Summary:

- Snowflake and Palantir are two of the leading software companies offering generative AI solutions to enterprises.

- Both companies have strong offerings – although most of what is being offered by Snowflake is just now generally available.

- Investors are very concerned about Snowflake’s competitive positioning, particularly vis-à-vis Databricks, still a private company.

- We believe that many investor concerns regarding Snowflake are either overblown, out of date or totally spurious.

- We recommend shares of Snowflake compared to Palantir, and absolutely as well, because of its attractive relative valuation based on our estimates.

Sundry Photography

Can Snowflake, the star-crossed contender put up a reasonable AI strategy and will Palantir’s AI Platform accelerate its growth?

A few years ago, SA ran a contest in which participants were asked to write about comparing two of the high growth IT vendors of the last decade, Palantir Technologies Inc. (PLTR) and Snowflake Inc. (NYSE:SNOW). I wrote an article then arguing that Palantir was a better choice although truth to tell I didn’t quite recommend it. I suppose at one level, the call has weathered reasonably – Palantir shares have outperformed Snowflake shares significantly. That said, Palantir shares are basically flat over the last 3 years, while Snowflake shares are down by almost 50%.

Recently a subscriber to my Ticker Target investment service asked me if I would reprise my discussion of the two companies and see which stood where in my investment universe. This is a reprise of the comparison I made 3 years ago. The results are different; I recommend shares of Snowflake now and while I would like to recommend shares of Palantir, its relative valuation simply is too high for me at this point.

That, I realize, is a bit of a contrarian call, especially on the pages of SA. Palantir has an average buy rating from SA analysts while Snowflake is rated by the SA analyst cohort as a hold. The Quant service that SA offers labels both stocks as a hold.

Snowflake shares look simply horrible on a chart. According to IBD, the shares have an RSI share of 12 out of 99 and IBD provides a composite rating of 24 out of 99. It has an accumulate/distribution rating of E. All of these ratings are saying the same thing; many investors do not like Snowflake as an investment at this time.

In recent weeks Snowflake shares have been dealing with multiple noticeable headwinds. These include an analyst day which was not specific enough for some – although being specific about the outlook for a new AI product would probably have been fairly foolish, at least in my opinion. One analyst wanted to see some customer testimonials – I can find a few on the company’s website – Zoom and Bayer are using Cortex Analyst. Sigma Computing is using Cortex language models. Northern Trust is another early adopter that was recently called out as part of the Investor Day presentation. While customer testimonials are nice, adoption is really better. And it appears as though Cortex adoption is happening now. This quote is from Snowflake’s latest earnings conference call.

We’ve seen an impressive ramp in Cortex AI customer adoption since going generally available. As of last week, over 750 customers are using these capabilities.

The shares have also been dealing with an outlook which has margins down because of higher than anticipated consumption of GPUs, in part to support demand for new deployments of Cortex. And most recently, the company has been dealing with a cyber-attack – not on its infrastructure which has been found to be safe, but based on the theft of passwords of some users who have not been using multi-factor authentication – hard to believe, but apparently the case.

I personally am far more of a momentum investor than a falling knife buyer. But I will lay out here my case to buy the shares, even knowing all that I know and the negatives that have been highlighted by many over the past several months.

By comparison, as a business, Palantir has gone from strength to strength. It reported strong results and raised its forecast as part of its latest earnings release – although like many other companies, its shares fell post earnings. It has a well-received AI platform – AIP and a well running sales engine – in part based on its boot camp strategy, particularly in North America. Its issue has been one of valuation, and to an extent, the company’s commercial revenue growth. That said, the shares are up 53% year-to-date while Snowflake shares are down by 34% over the same span.

I am going to review Snowflake’s positioning and outlook first, simply because it has so many more investment issues to consider as compared to Palantir. But before I do, I think it is worth noting one theme that seems to have eluded some investors and commentators. Generative AI software demand is still in what many have called a discovery phase. I wrote that I guessed that would be the case based on several surveys that Gartner published at the start of the year. Now, after a quarter in which software demand has been said to be mixed, a theme was presented at the B of A Global Technology conference just concluded by their analyst team. Their thesis is that there is perhaps some evidence that the consumption of GPUs and other AI hardware has had some “cannibalizing” impact on the growth of software demand.

In the next several quarters that will start to change. Users are planning to use their AI hardware to run something – we just do not know yet exactly what that something is or will be and how quickly this change will take place. This theme has been picked up by other analysts and has been a factor in the relative underperformance of software stocks in the short term. That in no way suggests that long-term demand for Generative AI software will not be huge and that there is a discovery phase before massive investments in deploying software that is entirely revolutionary.

I have seen much written already about winners and losers in the AI space. It is beyond foolish to pick winners and losers before all the horses are on the track and at least approaching the starting gate. Users are still searching for AI applications that can deliver real ROI. That discovery process is going to take a few more months. Perhaps in the last 1/3rd of the year, some AI horses will really leave the starting gate. But don’t get mad at your investment because it is not yet talking about specific enhanced IT demand coming from generative AI. We live in an impatient world, I get that, but users need to figure out what AI strategy is right for their business and will produce the best ROI most quickly. And when they do, they have to create models that are specific to their own businesses and can be used to create generative AI apps. That hasn’t yet happened and much of that will not happen until 2025

Snowflake – the stock seems like a lost cause; the business… not really, if at all

For some years Snowflake’s growth was incredible and the shares were priced as though the company were offering a service that had benefits akin to those that might be expected from the 2nd coming. Inevitably, growth slowed, and the share price has gotten eviscerated. The company seems under attack from many quarters and concerns have emerged about a multiplicity of competitors. It is probably relevant to put Snowflake issues in perspective. This is still a company whose growth last quarter, which significantly exceeded expectations was 34%. It is non-GAAP profitable, and it has a free cash flow margin in the mid-high 20% range. As these things go, Snowflake isn’t sick, or feeble, or showing signs of senescence.

What are some of the concerns that have bedeviled the shares, and are they being mitigated?

1.) Snowflake’s core business is based on consumption and there is a lot of remaining controversy about the outlook for consumption

Snowflake’s core business has been that of providing a database built for use on the web. Customers have chosen to partner with Snowflake as they moved workloads to the web. This in turn led to an explosion of usage on Snowflake’s infrastructure – and an explosion in customer bills as well. Starting about 2 years ago, most users started a generalized strategy of trying to optimize their bills by optimizing their usage of Snowflake – and much else besides. In turn, this dramatically reduced Snowflake’s growth rates. Like many other trends in IT, optimization can go only so far. It might, for example, be possible to reduce the number of years of data retained in a Snowflake database, but once being done, it can’t be done again. At some point, the analytics, which is the outcome of queries against the Snowflake database, won’t work without enough years of data. Users experimented in terms of eliminating or reducing some storage and compute requirements, and there were some users who delayed or eliminated their plans to move workloads to the cloud. User optimization activities are going to continue in the future as they have in the past – it is the elevated optimization that has been an issue for investors.

Optimization activities caused Snowflake’s revenue growth to fall precipitously. Optimization has always been a component of managing an IT deployment. It is part of the business and always has been. But excessive optimization as was seen over an 18-month period was a surprise to many, including vendors, and upset growth rate expectations. The last couple of quarters, including the quarter that was reported a few weeks ago, seem to suggest that the era of above-trend optimization has come to an end. Snowflake’s growth last quarter was well above expectations; this was mainly driven by faster than anticipated usage growth.

Usage growth is mainly a function of workload growth. Recently, Snowflake switched its sales comp plan to focus compensation on acquiring new workloads. The CFO suggested that this changed incentive structure was starting to bear fruit. That said, the guidance provided by Snowflake basically has ignored these positive trends. The company did raise revenue guidance for the balance of the year – but to my mind by a derisory amount. The initial forecast for FY 2025 revenue had been for revenues of $3,250 million. Q1 product revenues were $40 million greater than forecast. The revised product revenue forecast increased by just $50 million, or in other words by about $10 million adjusted for Q1 actuals. Usage growth trends were said to have softened in April, perhaps because of seasonal factors, and then to have improved in May. It seems likely that the current guidance for product revenue growth is excessively “prudent” or substantially de-risked. At this point, I think investor concern about usage growth should be essentially laid to rest.

2) Snowflake’s Competitive positioning-a major investor concern

Another major concern amongst many Snowflake investors and commentators has been competition. Snowflake faces a variety of competitors, including companies such as Oracle Corporation (ORCL) and Teradata who have had data warehouse solutions for years, the hyperscalers who all have their own data warehouse offerings, but perhaps most significantly from Databricks. Databricks has a very similar database offering that was purpose developed for the cloud. It has tools that make developing applications built on its stack rapid and efficient. It has acquired much of the technology necessary to develop AI applications on its infrastructure. I am going to focus on competition with Databricks because I think many institutional investors and analysts feel this is by far the greatest threat to Snowflake’s future.

Databricks is still private, but it has reported revenue. Last year, Databricks reported revenue of $1.6 billion, which was growth of greater than 50% last year, which compares to Snowflake’s revenues of $2.8 billion or growth of 36%. It is now projecting growth of greater than 60% this year. Databricks might be profitable; its gross margin was greater than 80% according to industry publications. But given the cadence of acquisitions of some scale, profitability has probably proven elusive. I think that with all of these acquisitions which likely have highly elevated opex ratios, Databricks has been losing money.

The company’s faster growth when compared to Snowflake is possibly due to its generative AI offerings. It indicated that in its latest quarter, its bookings metric was at a record level and had doubled year on year in part because of its generative AI offering. Obviously, some of the company’s growth has been inorganic – it bought MosaicML for $1.3 billion and it subsequently bought Arcion, Einblack and LilacAI. It most recently has announced plans to buy Tabular for more than $1 billion. Tabular. Tabular offers users an approach to what are called Iceberg tables. Apparently this acquisition came after a bidding war with Snowflake. In response, a few days ago, Snowflake announced Polaris Catalog, a service tied to Iceberg.

The CEO of Databricks, Ali Ghodsi has recently been quoted as saying that Snowflake

Snowflake was basically not doing AI whatsoever.

Of course that was at the end of March – life has changed since then. I will try to provide some perspective on those changes just a bit further on.

Ok, so Snowflake has lots of competitors and its AI offerings are just now becoming available. Where has that left the company in terms of bookings, probably the most salient number to consider when looking at competition? Last quarter, the proxy for bookings, RPO balance rose by 46%. The prior quarter, the RPO balance rose by 41%. Basically, these metrics were pre-AI in the sense that AI has just now become generally available.

In the latest earnings conference call, the CEO talked about the early adoption of Cortex.

We’re investing in AI and machine learning, and our pace of progress in a short amount of time has been fantastic. What is resonating most with our customers is that we are bringing differentiation to the market. Snowflake delivers enterprise AI that is easy, efficient, and trusted. We’ve seen an impressive ramp in Cortex AI customer adoption since going generally available.

As of last week, over 750 customers are using these capabilities. Cortex can increase productivity by reducing time-consuming tasks. For example, Sigma Computing uses Cortex language models to summarize and categorize customer communications from their CRM.

Given the CEO’s comments regarding AI adoption, I expect that the company will continue to enjoy strong bookings results. While in the Snowflake model, bookings do not immediately lead to revenue – revenue is mainly consumption-based – they suggest that the company has been able to see notable success in the marketplace.

Concerns about Snowflake competition aren’t going away any time soon-or at least not until the company shows it is generating significant revenues from Cortex in all of its many incarnations. That is not going to happen immediately, although obviously with 750 customers already deploying Cortex, it would appear that it is a gross exaggeration and oversimplification to believe that Snowflake will not have a significant competitive position in the world of Large Language Models and as foundation technology for generative AI applications. But so long as the company is growing bookings in the 40%+ range before its AI solution become available, I am comfortable that the company’s growth is not being upended because of competitive pressures.

3) Snowflake’s CEO succession – was it forced or was it a positive progression?

We live in an impatient world. The simplified story about Snowflake is that its former CEO, Frank Slootman didn’t understand the signs that the world was to be upended by the generative AI revolution, and that the board had to act precipitously because the company was in a bad place. The story, so it goes is that the company had no AI strategy and needed an emergency transfusion.

Frank Slootman has never been a technologist. He has been a legendary operator – his prior two companies were DataDomain, ultimately acquired by EMC/Dell Technologies Inc. (DELL) and ServiceNow, Inc. (NOW). His reputation has been built on his record as a sales leader and a company leader.

The reality of the transition is quite different than the current legend. In the spring of 2023, Snowflake acquired an early-stage company, Neeva that had been founded by Sridhar Ramaswamy. Neeva’s initial product offering was that of search technology that was essentially based on AI. Ramaswamy has considerable knowledge of the space given his role as head of Google’s advertising and commerce operations.

At the time of the acquisition, Neeva had just pivoted to providing a search experience for the enterprise based on AI. When Neeva was acquired, Ramaswamy became the head of Snowflake’s AI. In the few months he was in that role, he launched Snowflake’s Cortex. Cortex, is just now in general availability. In February of this year, Ramaswamy succeeded Frank Slootman as CEO of Snowflake. Slootman remains as Chairman of the Board. Ramaswamy has indicated in interviews that he was heavily recruited by several vendors for a CEO role but he ultimately chose to work with Snowflake in that role.

Ramaswamy has a powerful resume that seems well-suited for his current role. He is driven both as a technology visionary, but also as an operator. From what I can tell from interviews, Ramaswamy is the right man at the right time for the right job.

Slootman is now 65, and Snowflake is the largest organization he has ever led. My own take is that Slootman and his team have been well aware that Snowflake was behind Databricks in terms of AI development and bought Neeva as a tactic to accelerate its own AI development. While I doubt if there was a conscious succession plan involved, I think this succession was always considered as a possibility, and essentially Neeva’s development team started to build the AI suite that has become Cortex even before the acquisition was finalized under the leadership of Ramaswamy.

4) What is Cortex and what are its chances in the market

Cortex is Snowflake’s AI platform. It would be presumptuous of me to believe that I am able to precisely handicap its likely success and contribution to Snowflake overall. In addition to Cortex, Snowflake will be introducing other AI elements to its offering in the next several months. These will be:

Iceberg, Snowpark Container Services, and Hybrid Tables will all be generally available later this year.

I am not going to review all of these offerings; it would be more than a bit tedious to do so, and I doubt it would contribute specifically to developing an investment thesis.

I think it is easy to underestimate the element of drag in all of this. Drag, in the IT world, means the impact of one product on the success of another product. In this case, just having Cortex and other AI products available is likely to influence the ability of Snowflake to gain new workloads and acquire new users. Users who heretofore might have been concerned about Snowflake’s product roadmap can now make commitments based on understanding the extent of Snowflake’s platform.

Drag can be very hard to measure. But it is real, and not something I would dismiss as insignificant in considering the company’s growth cadence going forward.

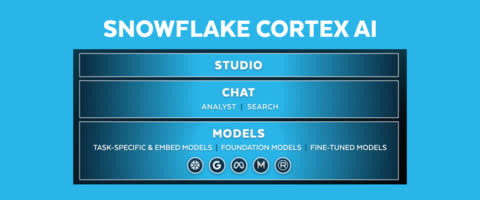

A couple of weeks ago Snowflake made a series of announcements regarding product availability and functionality for Cortex. The announcements were centered around ease of use features including a new chat experience and a no-code capability. Interfaces are now available to access many leading large learning models and integration with Snowflake ML (Machine Learning) was also announced. Other capabilities, such as Cortex Analyst and Cortex Search, were announced, but are not yet in public previews. The image here is a graphical representation of how these capabilities work together:

Snowflake AI Stack (Snowflake)

Zoom is a Cortex reference customer. I call this out because of some commentary that Snowflake doesn’t have reference customers for Cortex;

“Data security and governance are of the utmost importance for Zoom when leveraging AI for our enterprise analytics. We rely on the Snowflake AI Data Cloud to support our internal business functions and develop customer insights as we continue to democratize AI across our organization,” said Awinash Sinha, Corporate CIO, Zoom. “By combining the power of Snowflake Cortex AI and Streamlit, we’ve been able to quickly build apps leveraging pre-trained large language models in just a few days. This is empowering our teams to use AI to quickly and easily access helpful answers.”

Recently, Snowflake shares have been pressured because of news about data breaches. The breaches are really those of customers not properly protecting their data assets stored on Snowflake, and not a breach of Snowflake infrastructure. I will expand on that in the next section. Ironically, the company is introducing Snowflake Cortex Guard which uses LLM input/output capabilities to filter and flag harmful content.

With Cortex Guard, Snowflake is further unlocking trusted AI for enterprises, helping customers ensure that available models are safe and usable.

Snowflake technology has always been carefully orchestrated to reduce threat surfaces and maximize data security.

Another capability that has been announced is Snowflake’s Document AI. Document AI is basically a function that enables visual document question answering. And here too, there is a reference, in this case Northern Trust which uses the service to process documents at scale to lower operational costs – it is replacing people with software to answer queries.

This is not intended to be a Cortex commercial. And I do not wish to be tedious in addressing readers. What I am suggesting here is that Snowflake has a cogent generative AI strategy which offers users the ability to create lots of applications easily that solve a multitude of business problems. Snowflake’s AI is built on the data it stores in its Cloud Data Platform, the models it has available, both internally developed Arctic, and the several other models with which it has connectors, its analyst and search capabilities, and its no-code studio offering.

Given that much of Cortex is even now either just generally available, or will be generally available in a few weeks, it would be more or less impossible to develop an informed point of view on how the functionality the company has announced compares to what is on offer from Databricks and others in this space. That said, I wouldn’t be surprised, given the background of the CEO, that Snowflake’s Cortex offerings would be at least competitive, if not more than competitive.

As mentioned, Snowflake’s management has made a decision not to make any revenue estimates for Cortex or its other new products as part of its forecast. I have linked to a discussion of Cortex which includes pricing data – but while it shows how costs are calculated, it really doesn’t provide any estimate of how much a user might pay for a workload.

Snowflake at this point is forecasting product revenues of $3.3 billion. It would probably be overly optimistic to believe that revenues from Cortex are going to change this forecast materially in the current fiscal year. My guess would be something like 1%-2% is likely, although changing expected revenue growth from 24% – the current 1st Call consensus, to 26% would likely be meaningful for Snowflake’s valuation, in my opinion.

Really, revenue growth from usage will be far more important in determining just how much the company might exceed its current revenue growth forecast. And that is where drag comes in. My view is that users, seeing a clear functional path to the creation of generative AI applications, are more likely than before to choose Snowflake for new workloads. And that isn’t baked into estimates or expectations at this point.

5) Does Snowflake have a cyber-security problem?

In two words, not really. A few days ago, headlines blared from every investor platform and from many publications addressed to the IT community about Snowflake’s data breaches. And almost certainly that has brought the shares down even further. It probably seems like every day there has been a negative story about the company. But the fact is – Snowflake didn’t have a breach. Really!

“Mandiant’s investigation has not found any evidence to suggest that unauthorized access to Snowflake customer accounts stemmed from a breach of Snowflake’s enterprise environment,” the Alphabet Inc. (GOOG), (GOOGL) -owned company said.

“Instead, every incident Mandiant responded to associated with this campaign was traced back to compromised customer credentials.”

In addition to Mandiant, Snowflake apparently contracted with CrowdStrike Holdings, Inc.’s (CRWD) Falcon consultancy to analyze potential Snowflake vulnerabilities or misconfigurations. The results of this analysis were a similar clean bill of health.

The subject of cybersecurity is complex and riven with details and nuances. But what happened is that some of Snowflake’s 9850 customers – 165 perhaps – were themselves allegedly guilty of major security malpractice. Users were not using MFA to protect their data estates, they were using long-exposed credentials that had not been rotated, and users were not using “network allow lists” a basic cybersecurity concept.

The list of Snowflake users who had their data stolen is considerable. And the thieves are extorting money from these users. Potential victims of these infostealers include Ticketmaster, Santander Bank, Anheuser-Busch, Allstate, Advance Auto Parts, Mitsubishi, Neiman Marcus, Progressive and State Farm. Infostealing is gradually replacing Ransomware as the crime of choice in 2024.

What is happening now is that Snowflake is enforcing basic cyber security policies on its customers. Users will have to adopt MFA to use Snowflake, and they will have to rotate credentials.

Will these incidents have a noticeable impact on Snowflake usage? Most users will rapidly adopt MFA and continue to process queries on Snowflake infrastructure. Will these breaches impact Snowflake bookings this quarter? Probably not, although explaining the situation may cause a slight elongation of some sales cycles. Apparently, one insider doesn’t think too much of the issue. Michael Speiser, a Snowflake director and a managing partner at VC firm Sutter Hill Ventures, recently bought $10 million of Snowflake shares. Presumably he knows the company well as he was an initial investor in the firm and was its founding CEO from 2012-2014. His purchase reversed multiple sales over the last few years. I have to believe that if there were any issues – even short-term issues of usage or bookings, Mr. Speiser would not be buying the shares and he would be in a better position to know specifics about usage and bookings than almost anyone else.

6) Snowflake’s guidance – was it alarming?

Snowflake shares fell significantly in the wake of its earnings release when it provided guidance which essentially lowered margin expectations. I am going to focus on just the element of guidance that brought down margin expectations. I will simply comment that the CFO, a highly respected IT industry veteran who has pledged to remain at Snowflake for the next 3 years has indicated that guidance has been significantly de-risked in an understandable effort to provide Ramaswamy some breathing room for his innovations to bear fruit.

Specifically, Snowflake reduced its full year guidance for gross margins from 76% to 75%, its guidance for non-GAAP operating income from 6% to 3% and its guidance for its free cash flow margin from 29% to 26%. This forecast was the primary reason for share price decline in the wake of the latest earnings report. The reason for the margin guide down was specifically because of the greater GPU costs related to the company’s AI initiatives. It is also a function of a small acquisition, TruEra which added 35 development employees as well as a higher budget for additional R&D hires.

And at this point, the guidance becomes a bit misleading. The company needs more GPUs to support the deployment of Cortex as companies buy and deploy the offerings. But it doesn’t charge users based directly on how many GPUs they wind up using; as mentioned earlier, Cortex, like other Snowflake products, is charged mainly based on compute-the user consumes tokens. But because Cortex is a new product, and revenues are not being forecast, while the purchase of GPUs is being forecast, the result is, almost inevitably, a forecast in which margins are showing a decrease. Again, almost inevitably, Snowflake is not likely to need to buy GPUs at an accelerated rate unless its customers both ramp usage and deploy Cortex.

The margin guide down is not the result of any existential problem with the Snowflake business model. It is the result of a specific methodology used to forecast revenues that is a mismatch with the forecast used to forecast GPU costs. And it is a function of extremely rapid and accelerated product development activities, whose consummation is likely to accelerate revenue growth. Of course, stocks trade on specific forecasts – I get that – but in this case, looking at the details, the margin guide down is really not the negative suggested by the share price decline.

Risks to the Investment Thesis

At this point, there are a few highly visible risks to the investment thesis. One is that my evaluation of the company’s issues with cybersecurity are too optimistic. Another is that usage trends show less growth than the last two quarters. And finally, there is the risk that the company’s AI initiatives fail to attract customers at a rapid cadence. To an extent, Snowflake shares are where they are because investors are concerned about these risks and have sold the shares aggressively the last several weeks. So, I will turn to valuation to see if the investment makes sense given the risks to the growth thesis cited above.

Snowflake’s Valuation

Snowflake shares have historically sold at a premium valuation reflecting its strong growth until the optimization wave drove growth rates down substantially. The company’s valuation metrics now reflect that slowdown, while not incorporating the potential impact of the company’s AI initiatives and usage trends. Based on my forecast that total Snowflake revenues for the next 12 months will reach $3.84 billion, a conservative estimate in my view, the current EV/S for the shares is 10.1X based on the current Snowflake share price of about $127. I have forecast that the company’s free cash flow margin will be 28% over that span, essentially because the company’s margin forecast deliberately incorporates a mismatch between GPU costs and revenue. And finally, my analysis is based on a 3-year CAGR of 33%. Frankly, I wouldn’t have bothered writing this article and recommending the shares if I didn’t think that the company’s core business in terms of usage trends would show consistent trends as the company captures more workloads. And, of course, unlike the company’s forecasting paradigm, I am assigning a significant expectation for the company’s revenue growth from Cortex and other AI initiatives. Using these assumptions, Snowflake shares are now valued at a discount to the relative valuation of peer high growth companies. Not only is it valued at far lower levels than Crowdstrike, for example, but it is also valued far below valuation levels of Samsara Inc. (IOT), Cloudflare, Inc. (NET), Datadog, Inc. (DDOG), The Trade Desk, Inc. (TTD), MongoDB, Inc. (MDB) and GitLab Inc. (GTLB). Its valuation is now approximately comparable to that of Zscaler, Inc. (ZS) shares. It’s not just that this is a turnaround from the recent past which in itself wouldn’t factor into my view; it’s that Snowflake shares are now valued at significant discounts to peer high growth IT shares – and in some cases the discount is yawing. To reiterate, I recommend that long-term investors look through the current noise and establish or augment positions in Snowflake shares at this time and at this price.

Palantir: It’s all about the ramp of the company’s AIP and how that translates into revenue growth

As mentioned earlier, the Palantir debate is far simpler with fewer issues and that means a much attenuated discussion. Palantir shares fell by about 15% after quarterly results were announced despite a beat and raise quarter. Like many other software companies, the amount of the raise was probably too small to satisfy heightened expectations.

Palantir’s management and the CEO have been more vocal than almost anyone else in the IT space in articulating support for Ukraine in its current conflict. Given the foundation of the company’s business and the use of its technology by Western militaries, that is completely unsurprising. It isn’t apparently impacting the company’s ability to win commercial deals, and thus is a non-issue with regard to the company’s investment thesis.

Despite the pull-back in the wake of earnings, Palantir shares are up by 35% since the start of the year, obviously far better than Snowflake’s share price performance. Much of this related to the significant upside surprise the company reported back in February which drove the shares up by 29% in a single day.

Here are the specifics that show the company’s results vs. its prior forecast and then show the actual change in guidance after adjusting for the quarterly beat.

At the start of 2024, Palantir had projected full year revenues of about $2.66 billion, US Commercial revenues of greater than $640 million or growth of 40%, non-GAAP operating income of a bit greater than $840 million and free cash flow at the mid-point of the forecast of $900 million.

Q1 was a beat with revenues $20 million above the forecast and non-GAAP operating income $28 million greater than forecast.

The company’s new forecast is for revenue to be about $2.685 million, for US commercial revenue growth to be above 45% and for adjusted operating income of $875 million.

So, basically, the company raised its forecast for the balance of 2024, adjusted for the first quarter beat of $5 million, or about 0.3%. It raised its forecast for non-GAAP operating income, again adjusted for the Q1 beat of $28 million by $7 million, or a bit less than 1%. Given the beat in US commercial revenues last quarter, the forecast for 45% growth is really no increase at all for the balance of 2024.

The company called out that it would be increasing its opex investments in the US to take advantage of AIP-related opportunities. This opex investment is apparently constraining forward margin expansion opportunities in the current year, but should lead to faster revenue growth. It might be considered to be an analogous decision as to that made by Snowflake in terms of its own spending for development, and is thus far having similar impacts on valuation.

Some of the issues are what Palantir calls strategic contracts, or really, larger enterprise deals that are long-term commitments to Palantir. Strategic contracts were $24 million in Q1, and are expected to decline to $7-$9 million in Q2. Overall, strategic contracts are expected to be 2% of total revenues, the same as in the year earlier.

Overall, Palantir offered a forecast that was fairly typical in the software space over the last 60 days, and which has led to a valuation compression, not just of Palantir shares, but of the shares of many other high growth software companies as well. The company reported a strong increase in RPO balances, which were up 39% year on year and up 5% sequentially. While those numbers look impressive, they really are based on the performance of the company’s commercial business; the US government business has contractual terms that prevent multi-year orders from being counted as part of the RPO balance.

So, the question is, if RPO growth for Palantir’s commercial business was strong, then why not raise guidance for the growth of the US commercial business segment? And looking at Snowflake vs. Palantir as investments, it would appear that percentage bookings growth for Snowflake is actually growing noticeably faster than Palantir, and was doing so before Cortex was generally available.

The company has been trying to focus investor interest on US commercial growth which has been particularly strong with revenues, excluding strategic transactions, growing by 68% last quarter and 22% sequentially, in what is normally the lowest growth quarter of the year. US commercial revenue growth as reported was less strong, with growth of 40% year on year and 14% sequentially. Overall, US commercial revenue was $150 million last quarter or about 17% of the total. In other words, growth in the US commercial segment constitutes 40% of the company’s total growth; the other 83% of the company’s revenue had growth of about 12.5%. Needless to say, that kind of disaggregation, which is done by most professional investors, constitutes an issue in terms of valuation, at the least, and suggests a bit less positive momentum than the conference call presented.

As has been typical of Palantir calls, the Q&A segment was brief and not terribly enlightening. Alex Karp, the company CEO is who he is, and I suppose given the success of the company he is entitled to some of his idiosyncrasies. The call reaffirmed his support of Ukraine in its current conflict and indicated that while there had been a bit of turnover due to the company’s stance, the stance had not impacted actual business trends.

That said, it would have been more enlightening to hear more about competition, particularly for AIP. Saying that AIP has no competitors, or that others use LLMs incorrectly (a part answer on this latest call) is really no answer. At some level, AIP does compete with the offerings of both Databricks and Snowflake. At the time of the call, Snowflake Cortex had not been formally released.

To me the call was lacking because no one had the temerity to ask the $64 question about why guidance was increased by such a small amount given the obvious momentum in Q1. If this company, or Snowflake or any company is going to ramp opex growth, wherein the numbers are the payback.

I am going to avoid commenting about Palantir’s boot camp initiatives. It is a go-to-market motion; it is going to have some success but without a lot more quantification than has been provided, their overall efficacy cannot be determined.

AIP has, and will have many competitors. Basically, AIP includes machine learning, large language models and AI itself, or the user interface to the LLM. Is AIP better than similar offerings from the hyper-scalers, and from Databricks and Snowflake? This is really fluid situation; new offerings are being introduced weekly and I think trying to handicap who has a better set of models, or interfaces or has a better way of ingesting data to create what is called machine learning is premature to say the least.

The advantages that Snowflake and Databricks offer is that their customers are already storing lots of data that is needed to train models for specific use cases running on their infrastructure. On the other hand, Palantir has thousands of users who have deployed Foundry which might possibly be considered as a precursor to some generative AI apps.

AIP has been available for about 15 months now, and it has obviously kick-started the growth in the company’s US commercial sector. The company is in the process of developing an AIP variant specifically designed to capture opportunities in the defense space.

The Comparison and My Conclusion

Without attempting to be too anodyne, investing is a matter of making choices. There are many ways to invest in AI. Both Snowflake and Palantir now offer AI solutions. I have neither the temerity nor the desire to try to declare that one of these two companies has a “better” AI solution. My guess is that both AIP and Cortex will be successful, and presumably more successful than what is embodied in consensus numbers. I personally think that having a data estate as part of an overall AI solution makes eminent sense, but I will leave technology evaluations to the many highly skilled industry consultants.

The assumptions used in this comparison are as follows:

Snowflake Palantir

Stock prices as of 6/14/24 $125.65 $23.12.

Enterprise Value $38.0 bil. $55.0 bil.

Current Revenue Estimates $3.84 bil. $3.1 bil.

(Next 12 months).

EV/S 10X 17.8X.

3-year CAGR 33% 27%.

Free Cash flow margin 28% 33%.

I want to note here that my 12-month forward revenue estimate is based on the average revenue beat percent compared to the forecast over the last 4 earnings reports for both companies. And to be clear, it is the next 12 months and not the calendar year – that requires trending an additional quarter that I am showing as a revenue forecast. The 3-year CAGR is my estimate. If readers think that different metrics are more appropriate, please use the comments section to express why a different estimate might be more reasonable.

I think with the data that is available, the choice of Snowflake compared to Palantir as an investment is clear. The valuation compression of Snowflake has carried the shares into GARP territory, although many readers have different things in mind for a GARP investment. Many of the reasons why Snowflake shares have seen their valuation eviscerate are either inaccurate or out of date or the result of unreasonable analysis in my opinion.

Palantir is a company in the right place at the right time with a strong AI product offering. The problem, basically, is that is well known, and reflected in the valuation-not just absolute, but relative. I have obviously ramped my CAGR estimate above consensus to take account of further success for AIP. Could it be more than that? Certainly. But it would have to be far greater than 27% to justify the company’s relative valuation.

As mentioned at the start of the article – many words ago, I admit, that right now software stocks are under pressure because of the thesis that their current growth is being deflated by user priorities to create AI infrastructure using products from NVIDIA Corporation (NVDA), Super Micro Computer, Inc. (SMCI), Dell and perhaps Broadcom Inc. (AVGO). Like many such strategies, it is overdone, lacks context and nuance, and seemingly ignores that the following infrastructure will be apps. The CEO of Datadog had an excellent comment regarding the cadence of AI revenues on his latest conference call which I have linked here. Well worth the read.

Last week, both results from both Oracle Corporation (ORCL) and Adobe Inc. (ADBE) may have dented the thesis – the level of bookings Oracle reported might suggest that there is a rather significant budget available for AI-trained databases while the momentum of Adobe’s Firefly and its impact on that company’s growth was far greater than most (and that includes this writer) had expected.

The latest concerns about Snowflake and its so-called security issue seem to have been laid to rest. The company’s usage problem seems to have come to an end. The company may have been behind rival Databricks in the AI race; that doesn’t seem to have impacted bookings, and at this point, the company has seemingly caught up in terms of its overall AI offerings. Sentiment, as I mentioned, on Snowflake looks positively awful and I am sure technical analysis would not be very positive. That said, I am reiterating my recommendation to buy Snowflake shares at this time and this price with the expectation of significant positive alpha over the next year.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.