Summary:

- The Coca-Cola Company is a reliable investment for capital preservation, but current share prices make it less compelling compared to better opportunities.

- Despite impressive revenue and profit growth, Coca-Cola’s valuation is high, especially when compared to its competitor, PepsiCo, which offers better growth at a lower price.

- Coca-Cola continues to expand, benefiting from increased pricing and product mix, but growth has slowed, and recent profits and cash flows have seen mixed results.

- The company excels in returning capital to investors through share buybacks and dividends, but a ‘hold’ rating is appropriate given its current valuation and growth prospects.

Jonathan Knowles

One of the largest and most iconic consumer brands in the history of the world is The Coca-Cola Company (NYSE:KO). With its products sold in over 200 countries and territories, the firm has its hands pretty much everywhere. And what’s really exciting is that, even though the business is so developed, it continues to expand a bit each year. Long term, it might be difficult to imagine this trend continuing. But with the global population expected to grow and the company’s products accounting for only a sliver of the global beverage market, I would argue that the picture for the company down the road is quite positive.

If your priority as an investor is to preserve capital, there are few companies as reliable to bank on as The Coca-Cola Company. And over the years, the firm has proven itself time and time again. Unfortunately, I have not followed the business as closely as I should have over the years. In fact, the last time I wrote about it was just over six years ago in early September of 2018. In that article, I called its decision to acquire Costa, a UK based coffee house with a big presence in Europe, a ‘brilliant attack’ on Starbucks (SBUX). And since then, the 94.6% return the company has achieved comes very close to matching the 98.3% increase seen by the S&P 500 over the same window of time. Having said all of this, I don’t think that this makes for a compelling ‘buy’ candidate at this point. I do suspect that the company will continue to expand for the foreseeable future. But when you look at how shares are currently priced, I would make the case that there are better opportunities that can be had.

Continued growth

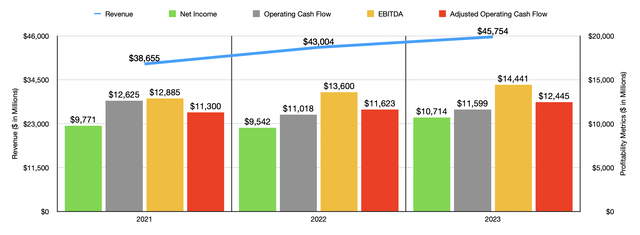

Over the past few years, The Coca-Cola Company has achieved impressive growth considering how big the company really is. Back in 2021, revenue for the firm was $38.66 billion. But by 2023, it had expanded to $45.75 billion. That’s an annualized growth rate of 8.8%. To be fair, the firm did receive a nice jolt as the COVID-19 pandemic was coming to an end. If you look at the contributors to the upside it experienced during this window of time, you would notice that it benefited from a jump in volume. In 2021, volume increases added 9% to the firm’s top line. In 2022, it was 5%. But by 2023, it had come back down to more normal levels at 2%. This is not to say that there were other contributors as well. In fact, higher pricing played an even larger role in the firm’s upside. Changes in pricing, product mix, and geographic mix played the largest role. In 2021, these items contributed 6% to the firm’s upside. In 2022, the contribution was 11%. And last year, it was 10%. This does go to illustrate the company’s robust market power.

With revenue rising, profits and cash flows followed suit. Net income rose from $9.77 billion to $10.71 billion over this window of time. As the chart above illustrates, operating cash flow in 2023 was actually lower than it was two years earlier. But if we adjust for changes in working capital, we get consistent year-over-year increases. During this time, that metric expanded from $11.30 billion to $12.45 billion. And finally, EBITDA for the company managed to climb from $12.89 billion to $14.44 billion.

When looking at the company at a deeper level, we can see that shareholders have benefited over the last few years from a rise in the number of cases of product sold by the company. These cases expanded from 31.3 billion in 2021 to 33.3 billion last year. One concern that I remember hearing years ago about The Coca-Cola Company was that a shift away from sodas and toward healthier drinks might prove damaging to the company. However, it’s sparkling water sales have only managed to climb from here. They grew from 21.6 billion cases to 23 billion cases over this window of time. The fact of the matter is that the Coca-Cola product that we know today is included in this group. In fact, when you look at all Coca-Cola branded products combined, the company saw an increase in the number of cases over the last few years from 14.7 billion to 15.7 billion.

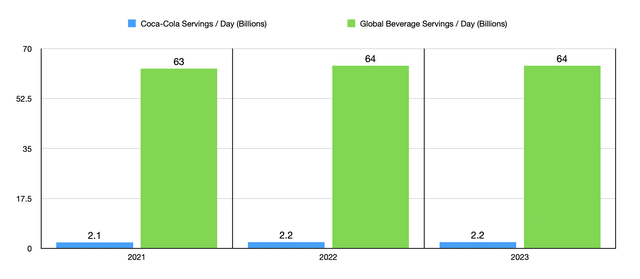

If these numbers sound large, you need only understand how big the global beverage market is. Management pegged this number at 64 billion servings each day. And if what management says is accurate, The Coca-Cola Company’s products are responsible for 2.2 billion of these servings. That’s a slight uptick from the 2.1 billion servings out of the 63 billion servings globally that management estimated just two years prior.

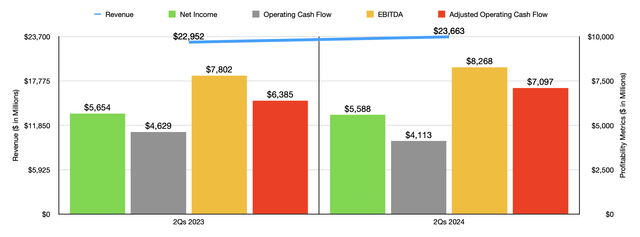

The good news for investors is that the company continues to see growth into the current fiscal year. For the first half of 2024, revenue was $23.66 billion. That’s up 3.1% compared to the $22.95 billion reported one year earlier. During this time, the company benefited to the tune of 11% from changes in price, product mix, and geographic mix. However, acquisitions and foreign currency fluctuations offset this to some extent. Meanwhile, the firm benefited from a 2% increase in total volumes.

This is not to say that everything has been fantastic in 2024. For the first half of the year, the company generated net profits of $5.59 billion. That’s down slightly from the $5.65 billion reported one year earlier. Operating cash flow also took a hit, declining from $4.63 billion to $4.11 billion. As scary as these changes might seem, in my view, management delivered where it mattered most. If we adjust for changes in working capital, for instance, we see a nice rise in operating cash flow from $6.39 billion to just under $7.10 billion. Meanwhile, EBITDA successfully grew from $7.80 billion to $8.27 billion.

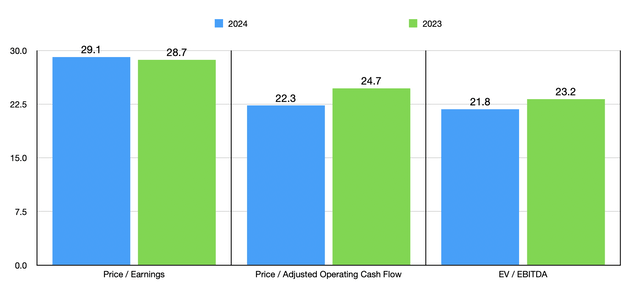

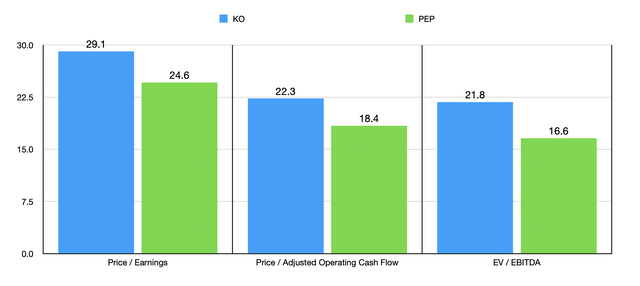

As happy as I am to see one of my favorite brands continue to expand, a brand I should mention I consume almost daily (much to my doctor’s chagrin), this does not mean that I think it’s a good decision to buy the stock. In the chart above, you can see how the company is currently valued using historical results for 2023 and estimates for 2024. The 2024 figures are based on an extrapolation from what the company has seen so far this year. This would mean net income of $10.59 billion, adjusted operating cash flow of $13.83 billion, and EBITDA of $15.30 billion. To put in perspective the figures, which to me look pricey on an absolute basis, I need only compare the firm to its largest competitor. This would be PepsiCo (PEP). As the chart below illustrates, PepsiCo is trading at a discount to its rival.

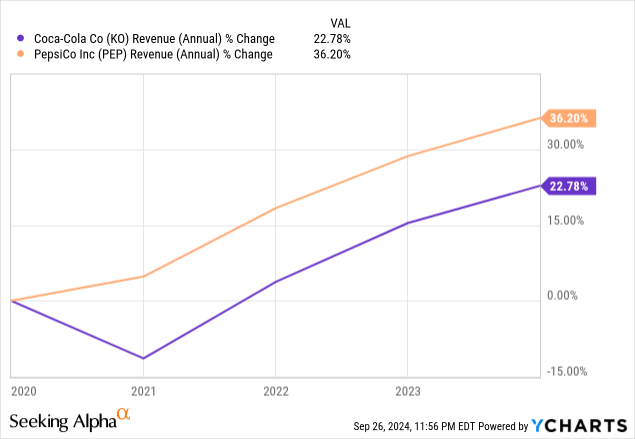

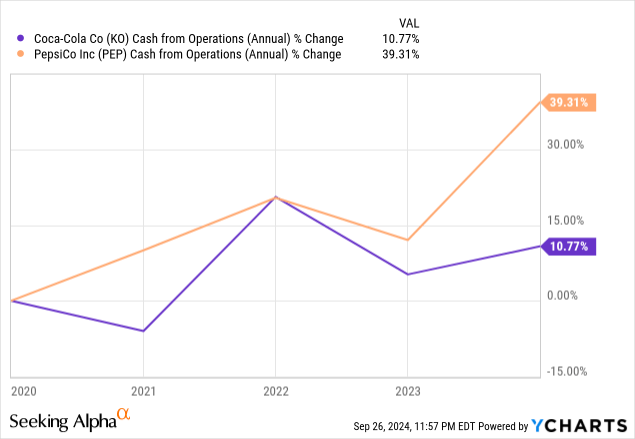

A case could be made that The Coca-Cola Company deserves to trade at a premium to its competitor. But honestly, I don’t know why that would be. In the first chart below, you can see revenue growth for each of the businesses over the last five years. In the second chart, you can also see operating cash flow growth for each of them. In both instances, PepsiCo boasts the more impressive track record of the two companies. By buying it, you get a firm that is not only cheaper, but that has a better growth record under its belt.

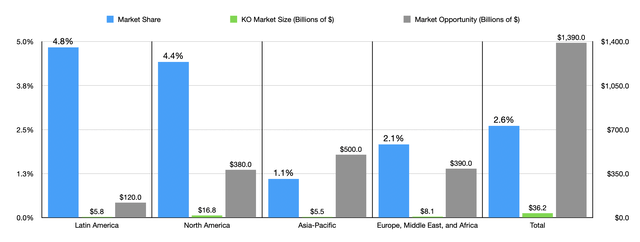

This is not to say that I don’t believe in the potential that The Coca-Cola Company offers when it comes to growth. In the chart below, you can see the size of each of the major geographic regions that the company plays in. That chart also shows the size of its market share in each of those areas. All combined, we are talking about a $1.39 trillion opportunity for the company. And the sales located in those regions comes out to roughly 2.6% of that. This means that there is still plenty of room for upside, and that does not even factor in the fact that many parts of the world will continue to see their populations grow for the foreseeable future.

Another reason to appreciate The Coca-Cola Company is that management is not shy about returning capital to investors. Over the last three-and-a-half years, the company has allocated $2.18 billion toward share buybacks. This is net of the value of shares issued. In addition to this, over the same window of time, management has made sure to allocate $25 billion toward dividends. To achieve consistent growth while also returning billions of dollars a year to investors is something that only the highest quality companies can do.

Takeaway

Fundamentally speaking, I believe that The Coca-Cola Company is a great company. I think that the long-term picture will be positive and that growth prospects remain. Having said that, shares are far from cheap. In addition to this, they are a bit pricey compared to their largest competitor. Add on top of this growth that has fallen short of what PepsiCo has achieved, and I would argue that a ‘hold’ rating is appropriate for the business at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!