Summary:

- Textron Inc. lays off 2% of its global workforce due to market conditions and mix pressure.

- The layoffs in the aerospace and defense segment align the company for a higher share of lower-margin development work.

- Textron’s product line does not benefit significantly from increased demand for defense equipment in the war in Ukraine.

Wirestock

In October, I covered Textron Inc. (NYSE:TXT) stock, pointing out the favorable performance compared to the market since my April 2023 report. However, following my October 2023 report, TXT stock performance has been rather disappointing, returning just 6.2% compared to a >14% return for the S&P 500 (SP500). Since then, the company has announced a workforce reduction.

In this report, I will discuss whether the layoffs provide any reason to believe that the underperformance of Textron will come to a halt. I will also highlight why Textron might not be the preferred play on the Ukraine war.

Textron Lays Off 2% Of Global Workforce

In total, Textron will be laying off approximately 725 employees, representing 2% of its global workforce. In some way, that can be somewhat of a surprise, given that we have heard about labor shortages in the aerospace supply chain for quite a long time. Seeing the announcements of layoffs can be somewhat counterintuitive, but can also be somewhat explained by Textron’s overall business. As interest rates have increased, pushing the Eurozone into a recession, demand for fuel systems from European automotive manufacturers has declined. This has triggered layoffs at Kautex, while lower demand for powersports products triggered reductions at Textron Specialized Vehicles.

So, those are the non-aerospace layoffs in the Textron Industrial segment. The company has not disclosed how many positions will be eliminated exactly at each segment, but the Industrial segment layoffs in some way do make sense given high financing costs in the end markets. The big question is whether the layoffs at Bell and Textron Systems, which together with Textron Aviation and Textron eAviation form the aerospace & defense part of the business, do make sense.

The answer, somewhat counterintuitively, is “Yes.” For Aerospace & Defense companies maintaining a healthy mix of next generation platforms as well as legacy platforms is important, and ideally you have next generation development programs largely finished before legacy platform revenues start declining, and for Textron that is unfortunately not the case which affects the mix between legacy programs and lower margin development programs, and Textron is making headcount changes for that to preserve some margin and align the headcount with manufacturing capacity requirements.

What About Weapon Deliveries For The War In Ukraine?

One question that one could be asking is how it is possible that demand for legacy programs is not higher given the war in Ukraine. While we see many analysts building bull theses for all aerospace and defense stocks based on increased demand for defense equipment including weapon system deliveries to Ukraine, the reality is that Textron sees little to no opportunities for its product line to benefit from the demand of weapon systems and munition from Ukraine. There is some demand that is going to be filled from the Army’s inventory and some talks about unmanned aerial systems, but nothing major. Even if we assume that additional aid packages for Ukraine are approved, which already is a challenge, there is little to gain for Textron since the company simply does not have the in-demand portfolio to cater.

Furthermore, Textron derives around 20% to 25% of its revenues from the U.S. Government, with the remainder attributed to the Commercial revenue stream. So, Textron simply is a more commercial aerospace play focused on commercial jets via Cessna and turboprops via Cessna and Beechcraft and helicopters via Bell than a defense aerospace play via Bell and Textron Systems.

What Are The Financial Implications Of The Textron Job Cut?

Textron does not expect the restructuring to have a significant impact on its 2023 financial outlook, but that is because severance costs and asset impairments are adjusted for. Simply speaking, the guidance would never reflect any impact of a layoff, even if the size of the layoff would be magnitudes bigger.

Textron expects restructuring costs in the $115 million to $135 million range, of which $35 million to $45 million will be severance costs which are cash costs to be incurred in 2024 with $80 million to $90 million in impairment charges. While the cash outflow will take place in 2024, the entire amount will be expenses in the fourth quarter results of FY2023. Annualized gross savings of the headcount reductions are expected to be around $75 million. With annualized costs of nearly $12 billion, $75 million in savings is barely going to move the needle, I would say. Given the underperformance of the stock, I would think that selling Kautex, which produces plastic fuel systems solutions, would be more meaningful. The company, however, explored similar possibilities in 2019 which seems to have been unsuccessful.

Textron Scores As Top Aerospace and Defense Stock Despite Underperformance

While Textron is not showing extremely strong performance on multi-year timeframes, the stock scores well in the list of Top Aerospace and Defense Stocks, occupying the 5th spot. The stock scores a strong Buy rating according to the Quant ratings, a buy according to SA Analysts and a Wall Street Rating of Buy. The company scores a D+ on Valuation metrics, driven by the horrible 0.1% dividend yield.

Textron Provides A Difficult Valuation Case, But There Is Upside

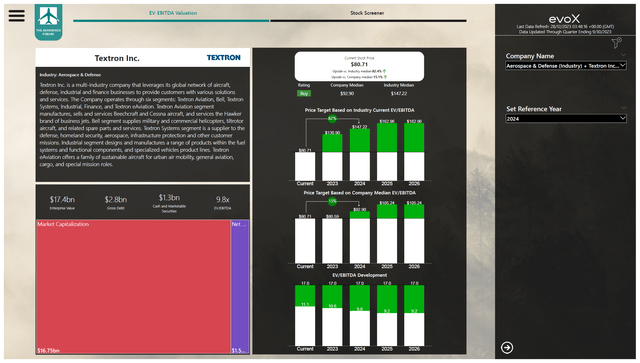

Stock price valuation Textron Inc. using evoX Stock Screener (The Aerospace Forum)

Valuing Textron stock is quite challenging. If we use the 10-year company EV/EBITDA median of 10.4x, we get to a price target of $93 for 2024, meaning we would get around 50% upside for 2023 and 83% upside towards 2024 using a 17x EV/EBITDA for the aerospace and defense industry. Including the fourth quarter special items, Textron stock is valued fairly at current prices. Overall, we have reduced our price target for the stock by 1% to $80.60 for 2023 but increased the price target to $93 or 3% for 2024 and 9% for 2025. As a result, I maintain my buy rating on the stock, noting that despite the upside potential, the company has a rather weak long-term track record of outperforming driven by the pandemic.

Conclusion: Textron Continues To Offer Opportunities

The layoffs at Textron might be somewhat surprising given the industry trend of labor shortages. However, Textron is hit by end market realities for its automotive-related businesses while the aerospace and defense segment is facing pressures on revenue mix as development programs which tend to be lower margins are taking a bigger share of the pie. Textron’s 2% headcount reduction is merely a realignment of those realities. The stock has not quite shown appreciable performance compared to its peers as it fell deep during the pandemic, and that has affected its longer-term performance profile. That also means that the company is not necessarily a company that will continue to underperform and even against the EV/EBITDA valuation in line with the company median there is an upside that could expand further on EV/EBITDA expansion towards peer group standard. As a result, I am maintaining my buy rating, noting that Textron Inc. stock is fairly valued for unadjusted FY2023 earnings but with bigger than initially anticipated price targets for 2024 and 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.