Summary:

- Apple Inc.’s success is attributed to its seamless integration of hardware and software, but rising interest rates may lead to multiple contraction and make it a poor investment.

- The company’s business revolves around providing integrated products, with the iPhone being its flagship product, but its financial performance has shown a decline in sales and an increase in operating expenditures.

- Apple faces risks from China geopolitics, potential tech competition, and a possible re-evaluation by the market, which could result in a decline in share price.

Mykola Sosiukin/iStock via Getty Images

Apple Inc. (NASDAQ:AAPL) is the largest corporation in the world. The company achieved that by bringing connectivity to the masses, taking already existing products, and seamlessly blending the hardware and software experience for customers to make them indispensable to the masses. That, combined with a series of wins, has resulted in multiple expansion pushing up its share price.

As we’ll see throughout this article, with rising interest rates, Apple is due for multiple contraction, as a poor investment.

Apple’s Business

Apple’s business is centered around giving customers the integrated products they need.

The company started with the iPhone in 2007, which started its move, in terms of size, away from other companies. The iPhone still makes up the bulk of its portfolio. The company now has more than 2 billion installed devices, all devices that can take advantage of the company’s increased scale with its assets.

The company has since managed to grow dramatically by offering other add-on products, with new offerings. The iPad was a similar product division, with a larger screen that did incredibly well, although its popularity has gone down recently. The Apple Watch provided extraordinary health benefits and paired seamlessly with the iPhone.

The AirPod Max and AirPod/AirPod Pro have become headphones of choice for people. The company has built an ecosystem where even those who only replace devices every 5 years spend thousands. They purchase a MacBook Pro, an iPhone, AirPod Pros, and a Watch. Their total expenditures here might top $4000 easily given their desires.

The company has also added add-on business, Music, TV, app services etc. It’s improved margins with ruthless efficiency and a shift to Apple Silicon. It’s rumored to be attempting to expand this with its own Bluetooth chip. This business strength is worth paying close attention to.

Apple VR

It’s been numerous years since the company has come up with a new product category, and the headset supposed to launch next year is supposed to do just that. Unfortunately, we think this product won’t be the hit that the company is looking for. There are several reasons for this.

Each additional product that the company came up with offered a key benefit. Anecdotally here are the reasons (talking to Apple fans around us).

– Apple Watch = health benefits

– iPhone = camera and general communication

– AirPods = bug-free Bluetooth/headphone integration

– Apple Services = TV for cheap quality shows, Music because it’s higher quality and the same price as Spotify, Cloud for low-cost worry free back-ups.

These products each succeeded with their own advantage. The question is what advantage do the VR goggles offer? They’re not something you can easily carry around and use on an everyday basis for new pictures, accessing the web, etc., like the iPhone. They don’t provide additional data like the health data from the watch.

There are some workflow benefits, but right now, with Meta’s Oculus being the prime example, we see no indication that the product will hit mainstream adoption.

China Geopolitics

Another major risk to Apple is China’s geopolitics for two reasons.

The first is that the company’s manufacturing is heavily centered in China where millions of employees construct the company’s massive suite of devices. A recent Foxconn investigation here shows the risk of geopolitical tension. However, China seems to have increased its goal to reunite Taiwan which could lead to a direct conflict with the United States.

Rumors are the company is working to move some manufacturing outside of China, but until it fully revamps its supply chain, any conflict would be massively disruptive.

The second is that Apple’s products provide a unique and exciting benefit to customers but not one that customers can’t live without. China has already banned the company’s products among government workers. As the country continues to focus on supporting Huawei, we see there as being a significant risk that Apple will simply be banned at some point.

That’s especially true if manufacturing moves out of the country, and presents a substantial risk.

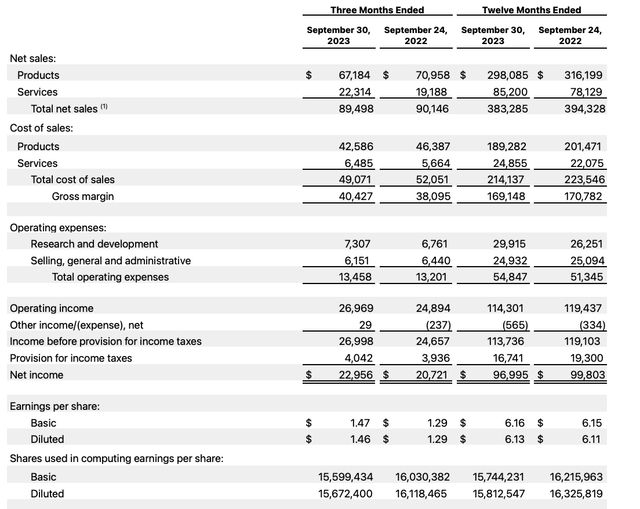

Apple Financial Performance

The company’s financial performance shows the risks its business faces as the tech environment changes.

The company had $89.5 billion in total sales, down YoY in an inflationary environment. Its TTM sales have also gone down by 3% YoY, showing the continued impact of the downturn. The company’s services sales have gone up, but its product sales have gone down roughly 10% YoY and 5% for the TTM YoY.

At the same time, the company’s operating expenditures went up as well. Fortunately, the company managed to improve its margins with a decline in cost of sales, resulting in total operating income for the quarter improving YoY. TTM operating income did decrease substantially YoY. As a result, net operating income was up.

The company’s earnings per share went up and were roughly flat TTM YoY despite a noticeable decline in the company’s outstanding shares. The company maintains a very modest dividend of 0.5% but it continues to deploy effectively all of its cash flow into repurchasing shares. YoY, the company has managed to repurchase ~4% of its shares.

Tech Risk

At the same time, it’s worth noting that Apple has a major tech risk that’s not being taken into account.

20% of the company’s profits come from a single payment to Google in exchange for being the default search engine in Safari. The U.S. government has filed an antitrust suit in relation to that, and the payment could be ended permanently. That presents a strong immediate risk and could upend the industry.

At the same time, the company could see strong competition in its existing platforms. Huawei was growing faster than Apple before it was stymied by restrictions on its technology. Another watch competitor could for example find a way to provide blood pressure, something that Apple hasn’t been able to do yet. Samsung continues to work on camera tech.

Any of these risks could hurt Apple’s global dominance and its ability to provide long-term returns.

Valuation

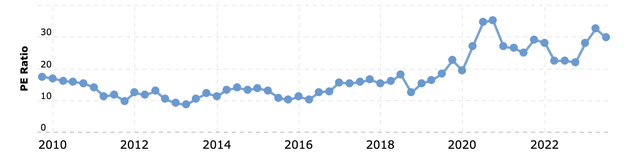

At the end of the day, Apple’s largest risk in our view is multiple contraction.

The above chart shows Apple’s P/E by year. It’s worth noting that the company’s massive share price appreciation that started in 2020 was based on the market reassigning Apple a higher multiple. The company’s P/E went from a normal of 20 or less to a new normal of almost 30 over the last several years. That’s a 50% increase.

That means the company’s share price went up 50% with no growth in profits. As the company stagnates, especially with additional risks from the government lawsuit, etc., we think there’s a major risk that the market re-evaluate the company. That could cause the company’s share price to decline substantially, in line with our expectations.

Thesis Risk

The largest risk to our thesis is Apple doing what it’s always done: Innovating. If the company manages to come up with another great product that seamlessly integrates with its existing suite, and convinces its customers to add several hundred $ every few years to their long-term bill, that could help the company’s earnings grow.

Similarly, if the company finds other ways to increase margins, that could also help its long-term earnings.

Conclusion

Apple is a phenomenal company, and its innovation and ability to change the habits of customers and ingrain new ones, has resulted in its multi-trillion dollar valuation. The company, despite its long history, has seen its share price increase substantially recently due to the market providing the company with a new higher multiple.

The company now has a free cash flow yield of roughly 3.5%, versus 30-year bonds (US30Y) yielding 5%. The company has seen minimal growth YoY, with a substantial part of its EPS performance coming from repurchasing shares YoY. Despite its size, we expect the market to give the company a lower multiple making it a much worse long-term investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.