Summary:

- TG Therapeutics beat first quarter revenue expectations and raised the full-year revenue guidance by $40 million at the mid-point.

- Work on the subcutaneous version of Briumvi continues and could represent the next step for increased long-term growth expectations.

- TG plans to start another clinical trial of Briumvi in a second autoimmune disease and the trial of azer-cel is on track to start this year as well.

- The first quarter results and the improved outlook leave less room for doubt about Briumvi’s growth trajectory.

Klaus Vedfelt

Shares of TG Therapeutics (NASDAQ:TGTX) rallied after the company beat first quarter revenue expectations and increased the full-year revenue guidance range by $40 million at the mid-point. The results point to clearly improving demand for Briumvi and the improved outlook means there is less room for doubt about Briumvi and its long-term sales potential.

Encouraging start to the year with strong sequential growth of new patient starts and net sales of Briumvi

TG exceeded analyst expectations and its own guidance range in the first quarter:

- Total revenues were $63.4 million, and this was well ahead of the $54.6 million analyst consensus.

- Briumvi net sales were $50.5 million and were ahead of the company’s $41-46 million guidance range, although management did say on the Q4 2023 earnings call in late February that sales were trending near the top of the range and that if these trends persist through the end of March that Briumvi sales could exceed the high end of the range.

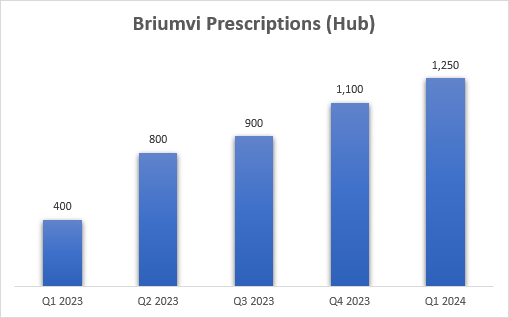

The strong sequential growth was achieved despite the usual seasonal headwinds at the start of the year such as insurance changes, copay resets, and higher discounts compared to the fourth quarter, and the company generated more than 1,250 new patient starts during the quarter, a greater than 25% sequential increase, although my math says the increase was slightly below 15% based on the quarterly and cumulative numbers provided in each of the previous five quarters.

TG Therapeutics earnings reports

As a reminder, the new patient starts TG reports are only for patients that go through its patient hub and there are between 10% and 20% of multiple sclerosis patients that get prescribed Briumvi outside the hub. Based on the estimate of approximately 40,000 patients starting CD20 antibodies each year in the United States, TG’s new to class market share has exceeded 12% in the first quarter, and it could be as high as 14-15% if patients outside TG’s hub are included.

For the second quarter, TG expects Briumvi net sales to rise nearly 30% sequentially to $65 million.

Based on the strong year-to-date performance, TG increased the full-year net sales guidance range for Briumvi from $220-260 million to $270-290 million, or $40 million at the mid-point of the range. Management also noted on the earnings call that the guidance was increased based on the strong year-to-date performance and not the recent Veterans Affairs (‘VA’) contract win with a maximum value of approximately $37 million per year. This contract will go into effect in June and will ramp slowly. This was a nice win for the company, but I do not expect a material impact on Briumvi’s growth trajectory.

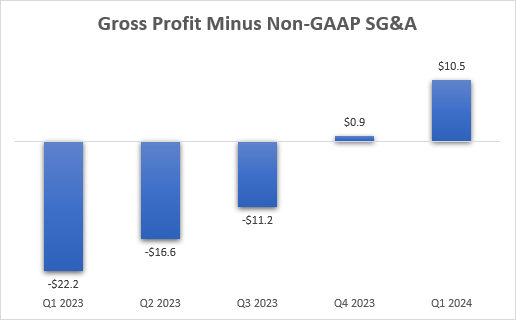

With the strong performance in the last two quarters and the improved full-year outlook, there is now far less room for doubt about Briumvi’s commercial success or growth potential. The company has been gradually ramping up investments, and it has expanded the sales force, and the efforts are starting to pay off. Briumvi is already a profitable product for TG as gross profit (only on Briumvi and excluding milestone payments from partner Neuraxpharm) minus SG&A expenses has already reached $10 million in the first quarter (even though not all of SG&A is spent on Briumvi)

TG Therapeutics earnings reports, author’s calculations

And TG is not far from reaching cash flow breakeven and quarterly profitability. Based on the 2024 expense guidance of approximately $250 million, I would expect the company to become cash flow positive when Briumvi net sales exceed $75 million a quarter and this could happen as soon as Q3 2024, and I expect TG to become profitable on an ongoing basis in Q4 of this year. These estimates exclude royalties from partner Neuraxpharm, but I am still anticipating very modest ex-U.S. contribution in the next few quarters, as it will take time for Neuraxpharm to secure reimbursement and show sales growth in its territories.

Improved convenience is the next important step for Briumvi

The work continues on the subcutaneous version of Briumvi which could provide a step-up in long-term growth expectations. CEO Weiss talked about the efforts on the earnings call and said the first patients in the bioequivalence study are expected to be dosed in the following months.

I think it is important to frame expectations here on administration frequency. The lowest bar should be very convenient monthly dosing with an autoinjector pen that will make Briumvi comparable to Novartis’ (NVS) Kesimpta. When asked about this possibility and whether such an opportunity is worth pursuing, Weiss said they would still push forward with subcutaneous Briumvi, but that this scenario does not seem likely.

Investors seem afraid and bears emboldened by Roche’s (OTCQX:RHHBY) subcutaneously administered Ocrevus, as it can be dosed every six months. But this is not nearly as patient friendly as once monthly self-administered Kesimpta which takes less than a minute to take with an autoinjector. The subcutaneous Ocrevus will need to be administered by a healthcare provider, and it takes 10 minutes to administer the large-volume 920mg dose of Ocrevus.

Roche is working on a self-administered version of subcutaneous Ocrevus, but this is a longer-term project that will take time, and it will not change the volume of the injection, the dose of Ocrevus, or the time it takes to administer it. I believe the easy-to-administer Kesimpta is still more convenient than the soon-to-be-available HCP-administered or a self-administered Ocrevus in a few years.

The maintenance dose of Briumvi is 450mg every six months, and I do not believe it can fit into a single subcutaneous injection that is convenient and easy to administer. This usually requires a volume of 2 milliliters, and the best I see biopharma companies can fit into that is approximately 300mg. This either means two injections are required for administration, or, more likely, a lower dose of Briumvi every three months.

My base and bullish case for administration frequency is three months, and the bearish but still acceptable case is once monthly administration.

Convenience is by no means the ultimate measure of success for this drug class. I still expect TG to take 20% global patient share in the following years with the IV-administered Briumvi and I do not anticipate dosing frequency of the potential subcutaneous version to matter as much. In the meantime, the upcoming battle between Kesimpta and the subcutaneous Ocrevus, likely starting in 2025, and the likely continued growth of IV Briumvi should show that subcutaneous Ocrevus should not be feared.

What matters more is the efficacy of these drugs, as well as safety. Briumvi is best-positioned on the efficacy side with the lowest absolute efficacy numbers (lower is better) with annualized relapse rates (‘ARR’) below 0.10 in both phase 3 trials. And both Kesimpta and Briumvi have a safety advantage over Ocrevus as neither have a warning for increased risk of breast cancer in their labels, and Ocrevus does.

No time to waste waiting for a buyout – new pipeline projects starting this year

A buyout is always a consideration and one of the potential reasons to hold a stock like TG. But the company cannot just sit and wait for buyers to line up and make offers. The pipeline behind relapsing forms of multiple sclerosis is finally emerging.

The first clinical trial of Briumvi outside of multiple sclerosis will start later this year. The indication is yet to be disclosed, but CEO Weiss said they are looking at rheumatoid arthritis and systemic lupus erythematosus.

The first clinical trial of the recently in-licensed azer-cel is expected to start in the second half of the year in an undisclosed autoimmune indication. TG received no credit for this in-licensing (and it should not have received it), and it remains to be seen what an off-the-shelf cell therapy can do for patients with severe autoimmune disorders.

Yes, these projects will cost money, but the risk-reward looks great to me as I do not believe any of these projects are given credit by the market. The potential upside drivers have multiplied in less than a year – from a subcutaneous Briumvi to additional indications for Briumvi and azer-cel for rare autoimmune diseases. None of these medium- to long-term growth drivers were on investors’ radars last year.

Risks

There are always risks to the investment thesis, but I believe some of them have been reduced in the last two quarters:

- Launch execution risk. This risk can never be eliminated, but Briumvi is increasingly looking like a commercial success.

- Increased competition. The potential launch of subcutaneous Ocrevus in late 2024 could put pressure on Briumvi in 2025 and beyond as patients and healthcare providers focus on shorter administration time.

- TG failing to bring a subcutaneous version of Briumvi to market or bringing a suboptimal version to market. I still expect the IV-administered Briumvi to be sufficient for significant shareholder value creation from current levels, but the upside could be more significant with a subcutaneous version, and it will be easier for TG to defend its market position in the future with a subcutaneous Briumvi.

- Financial risks have been greatly reduced, and I do not expect TG to need to raise cash again for commercial operations or pipeline investments, and additional dilution, in my view, is only likely if the company uses equity for business development.

- I do not expect any other treatment modality to seriously challenge the anti-CD20 antibody class in the next 5–10 years, but I do expect new treatment options for multiple sclerosis to emerge in the following years that could slow the growth trajectory of Briumvi and the anti-CD20 antibody class.

Overall, there are still risks, but I believe the risk-reward ratio has improved from late July 2023 (the time I added the stock to the portfolio), especially with the stock trading almost 20% lower.

Conclusion

I continue to see TG as very well positioned to deliver long-term shareholder value and believe that the risk-reward ratio has further improved in the last two quarters.

Briumvi is off to a strong start in 2024 with first quarter net sales exceeding the high end of the company’s guidance range and the full-year guidance increasing by $40 million at the mid-point of the range.

The pipeline projects are on track, with three trial initiations expected in the following months.

With a high likelihood of reaching cash flow breakeven in the third quarter and profitability in the fourth quarter, I would expect TG to make further investments to improve Briumvi’s position in the multiple sclerosis market and to potentially further expand its clinical pipeline through business development.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.