same incentive to hold inventory, given that orders can be fulfilled fairly quickly using TXN’s inventory, a safety net absent in other industry peers such as ON, STMicroelectronics (STM), and NXP Semiconductors (NXPI).

China’s automotive activity is nothing short of spectacular, as evident in the influx of large tech companies launching their EV debuts this year. Xiaomi (OTCPK:XIACF), dubbed “China’s Apple,” debuted an EV sedan last April, the SU7, creating a strong interest that even Ford’s CEO described it as his favorite EV. Huawei, the telecommunication giant that pioneered 5G equipment, also debuted (paywall) its first EV this year.

Cautious Outlook

Despite growing EV demand in China, and a rebound in PC, communication, and enterprise systems microchip sales, TXN’s Q4 2024 guidance was pretty disappointing. The company expects revenue between $3.7 billion and $4 billion, down 8% sequentially (at midpoint) and 6% YoY. This subdued guidance is likely, at least partly, due to management’s desire to manage expectations. The last thing TXN wants is to overpromise and underdeliver. Except in China, the industrial sector is in a contraction state. Add to that the sluggish EV transition in the US and Europe, and the fact that Q4 has historically demonstrated seasonal weakness, it is no wonder that TXN management isn’t particularly optimistic in its guidance.

Modernizing Production Lines

In Q3 2024, TXN generated $1.7 billion in Operating Cash Flows and spent $1.3 billion in capital expenditure, but thanks to a cash flow injection from the government under the CHIPS Act, free cash flow stood at $1.5 billion. On a trailing twelve-month basis, cash flow from operations stood at $6.2 billion, weighed against $4.8 billion in capital expenditure.

Analog devices don’t require the most cutting-edge semiconductor nodes to function. In fact, during UBS (UBS) Technology Conference last month, TXN CEO complained that some of TXN’s equipment is so old that when it breaks down, they don’t find spare parts, noting that some of its manufacturing facilities were built in the 1980s. The company is capitalizing on the CHIPS Act to renew its manufacturing facilities, which is great, especially since the manufacturing equipment of analog devices isn’t as expensive as those for logic, memory, or artificial intelligence.

In terms of capacity, I think TXN’s new facilities are inherently more efficient than its old facilities. So, we should expect capacity expansion on the back of TXN’s Capex. On a TTM basis, Capex stood at $4.8 billion, versus a depreciation and amortization of $383 million, as of September 2024, suggesting that its capital programs extend beyond maintenance capital. Equally important, with new expensive facilities replacing older facilities, investors should expect a rise in depreciation expense.

Is TXN Overpriced?

TXN is anything but cheap. Remember, the company is primarily an analog microchip designer-manufacturer, an industry characterized by fierce competition, price sensitivity, and in many product lines, commoditization or lack of differentiation across suppliers. So, while its 32x 1-year Forward PE ratio falls within the industry’s range (albeit at the upper bound of that range), I believe TXN is expensive when compared to other analog device manufacturers, as shown in the table below.

| Company | 1-Year Forward PE |

| Marvell (MRVL) | 36.77 |

| Texas Instruments (TXN) | 32.62 |

| Analog Devices (ADI) | 28.86 |

| Broadcom (AVGO) | 26.51 |

| Infineon (OTCQX:IFNNF) | 23.8 |

| Microchip Technology Inc. (MCHP) | 23.05 |

| STMicroelectronics (STM) | 18.70 |

| NXP Semiconductors (NXPI) | 17.09 |

| Skyworks Solutions (SWKS) | 16.42 |

| ON Semiconductor (ON) | 15.30 |

Final Thoughts and How I Might Be Wrong

This sell rating is mainly predicated on TXN’s high valuation and lack of differentiation from other analog Integrated Device Manufacturers ‘IDM’ in terms of product portfolio width and technological depth. TXN is hardly the largest analog IDM on the market today. Its valuation currently stands at the upper bound of the industry range and is much higher than the analog IDM average. For this reason, I believe that TXN will likely underperform its peers going into 2025, underpinning this sell rating.

However, TXN has historically traded around 24x – 26x forward PE. A rebound in EPS could bring it to this historical average, underpinning our overvaluation hypothesis. Moreover, TXN has historically adopted a shareholder-friendly capital allocation policy, with 19 years of dividend hikes. This, in addition to the long-term cyclical tailwinds, manifested in digitalization trends and EV transition, could render our short-term sell rating obsolete for long-term investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.