Summary:

- Coca-Cola has outperformed Pepsi in growth and market share by targeting Gen Z consumers, despite recent share price pullback and economic headwinds.

- KO’s Q3 earnings beat estimates, but volumes declined slightly due to high interest rates and international market challenges, particularly in Eurasia and Africa.

- Pepsi’s acquisition of Siete targets health-conscious Gen Z consumers, but KO’s digital ecosystem and marketing strategies have shown stronger engagement and market penetration.

- Despite KO’s solid performance and strong cash flows, the stock offers no margin of safety; recommend waiting for a price pullback to mid or low $50s.

- Higher for longer interest rates have also plagued both companies as consumers are more cost-conscious as their finances face downward pressure.

igoriss/iStock via Getty Images

Introduction

Although The Cola-Cola Company (NYSE:KO) and Pepsi (PEP) have both faced headwinds over the past year, partly due to high interest rates, the former has been outperforming its peer in terms of growth and price appreciation over the same period.

With KO focusing on Gen Z consumers, this has enabled them to power past their peer while growing market share and expanding their operations. But over the past two months or so, KO has seen its share price pull back despite the momentum the company gained in the past year.

In this article, I discuss the company’s earnings, headwinds, and why the price pullback may be worth considering for long-term investors.

Previous Thesis

I last covered The Coca-Cola Company back in March assigning the beverage maker a hold rating as I thought the share price was getting a bit expensive. Despite this, the stock has performed well over the past 8 months, up 10.51% while the S&P is up 11.20% over the same period.

In the article I discussed how KO was cleverly targeting Gen Z consumers, implementing strategies and marketing campaigns that resonated well with the consumers.

Moreover, despite economic challenges, KO saw solid earnings, organic revenue growth, and further penetration into key markets, essentially growing its market share.

Using the Discounted Cash Flow method, I had a price target of nearly $64 a share. And although the stock’s share price blew past this, KO has seen a recent pullback which I’ll discuss more later in this article.

Latest Earnings

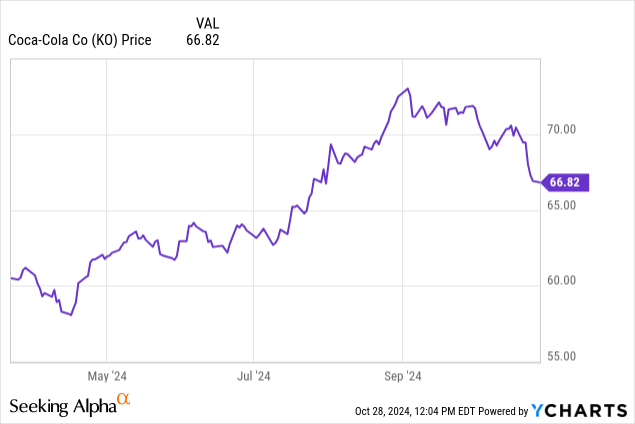

As you can see in the chart below, Coca-Cola’s share price was trading above $72 a share roughly two months ago, but pulled back at the end of September to roughly $67 where it trades at the time of writing. So, what happened? The company reported their Q3 earnings and managed to beat estimates on both their top and bottom lines.

During earnings KO beat analysts’ estimates on EPS by $0.02 and revenue by $290 million. EPS came in at $0.77 while revenue was $11.9 billion. But despite the solid report, both declined from $0.84 and $12.4 billion in the previous quarter, likely the reason for the price pullback.

After having a good start to the first half of the year, KO saw volumes decline slightly during Q3 by 1%. Management attributed this to a slow July start. While companies like The Coca-Cola Company and Pepsi have strong pricing power, the high-interest rate environment has resulted in much tighter financials for consumers.

U.S. consumers have remained resilient, but in KO’s international markets is where the brunt of headwinds has been felt. The Eurasia & The Middle East as well as Africa saw volumes decline. And management thinks these will continue for the near-term. But they plan to combat this with metrics like increased affordability, availability, and accelerating refillable offerings.

In Latin America volumes were flat during the quarter. Peer Pepsi also saw lower growth in their international segments, particularly Latin America, Africa, Middle East & South Asia, Asia Pacific, Australia, New Zealand, and China region. I discussed this during a recent article you can read here.

But KO did see improvements in Brazil and Europe, thanks to the Olympic and Paralympic games. Additionally, Rock In Rio, a music festival that features artists from around the world, reached more than 70 million people and led to the company being the most mentioned brand on TikTok.

Moreover, KO’s digital ecosystem launched in 2023 has resulted in strong recruitment of Gen Z consumers. Topo Chico, a sparkling water brand owned by KO reached the #1 brand as KO has connected the brand to music, art, and food, all something Gen Z consumers love.

In Q3 alone, it grew 20% globally. And KO is not stopping there. During the earnings call, management mentioned the company launched Topo Chico’s first ever experimental activation with Think Like An Artist campaign in Mexico.

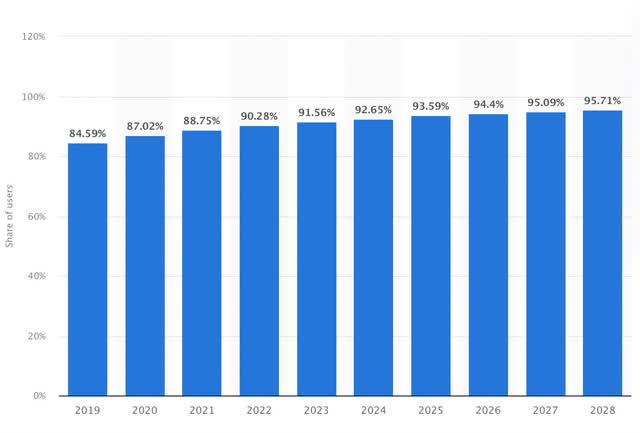

This is a feature that connects the brand with local artists across multiple events in five cities and are amplified through social media outlets. This is a smart move on KO’s part as Gen Z consumers are highly addicted to various social media platforms. And social media is expected to continue seeing solid growth in the coming years.

Pepsi seems to be now focusing more on Gen Z consumers. One potential move is the recent acquisition of Siete. They also talked about the long-term potential of their food business, analyzing Gen Z snack patterns.

Their CEO mentioned how their snacking and food patterns favor the snack giant over the long term as these consumers are snacking more. Moreover, with U.S. consumers seemingly more health-conscious, this could potentially play into Pepsi’s favor with Siete, a healthier food & snack alternative.

Cash Flows & Earnings Growth

Despite KO’s solid performance through 3 quarters, their cash flows did see a decline year-over-year. Year-to-date free cash flow was $7.6 billion vs $7.9 billion in 2023. This was due to higher tax payments and higher capital expenditures.

Comparably, Pepsi’s free cash flow also declined from the previous year as the company saw higher CAPEX vs the previous year. Pepsi’s cash from operations declined, ultimately resulting in free cash flow declining from $5.093 billion to $3.370 billion, a much larger decline than its peer.

Through 3 quarters, Cola-Cola has paid $4.274 billion in dividends while free cash flow was $7.6 billion while their peer has paid $5.369 billion in dividends and brought in free cash flow amounting to $3.370 billion.

While I expect Pepsi to continue covering their dividend due to their strong cash position, KO’s dividend was safer at the present moment and completely covered by free cash flow.

Moreover, while PEP expects at least 8% earnings growth this year from $7.62 in 2023, Cola-Cola re-iterated 5% to 6% growth from $2.69 the previous year. With analysts expecting earnings per share of $0.52 in Q4, this would put EPS for the full-year at $2.85, a growth rate of 5.9% from the previous year.

|

FY2024 |

FY2023 |

|

|

Coca Cola |

5% – 6% / $2.85 |

$2.69 |

|

Pepsi |

8% / $8.15 |

$7.62 |

And despite currency headwinds and financially constrained consumers, I suspect KO can deliver 8% to 9% earnings growth for the full-year. And if so, this will likely result in price appreciation. For the full year, both KO expects significantly higher organic revenue growth than its peer at 10% in comparison to 1%.

Healthy Balance Sheet

Aside from long-term debt increasing from the previous year, KO’s balance sheet was healthy, with leverage below management’s targeted range of 2.0x – 2.5x at 1.7x. This increased slightly from the beginning of the fiscal year and previous year’s quarter that saw leverage of 1.6x and 1.5x respectively.

Long-term debt stood at nearly $43 billion, an increase of more than $7 billion from $35.547 billion at the end of 2023. For comparison, Pepsi’s long-term debt stood at $38.5 billion, a slight increase from roughly $37.6 billion year-over-year.

But The Coca-Cola Company also increased their cash position over the same period from $9.366 billion to nearly $14 billion, while PEP’s declined from $9.711 billion to $7.308 billion.

Valuation

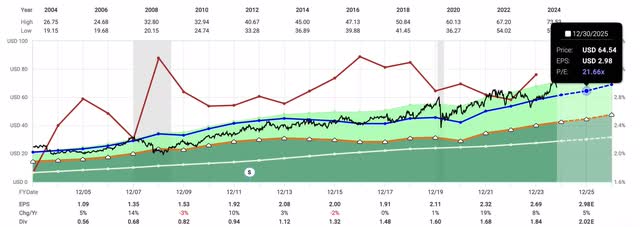

Despite KO’s pullback in price, the stock offers no margin of safety in my opinion. Using their earnings estimate, this gives them a forward P/E ratio of 23.42x. And while this is below their 5-year average of 24.32x, I like the stock below $55 a share.

For comparison purposes, Pepsi’s share price has also recently pulled back. The snack giant now has a forward P/E of 20.86x, also below their 5-year average of 24.18x.

Using their normal P/E of 21.66x, the stock offers no upside with a price target of $64.54. As previously mentioned, I like the stock in the mid to low $50’s and would wait for a better entry price.

Risks & Bottom Line

Although The Coca-Cola Company has seemingly been outperforming its peer in every metric, they still face several headwinds.

Due to their strong pricing power and brand recognition, the beverage giant is able to raise prices on its products. But due to tighter financials for consumers, volumes have experienced a decline, particularly internationally.

Moreover, rising conflicts in The Middle East will likely continue to suppress volumes as well as weakness in China.

Lastly, the company has an ongoing tax dispute with the IRS that KO made a $6 billion deposit to in Q3. Coke filed an appeal and further tax litigations could negatively impact the company’s cash flows further.

Despite headwinds that will likely continue for the near-term, KO expects to achieve 5% to 6% earnings growth and double-digit organic revenue growth of 10% compared to just 1% for Pepsi.

Additionally, the company saw stronger cash flows than its peer and continues to grow market share thanks to its Studio X platform launched in 2023 to target Gen Z consumers.

And despite Pepsi’s recent efforts with its Siete acquisition that could potentially result in solid growth over the long-term, KO seems to be well-ahead of its peer in this category.

And while this is reflected in their share price performance over the past year, I think the stock’s price is too rich here as it offers no margin of safety. For long-term investors looking to add, I suggest waiting for a pullback in the mid or low $50’s before adding.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.