Summary:

- Disney underperformed the market but is now at strong long-term support, presenting value in the mid $80s with the potential for appreciation in late 2024 and 2025.

- Disney had a poor response to its quarterly earnings report due to weakening margins in its Parks and Experiences division and potential higher costs for acquiring Comcast’s Hulu stake.

- A Disney insider acquired $1 million in DIS stock, indicating compelling value and potential for appreciation.

- Disney has a strong roster of upcoming theatrical releases in the second half of 2024 and through 2025, and recently announced the development of Parks and Experiences buildouts that should support their demand.

HuyNguyenSG/iStock Editorial via Getty Images

Disney (NYSE:DIS) has recently underperformed the market, but after its poor response to its quarterly earnings report, there is reason to believe that DIS is currently at or near strong long-term support. Shares appear to present reasonable value here in the mid $80s, with strong potential to appreciate in late 2024 and 2025. Further, an insider recently acquired roughly one million dollars in DIS stock, indicating they agree that shares present compelling value here.

Earnings and Recent Announcements

On August 7, 2024, Disney reported its Q3 2024 earnings, where Disney’s Q3 occurs during the April to June months of the year. DIS shares were already in a multi-month downtrend going into their reporting, and responded poorly to the report.

The primary reason for the poor response appears to be that their Parks and Experiences division had weakening margins, and also that the company continued to likelihood that the company will incur a higher than expected cost in its endeavor to acquire the 33% stake in Hulu that Comcast (CMCSA) owns. Pricing that stake is currently a matter of appraisal by arbitration, where Comcast’s position on the matter would obligate Disney to pay it an additional $5 billion.

At the same time, Disney reported that its streaming services are now profitable, and that they reached this milestone ahead of schedule. This good news was not significant enough to overcome the above-mentioned bad news. Further, the strength of streaming products is largely on the back of continued weakness in traditional television and cable lines of business.

Disney noted that Parks and Experiences had some weakness for reasons that included some lower income consumers spending less, and also that many higher income consumers were opting for international travel rather than their domestic options. Of course, Disney also has multiple international venues within its Parks and Experiences division. For example, this summer, Disney opened Fantasy Springs within the Tokyo Disney Resort, and also Lookout Cay, in the Bahamas.

These new locations are likely to attract some additional demand, while also increasing Disney’s capacity with Parks & Experiences. The company is also expected to launch a new cruise ship, the Disney Treasure, late this year. Further, shortly after reporting earnings, Disney announced multiple new initiatives. At the Disney’s D23, a biannual fan event the company holds, it announced four additional new cruise ships, as well as some preliminary details about six new themed lands as expansions to its Parks.

It is not entirely clear whether these new announcements are additions to Disney’s capital plans, or merely the further disclosure of details. Last year, the company previously announced plans to invest about $60 billion in Parks and Experiences over the next 10 years. Therefore, these recent announcements are likely merely providing the market with details on how some of that will be utilized.

Disney’s expansion plan includes a doubling of its Avengers campus at the Disney California Adventure location in Anaheim, California, as well as a new villains land at Walt Disney World’s Magic Kingdom in Orlando, Florida. The Avengers campus will include two new attractions called Avengers: Infinity Defense and the Stark Flight Lab. California Adventure will also add a new Avatar themed attraction.

Disney also announced two new attractions for its Animal Kingdom park in Orlando, Florida. One will be based upon Indiana Jones discovering and exploring a Maya temple. The second attraction is based on Encanto. The company further announced a new land themed around Pixar’s Monsters, Inc. that will be added to the Hollywood Studios at Walt Disney World Resort. Another Pixar franchise, Cars, will also get an expansion section within Frontierland at Magic Kingdom.

Some international developments include new Spider-Man attractions that are to be added to Disney’s parks in Shanghai and Hong Kong, and the Paris park will get a new ride based on The Lion King.

Disney also disclosed some new details on its collaboration with Epic Games. The company previously invested $1.5 billion in the video game maker, and now added that it intends to develop a games and entertainment universe connected to Fortnite.

Disney also recently released an extended sneak peek of the Moana 2, which is scheduled to open in theaters on November 27. Disney added that Incredibles 3 was in development, and also that James Cameron is working on a third Avatar film.

A Disney Insider Buys

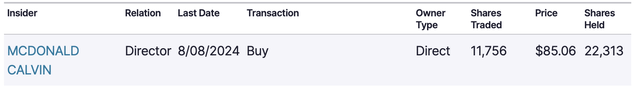

While there may be many reasons a person chooses to sell shares, several of which may have little or nothing to do with the performance and value (consider buying a home or getting divorced), there are far fewer reason why an insider would choose to acquire shares on the market. On August 8th, a day after Disney’s August 7th earnings release, Calvin McDonald acquired 11,756 DIS shares for a total value of just under one million dollars.

Calvin McDonald’s recent acquisition of Disney (Nasdaq.com)

Calvin McDonald has been on Disney’s board of directors since 2021 and is also the CEO of Lululemon Athletica (LULU), as well as a member of its board. Mr. McDonald should be seen as a reasonably sensible operator that is unlikely to make a million dollar investment in Disney merely as a gesture, but rather because he recognizes that the shares appear to be at a strong level of support and value from which they are likely to appreciate. This sizable purchase of Disney shares is slightly more than a doubling of his holdings in the company.

The Charts Agree

Disney’s share valuation is now at or near apparent support. Disney has performed exceedingly poorly over the last several months, but shares are now hovering just above a zone that has consistently acted as support in the past. Current pricing brought Disney to the bottom of its recent trading range and back to the price range that acted as support in both late 2022 and throughout the last quarter of 2023.

Disney’s weekly candlestick chart (Finviz.com with red line added by Zvi Bar)

This also is roughly in line with the pandemic bottom that Disney made in the spring of 2020. This pricing was highly supportive between 2015 and 2020. Disney spent those five years stuck in a trading range between about $85 and $120 per share. That is also where Disney shares have traded since 2022.

This recent move is also a total retracing of the string of appreciation DIS shares saw between November 2023 and April of this year. On the chart, the move looks like a mountain, and also arguable the completion of a head and shoulders chart formation.

Disney’s daily candlestick chart (Finviz.com with red line by Zvi Bar)

Now, it appears probable that this level which acted as resistance in late 2023 will act as a strong level of support. Further, there is some reason to anticipate a strong forthcoming quarter, as well as the announcement of additional positive details in the second half of 2024.

Disney just found some level of success in the release of Deadpool & Wolverine. Disney also had tremendous success with Inside Out 2, which became the highest grossing animated film ever, having achieved over $1.5 billion in global box-office sales. These movies are also likely to support merchandising efforts in the holiday season, as well as Halloween, and Disney+ subscriptions as they become added to the service.

Beyond merely generating strong revenue to the sum of already generating over $1 billion in worldwide box-office sales, Deadpool & Wolverine also established a strong case for a Gambit movie to now be developed, among other potential reboots and possible series developments. This recent success is likely to cause analysts to re-evaluate some of the underutilized Marvel intellectual property that Disney has not yet effectively monetized. Disney is also likely to develop more R-rated movies after this recent showing of success.

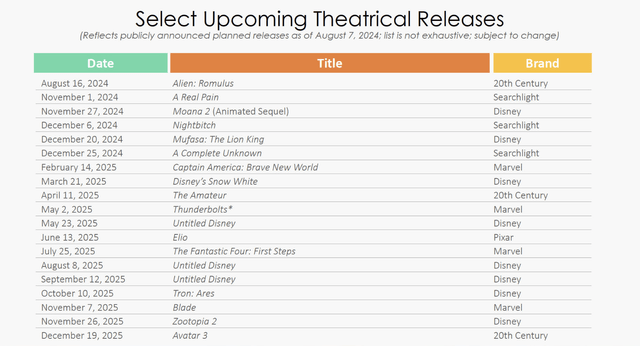

Disney has a fairly large and strong roster of theatrical releases coming in the second half of 2024 and throughout 2025. The list includes several movies with the potential to earn over $1 billion in box-office sales, as well as further opportunities for merchandising.

Disney’s upcoming movies (Disney’s Q3 earnings presentation)

Risks

Risks associated with Disney would include the failure of it to perform to expectations, as well as continued weakness from its consumer base. Disney has numerous films coming out in the next several quarters, and its recent string of success could be broken with a poor performing film, and potentially multiple poorly received releases. Disney’s model somewhat requires strong new content releases that will drive new streaming subscriptions, new attractions within its parks, and merchandising opportunities. Therefore, a series of unsuccessful films could gunk up the works of their flywheel model.

A recession, or even continued reluctance to spend on big ticket items, could also work against Disney. While a trip to one of Disney’s parks is not a luxury experience, it is a costly vacation for a family compared to most domestic destinations. Consumers could become reluctant to pay for a Disney branded experience, lowering attendance rates, or those going to Disney’s parks could simply attempt to be more frugal about the trip, including buying less merchandise. Such downgrading would have a negative effect upon Disney’s revenue and margins.

While it may appear that Disney is at a strong level of support, it is possible that this level will not hold. If Disney were to break through current levels to the downside, there is the potential for a dramatic gap down in valuation. While I do not believe this is a probable event, a further capitulatory drop is certainly within the realm of possibility. Such a capitulatory gap down could be caused by Disney’s subjective inability to perform to expectations, as well as due to macro forces, such as geopolitical conflict, or anything else that may cause a broad market sell-off.

Conclusion

Disney recently went through what appears to be a capitulatory downtrend that took shares to their long-term support. Disney has had theatrical success so far in 2024 and is likely to have some further successful movie and streaming success in late 2024 and early 2025. Similarly, the Parks & Experiences division should benefit from new venues and increased pricing, and domestic advertising should benefit from significant political campaigning through November.

Further, the sizable acquisition of DIS shares by Calvin McDonald, a Disney’s board member the CEO of Lululemon, is a positive indicator of the opinion of a respected insider. For these reasons, it appears likely that Disney shares present a reasonable value at risk within their current trading range.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.