Summary:

- The Coca-Cola Company’s shares have lagged the S&P 500 since my initial sell ratings.

- The company has, however, increased its earnings power, return on invested capital and return on equity.

- An updated analysis of the company and its economics in addition to two valuation frameworks are provided.

- Based on the analysis, the rating is upgraded to hold.

fergregory

Introduction

The Coca-Cola Company’s (NYSE:KO) shares have staged a good comeback from the lows seen in early October. I’ve written two articles on KO here on Seeking Alpha and both have ended up with a Sell rating (I never short stocks and would never advise anybody to short a stock). You can find my first article here and the second one here. In the second article, I argued that the fair value per share could be in the $50 to $56 range assuming a sustainable long-term earnings power of $2.25 to $2.50 per share and a 22.5x multiple on those earnings. As KO has increased its earnings power considerably since that article (EPS during the last twelve months is now $2.42), I thought it would be timely to update my analysis and potentially change my rating for KO. Below is some data on how KO has performed compared to the S&P 500 since my first and second articles were published.

| Total return (including dividends) |

The Coca-Cola Company (KO) |

S&P 500 | Excess return |

| Since 1st June 2020 (1st article) | 38.4% | 48.8% | +10.4% |

| Since 7th Feb 2022 (2nd article) | 0.2% | 1.7% | +1.5% |

Investment Thesis

Most readers are familiar with The Coca-Cola Company (KO) which is why I’m not going to give a granular rundown of its business or its markets here. If you’re interested in learning more, check out my earlier articles on KO, which are linked in the introduction. What I can say though, is that KO’s business performance is fairly predictable and is not prone to disruption. That’s one of the reasons why Charlie Munger and Warren Buffett felt comfortable buying their first shares of KO in the late 80’s. As most of you know, KO is currently one of Charlie’s and Warren’s largest positions. They felt strongly that the brand would create loyal customers who would purchase the company’s soft drinks for decades into the future. We now know they were proven right. The business model is fairly simple: producing and selling beverages and concentrates (even I’ve produced homemade beer from time to time – it’s not rocket science). It’s the brand that makes KO stand out against its competitors. It works as a moat in the sense that the brand is hard if not impossible to copy as it’s the consumer’s perception of the company and its products/services that makes the brand what it is. According to brand consultancy firm Kantar BrandZ KO rose 7 places in 2023 to reclaim its position in the top 10 brands globally. Although the business model is fairly simple, the economics are still attractive. The company enjoys a return on invested capital above 20% and a return on equity above 40% due to the company’s fairly levered balance sheet.

In addition to this, KO is one of the market leaders in the non-alcoholic soft drinks market. Coca-Cola, Sprite and Fanta are some of its most popular products. The market is huge (about $850 billion), highly fragmented (KO is one of the biggest players with about $44 billion in sales indicating a ~5% market share), and grows slowly at about 4% each year. All of this means the market is relatively competitive as several players fight for market share in a market that is expanding slowly.

With these things in mind, KO undoubtedly deserves a premium valuation compared to its peers. The current share price has, however, most of the good things baked into it which means that one can earn better returns in other areas of the stock market.

A global powerhouse

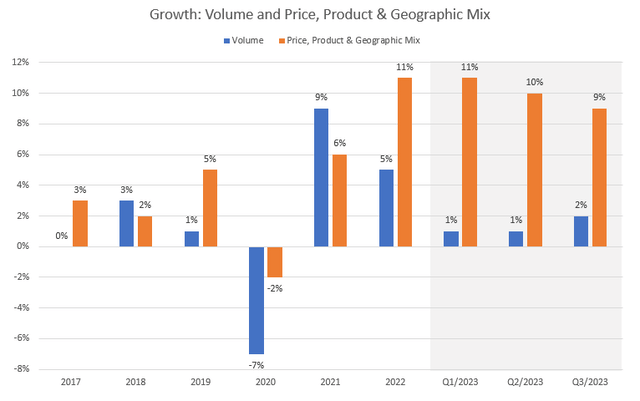

KO has been active globally for several decades which also means that the company can’t grow by expanding to new geographies anymore. To grow, the company has to (1) expand its product categories organically or via acquisitions without cannibalizing existing products and/or (2) increase the pricing of its existing products. The chart below illustrates my point (I have excluded growth from acquisitions, FX and accounting changes). Volume growth has been in the low single digits while price increases have been in the mid-single digits.

Growth breakdown of Coca-Cola (Company financial statements)

The volume growth of the years 2020-2022 are anomalies due to the pandemic. The decline in volumes in 2020 led to higher-than-average volume growth in years 2021 and 2022. KO’s business shrank during 2020 as people couldn’t consume its products in away-from-home channels such as bars, restaurants, events, etc. In 2021 and 2022, restrictions were lifted and people’s consumption patterns started to normalize, which explains the high growth in 2021-2022. Adjusting for these years, we can see that volume growth is in the low single digits. What we can also observe from the graph, however, is that KO has pricing power as the company has been able to increase prices each year, especially during the inflationary environment of 2022-2023. So far, demand has proven inelastic to KO’s price changes as volumes have also increased. When inflation subdues, price increases will also be more modest, indicating KO’s topline growth will most likely be in the 5-10% range going forward if we assume that volume growth stays in the low single digits and price increases are slightly above inflation.

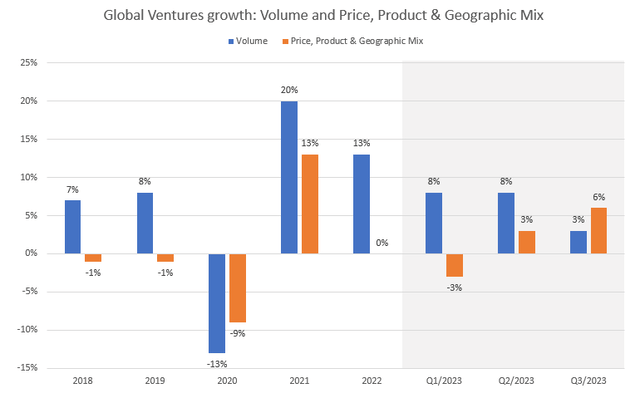

I mentioned that I excluded growth from acquisitions in the graph above, so I’d like to show the breakdown of the segment Global Ventures. KO has combined its acquired product lines under this segment which includes Costa (products: coffee), Innocent (juices and smoothies), Dogadan (tea) and Monster distribution fees (energy drinks). These businesses should at least in theory be able to grow topline faster than KO’s main brands as they are much smaller in size. In the segment’s growth graph below I have again excluded growth from acquisitions, FX and accounting changes. As KO has added acquired new brands to the Global Venture segment, acquisitive growth is obviously a big part of the growth of this segment but gives a distorted view of its organic growth if included.

Breakdown of Global Ventures’ growth (Company financial statements)

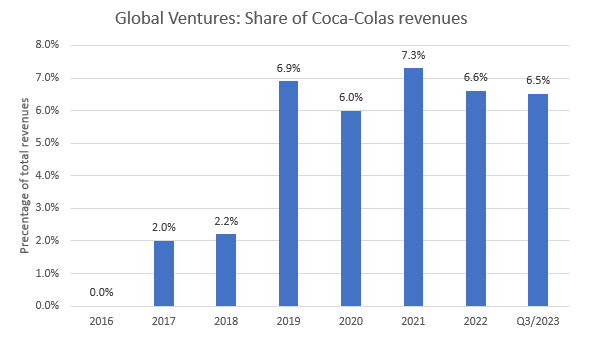

Volume growth has been higher in this segment than in KO’s broader operations which should be the case as well. The products’ pricing power does not equal that of KO’s flagship products as price increases have been fairly insignificant so far. It may be more difficult to build brand awareness for coffee, tea and juices even when you’re KO. Below you can see Global Ventures’ revenues as a percentage of KO’s total revenues. The increase from 2018 to 2019 relates to the acquisition of Costa. Since then, the share of total revenue has remained fairly stable indicating that these newer products have grown at the same rate as the rest of the company. Due to this, I would argue that the acquisitions haven’t been as successful as management would have hoped. I agree that it’s a step in the right direction but it hasn’t really provided any meaningful value to the shareholders of KO.

Global Ventures share of total revenues (Company financial statements)

Economics of the business

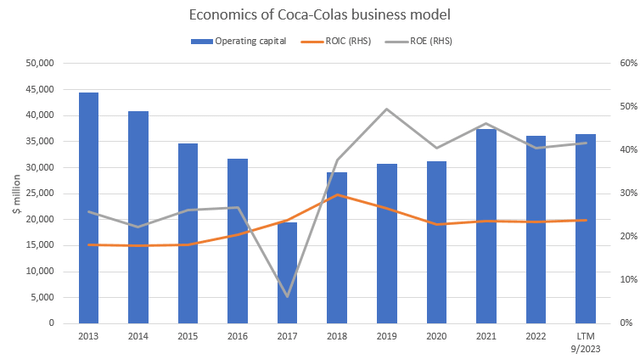

KO has been able to increase its return on invested capital [ROIC] during the last decade from the high teens to the mid-20s by divesting (refranchising) its bottling operations. Bottling is asset heavier than KO’s core business of producing and selling beverages and concentrates which means KO now operates a leaner balance sheet than was the case previously. The divestments naturally led to decreased revenues and earnings which bottomed out in 2018. Since then revenues and earnings have climbed steadily with price increases and volume growth. Return on Equity [ROE] has also increased to a staggering +40%. This is achieved due to higher relative debt levels and higher profitability due to the just-discussed divestments. Take a look at the chart below to get a better idea of how the divestments impacted KO’s economics.

The economics of KO’s business (Company financial statements, compiled by analyst)

As we can see there’s a clear regime change in 2018 and forward compared to the period 2013-2016. The year 2017 is an outlier due to the tax reform act which impacted KO’s net income and a few line items on the balance sheet. The increase in operating capital since 2018 is explained by acquisitions i.e., it is mostly increased goodwill.

The cash that KO generates is mostly distributed to its owners as dividends. The payout ratio to comparable EPS has ranged from a low of 60% in 2014 to a high of 84% in 2020. It has since then come down to slightly above 70% i.e., it seems that it’s still on a sustainable basis. The growth rate of the dividend has been slightly below 5% during the last two years. I believe KO can keep raising it by about 4-5% yearly as price increases and volume growth should keep earnings growth at 5% or slightly above that. For example, if we assume that KO’s retention rate is about 30% (i.e., payout rate stays steady at 70%) and use the comparable trailing twelve months earnings [TTM] of $2.60 per share, then $0.78 EPS is retained by the company. Assuming all of this goes to capital expenditures (capex) and generates returns on investment (i.e., ROIC) of 22.5% we get EPS growth of about $0.18 which is equal to a about 6.8% earnings growth rate (compared to $2.60). My assumption may be a bit aggressive here but my point is that KO should be able to grow earnings at 5% or above.

Coca-Cola has a full valuation

I have applied two valuation frameworks to value KO. In one framework I have two cash flow models: The Dividend Discount Model [DDM] and the discounted cash flow model [DCF]. In the other framework, I use multiples based on a peer group: EV/Sales, EV/EBIT, P/E and P/B. The peers are PepsiCo, Inc. (PEP), Nestlé S.A. (OTCPK:NSRGY), Keurig Dr Pepper Inc. (KDP), Danone S.A. (OTCQX:DANOY), Unilever PLC (UL), Anheuser-Busch InBev SA/NV (BUD), Heineken N.V. (OTCQX:HEINY) and Diageo plc (DEO). All of these companies operate in the beverage industry although it should be noted that they are active in other business lines, such as snacks and food. The multiples for the consumer staples companies can be seen below. The max/min is the range around the median in percentage terms. I also included KO here for comparison purposes at the top although KO’s figures are excluded from the statistics (median, average, max and min) and also when calculating KO’s valuation through the multiples approach. When the forward [FWD] multiples haven’t been available I have used the TTM multiple (only in two instances). All figures are from Seeking Alpha. The companies are sorted in order of size (excluding KO which is at the top).

| Name | Market-cap ($ million) | Enterprise value ($ million) | P/E [FWD] | P/B [FWD] | EV/Sales [FWD] | EV/EBIT [FWD] |

| The Coca-Cola Company | 253,200 | 281,100 | 21.8x | 10.0x | 6.2x | 21.2x |

| Nestle | 304,000 | 367,400 | 20.5x | 6.5x | 3.5x | 20.4x |

| PepsiCo | 235,600 | 270,300 | 22.4x | 12.2x | 2.9x | 19.6x |

| Anheuser-Busch InBev | 125,500 | 213,900 | 20.8x | 1.7x | 3.5x | 14.2x |

| Unilever | 119,700 | 149,000 | 18.1x | 5.9x | 2.2x | 13.8x |

| Diageo | 79,700 | 101,300 | 17.8x | 7.6x | 4.8x | 15.9x |

| Heineken | 52,000 | 74,400 | 17.4x | 2.5x | 2.3x | 15.8x |

| Keurig Dr Pepper | 45,600 | 60,000 | 18.3x | 1.8x | 4.0x | 16.4x |

| Danone | 41,500 | 53,900 | 17.5x | 2.2x | 1.8x | 14.3x |

| Median | 18.2x | 4.2x | 3.2x | 15.9x | ||

| Max | 23% | 192% | 49% | 28% | ||

| Min | -4% | -60% | -45% | -13% |

The widest multiple range (min and max multiple compared to the median multiple) belongs to the P/B multiple while the narrowest range belongs to the P/E multiple. The companies trade fairly consistently on earnings but not on book value.

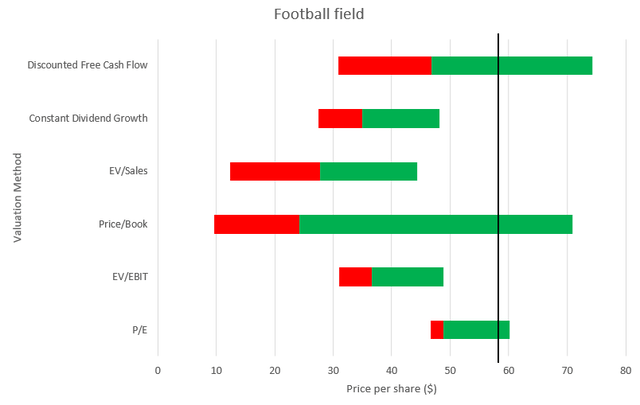

I have shown the output from the different valuation methods in the “football field” graph below. When applying the median, max and min multiples to KO’s 2023E financials we get a range of possible stock values. In the DDM I have used 4.5% as the base case growth rate for KO’s dividend and 3.0% and 6.0% for the bear and bull cases respectively. The return on equity I have used is 10% as I have assumed that that’s the best alternative return one could earn by investing for example in an S&P 500 index fund.

In the DCF model, I have assumed 7% sales growth during 2023-2027E and 5% as the terminal growth rate. I have assumed that the return on equity equals 10% and the cost of debt is 3.0% (the average interest rate was 2.3% as of 12/31/2022 so I assume it has risen with refinancing). Accounting for the interest tax shield of debt we get a weighted average cost of capital [WACC] of 9.0%. EBIT margin is expected to remain at 25% throughout the forecast period while capex is modeled as 3.5% of sales, depreciation as 13% of PP&E and NWC as 10% of sales. In the bear/bull case I have adjusted the sales growth rates and EBIT margins by +/-2% during the forecast period and the terminal sales growth rate by +/-1%. The black line represents KO’s current share price of about $58.6.

Valuation analysis (companies’ financial statements, SeekingAlpha, compiled by analysts)

The base case and median share prices I get for the different methods are:

- DCF: $46.8.

- DDM: $35.0.

- EV/Sales: $26.8.

- EV/EBIT: $37.8.

- P/E: $51.2.

- P/B: $29.3.

All different approaches indicate KO is overvalued. I would however argue KO deserves a premium against its peers due to being solely focused on beverages (excluding Costa) and being the clear market leader in soft drinks. Therefore the multiples approach may not be the best way to value KO although the P/E ratio gives a fairly narrow range of possible share prices. The DCF and DDM models, however, also indicate KO is overvalued. Intuitively, the DDM model should give a fair estimate of KO’s fair value as it is very important for KO’s shareholders that the dividend keeps growing. I also find it highly likely that the dividend will grow in the 3-6% range in the future. The return on equity is obviously debatable but assuming 10% is what you could earn from the S&P 500, then it wouldn’t make sense to decrease KO’s return on equity. How could KO be less risky than the combination of the 500 largest corporations in America? The estimated expected return I get is 6.8% which is below what you could earn on the best alternative investment (10% from the S&P 500). The current price is still reasonable in my view (P/E ratio not excessive) which is why I upgraded my KO rating to a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.