Summary:

- Earnings momentum has lifted shares of Textron higher over the past year.

- We preview the company’s upcoming Q2 report.

- Several tailwinds support a bullish outlook for the stock.

Bradley Caslin /iStock Editorial via Getty Images

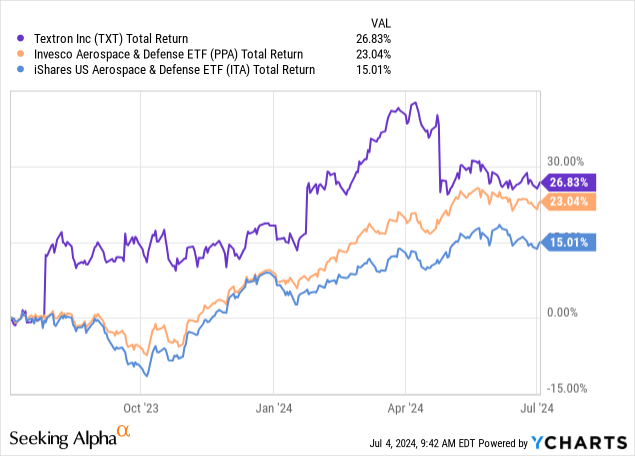

Textron’s (NYSE:TXT) stock has been a high flier, returning about 27% in the past year and outperforming industry benchmarks.

The aviation, defense, and industrial products leader, recognized for brands like “Cessna”, “Beechcraft”, and “Bell”, has managed to move past pandemic-era supply chain headwinds to kickstart a new round of earnings growth. That was our takeaway when we last covered the stock earlier this year with a bullish outlook citing the company’s impressive financial execution.

While shares are trading marginally higher from that last article publication date, Textron has exhibited some volatility in recent months ahead of its upcoming second-quarter earnings report set for July 18.

Ultimately, we believe the outlook remains positive supported by several fundamental tailwinds. Here are four reasons to stay bullish on the stock through the second half of 2024 and the themes to watch.

1. A Solid Start to 2024

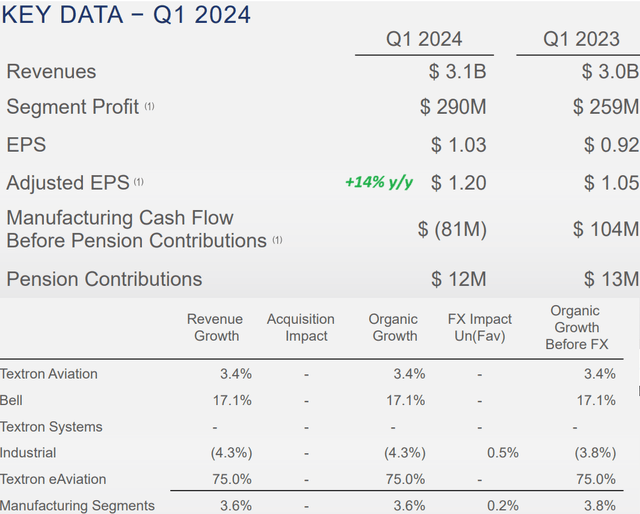

The sell-off in TXT from its 52-week high likely goes back to the company’s Q1 earnings report from late April which missed estimates in what can be described as mixed results.

Still, Q1 EPS of $1.20 represented a solid 14% increase from the period last year on 4% revenue growth. The timing of aircraft deliveries in the aviation segment and lower volumes in the smaller industrial business was balanced by the stronger Bell segment where revenue climbed 17.1% y/y.

Textron is benefiting from the ramp-up of the Future Long-Range Assault Aircraft (“FLRAA”) program through the Department of Defense, based on progress awards for the ongoing development of the “V-280 Valor” expected to be a major growth driver for the company into the next decade.

For now, management favorably reiterated its full-year adjusted earnings guidance to between $6.20 and $6.40 per share, which represents a 13% increase from 2023 at the midpoint.

For Q2 earnings set to be released on July 18, the market is eyeing EPS of $1.47, up 1% from Q2 2023, and a 3% increase in revenue from the period last year. The context of the softer top-line considers this quarter is up against a particularly strong comparison period in 2023.

Nevertheless, the understanding is that the high-level trends remain in place being strong customer demand and Textron’s effort at financial efficiencies translating into higher underlying cash flows.

A key monitoring point will be the evolution of the company backlog which ended Q1 at $13.7 billion, up from $13.1 billion in the period last year. This metric is a good indicator for the operating environment suggesting a runway for further earnings momentum.

As we see, the market pulled back Q2 estimates since the Q1 results which has left a low bar of expectations. Textron’s ability to beat the EPS consensus amid several levers in support of profitability could be positive for the stock.

Seeking Alpha

2. Strong Earnings Momentum

Beyond any quarterly noise, the attraction of Textron comes down to the strong diversified business profile. The importance here is that exposure to executive aviation, military applications, specialty vehicles, and industrial systems can all add to growth over the long run.

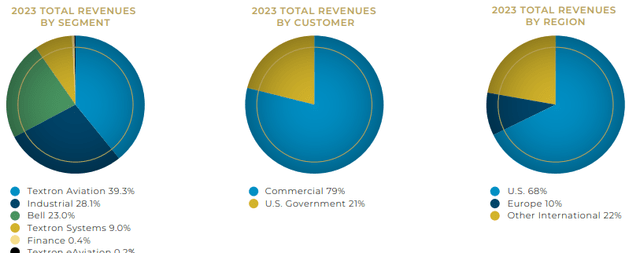

In 2023, approximately 21% of total revenue was related to supplying the U.S. Government. The expectation is that programs like FLRAA and other products across its operating segments work to gradually increase the exposure to Defense over time which works to add a layer of quality to Textron’s earnings and cash flows.

The company also has an opportunity to expand internationally where regions outside the U.S. currently only represent around 32% of the total business. There is a thought that the ongoing war in Eastern Europe as well as tensions in the Middle East could spur demand in its defense product categories.

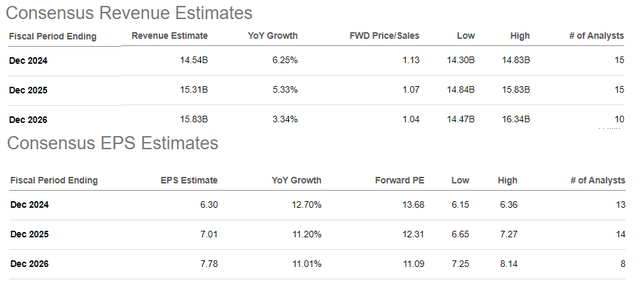

The ability to grow earnings above revenue highlights the dynamic of expanding margins in a shifting portfolio mix toward value-added opportunities. According to consensus, Textron is expected to generate average revenue growth in the mid-single digits through fiscal 2026 while EPS is stronger above 11% annually over the period.

Part of the bullish case for the stock is that there is some upside to sales, in a scenario where global macro conditions re-accelerate as a tailwind for the industrial sector. The potential that interest rates normalize lower could also be positive for the stock.

3. A Compelling Valuation

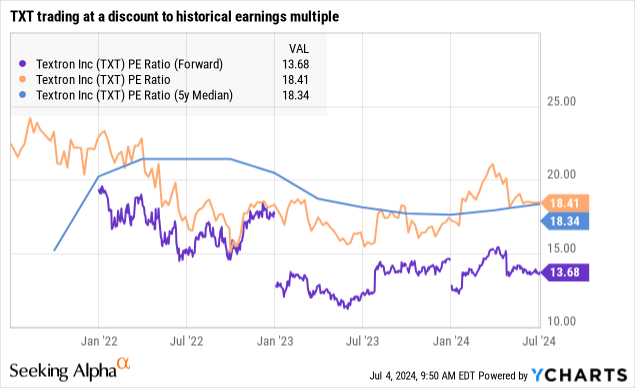

The metric that stands out to us when looking at Textron is its forward price-to-earnings ratio of 13.7x. Notably, this is below the 5-year average for the stock closer to 18x. An interpretation here is that with the earnings growth momentum, shares have become undervalued with room for some expansion of the premium offering upside in the stock as part of the bullish case.

The spread becomes even more compelling into fiscal 2025 where an EPS estimate of $7.01 implies TXT is trading at a 1-year forward P/E of 12.3x.

4. Ongoing Buybacks

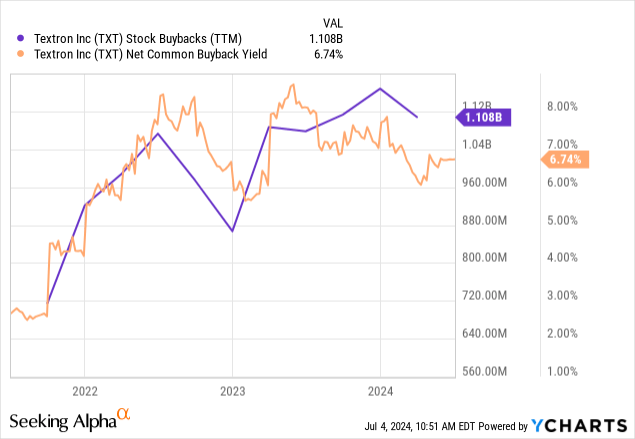

Another factor that deserves some attention is Textron’s ongoing stock buybacks. In Q1, the company repurchased $317 million in shares and $1.1 billion over the past year. So while TXT’s quarterly dividend of just $0.02 per share yields only a modest 0.1% on an annual basis, investors are compensated by an implied 6.8% buyback yield.

We expect the current pace of approximately $300 million in buybacks per quarter to be maintained within the authorization that still has a maximum of 24.9 million shares, or $2.1 billion in stock at current prices that have yet to be purchased. The setup should be supportive of the stock going forward.

Final Thoughts

Overall, we rate TXT as a buy with a price target for the year ahead at $110 implying a 17.5x multiple on the current consensus 2024 EPS of $6.30. Room to deliver stronger growth as the large aviation backlog gets fulfilled could allow growth to surpass expectations over the next several quarters including for the Q2 report. The evolution of the gross margin and cash flow should be key monitoring points.

The main risk to consider is that the company remains exposed to potentially volatile global macro conditions. Weaker-than-expected aircraft delivery figures or some setback in the high-profile FLRAA program would force a reassessment of the earnings outlook and open the door for a deeper selloff in the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein represents the personal opinions and views of Dan Victor only and is intended for informational and/or educational purposes. It should not be construed as a specific recommendation or solicitation to buy or sell any security or follow any particular investment strategy. Please consult with your financial advisor before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.