Summary:

- Coca-Cola’s Q3 2024 earnings release is expected to show increased profitability but a 2.8% drop in revenue year-over-year.

- North America and Latin America have been key growth drivers, with notable revenue and profit increases despite flat volumes and foreign currency impacts.

- Analysts forecast a rise in EPS to $0.75 from $0.71, with net profits increasing from $3.09 billion to $3.24 billion.

- Maintaining a ‘hold’ rating due to unchanged fundamentals and potential revenue weakness from divestitures, despite expected profit and cash flow growth.

rachasuk/E+ via Getty Images

For publicly traded companies, there are four times a year that can be incredibly volatile. Each of these involves the release of earnings for each fiscal quarter. This is when new data comes out and, when management obliges, updated guidance is offered. This paints a picture of how the business performed during a three-month window of time and gives the best indications possible as to what the near-term outlook for the company in question might be. It just so happens that, for one of the largest companies in the world, The Coca-Cola Company (NYSE:KO) the next earnings release is just around the corner. On October 23rd, before the market opens, management will be reporting results covering the third quarter of the 2024 fiscal year. Leading up to that time, analysts expect a nice increase in profitability. However, revenue is currently forecasted to drop year over year.

This is not the first time that I have written about The Coca-Cola Company this year. In fact, the last article that I published about the company came out late last month. In that piece, I extolled my passion for its hallmark drink. I consume it virtually every day. But as investors, it is imperative that we don’t let our own biases control our judgment. And because of how the stock was priced, I ended up rating the firm a ‘hold’. Since then, there hasn’t been much movement for investors. The stock is down 1.5% compared to the 1.9% increase the S&P 500 saw over the same window of time. But that’s barely any change at all.

My goal in this article is not to rehash the details of that prior piece. My overall assessment of the business has not changed. Having said that, I do believe that there are important things that investors should be paying attention to for when new data is revealed. In particular, there are certain spots of both strength and weakness that investors would be wise to pay attention to. Ultimately, if the picture can come in better than anticipated, or if shares drop materially in response to the news that is released, my mindset could change. But for now, I’m deciding to maintain a ‘hold’ rating.

What analysts are forecasting

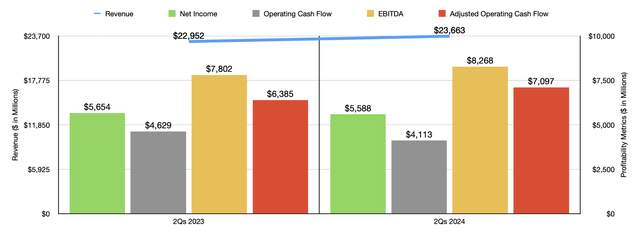

For the third quarter of the 2024 fiscal year, analysts have mixed expectations when it comes to The Coca-Cola Company. For starters, they don’t think that revenue will come in all that high. They currently anticipate sales of $11.61 billion. Although that’s more money than you, or I could likely fathom, it would actually represent a decline of 2.8% compared to the $11.95 billion the company reported one year earlier. This is interesting because, so far this year, the picture for the business has been quite positive from a sales perspective. Taking a chart from my prior article, you can see revenue and certain profitability metrics for the business above. Year over year, sales for the company grew by 3.1% for the first half of 2024 compared to the same time last year. That took revenue up from $22.95 billion to $23.66 billion.

*Revenues in Millions of Dollars

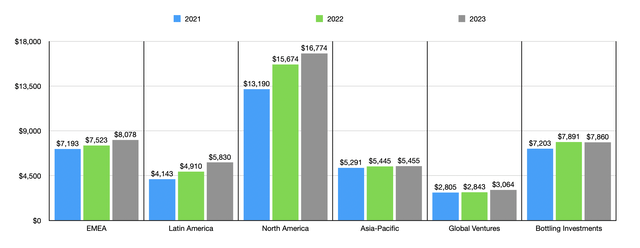

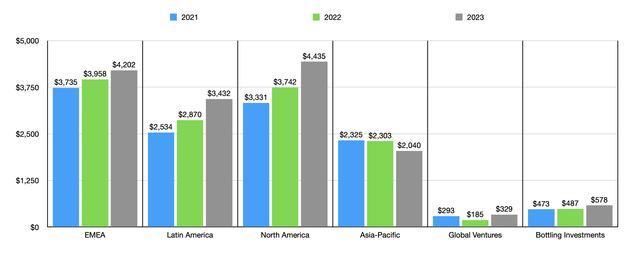

This marks a continuation compared to how the company has performed in recent years. However, while I did talk about the different market opportunities for the business, I did not dig into each of its operating regions. Doing so is very illustrative. Outside of its miscellaneous corporate operations, The Coca-Cola Company has six different operating segments. The largest of these is its North America business. Considering that Coca-Cola the products originated from North America and that the US itself is an incredibly developed country where product saturation should probably be a thing, growth in recent years has been impressive. Before diving into this year’s figures, using results from the prior three years might be a good place to start. From 2021 through 2023, revenue coming from North America shot up from $13.19 billion to $16.77 billion. In fact, during this three-year window of time, the North American operations accounted for 49.5% of the firm’s segment operating revenue growth despite accounting for only 33.1% of those sales in 2021.

This kind of growth has come from a combination of factors, including higher pricing and changes in product mix and geographic mix. Interestingly, this growth occurred even as volumes remained virtually flat during this window of time. Outside of the company’s Bottling Investments segment, which took up the largest share of capital expenditures, North America has been a source of major cash outflows for the company from a capital expenditure perspective. Over that three-year window of time, $921.8 million, or 19.6%, of the company’s capital expenditures were allocated to the continent.

The other major source of growth for the company has been its Latin America operations. This part of the business is smaller than its operations in the EMEA (Europe, Middle East, and Africa) regions and smaller than its Asia Pacific business. Even so, revenue skyrocketed over the three-year window of time by 40.7% from $4.14 billion to $5.83 billion. Despite only accounting for 10.4% of the company’s total segment revenue in 2021, the growth that the region brought in for the company was responsible for 38.6% of the firm’s overall revenue expansion. Just like the North America business, the Latin America set of operations ended up benefiting significantly from higher prices and changes in product mix and geographic mix. All combined, these factors were responsible for cumulative growth of 35.7% over this window of time. However, this region also exhibited tremendous volume growth. Volume grew by 7% from 2021 to 2022, while growing another 6% from 2022 to 2023. This is in spite of the fact that the company has only allocated $10.3 million toward capital expenditures to the region.

Other parts of the company have increased as well. But none of them have been as impressive as these two regions. The next best performer was the EMEA set of operations, which reported a 12.3% increase in sales. The 9.2% coming from the firm’s Global Ventures unit was not too far behind. This was followed by the 9.1% increase in sales coming from the company’s Bottling Investments business. That left the Asia Pacific region as the laggard, with growth of only 3.1%. However, this expansion is somewhat deceptive because much of the growth experienced was offset by foreign currency fluctuations. Over this three-year window of time, changes in price, product mix, and geographic mix, increased by an aggregate of 8.2%. Volume grew another 8%.

*Revenues in Millions of Dollars

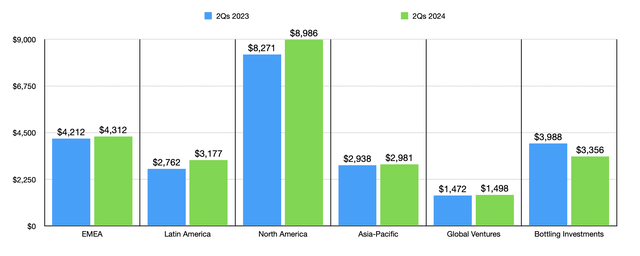

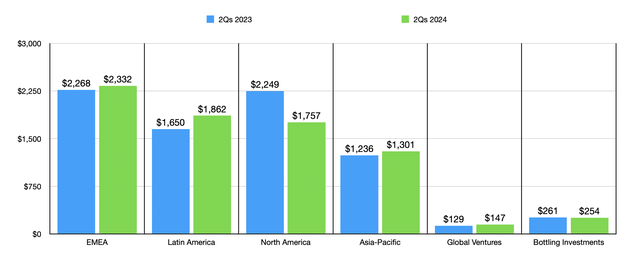

As I illustrated in the first chart in this article, the 2024 fiscal year has also been a time of expansion for the business. But again, that growth has not been even across the board. The North America business, for instance, was once again a big source of expansion for the company, with revenue jumping by 8.6% year over year. That resulted in an increase in sales from $8.27 billion last year to $8.99 billion this year. Meanwhile, the Latin America business grew to the tune of 15% from $2.76 billion to $3.18 billion. The same factors that contributed to growth for these units from 2021 through 2023 also contributed to growth in the first half of this year compared to the same time last year. In North America, volume was flat. But changes in price, product mix, and geographic mix, resulted in a nine percent expansion. In Latin America, changes in price, product mix, and geographic mix, pushed sales up by 21%. Volume grew another 4%. It was only because of a 10% hit caused by foreign currency fluctuations that sales weren’t higher.

Naturally, the other parts of the company saw mixed results. But at first glance, the one that’s really surprising is the Bottling Investments part of the firm. Revenue actually fell 15.8% year over year. This was in spite of the fact that volume expanded by 7% and changes in price, product mix, and geographic mix, added 6% to the firm’s top line. Some of the weakness was caused by foreign currency fluctuations. But the real hit came from acquisitions and divestitures. This caused a 26% hit because of management’s decision to sell off some of its bottling operations. In particular, during the first half of this year, the firm saw $2.91 billion in proceeds, mostly related to the refranchising of its bottling operations that had been classified as held for sale at the end of last year. The firm also received $720 million of proceeds stemming from the sale of its ownership interest in an equity method investment in Thailand.

In all likelihood, it’s this kind of activity that will probably result in any sort of drop in sales for the company for the third quarter of the 2024 fiscal year compared to the same time last year. For decades now, The Coca-Cola Company has made it part of its business model to buy up struggling or underperforming bottlers, improving their operations, and then refranchising them.

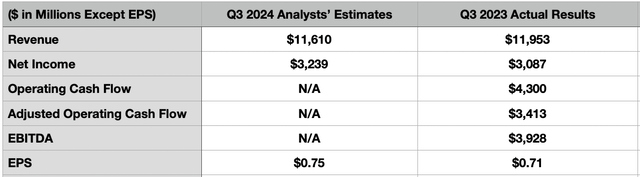

When it comes to the third quarter, revenue might drop, but analysts are forecasting a rise in profits. They currently believe that earnings per share will come in at around $0.75. That would be an improvement over the $0.71 per share in earnings generated the same time last year. Should this come to fruition, it would translate to a rise in net profits from $3.09 billion to $3.24 billion. We don’t know what other profitability metrics will look like. But in the table above, you can see what these were for the same time of the 2023 fiscal year. It is very likely, I would argue, that these metrics will also improve year over year if profitability increases as well.

*Profits in Millions of Dollars

Just like what we have seen from a revenue perspective, earnings and earnings growth for the company have not been evenly spread. It’s not hard to imagine which of the two operating segments performed the best during this window of time. Naturally, this would be its North America and Latin America sets of operations. North America reported operating profit growth from $3.33 billion in 2021 to $4.44 billion last year. In Latin America, growth was from $2.53 billion to $3.43 billion. Because there was weakness for some parts of the business, most notably the Asia Pacific region, these profit increases from Latin America and North America ended up being responsible for 86.1% of the company’s increase in segment operating profit during these three years.

But when it comes to the 2024 fiscal year, the picture changes to some extent. Latin America continued to be a source of growth for the firm, with segment profits expanding by 12.8% from $1.65 billion to $1.86 billion. This is not surprising to me in the least. And in fact, that growth rate is more than double the growth rate experienced by the four segments of the company that involve specific geographic regions. But the weak spot during this time ended up being North America. Profitability dropped from $2.25 billion to $1.76 billion. That’s a plunge of 21.9% year over year. Management said that certain costs were higher, such as marketing expenses, various operating costs, and commodity costs. But the real source of the problem ended up being the firm’s sports drink business, BODYARMOR.

*Profits in Millions of Dollars

Back in 2021, The Coca-Cola Company acquired the 85% of BODYARMOR that it did not previously own in exchange for $5.60 billion. At that time, this resulted in the firm booking an $834 million gain on a remeasurement of its minority interest in the business. Unfortunately, however, this did not turn out well. During the first half of this year, management booked a $760 million impairment involving these operations. Certainly, it seems as though the purchase is not living up to expectations. Without this, profitability for the company would have been quite a bit higher. In fact, during the first half of 2024, the $5.59 billion in profits that the company generated did come in lower than the $5.65 billion reported the same time last year. So keeping all else the same, net income would have risen year over year during that window of time had it not been for this impairment. But unfortunately, that’s just the way things are.

The reason why I bring up this impairment is because, while the first half of this year has not been particularly great from a profitability or cash flow perspective, it’s not crazy to expect this trend to reverse for the third quarter. With the aforementioned impairment now out of the way, I see no reason why the firm’s bottom line shouldn’t return to growth, even though other factors like rising costs in some parts of the business might still persist. The Latin America business should especially be a source of strength for the company.

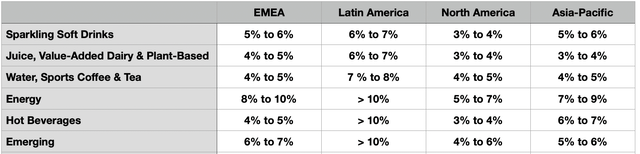

At this point, some of you might be asking how much additional growth an industry behemoth with a sizable market share can possibly occur. The good news, at least in the near term, is that the answer is probably a lot. In the table above, you can see certain product categories and management’s forecast for growth on a region-by-region basis for the 2024 through 2027 fiscal years. While North America does seem to offer weaker prospects than places like the Asia Pacific region or the EMEA regions, that growth is still solid. But most impressive is Latin America, with three of the six product categories indicating annualized growth greater than 10%. And with The Coca-Cola Company already having a good track record in that region, I fully expect things to go well.

Takeaway

Heading into earnings, I do think investors should be paying careful attention to the various operating segments that make up The Coca-Cola Company. Based on my own observations, both North America and Latin America should help to propel things higher. But this doesn’t mean that investors should expect an increase in sales. I do think that profits and cash flows will likely grow year over year. However, because of the aforementioned divestitures, revenue will likely come in weak. If this picture ends up being significantly different from what analysts are expecting, I could very well change my assessment of the firm. But sticking to my previous findings regarding how it’s priced and considering that nothing fundamentally has changed since then, including really its price, I believe that maintaining a ‘hold’ rating is logical.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!