Summary:

- Advertising may become the company’s primary growth engine over the next several years.

- Netflix produced solid double-digit revenue growth and profitability in its third quarter 2024 results.

- Although the stock’s valuation is on the higher end, its long-term revenue growth opportunity in the global streaming market could justify an investment.

JHVEPhoto

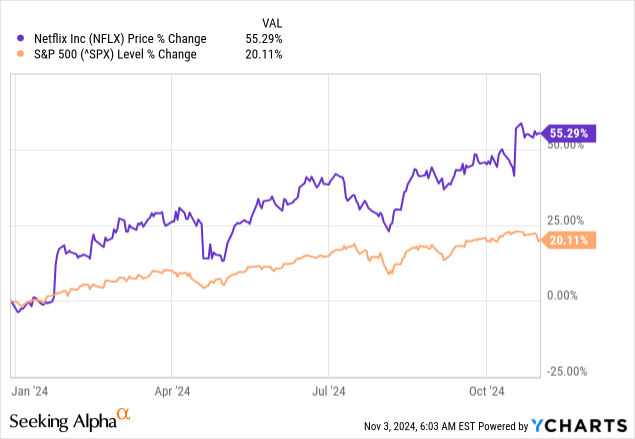

In retrospect, investors who chose to invest in Netflix (NFLX) when it was at peak pessimism after a substantial loss of subscribers in 2022 made a wise move. The company’s shift in strategy to establishing advertising tiers and eliminating password sharing has restored revenue growth and improved profitability. After consistently beating analysts’ revenue and earnings-per-share (“EPS”) estimates every quarter in 2024, Netflix is up 55.29% compared to the S&P 500’s (SPX) 20.11% rise, as of the November 1 closing price.

Although the U.S. market may have reached saturation, Netflix has a vast global opportunity to monetize. Fortune Business Insights forecasts that the global streaming market will grow from $674.25 billion at the end of 2024 at a compound annual growth rate of 18.7% to reach $2.66 trillion by the end of 2032. So, the company has plenty of room for membership and revenue growth internationally. Additionally, the company has several growth initiatives that it has yet to monetize fully in the U.S., including mobile gaming and expanding its advertising business. Last, one of the biggest bearish arguments against the company until around 2020 was that it burned too much cash and borrowed a lot of money to fund the creation of original content or licensing content from third parties. However, since the middle of 2022, the company has been solidly FCF-positive, giving it more flexibility to fund new content without raising capital.

This article will discuss how advertising should become Netflix’s primary growth driver. It will also examine the company’s fundamentals after the third quarter of 2024 earnings report, valuation, risk, and why Netflix is a buy.

Advertising is a growth engine

Netflix launched advertising tiers several years ago in response to slowing revenue growth and membership shrinkage. The U.S. market had become saturated with subscription services, giving consumers too many expensive viewing options, which some started referring to as subscription fatigue. Additionally, during an era of high inflation and rising interest rates, which turned consumers into penny pinchers, Netflix lost its ability to raise prices without adverse repercussions. In 2022, Netflix lost subscribers for the first time in a decade.

The company launched its lowest-priced ad-supported plan, Basic with Ads, in November 2022 in Australia, Brazil, Canada, France, Germany, Italy, Japan, Korea, Mexico, Spain, the UK, and the US. The ad tier appealed to price-sensitive consumers. One year later, the ad-supported tier reached 15 million global monthly active users, and advertising became one of the company’s possible future primary growth drivers. Co-chief executive officer (“CEO”) Greg Peters said in the company’s third quarter 2024 earnings call:

We see ads revenue growth on a good trajectory. We’ve got healthy CPMs [Cost Per Mille] at the high end of that premium CTV [Connected Television] ad market. That’s where we want to be positioned. And while ads won’t be a primary driver of revenue in 2025, because we’re still scaling that audience and that inventory faster than our ability to monetize it, we definitely see already the momentum growth in the monetization and our opportunity to close that gap. So for 2025, we expect that ad revenue will roughly double year-over-year, albeit off a small base, but just as a confidence point in that, this year’s U.S. upfront, we’re seeing 150% – over 150% increase in our ads sales commitments.

CEO Peters also mentioned on the earnings call that the company will likely launch a first-party ad server in Canada by the end of 2024, followed by the rest of its ad markets in 2025, boosting its advertising revenue growth potential. Netflix should benefit significantly from first-party ad servers because it can use first-party data on viewers, including viewing habits, demographics, and preferences, to create better and more personalized ads. The goal is to gain higher CPMs or cost per thousand ad impressions from advertisers. Using a fictional example, let’s say that Netflix gets $8 for every thousand ad impressions today; a first-party server may let it get $10 for every thousand impressions. A first-party server also has additional benefits, including reducing costs by eliminating third-party ad servers and increasing the profitability of its advertising business.

In May 2024, Netflix announced at its second Upfront presentation that by the end of 2025, it will roll out an in-house advertising technology platform. It also discussed partnerships with some of the best programmatic ad platforms. The company stated, “This summer, Netflix will also expand its buying capabilities to include The Trade Desk (TTD), Google’s (GOOG) (GOOGL) Display & Video 360, and Magnite (MGNI) who will join Microsoft (MSFT) as the main programmatic partners for advertisers.” The Trade Desk may be the largest and most dominant independent demand-side platform, and Magnite might be the largest independent platform on the supply side. Microsoft and Google are also major heavyweights that it has on board. The Trade Desk CEO Jeff Green said the following on the company’s second-quarter earnings call:

First of all, let me just say I’m a big fan of the leadership at Netflix and believe that they are very rational players, and I love that they, in some ways, come with a very objective and open mind as a result of not being a legacy media company of not having ever been in traditional media, but instead, of course, always been essentially a digital player. As it relates to the timelines, we have begun some testing. All we’re doing really is putting — we’re putting real money and real campaigns on it, but it’s just testing the pipes, nothing that has scaled. I think we’ll start seeing that ramp up a little bit this year. But really it’s in the next few years that I think we’ll see it ramp up and really start to contribute to us and to them, but we’ll spend the rest of this year sort of proving it out. And I think next year will be a very important year for the future of both of us and for the future of our partnership.

The partnerships with these companies should broaden the range of advertisers that Netflix can access, enhance its ability to personalize ads beyond its first-party data, and help it better measure ad performance. Investors can expect that advertising will evolve into one of the company’s primary growth drivers over the next several years.

Company fundamentals

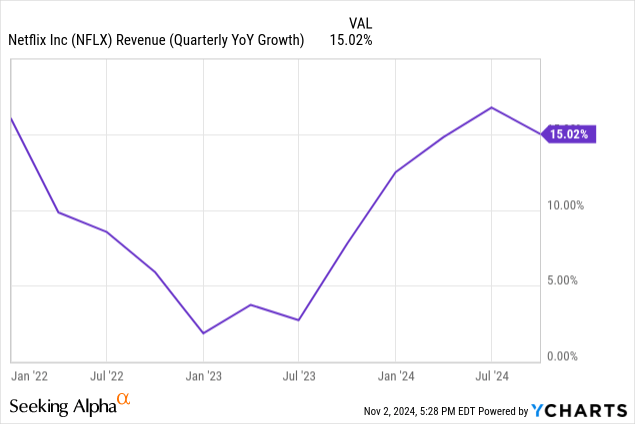

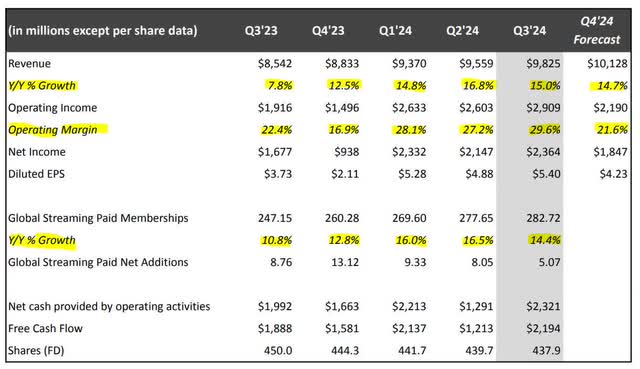

Netflix reported third-quarter revenue of $9.83 billion, beating analysts’ estimates by $57.65M. The good news is that if it hits management’s fourth-quarter forecast of $10.12 billion, it will generate solid mid-teens revenue growth for the fourth straight quarter. The market has far more positive sentiment towards the company than when it produced single-digit revenue growth in the first half of 2023.

One reason that Netflix’s stock has outperformed year-to-date is that the company has produced accelerating revenue growth (“ARG”) between the third quarter of 2023 and the second quarter of this year. ARG often attracts momentum investors, who can sometimes rapidly drive stock prices higher. However, the company’s revenue growth may have peaked in the second quarter of 2024 at 16.8%. So, although the stock rally may continue, momentum investors may become less enthusiastic about the company, and the stock price could become more volatile moving forward.

Netflix Third Quarter 2024 Shareholder Letter

Similarly, membership growth accelerated from the third quarter of 2023 and potentially peaked in the second quarter of 2024 at 16.5% year-over-year growth. Netflix’s third-quarter 2024 membership growth decelerated to a still solid 14.4%. If membership growth rates decline too sharply, it could indicate that Netflix’s video content is losing popularity or that there are customer retention issues.

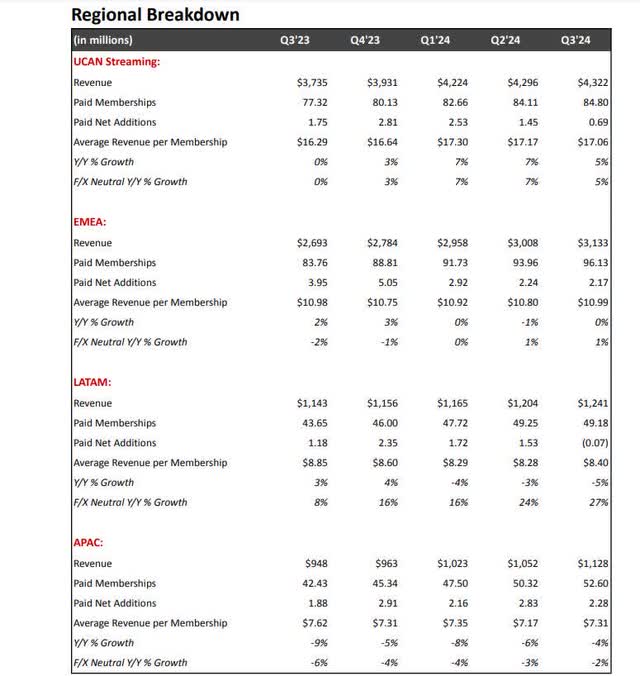

The fastest-growing region for memberships is APAC (Asia Pacific), at 23.96% year over year, and the slowest-growing is UCAN (U.S. and Canada), at 9.67%. The fastest third-quarter year-over-year revenue growth occurred in APAC, at around 19% year over year, and the slowest occurred in Latin America (LATAM), at 8.57%. EMEA stands for Europe, the Middle East, and Africa.

Netflix Third Quarter 2024 Shareholder Letter

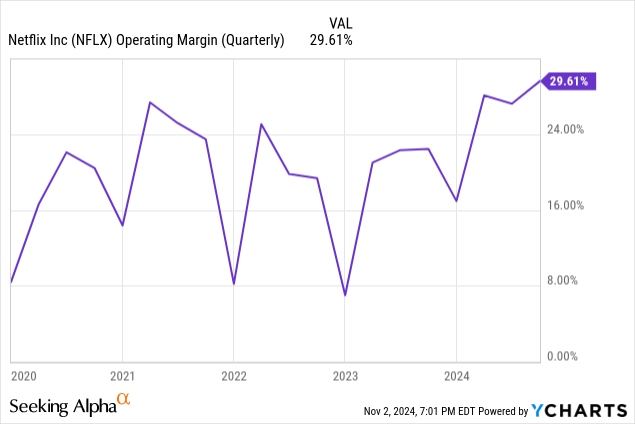

Netflix expanded its third quarter 2024 operating margins by 480 basis points over the previous year’s third quarter. The company indicated in its shareholder letter that it plans to invest more in its business in the near term, so investors shouldn’t expect outsized operating margin improvement to continue in 2025. However, management believes there is still a significant opportunity to improve operating margins in the long term.

The company grew GAAP (Generally Accepted Accounting Principles) diluted earnings-per-share by 44.77% over the previous year’s comparable quarter to $5.40, beating analysts’ estimates by $0.28. The company’s third quarter 2024 shareholder letter said the following about revenue and profits (emphasis added):

We’re pleased that we’ve reaccelerated our growth and, as we head into 2025, we expect to deliver solid revenue and profit growth by both improving our core series and film offering while investing in new growth initiatives like ads and gaming. For 2025, based on F/X rates as of 9/30/24, we forecast revenue of $43B-$44B, which would represent growth of 11%-13% off from our 2024 revenue guidance of $38.9B. We expect revenue growth to be driven by a healthy increase in paid memberships and ARM [Average Revenue Per Member].

Netflix’s levers to increase ARM include raising prices, expanding membership into territories with higher ARM, and adding premium services or higher-priced tiers. Its third-quarter shareholder letter outlines a few ways the company plans to raise ARM in the near term:

We’re also working to improve our monetization by refining our plans and pricing. Key is ensuring that we have a range of prices and plans to meet a variety of needs. Earlier this month, we increased prices in a few countries in EMEA plus Japan and starting tomorrow, we’ll increase prices in Spain and Italy. We phased out the Basic plan in the US and France this past quarter, and we’ll do the same in Brazil later in Q4.

By eliminating the Basic plan, Netflix forces viewers into higher paid tiers or the ad-supported tier, which should raise an ARM. Next, investors should monitor commentary surrounding engagement because it may give investors some idea of the popularity of Netflix’s content. The third-quarter shareholder letter stated the following about engagement (emphasis added):

Engagement on Netflix is healthy: around two hours a day per paid membership on average, despite the impact of paid sharing. As we’ve discussed before, paid sharing led to lower viewing on accounts that were shared, as fewer people were watching on them. In addition, when sharers bought their own subscriptions, much of that viewing was already reflected in hours viewed (impacting the trend in view hours per membership). When you isolate owner households (which excludes the impact of paid sharing), view hours for those owner households rose year over year in the first three quarters of 2024.

Rising engagement increases the likelihood that members will keep their subscriptions. Additionally, the higher the engagement, the more attractive Netflix’s platform becomes for advertisers and the higher CPMs the company can charge for advertisements.

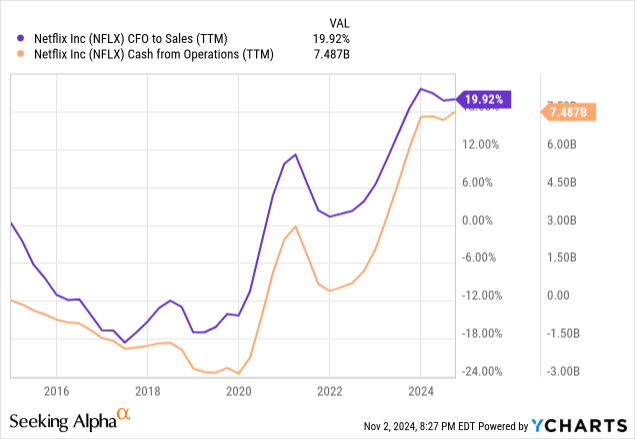

Netflix’s third quarter of 2024, trailing 12-month (“TTM”) cash flow from operations (“CFO”) to sales was 19.92%, which means that for every $1 sale, it produces $0.20 in cash. Its TTM CFO was $7.49 billion. Although the rise in CFO looks impressive, much of the increase came from the company spending much less on content in 2023 due to the writers’ strike. Netflix spent approximately $13 billion in 2023 on content. It should pay $17 billion on content in 2024 and possibly more in future years to remain competitive, so investors shouldn’t expect the same massive increases in CFO or operating margin in 2025. Seeking Analyst Curonian Research explains why in a recent article under the subhead, “The profit margins will likely decline next year.”

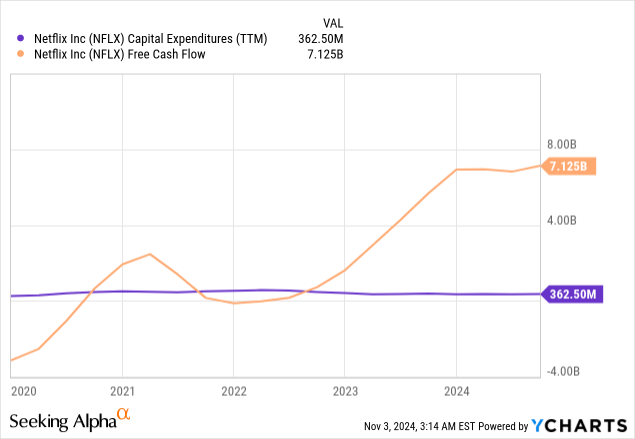

Netflix spends very little against its cash flow in capital expenditures, which were $362.50 million on a TTM basis in the third quarter, so most of its CFO turns into free cash flow (“FCF”). As the chart shows, its TTM FCF for the third quarter was $7.125 billion. The company used some of its cash flow to repurchase 2.6 million Netflix shares for $1.7 billion. It now has $3.1 billion remaining under its existing stock buyback authorization.

At the end of the third quarter, Netflix had $9.22 billion in cash and short-term investments. The company’s third-quarter shareholder letter stated the following about its debt:

We also raised $1.8B in our first investment-grade bond deal during Q3. As a result, our total debt increased to $16B from $14B in Q2, but net debt decreased from $7.4B in Q2 to $6.8B at the end of Q3. Proceeds from our bond offering will be used to pay down $1.8B in bonds that mature over the next 12 months.

Netflix’s debt-to-equity ratio is 0.70. Generally, the market considers a D/E below 1.0 less risky. Its net debt ($6.8 billion) to EBITDA TTM ($24.98 billion) ratio was 0.27, which means its operating profits can cover its net debt. Interest coverage is 14.05, which means the company’s operating income covered its third-quarter interest expense. Netflix has a solid financial position with enough flexibility to fund its growth initiatives, such as content production and advertising.

However, despite its impressive results, the stock has risen to the point where some have been concerned about its valuation despite the company’s excellent performance this year. So, let’s look at its valuation.

Valuation

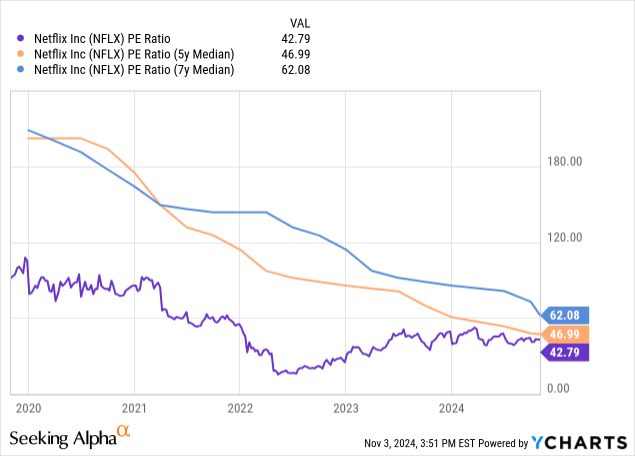

Netflix’s price-to-earnings (P/E) ratio is 43.10, below its five- and seven-year median, suggesting the market may undervalue the stock.

The company’s forward one-year price/earnings-to-growth (“PEG”) ratio is 1.59. Generally, investors will allow a growth stock’s PEG ratio to reach 2.0 before considering it overvalued. Therefore, the stock price would need to reach $949.70, about 26% above the November 1 closing price, before it reached a one-year forward PEG ratio of 2.0, and the market considered it overvalued.

Seeking Alpha

The following is Netflix’s reverse discounted cash flow (“DCF”), which I am using to determine what the November 1 closing price implies about the stock’s cash flow growth rate over the next ten years. This reverse DCF uses a terminal growth rate of 4% because the company should grow cash flow above the GDP (Gross Domestic Product) long-term growth average once it exceeds the forecast period. I use a discount rate of 8%, which is the opportunity cost of investing in Netflix, reflecting a low-risk level. This reverse DCF uses a levered FCF for the following analysis.

Netflix Reverse DCF

|

The third quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$7,125 |

| Terminal growth rate | 4% |

| Discount Rate | 8% |

| Years 1 -10 growth rate | 10.9% |

| Current Stock Price (October 8, 2024, closing price) | $760.08 |

| Terminal FCF value | $4.627 billion |

| Discounted Terminal value | $23.786 billion |

| FCF margin | 18.95% |

If it can maintain an average FCF margin of 18.95% over ten years, Netflix would need to maintain an annual revenue growth rate of 10.9% to justify the current stock price, which may be achievable if the company can expand its FCF margins. Netflix grew revenue at a 22.65% CAGR over the last ten years. However, its high revenue growth rate days are likely behind it. Assuming the company can grow revenue at 9% annually over the next ten years, the company would need to maintain an average FCF margin of 22% over the same period to justify the current price. Since I believe Netflix can achieve annual revenue growth of between 9% and 11% with FCF margins ranging between 19% to 22% over the next ten years, the market may fairly value the stock at the November 1 price. There is a potential upside to the stock price if it grows revenue or FCF margins beyond 9% and 22% over the next ten years, respectively.

Seeking Alpha’s quant rates Netflix’s valuation an F. The stock is currently at a level that some value investors would likely feel uncomfortable buying or holding.

Risks

One of Wall Street’s main worries about Netflix is that revenue growth will continue to decline, as one of the main reasons for ARG over the last year is that it received a boost from banning password sharing, which will likely vanish in 2025. If year-over-year revenue growth declines too much, the market may not sustain the company’s current valuation.

Each year, Netflix spends a lot to remain content king, which attracts and keeps subscribers. The company relies on its investment in content to pay off in popular shows. Suppose Netflix produces a lackluster slate of new shows; it could result in poor subscriber growth and increased churn. Investors would see less revenue growth, a shrinking operating margin, and reduced cash flow. Investors can quickly turn against content companies that fail to publish popular new content each year.

Netflix competes against studios like Disney (DIS), which has a large content vault filled with iconic franchises with global appeal, such as Marvel, Star Wars, Pixar, and Disney Animation. Meanwhile, Netflix had to start building up popular franchises from scratch, which took a lot of cash since only a small percentage of Netflix Originals became hit shows. A Bloomberg article claims, “For every hit [Netflix] TV show, there are more than 100 misses.” The company could be in trouble if the well runs dry in discovering popular content. The company could spend billions of dollars with little payoff in increased revenue.

An additional risk is that management has limited investors’ ability to see possible issues coming down the road by eliminating quarterly membership numbers and ARM reporting in the first quarter of 2025. Its engagement number will become one of the few ways investors can determine whether the company will have issues in the near future. Its first quarter 2024 shareholder letter stated (emphasis added):

As we’ve noted in previous letters, we’re focused on revenue and operating margin as our primary financial metrics — and engagement (i.e. time spent) as our best proxy for customer satisfaction. In our early days, when we had little revenue or profit, membership growth was a strong indicator of our future potential. But now we’re generating very substantial profit and free cash flow. We are also developing new revenue streams like advertising and our extra member feature, so memberships are just one component of our growth. In addition, as we’ve evolved our pricing and plans from a single to multiple tiers with different price points depending on the country, each incremental paid membership has a very different business impact. It’s why we stopped providing quarterly paid membership guidance in 2023 and, starting next year with our Q1’25 earnings, we will stop reporting quarterly membership numbers and ARM.

In my opinion, more information is better than less. Revenue and operating margins are also a backward-looking proxy for customer satisfaction. Engagement is an important metric, but membership growth and ARM give additional insights into the business. So, investors may remain unaware if Netflix is encountering problems until it shows up in loss of revenue growth, operating margin, and FCF.

Netflix is a buy

One reason that Netflix has diversified into advertising and gaming is to mitigate the risk of the company failing to produce enough hit shows in any given year. Additionally, its global diversification helps stave off the risk of having too many clunkers in the U.S. market. In a fictional example, if Netflix does poorly in the U.S., success in Europe or Asia can mitigate some of the downside.

Despite Disney’s initial lead with a larger vault of winning movies and TV series, Netflix has become the reigning king of streaming. It has the greatest variety and the best original series. With its growing cash flow, Netflix’s status as the top investor in streaming content should remain intact. As the market shifts from linear to Connected TV, the company should maintain above-average revenue growth. If you are a long-term growth investor, consider purchasing the stock. Netflix is a buy, especially on any pullback.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.