Summary:

- Capital One Financial shares are trading at a cheap valuation of less than 10x earnings.

- The company’s credit card loan balances and delinquency rates have returned to pre-pandemic levels, indicating a “great normalization” of credit activity.

- Despite challenges such as declining net interest margins, Capital One has managed through crises well and is expected to sustain its earnings and increase share repurchases.

Win McNamee/Getty Images News

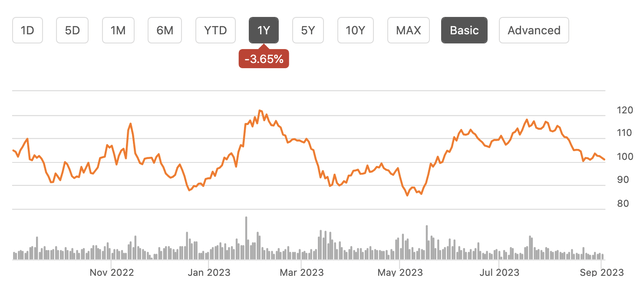

Trading at less than 10x earnings, Capital One Financial (NYSE:COF) shares do appear to merit deeper consideration. That said given its cheap valuation, last year, I had argued shares should trade over $120, which has not materialized with shares roughly flat since that recommendation. It should be noted that while shares are down 4% over the past year, that has outperformed banks more broadly, with the SPDR S&P Bank ETF (KBE) down 17% during the period. Clearly the regional banking crisis earlier this year limited the stock’s upside, but re-evaluating the company today, I believe COF is a value opportunity, not a value trap.

Seeking Alpha

I expect the company to earn about $12 this year, lower than originally expected, but still leaving the stock with an 8.5x earnings multiple. Capital One has seen further normalization in credits losses as expected, but also pressure on net interest margins to a degree that was unexpected. Still, in the company’s second quarter, it earned $3.52 even as it faced these headwinds. We will look at these issues separately.

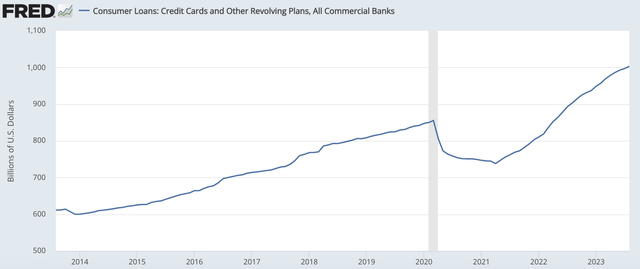

First on the credit front, Capital One is a large credit card lender, and credit card lending can be a cyclical business. As the economic cycle has aged, there has been some concern that losses could increase, particularly if the US were to enter a recession. Credit card balances have also attracted significant media attention, having passed the $1 trillion level, leading to worries that consumers are borrowing too much.

St. Louis Federal Reserve

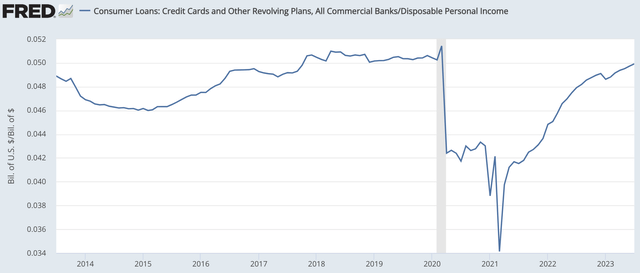

However, I think it is crucial to remember that while credit card balances are rising to new highs that wages have also risen substantially over the past four years. Higher wages mean people can support higher loan balances, all else equal. That is why I like to look at loan balances relative to disposable income to see if consumers are borrowing more or less compared to what they earn. Using this metrics, we are essentially right back to where we were in 2018-2019, a time when the economy was solid.

St. Louis Federal Reserve

This supports my view that what we have seen is a “great normalization” of credit activity. COVID and government stimulus led to significant deleveraging and after nearly four years, we have essentially returned to exactly where we were, which was a pretty healthy place. Accordingly, delinquencies and defaults should naturally rise back to 2019 levels—this is not cause for concern of ever-spiraling increases, but rather a return to more normal levels.

In fact, that is what we have seen in Capital One’s (and many other banks’) financial results. Credit card loan balances have risen 18% over the past year, in keeping with the overall rise in credit card debt. Credit card charge offs were 4.41% in Q2, up from 4.06% in Q1 and below 3% last year. 3.77% of loans are 30+ days delinquent. If we look back to Q4 2019, credit card charge off were 4.31% with 3.89% 30+ days delinquent. It is actually striking just how similar these levels are. This is why I believe we are largely through the increase in charge-offs, delinquencies, and reserving, absent a recession.

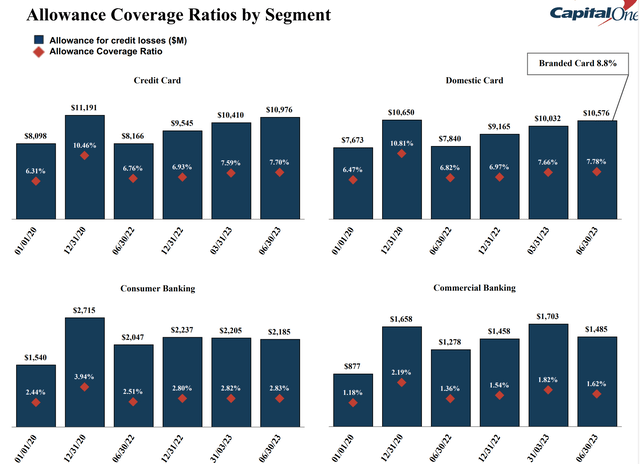

One area of difference is loan loss allowances. Back in 2019, allowances were 2.71% of loans. Today, COF has $14.7 billion in reserves, or 4.7% of loans (from 4.64% last quarter). Note that accounting standards changed in 2020 with the implementation of CECL, which forced banks to set reserves based on expected performance over an entire economic cycle, not just based on currently probable defaults. This is why reserves are structurally higher than in the past, and since banks are factoring in some recession risk to their reserves, reserves should rise less during downturns than in the past.

As you can in the chart below, COF has been steadily increasing its reserves as the economic cycle matures. Indeed, reserves are higher than Jan. 1, 2020 levels (when CECL took effect) across all segments. Reserves are now higher than delinquency rates, meaning that the vast majority of reserve building, which reduces net income, is likely complete.

Capital One

As the economic cycle ages, I expected the company to conservatively bolster reserves, and so that is not a surprise. What has been a surprise relative to expectations last year is that COF’s net interest margin (NIM) has been declining this year. Typically, NIM expands as the Fed raises rates, but the regional banking scare has forced banks to increase deposit yields. NIM was 6.48% last quarter, down 12bp sequentially.

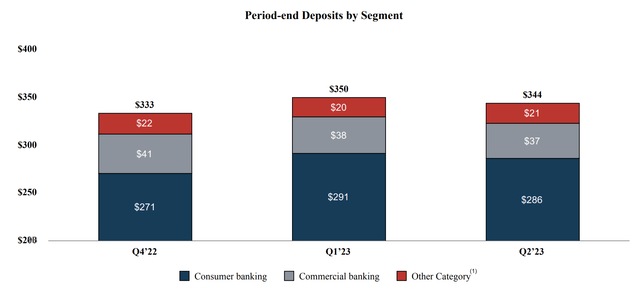

After the failure of Silicon Valley Bank, there was significant movement of deposits around the banking system. COF actually was a net beneficiary of this, with deposits rising $17 billion in Q1 and then moderating back down $6 billion in Q2. 79% of its deposits are insured, helping to insulate it from the worst fears.

Capital One

Additionally, given the uncertainty around deposit flight, it looks like COF took proactive steps to protect and grow its deposit franchise via aggressive pricing. As a result, interest-bearing deposits are up $14 billion vs. an $11 billion total deposit increase this year. The average deposit interest rate was 2.46% in Q2, from 1.42% at year-end. Whereas Capital One had been passing about 1/3 of Fed rate hikes to depositors prior to this year, in 2023, it has raised deposit rates faster than the 76bp increase in the effective Fed funds rate in the first half of the year.

While deposit costs rose 104bp, loan yields are up just 34bp to 7.65%, driving the contraction in NIM. In hindsight, COF may have increased deposit yields more than it needed to, driving the surge in Q1 deposits that it has since let moderate. However, in a crisis, it is better to attract excess liquidity than err in the other direction. Just as COF has conservatively been building reserves, it conservatively managed deposits. While this is weighing on NIM, given the risk inherent in credit card lending, I think managing other aspects of the business conservatively is the prudent approach.

So, H1 2023 was a rare example of higher rates compressing net interest margins as COF fought to protect and indeed increase deposit market share. With the situation now normalizing, COF can re-examine deposit pricing, and over the next year as higher-interest rate certificate of deposits mature, I would not be surprised to see deposit costs moderate somewhat and allow NIM to recover.

Even as it takes up reserves and added to deposits, Capital One has been increasing its capital position, with Tier common equity of 12.7%, up from 12.1% in Q4 2022, as the company retained about $950 million in earnings this year to prepare for the rise in its stress capital buffer to 4.8% from 3.1%. Still, the company was able to restart its repurchases in Q2, buying back $150 million in stock. In 2019, with lower reserves prior to the accounting change, capital was also slightly lower than current levels at 12.2%.

With this capital build having occurred ahead of its increased buffer, COF should be able to retain less of its earnings and use that capital to accelerate its buyback pace, on top of its $0.60 quarterly dividend.

Overall, uncertainties from the banking crisis and increased funding costs have been headwinds for Capital One’s stock, but it has managed through these crises well, which is likely why shares have outperformed banks overall. With NIM pressures likely past their peak and reserve builds in an adequate position, I believe COF will be able to sustain its ~$3.50 in earnings run rate over the next year, getting towards $12-13 in 2023 EPS and $14-15 in 2024 EPS.

This valuation combined with the prospect for higher share repurchases next year make COF a compelling investment opportunity. Ultimately, I continue to see the stock trading well above $120 and towards $150 (or 10x earnings) as the underlying earnings power of its franchise becomes apparent. The banking crisis may have delayed the upside in COF, but it has not diminished it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.