Summary:

- Textron Inc. is currently a buy due to its solid guidance, strong balance sheet, value creation through acquisitions, and undervaluation.

- The company has a strong balance sheet and has demonstrated resilience and a solid core business model, despite 2020 travel restrictions.

- Textron’s acquisition strategy, including the purchase of Beechcraft, has allowed it to diversify its income streams, improve operating efficiencies, and increase its presence in the military aircraft market.

- Assuming my DCF figures, Textron is currently undervalued, resulting in a buy rating.

Franco Ercolino

Textron Inc. (NYSE:TXT) has recently recovered from its 2020 decline due to the resurgence in demand. I believe that the company is currently a buy due to its solid guidance, strong balance sheet, the firm’s value creation through acquisitions, and undervaluation assuming my DCF figures.

Business Overview

Textron Inc. operates globally in the aircraft, defense, industrial, and finance sectors, with its business divided into six segments: Textron Aviation, Bell, Textron Systems, Industrial, Textron eAviation, and Finance.

Business jets, turboprop and piston-powered aircraft, military trainers, and defense aircraft are among the products that Textron Aviation manufactures, sells, and services. This category also provides maintenance, inspection, repair, and sales of commercial parts.

The Bell division focuses on tiltrotor aircraft, tiltrotor helicopters, and related services and replacement parts. Contrarily, Textron Systems concentrates on offering unmanned aircraft systems, electronic systems, cutting-edge marine craft, aircraft engines, air-to-air and air-to-ship training solutions, as well as weaponry and armored vehicles.

Textron provides blow-molded products in the Industrial area, such as fuel tanks for hybrid cars and plastic tanks for catalytic converters. Additionally, this sector is in charge of producing a range of cars for golf courses, hotels, vacationers, and business users.

The Textron eAviation business unit produces and markets electric and combustion-powered light aircraft and gliders while also pursuing R&D projects for environmentally friendly aviation solutions.

Lastly, the Finance division offers financing services for the acquisition of Bell helicopters and new and used airplanes.

Textron

Financials

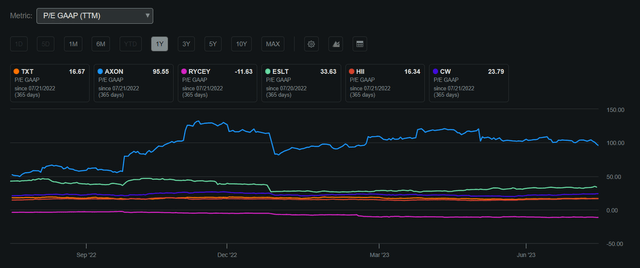

Textron’s market capitalization stands at $13.64 billion, with a return on invested capital of 5%. Presently, the stock is trading at $67.63, in proximity to its 200-day moving average of $68.38. With a GAAP P/E ratio of 16.67, Textron appears to be undervalued compared to its industry peers, making it a relatively affordable investment opportunity as discussed in the valuation segment of this article.

Textron P/E GAAP Compared to Peers 1Y (Seeking Alpha)

Textron also offers a very small dividend of 0.12% representing a payout ratio of 1.97%. Although this dividend is extremely small and would be negligible in the big picture of returns, it signifies that management is committed to providing value in a multitude of ways in the future as I expect the dividend to grow from here.

Another method Textron uses to provide value that is more impactful currently to shareholders is their share buyback program which has repurchased a large number of shares over the years and provided shareholders with more EPS per share and subsequently greater value as shown in the image below. I especially like the idea of Textron repurchasing shares with its FCF instead of a large dividend as the company is currently trading for a cheap price allowing Textron to repurchase shares at a discount and create value with little FCF.

Annual Shares Outstanding (TradingView)

Share Performance (Seeking Alpha)

Earnings

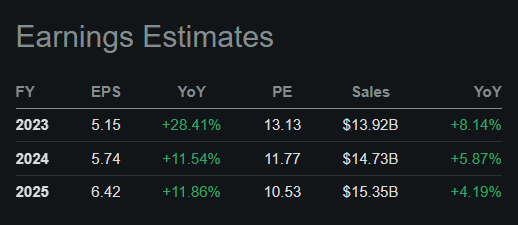

Textron’s recent Q1 2023 earnings came in with mixed results with EPS beating by $0.06 at $1.05 and revenues missing by $90 million at $3.02 billion, the company is displaying slight weakness in macroeconomic headwinds. But, with revenue and EPS expected to continue growing at a strong pace, I believe that Textron will rebound from this slight miss due to its solid core business model.

Textron Earnings Estimates (Seeking Alpha)

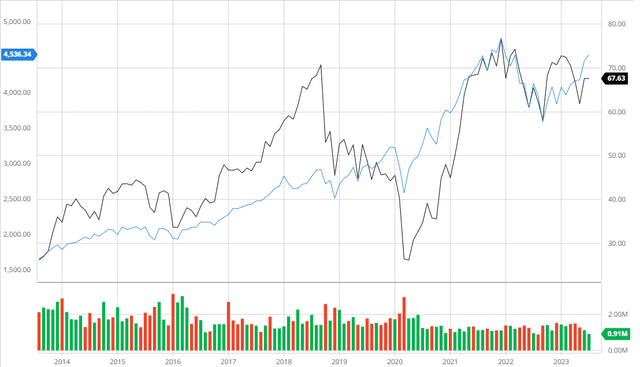

Performance Compared to the Broader Market

Over the past 10 years, Textron has slightly underperformed the broader market when adjusting for dividends. I believe that even after the decline due to 2020 travel restrictions, Textron’s ability to recover and still maintain performance demonstrates the company’s solid strategy and core business model’s resiliency.

Textron Compared to the S&P 500 10Y (Created by author using Bar Charts)

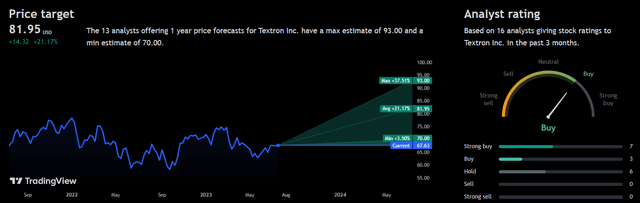

Analyst Consensus

Over the past 3 months, analysts have rated Textron stock as a “buy” with a 1Y price target of $81.95 presenting a potential 21.17% upside. I believe that this demonstrates analysts’ confidence in the firm and are optimistic about Textron’s future due to its solid growth strategy.

Analyst Consensus (TradingView)

Balance Sheet

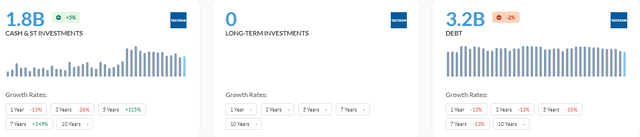

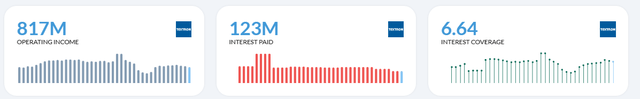

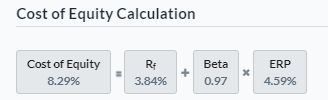

Textron also holds a strong balance sheet which will allow the firm to remain resilient in headwinds while also having room to leverage in order to expand. With cash and investments more than doubling in the last 5 years while debt declined by 18%, the company is offloading its current leverage in this high-rate environment to preserve cash flows by preventing expensive interest payments. The company also has an interest coverage of 6.64, demonstrating Textron’s ability to endure high rates if needed. Lastly, with a current ratio of 1.77 and Altman Z-Score of 2.49, the firm is in a decent position to remain solvent in the upcoming years, further demonstrating the company’s safety in regards to its balance sheet.

Financial Position (Alpha Spread)

Interest Coverage (Alpha Spread)

Solvency Ratios (Alpha Spread)

Valuation

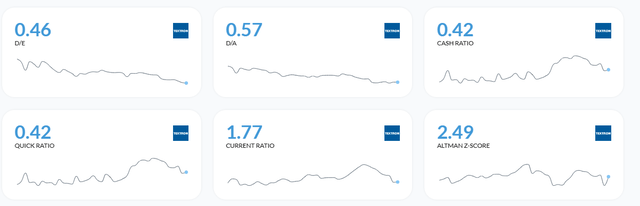

To find an accurate fair value for Textron, I must calculate a fair discount rate using the firm’s Cost of Equity and WACC. First off, I was able to find the Cost of Equity for Textron to be 8.29% by using a discount rate of 3.84% which corresponds with the current 10-year treasury yield.

Cost of Equity (Created by author using Alpha Spread)

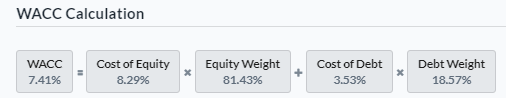

Now, assuming the previous calculation, I was able to compute Textron’s WACC to be 7.41% which is below the industry average of 10.59%.

WACC Calculation (Created by author using Alpha Spread)

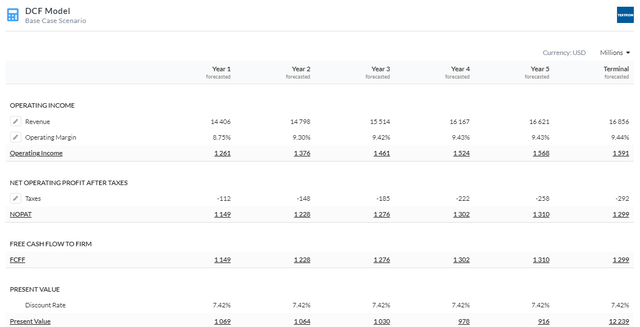

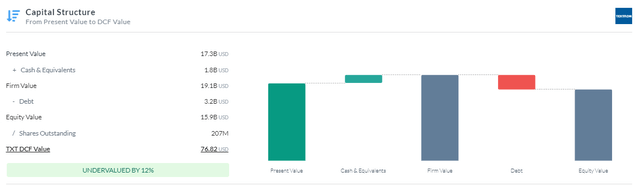

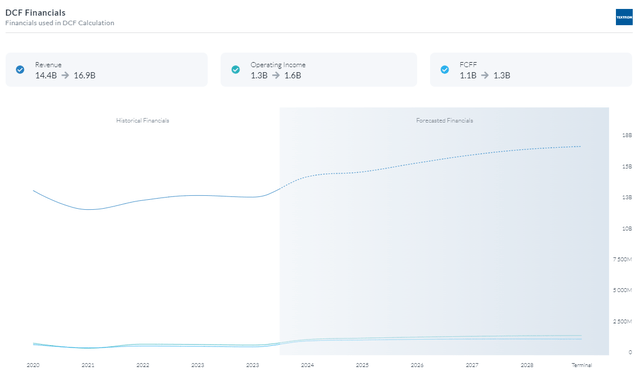

Now that I have calculated an appropriate discount rate, I can now find an accurate fair value for Textron using a 5-year Firm Model DCF without CapEX. Using a 7.42% discount rate, Textron is currently undervalued by 12% with a fair value of $76.82. I also assumed revenues and margins will grow in line with expectations, which seems reasonable within the short term.

5Y Firm Model DCF Without CapEX (Created by author using Alpha Spread)

Capital Structure (Created by author using Alpha Spread)

DCF Financials (Created by author using Alpha Spread)

Strategic Acquisitions Resulting in Compounding Growth

To increase the number of firms in its portfolio and accomplish its strategic goals, Textron has implemented a targeted acquisition approach. Textron seeks out acquisitions that complement its core competencies and add value through synergies, market diversity, and expansion possibilities.

The 2014 acquisition of Beechcraft Corporation for $1.4 billion by Textron is one significant instance of the company’s acquisition strategy. Known for its iconic Beechcraft King Air and T-6 Texan II trainer aircraft, Beechcraft was a reputable producer of general aviation and military aircraft. As a result of this purchase, Textron strengthened its presence in the aviation sector and increased the variety of general and military aviation aircraft available through this acquisition.

The purchase of Beechcraft provided Textron with access to new market niches in the aviation sector, expanding its clientele and revenue sources. By combining Beechcraft’s goods with Textron’s already established Cessna and Bell aircraft lines, the business was able to provide a wide range of aviation options. By relying less on solitary items and supply chains as a result of this improvement in product offers, the company will be able to diversify its income streams further and provide more stable cash flows.

Second, the acquisition significantly improved operating and manufacturing efficiencies. The corporation might streamline production procedures and cut costs by combining Beechcraft’s production facilities and supply chain with Textron’s current operations. Additionally, Beechcraft customers had access to a greater selection of service options thanks to Textron’s extensive global distribution and support network, which increased customer satisfaction and loyalty. Since minor improvements will eventually lead to significant changes due to output variance from expectations, the firm will be better able to use leverage or safeguard its core business as a result of the cost reduction. This will increase margins, which will increase cash flow and create compounding growth over time.

Third, Textron’s foothold in the military aircraft market was increased with the acquisition of Beechcraft. Beechcraft’s T-6 Texan II trainer plane, which saw widespread deployment by the U.S. Air Force and other armed forces, brought Textron significant contracts and long-term revenue potential in the defense sector.

I believe that such acquisitions in the future will create great shareholder value as the company has demonstrated its ability to evaluate potential acquisitions and capitalize upon these opportunities to foster growth.

Beechcraft Plane (Textron)

Risks

Aerospace Industry Risks: Aerospace industry-specific hazards are present in Textron’s divisions, notably Textron Aviation and Bell. Regulations being altered, geopolitical concerns impacting defense spending, and delays in government contracts are a few of them.

Supply Chain Disruptions: To produce its goods, Textron uses a convoluted supply chain. Any interruptions, such as a lack of components or raw materials, could affect production schedules and raise prices.

Conclusion

To summarize, I believe that Textron is currently a buy due to its solid guidance, strong balance sheet, the firm’s value creation through acquisitions, and undervaluation assuming my DCF figures.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.