Summary:

- Textron Q4 earnings beat estimates for EPS, sending shares to a new all-time high.

- The Bell helicopter segment drove strong growth, while easing cost pressures lifted margins.

- Positive management guidance for the year ahead supports a bullish outlook on the stock.

Photofex/iStock Editorial via Getty Images

Textron Inc. (NYSE:TXT) reported its latest quarterly results with EPS beating expectations while management offered positive guidance for the year ahead.

Despite the global business aviation market with brands like “Cessna” and “Beechcraft” facing some macro headwinds, the story here has been expanding margins moving past inflationary cost pressures and supply chain disruptions. Separately, the company’s “Bell” helicopter group posted a re-acceleration of growth reflecting strong commercial and military demand.

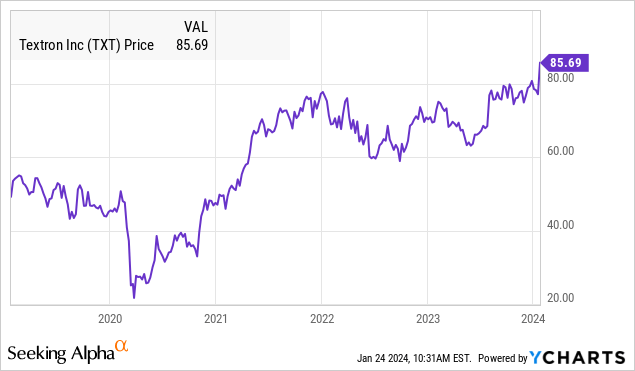

The stock has broken out to a new all-time high and we think the backdrop here warrants a bullish view with room for more upside.

TXT Q4 Earnings Recap

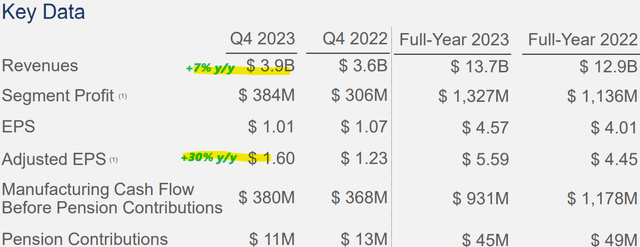

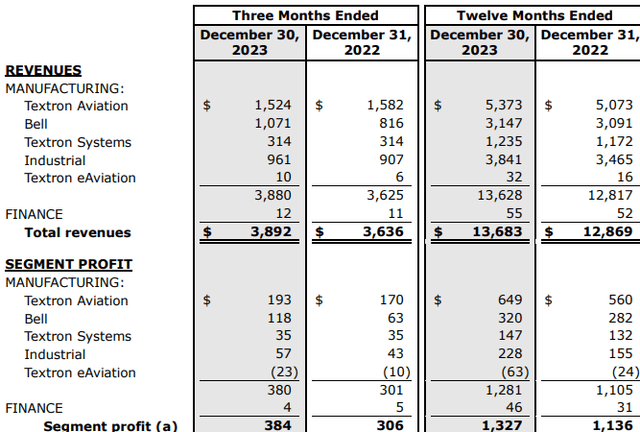

TXT Q4 non-GAAP EPS of $1.60 came in $0.07 ahead of estimates and also up 30% from $1.23 in the period last year. Revenue of $3.9B increased by 7.0% year over year or 6.8% on an fx-neutral organic basis.

Within the top line amount, the strength was driven by the Bell segment, where sales climbed by 31.3% to $1.1 billion from the delivery of 91 commercial units compared to 71 in Q4 2022. Even more impressive was the 115% climb in segment profit to $118 million.

The momentum in Bell helicopters helped balance a -3.7% decline on the Textron Aviation side. In this case, even as total jet and turboprop units were slightly down y/y, segment profit reached $193 million capturing higher pricing initiatives and easing cost pressures. Overall, the firm-wide segment profit margin reached 9.9%, up from 8.4% in the period last year also sequentially improving from recent quarters.

In terms of explaining the strength of the stock, which surged by nearly 10% on the earnings report, the strong guidance for 2024 played a big role. Management expects aviation unit deliveries to climb over the next several quarters, with the aviation backlog of $7.2 billion, up 11% from the end of 2022 representing a runway for growth.

Textron is forecasting 2024 revenues of around $14.6 billion, up from $13.7 billion in 2023. The theme of expanding margins should continue targeting adjusted EPS between $6.20 and $6.40, compared to $5.39 for the full year 2023. Notably, this is above the prior 2024 EPS consensus of $5.92.

The company also expects 2024 adjusted EBITDA to reach $1.9 billion, from $1.774 billion in 2023. With a current net debt position of $1.6 billion, the net leverage ratio under 1x implies a strong balance sheet position. We can also mention that Textron has been active with share repurchases, buying back $283 million in Q4 and $1.2 billion over the past year.

What’s Next For TXT?

We’re eying a multi-year breakout in shares of TXT that had struggled to cross over the $80.00 share price level since late 2021. There is a sense that the company has found the right balance of solid growth and improved profitability in a segment of aviation with a positive long-term outlook. This includes efforts at modernizing production and a focus on value-added product lines.

While climbing interest rates and macro uncertainties defined 2022 and 2023, the new round of optimism as inflation trends lower with a path for interest rates to stabilize should work as a tailwind for the broader industrial sector. In terms of commercial aviation, the understanding is that demand for new aircraft remains strong, likely getting a boost from easing credit conditions.

According to an industry report from Honeywell International Inc. (HON), 2024 should see a 10% increase in business jet deliveries over 2023. Survey participants are flying more with purchase plans including aircraft replacement have now exceeded pre-pandemic levels. Naturally, Textron should benefit from these dynamics.

We also expect to see some strength in military applications including through Textron Systems considering the conflicts in the Middle East and Eastern Europe. In late 2022, Textron was selected by the U.S. Army to develop the Future Long Range Assault Aircraft (FLRAA) based on the prototype Bell V-280 Valor. While not expected to enter operations until 2030, the program received $87 million as a contract award this past quarter and highlights the longer-term opportunities for future growth.

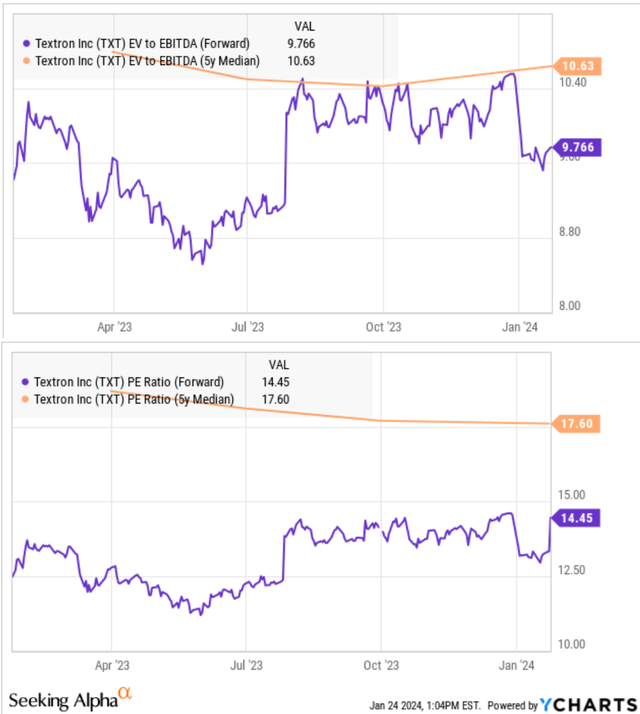

Overall, the improved financial execution may justify a trend of expanding valuation multiples for the stock. Even with the rally from the Q4 earnings report, shares remain at a discount to their 5-year average EV to EBITDA multiple and PE ratio. Considering the 2024 management EPS guidance at around $6.30, TXT is trading at a forward P/E of 14x which we believe still offers value for more upside.

Final Thoughts

There’s a lot to like about Textron as a category leader with overall solid fundamentals. In the immediate term, the base case here is that shares can see some consolidation of recent gains as the market digests the results. Ultimately, we believe any dip from here would represent a new buying opportunity.

In terms of risks, outside of a potential deterioration to the economic backdrop, quarterly aircraft delivery figures, margin levels, and cash flow trends will be key monitoring points.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.