Summary:

- TG Therapeutics’ Briumvi shows strong revenue growth, with Q2 2024 revenue up 350% YoY, leading to an upgraded full-year guidance of $290-$300 million.

- Expansion into CAR-T therapy for autoimmune diseases is speculative but aligns with TG’s expertise, balancing high risk with potential high returns.

- TG’s financial position is bolstered by a $250 million credit facility, supporting debt refinancing and a $100 million share buyback.

- Given Briumvi’s success and potential long-term exclusivity, TG Therapeutics presents a buy case despite competitive challenges.

Ben Garvin/DigitalVision via Getty Images

Introduction

TG Therapeutics’ (NASDAQ:TGTX) stock is up 120% following my rating upgrade and “hold” recommendation a little over a year ago. My last analysis in January, however, expressed concerns over what I perceived to be slowing growth for their lead asset, Briumvi (ublituximab), a monoclonal antibody therapy for various types of adult multiple sclerosis (MS). Three quarters have passed since my last look, so I figure it’s a good time to reassess.

| Date | Milestone | Details |

|---|---|---|

| Q4 2024 | Completion of Phase 1 Study for Subcutaneous Ublituximab | Expected completion of ongoing Phase 1 study |

| Azer-cel IND Update | Continued progress on azer-cel (allogeneic CD19 CAR-T) clinical trial for progressive MS | |

| H1 2025 | Presentation of ENHANCE Phase 3b CD20 Switch Trial Data | Additional data to be presented from the ENHANCE study on Briumvi’s efficacy and safety |

| Initiation of Phase 2/3 Trials for Briumvi in Additional Autoimmune Diseases | Expanding Briumvi’s application to other autoimmune diseases beyond MS | |

| Topline Phase 1 Data for Subcutaneous Ublituximab | Positive results could accelerate development to pivotal trial | |

| Throughout 2025 | Market Expansion Activities | Continuing efforts to expand Briumvi’s market presence, including potential new regulatory approvals and partnerships |

| Patent Extensions and Intellectual Property Enhancements | Possible updates on patent protections and IP enhancements for Briumvi |

TG Therapeutics: Briumvi’s Steady Climb Amidst MS Market Hurdles

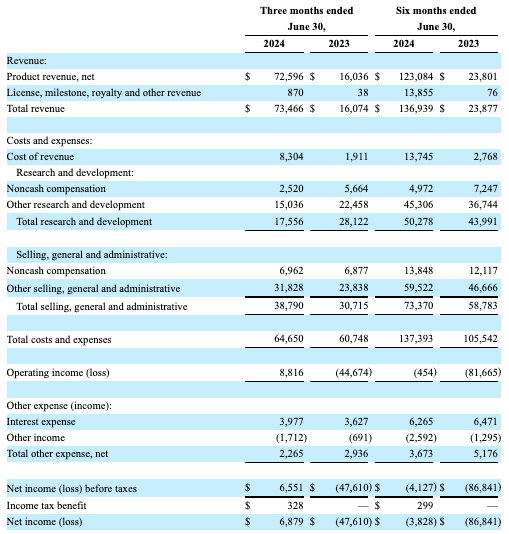

Briumvi’s net product revenue continues to grow, contradicting my previous concerns over potential deceleration in revenue growth. Q2 2024 revenue reached $72.6 million (beating estimates by $7.57 million), marking a year-over-year increase of over 350%. TG raised its full-year 2024 guidance for Briumvi to $290-$300 million, up from the previous range of $270-290 million. Impressively, TG’s OpEx hasn’t changed much.

TG Therapeutics

Subsequently, the company reported a net income of $6.879 million (EPS of $0.04, beating estimates by $0.09), representing a significant turnaround from the loss reported in the same period last year. TG reported over 5,850 new patient prescriptions since its launch, but the market is well-served, with a range of treatment options available for different stages and forms of the disease.

TG continues its efforts towards expanding their pipeline. The company initiated a Phase 1 clinical trial for a subcutaneous formulation of ublituximab. This prospect is a bit behind Novartis’ (NVS) Kesimpta, a subcutaneous formulation of an anti-CD20 monoclonal antibody that is administered once monthly after initial loading doses. Kesimpta has gained popularity due to its convenience compared to intravenous options like TG’s Briumvi. Other subcutaneous drugs include Copaxone and Plegridy, although these require more frequent dosing than Kesimpta. TG also received FDA clearance for an investigational new drug [IND] application for azer-cel, a CD19 CAR-T therapy for progressive MS. TG is not the first to trial CAR-T therapy for an autoimmune condition. Kyverna Therapeutics (KYTX) is also advancing a CD19 CAR-T therapy, KYV-101, for B-cell-driven autoimmune diseases like systemic lupus erythematosus and MS (Phase 2). Other biotechs exploring CAR-T or allogenic T-cell therapies for autoimmune conditions include Autolus Therapeutics (AUTL) and Atara Biotherapeutics (ATRA). At this moment, CAR-T therapies are approved in oncology conditions (e.g., Carvykti, Tecartus, and Yescarta). Although CAR-T therapy’s role in autoimmune diseases is certainly worth investigating, it remains speculative.

Financial Health

As of June 30, TG reported having $82.91 million in cash and cash equivalents. Short-term investments totaled $134.342 million. Total current assets were $389.115 million, while total current liabilities were $108.664 million. TG has a non-current “loan payable” of $102.537 million.

In August, TG announced a $250 million debt financing agreement with HealthCare Royalty and Blue Owl. There is also an option for an additional $100 million facility that can be utilized at the mutual discretion of TG and the lenders. The company also initiated a $100 million stock buyback program, reducing the number of outstanding shares and potentially increasing earnings per share. This, to me, signals that management is confident in their cash flow generation.

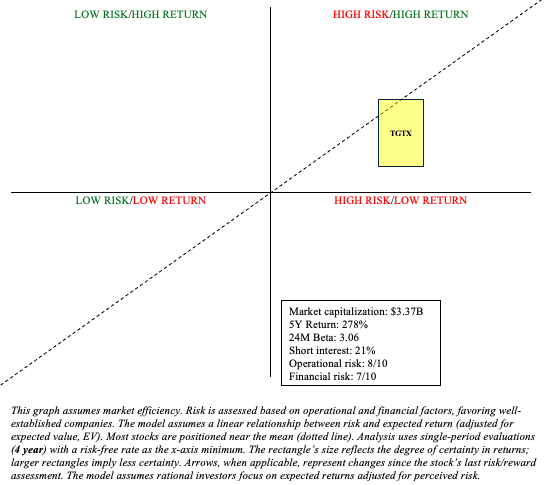

TGTX Stock: Risk/Reward Analysis and Investment Recommendation

Briumvi is making an impact on the MS market despite fierce competition. Despite being approved in December 2022, Briumvi could very well exceed $300 million in 2024 revenue. This is an impressive feat. Being a biologic, Briumvi has exclusivity through 2035 and possibly for years after, depending on the strength of its patents. It’s becoming apparent that Briumvi could be a blockbuster. With that being said, let’s also be mindful of Briumvi’s hurdles. It competes directly with well-established anti-CD20 therapies like Ocrevus (OTCQX:RHHBY) and Kesimpta. Although TGTX enthusiasts disagree, Briumvi, in my view, lacks convincing differentiation from its competition (e.g., safety, efficacy, convenience). Prominent treatment recommendations (i.e., UpToDate) do not differentiate between monoclonal antibodies. They (e.g., natalizumab, ocrelizumab, rituximab, ofatumumab, alemtuzumab, and ublituximab) are all treated as equals. It is, largely, a provider/patient decision, and this is heavily influenced by marketing. Also bear in mind, as a newer anti-CD20, long-term safety data for Briumvi is still being accumulated. If adverse events become more apparent over time, it could negatively impact Briumvi’s market growth.

Author

Expanding into speculative areas, such as CAR-T therapy for autoimmune diseases, has both advantages and disadvantages. It makes sense for TG. It remains within their area of expertise (e.g., autoimmune, B cells). On the flip side, it increases R&D investments that, given the nature of drug development, are unlikely to yield returns. So, despite maturing into a profitable commercial biotechnology company, they are still heavily reliant on a single product in a market flooded with nearly identical treatments. Given the prospect of high returns amid high risks, TGTX works best within a barbell portfolio. Due to Briumvi’s impressive early performance, I’m willing to upgrade TGTX to “buy.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.