Summary:

- Tesla, Inc. bears are not considering the long-term potential of the company, they do not understand Tesla’s strategy, nor do they have the patience and discipline to benefit from it.

- Concerns about Tesla’s falling margins and high valuation multiples are not what long-term investors should be focusing on. That is a short-sighted viewpoint on the company.

- Despite production delays and doubts about self-driving cars, the demand for Tesla’s products remains strong, with high revenue growth, and the company’s innovation should not be underestimated.

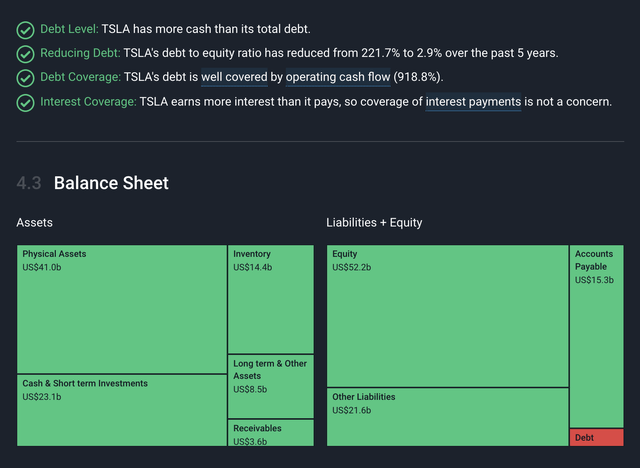

- Tesla is extremely financially strong, with over $23B in cash and investments with a 2.9% debt to equity ratio. They can afford to invest in capturing market share.

- Tesla is not just a car company, but also a sustainable energy company with the best visionary CEO and founder and talented employees, who are playing the long game.

Maja Hitij

What is the Goal of this Article?

As my readers know, I am a bullish investor on industry disruption, innovations in technology, reduced time to value being realized, recurring revenue, and economies of scale. The most important qualities I look for in a company, besides what I stated earlier, is that they have a differentiated product that solves important problems, they are driven by visionary leadership, and attract and retain the best talent. So, based off of that, it makes sense that one of my top three investments is in Tesla, Inc. (NASDAQ:TSLA).

I acknowledge the risk or concerns Tesla bears and other investors have, but I believe there are many common sense factors investors are not acknowledging when it comes to investing in Tesla. In my opinion, anyone who is short Tesla does not understand Tesla’s mission statement, the totality of its current business, and its future innovation. They are valuing a company with traditional financial models, that are backward looking and cannot accurately incorporate the current or future optionality in revenues and margins generated. The other thing to consider in my hypothesis is they do not have the patience and time horizon to hold on to the stock for very long.

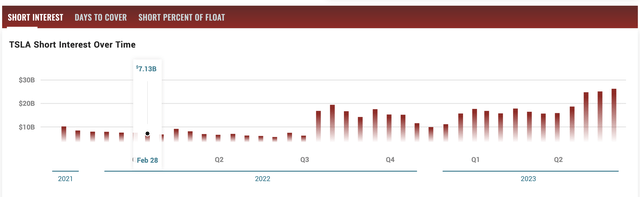

Short Interest Over Time on Tesla (Chart from MarketBeat)

I believe Tesla is one of the most misunderstood and overly criticized stocks in the world, and investors are missing out if they don’t take advantage of that. In this article I will first provide how most Tesla bears and institutional investment firms approach their thesis onto specific topics that are relevant to the company. I will then provide my refutations to the concerns and more or less the common sense response they are missing, in my opinion. The beauty of individual investing is it is a personal choice and you are entitled to your own thesis & decisions where your money goes. So, if you don’t agree with my thesis and common sense approach to investing in Tesla, you don’t have to buy the stock.

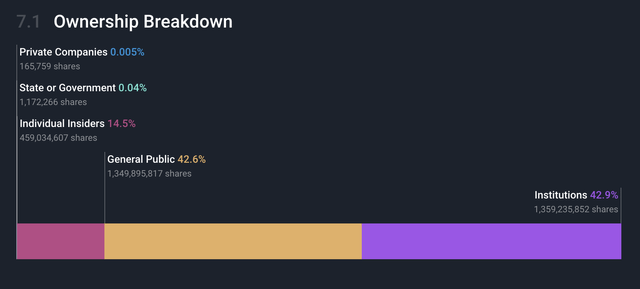

Institutional Investment Ownership in Tesla (Simply Wall. St. App)

I will conclude with what I believe to be common sense matters to ask yourself when it comes to investing in Tesla, and depending on your answer could determine your choice to buy or sell the stock. So let’s begin with what institutional investment firms and Tesla bears are concerned about around the company and stock. Please remember this is an observation, opinion, not a personal attack on Tesla bears, or financial advice.

The Financial Concerns and Delays

The Bear Perspective on Falling Margins:

Tesla Bears would argue much of Tesla’s profitability in recent years has not come from selling cars, but from selling regulatory credits to other automakers. Then the next supporting comment would be that this is not a sustainable source of profit, especially as other automakers develop their own electric vehicle (“EV”) lines and no longer need to buy credits. It raises their concerns about Tesla’s ability to be profitable in the long term purely from its operations.

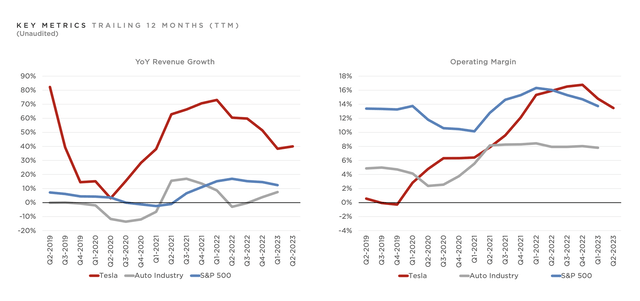

Tesla’s GAAP operating margin fell in Q2 to 9.6% sequentially from being 11.4% in Q1 2023. Analysts have driven home the fact that a year ago their operating margins were 14.6%. This is what Tesla bears or institutional money will say for why investors recently sold their shares or shorted the stock after the earnings. This could be the case, and you can see the history of revenue and margins below, but they are not looking into the fine details.

Key Revenue and Operating Margin Results (Tesla Q2 Earnings Presentation)

The Common Sense Perspective on Falling Margins:

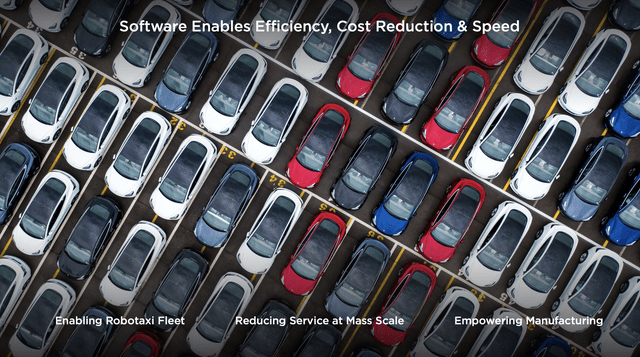

While it’s true that Tesla’s aggressive price cuts have led to declining operating margins, it’s crucial to remember that this is part of a larger strategy. You also have to take into consideration the timeframe we are operating in for the short term with higher interest rates and inflation. Tesla aims to increase the affordability of electric vehicles, which in turn will drive greater market penetration and volume. It is more important for Tesla to capture market share, more driving data, and a network at scale then protect margins. Remember, the more market share they have on the road the faster they will get to a fully operating FSD business model on the road and eventually robotaxis, that will open up economic scale not being factored by analysts.

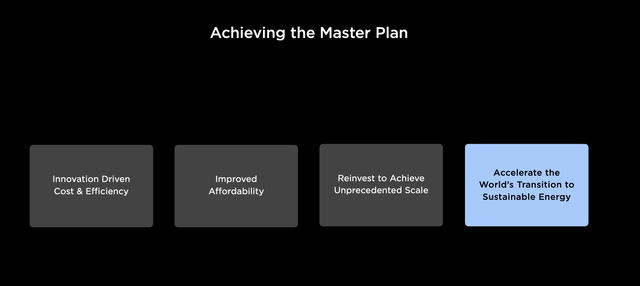

Tesla Masterplan Requires Capturing Marketplace at Scale (Tesla Investor Day Presentation)

If you do not believe robotaxis will ever happen, then just examine the logical reasons for the reduced margins in Q2 which are all temporary.

- Tesla was not forced but chose to reduce its ASP to align with their long-term strategy.

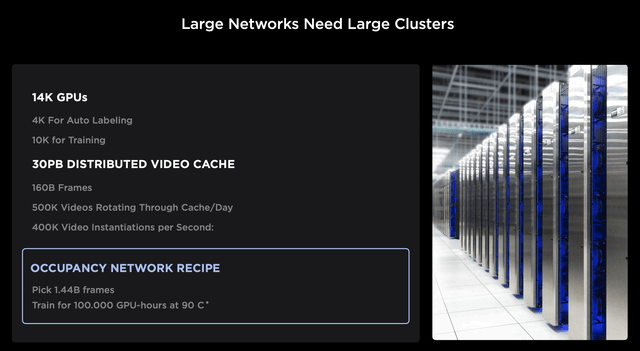

- The cost of production ramp of 4680 cells and their other related charges such as purchasing massive amounts of Nvidia (NVDA) GPUs for AI training and inferencing.

- Increase in operating expenses driven by Cybertruck, AI, and other large projects.

- Negative FX impact globally.

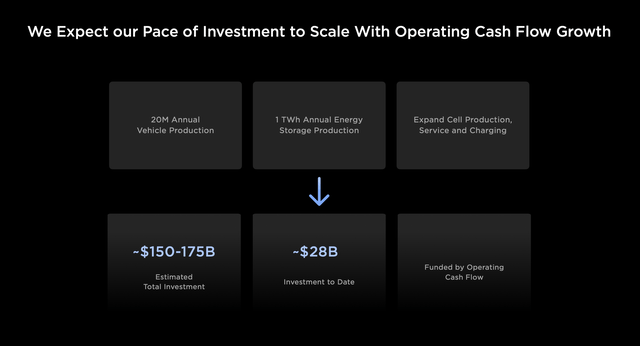

Tesla Expectations of Scale (Tesla Investor Day Presentation)

Now look at the positives they outlined in their earnings call.

1. Growth in vehicle deliveries (despite margin headwind from underutilization of new factories)

2. Lower cost per vehicle, which includes lower raw material costs and IRA credit. (Tesla is lowering COGS and becoming more operationally efficient for the long-term)

3. Gross profit growth in Energy business as well as Services & Other (An emerging market arena for Tesla to capture, will discuss more later)

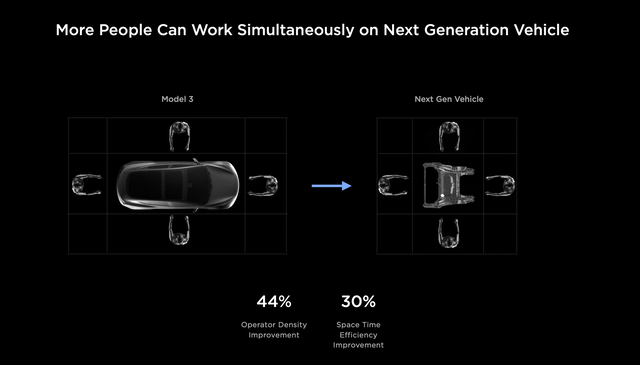

Moreover, the ramping up of new manufacturing facilities should yield economies of scale, they will be able to build cars 2x the speed with their new assembly processes, lowering production costs over time, and potentially improving margins in the future.

New Tesla Manufacturing Processes (Tesla Investor Day Presentation)

The Bear Perspective on Valuation:

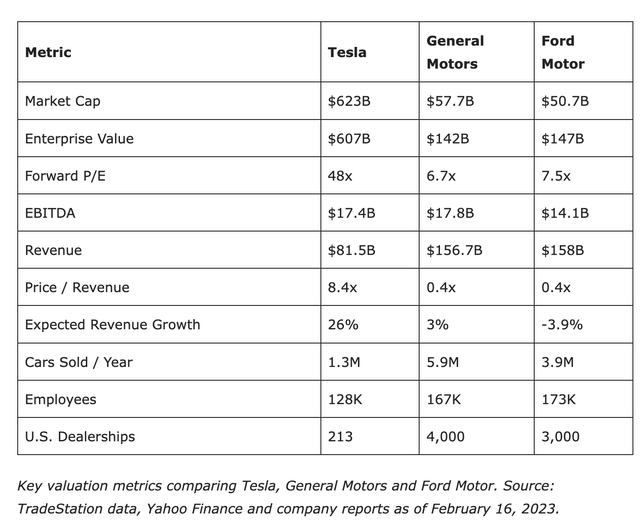

Institutional investment firms and analysts have been always focused on Tesla’s valuation multiples being far higher than any other automaker’s. In fact, the company’s Price to Earnings (P/E) ratio is multiples higher than the industry average, suggesting that the stock may be overvalued from a strictly numbers perspective. Such a high multiple is usually justified when a company has a significantly higher growth rate than its peers. The institutions and Tesla bears believe that Tesla’s growth rate, while impressive, is expected to slow down as the company gets bigger and competition continues to release new EVs to market, making it hard to justify the high valuation multiple. Below is a chart from back in February 2023 comparing the valuation to General Motors (GM) and Ford (F).

February 2023 Tesla Valuation vs. Ford & GM (Tradestation data & Yahoo Finance )

Many Tesla bears and institutions value the stock as just a car company. They do not have faith in Tesla’s innovation, long-term growth, and believe it is just matter of time before people realize this extreme “over-valuation” on the company and stock. However, these bears have been wrong so far considering this is what they have been saying for the last 20 years. CEO Elon Musk & his team have overcome numerous challenges over the past two decades to create a whole new industry of automobiles that forced all competitors to change how they were manufacturing their products and to build EVs. This may have never happened if it wasn’t for Elon’s commitment to the mission.

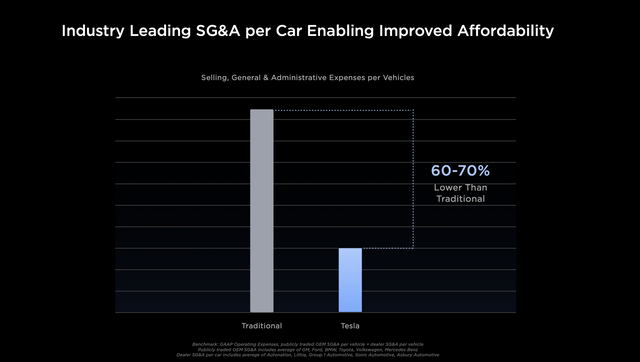

SG&A Comparisons of Tesla vs. Traditional Auto Manufacturers (Tesla Investor Day Presentation)

The Common Sense Perspective on Valuation:

High valuation multiples are not uncommon for companies that are leading and expanding new industries. Amazon (AMZN), for example, was criticized for its high valuation during its growth phase, but it has provided enormous long-term returns for shareholders who stayed invested. You can look at other examples such as Apple (AAPL), Netflix (NFLX), Google (GOOGL), Nvidia, Meta Platforms (META), Salesforce (CRM) and others. What do these companies have in common? They disrupted and redefined industries and how humans and businesses interact, enjoy entertainment, and acquire knowledge.

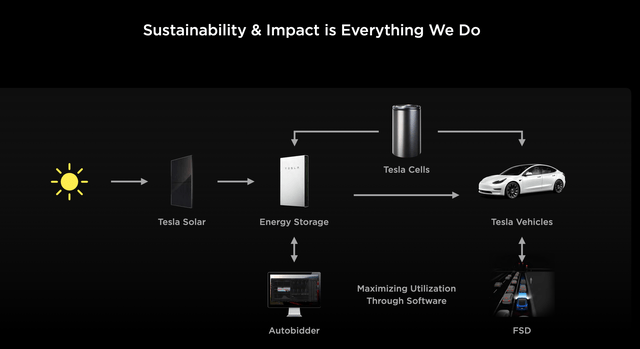

Tesla’s Focus on Sustainability & Impact (Tesla Investor Day Presentation)

It is extremely hard to put traditional financial constraints and valuations on companies like this, because they continue to innovate and scale for long periods of time. There is also something to be said that there are not as many companies like this that have impacted society like they have. I believe Tesla is most definitely one of these type of investments. Just like when those other companies were in their early innings they were misunderstood and expressed to be “too expensive,” but for a long-term investor they would do wonders!

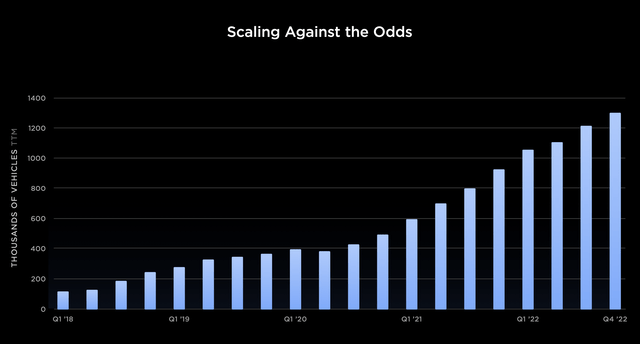

Tesla Scaling at Odds (Tesla Investor Day Presentation)

The other things to consider when bears scream about valuation are the following:

1. The continued high revenue growth at 47% YoY, and this is during high interest rates and inflation like we have never experienced in many years.

2. The financial excellence and good stewardship of the company’s assets with over $23B in cash and investments, a staggering 2.9% debt to equity ratio, operating cashflow last quarter of $3.1B, and a free cash flow of $1B.

3. The newest factories are still ramping up to scale, more are on the horizon, along with new products in high demand.

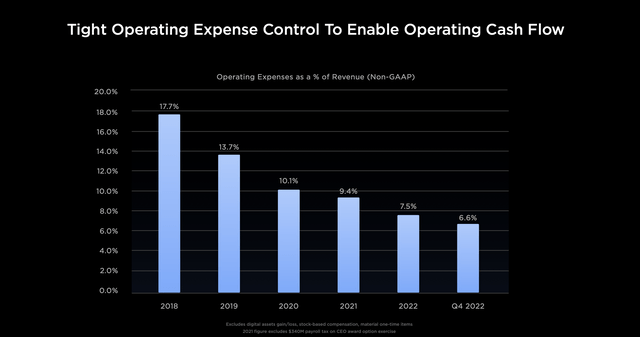

Reducing Operating Expenses (Tesla Investor Day Presentation)

I honestly feel like I could have stopped writing this article at this point and defended my stance on the common sense approach to investing in Tesla as a great long term stock that will yield market beating returns. However, let’s really dig into what everyone is saying and then provide some common sense from a long term investor perspective.

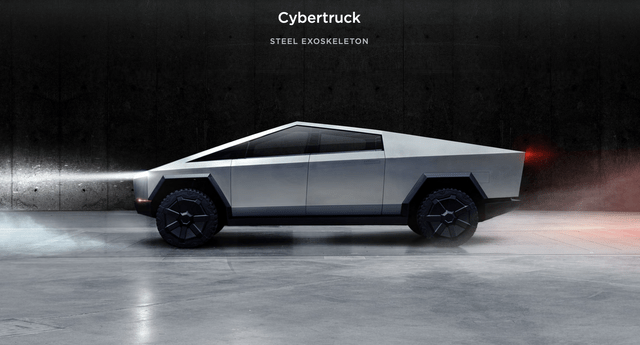

The Bear Perspective on Cybertruck Production Delays:

Tesla has a history of facing initial delays in production and providing release dates that take longer than initially estimated; however, these delays have typically not impeded the long-term success of its vehicles, but bears miss this. The bear position on the Cybertruck is that it has been talked about for four years, but nothing has been mass produced. During the demo day in 2019 Elon had Franz von Holzhausen, Tesla’s chief designer throw a metal ball at the windows to demonstrate the truck had armored windows that couldn’t break. Well, we all know how that one went down, and this is what bears will point to as another example of over promising and under delivering. Others like to comment on the look being so different than your standard pickup truck and say it is not practical. Competitors like Ford will say that the truck can’t function like a real truck and do “real work.” Now, let’s look at the facts.

Tesla Cybertruck (Tesla Investor Day Presentation)

The Common Sense Perspective on Cybertruck Production Delays:

If you are a long-term investor willing to dollar-cost average your investment consistently over time, it is not the end of the world if the vehicles are delayed, as long as they execute and drive massive demand. The demand for the cybertruck remains robust almost 5 years out, with 1.9 million reservations for order generated. Even if production is delayed, it does not fundamentally alter the long-term investment thesis. Please tell me another car manufacture that has generated this kind of demand on a launch of one of their newest vehicles.

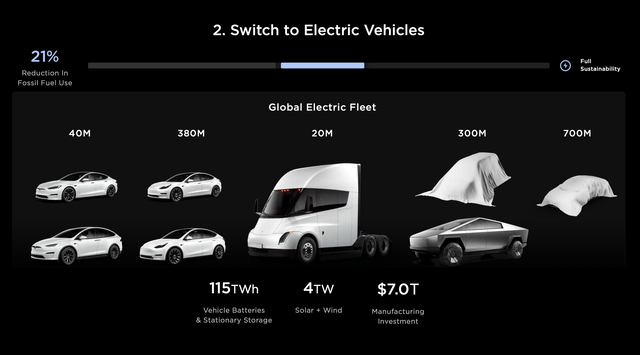

Tesla’s Global Electric Fleet (Tesla Investor Day Presentation)

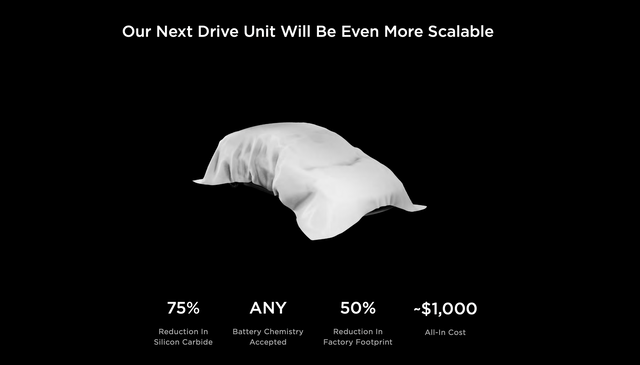

This addition to the fleet of Tesla vehicles on the road will help the company break into a new market and audience. This market is a very profitable one for North American truck manufactures, and Tesla will be growing their revenues and margins with this new launch. I believe Tesla will also be scaling their Semi-EV business over time as well, and eventually have a lower-cost EV that will allow them to capture another new market audience.

The Lack of Faith in Innovation & the Concerns Around Tesla’s Moat

The Bear Perspective and Doubt in Self-Driving Cars on the Road:

I believe due to Elon Musk’s missed original launch dates for Tesla vehicles and elongated timelines, analysts and media do not believe full self-driving (“FSD”) cars will ever be on the road. They believe this based on concerns around self-driving cars passing the regulatory guidelines, and the safety of self-driving cars vs. humans driving. We will address this in the common sense response section below.

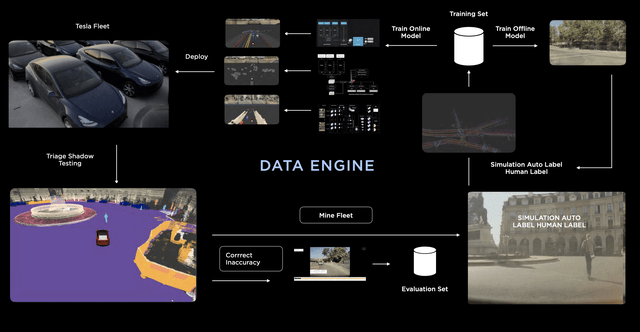

TSLA AI Data Engine (Tesla Investor Day Presentation)

Then the question is asked, “what if something glitches? On a highway etc. Would you trust your life in the hand of a computer?” The other narrative the media and analysts have regarding self-driving cars never happening is how long the FSD Beta program has been going on at Tesla, for nearly three years.

There are well-known investors who are bearish on Tesla and have been short the stock and made comments like those of Jim Chanos in 2017, “Obviously this is not being valued as a car company, it’s being valued on Musk… he’s the reason people own the stock.”(reut.rs/3qmx5HP). He then said in 2023 how he did not believe Tesla’s self-driving technology added any value in resale for cars, tweeting “The current value of the $TSLA “Full Self Driving” package is probably close to zero in the retail market. #RealityCheck,” responding to a tech reviewer.

There have been many institutional doubters about Tesla such as Jim Chanos, Andrew Left, John Paulson, Bill Ackman, Carson Block, David Einhorn, and George Soros. To anyone who follows the company or Elon Musk, they know Tesla has been one of the largest shorted stocks for a long time. In addition to shorting the stock, there are also just many institutional investors who are sitting on the sidelines when it comes to Tesla.

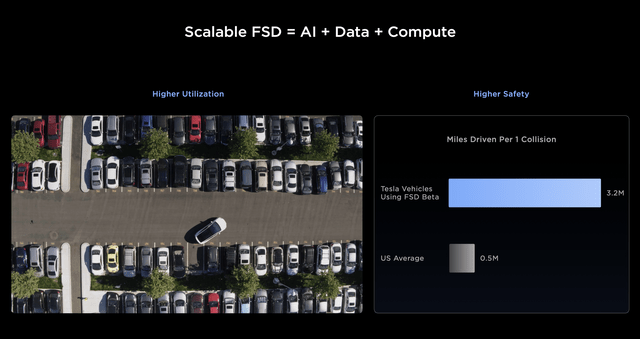

Scalability through Robotaxis (Tesla Investor Day Presentation)

The Common Sense Perspective on Self-Driving Cars on the Road:

Based on numerous recent studies, you may be surprised to know 94% of car accidents are caused by human error. Self-driving vehicles could potentially reduce traffic fatalities by up to 90%. In my opinion, even if self-driving cars could do a fraction of that, than the advancement in technology would be worth it. In 2020, only 1,977 traffic recordable incidents involved a self-driving car in the U.S. Vehicles with advanced safety systems (including self-driving capabilities) have 27% fewer bodily injury insurance claims. Self-driving vehicles could save around $190 billion in medical costs and could lead to a 60% decrease in vehicle emissions. Self-driving technology could potentially decrease rear-end collisions by 80%! Waymo and Cruise are already operating in certain counties in Arizona and California with their self-driving cars, and Waymo has a disengagement rate of about .076 per 1,000 miles.

Scalable FSD (Tesla Investor Day Presentation)

So, it is already happening and is proving to work. My bet is on Elon and that he has the safest vehicles on the road and the best AI data captured to provide the safest transportation. I could even see him licensing the data and AI models etc. for a pretty penny to other manufacturers. (The references for these statistics are captured from multiple studies from McKinsey, Consumer Reports, Statistica, ScienceDaily, Gartner, and others outlined in the bottom of the article).

Peter Lynch’s commentary on investing I believe can be used here, as some of the best wisdom against short sellers, traders, and Tesla bears.

“Thousands of experts study overbought indicators, head-and-shoulder patterns, put-call ratios, the Fed’s policy on money supply…and they can’t predict markets with any useful consistency, any more than the gizzard squeezers could tell the Roman emperors when the Huns would attack.” – Peter Lynch.

“It takes remarkable patience to hold on to a stock in a company that excites you, but which everybody else seems to ignore. You begin to think everybody else is right and you are wrong. But where the fundamentals are promising, patience is often rewarded—Lukens stock went up sixfold in the fifteenth year, American Greetings was a six-bagger in six years, Angelica a seven-bagger in four, Brunswick a six-bagger in five, and SmithKline a three-bagger in two.” – Peter Lynch, “One Up on Wall Street.“

Warren Buffet said, “be fearful when others are greedy and greedy when others are fearful.” So if you are not fearful of FSD not coming to fruition, the Cybertruck not meeting expectations, etc., then it sounds like a good buying opportunity.

If there is anything I have learned over my short career of investing and longer career in software sales, it is that there is great opportunity in investing in things that others don’t understand.

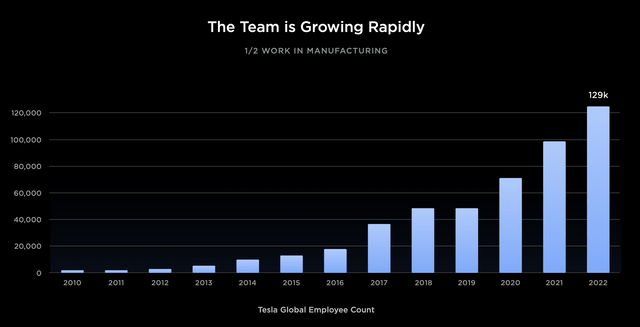

Tesla Headcount Growth (Tesla Investor Day Presentation)

The Bear Perspective on Tesla’s Increasing Competition and Belief There is No Moat

Tesla bears, institutional investment firms, and analysts create their valuations and comparisons of the company as solely just another automotive company. Most of these investors lack imagination and faith in Elon Musk, his leadership team, and the nearly 128,000 hard-working employees at Tesla, that they could achieve the mission statement of Tesla. Wait, have they even read the mission statement?

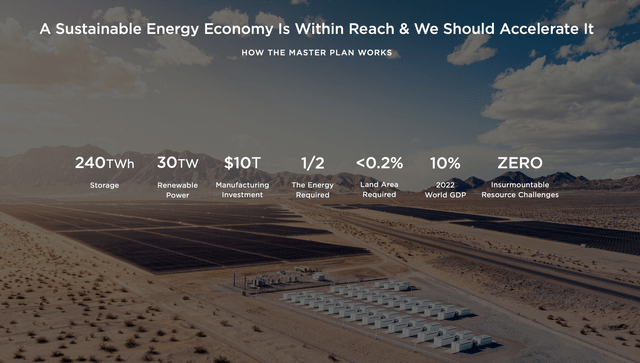

Sustainable Energy Economy via Tesla (Tesla Investor Day Presentation)

Tesla Mission Statement is “to accelerate the world’s transition to sustainable energy through increasingly affordable electric vehicles in addition to renewable energy generation and storage.”

Tesla Vision Statement is “to create the most compelling car company of the 21st century by driving the world’s transition to electric vehicles.”

For Tesla bears and other institutions to say Tesla is just another car company and it is overvalued and competition will eat into its market share says several things (which I will outline in the common sense portion below). The comments or belief Tesla does not have a moat, according to the definition of a moat would insinuate that the other car and energy companies would have something higher performing, better value, and unique to attack Tesla and steal their potential customers away. I don’t see it, but I could be wrong, but what I can share is what the competitors cannot do at the moment that Tesla offers, and why customers still choose Tesla over the competition.

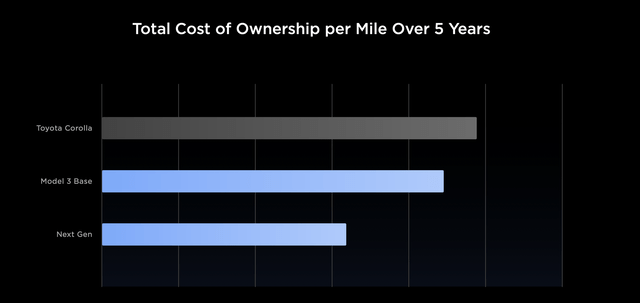

Total Cost of Ownership per Mile over 5 Years (Tesla Investor Day Presentation)

The Common Sense Perspective on Tesla’s Increasing Competition and Belief There is No Moat

Tesla has been an undeniable frontrunner in the EV industry, a status that’s been aided by several unique advantages that collectively form Tesla’s economic “moat.” This term refers to the sustainable advantages a company holds over its competitors, similar to how a moat protects a castle from invaders.

Tesla’s first-mover advantage in the EV market has played a critical role in its success. This early start gave Tesla the opportunity to develop and refine its technology, manufacturing processes, and marketing strategies before many competitors even entered the market. The result is a portfolio of highly desirable vehicles like the Model S, Model 3, Model X, Model Y, and the much-anticipated Cybertruck and Semi. By the time legacy car manufacturers pivoted towards electric vehicles, Tesla had already established itself as a dominant player and a symbol of electric mobility.

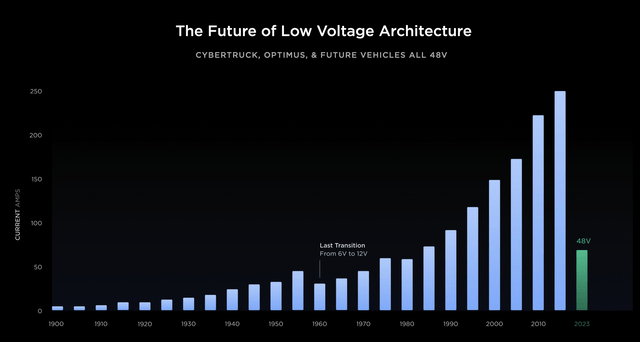

Improving Low Voltage Architecture (Tesla Investor Day Presentation)

Next, Tesla’s DOJO AI supercomputer is another aspect of its moat. The DOJO is designed to process vast amounts of data collected from Tesla’s vehicle fleet and use it to train and improve Tesla’s Autopilot and full self-driving systems. As Tesla’s fleet grows, so does its data pool, feeding into a virtuous cycle of constant learning and refinement for Tesla’s AI. This proprietary AI technology not only underpins Tesla’s FSD capabilities but also drives advancements in other areas, like the Optimus line of robots, which are designed for use in Tesla’s factories to increase automation and efficiency.

The full self-driving mode is another key component of Tesla’s moat. While full Level 5 autonomy is not yet a reality, Tesla’s driver-assist system is among the most advanced on the market. The data collected from this system not only helps improve the technology but also sets Tesla apart as a data-rich company. With millions of miles of driving data from diverse conditions around the world, Tesla’s FSD has the potential to be a game-changer in the autonomous vehicle industry.

Tesla Needs GPUs for AI (Tesla Investor Day Presentation)

Tesla’s Semi and Cybertruck represent its willingness to innovate and push boundaries in the EV market. The Cybertruck, with its futuristic design, and the Semi, aiming to revolutionize commercial transportation, further extend Tesla’s reach into markets traditionally dominated by internal combustion engine vehicles.

Looking ahead, Tesla’s intent to produce a lower-cost EV is a key strategy to widen its consumer base and increase market share. By offering a more affordable vehicle without compromising on the advanced technology Tesla is known for, the company could tap into a segment of the market that is currently underserved by EV manufacturers. This approach should not only generate additional revenue for Tesla but also help accelerate the global transition to sustainable energy, a mission Tesla has been steadfastly committed to from the beginning.

The Next-Gen TSLA vehicle (Tesla Investor Day Presentation)

In summary, Tesla’s moat is multi-faceted and rooted in a first-mover advantage, advanced AI and data collection capabilities, innovative and diverse product offerings, and a strategic future direction. While competition in the EV industry is growing, these factors combined continue to set Tesla apart, helping it maintain its leadership position in the market. Now, let’s explore what investors should pay attention to regarding the expansion of this moat from an energy storage business perspective, as this is part of the overall mission at Tesla.

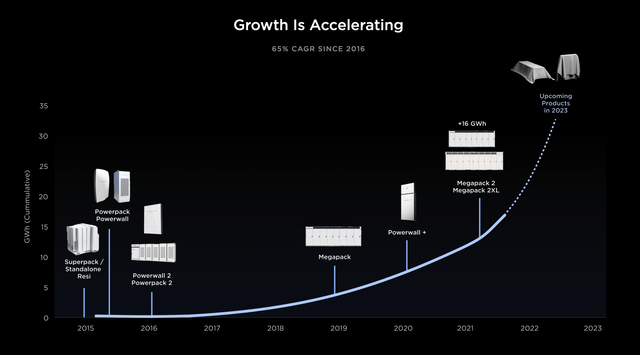

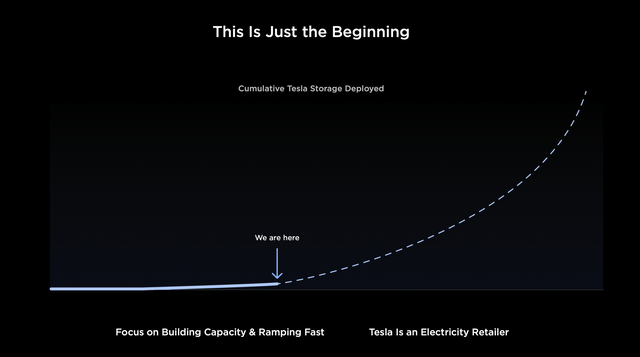

Tesla Energy Storage Business (Tesla Investor Day Presentation)

The Q2 2023 earnings report for Tesla indicated a clear forward momentum in the energy storage sector, showing a notable YoY growth of 222% in energy storage deployments to reach 3.7 GWh. This progress, largely driven by the successful ramp-up of their first dedicated Megapack factory in California, suggests a robust growth potential that could be leveraged for significant revenue generation.

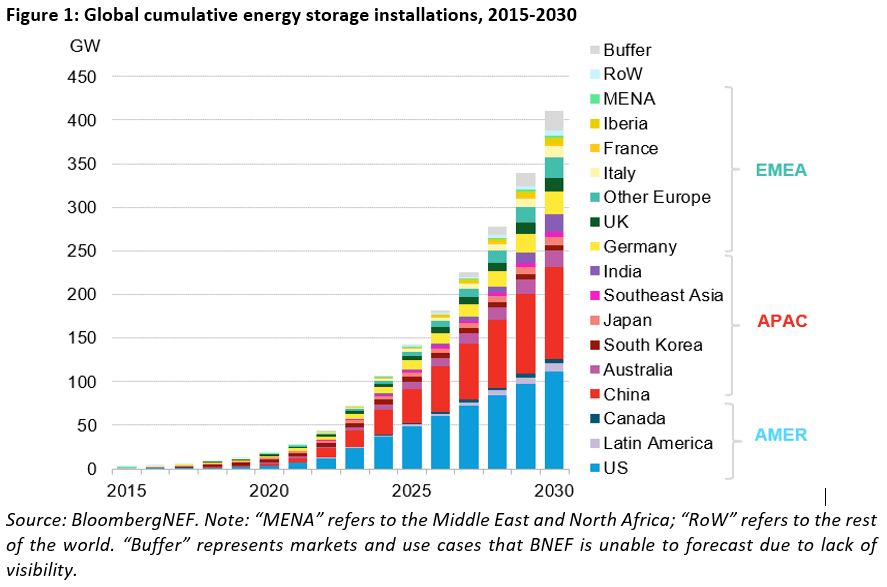

Delving into the numbers from BloombergNEF, we learn that energy storage installations worldwide are projected to hit a cumulative 411 gigawatts (1,194 gigawatt-hours) by the end of 2030. This is a 15-fold increase from the 27GW/56GWh of storage online at the end of 2021. The forecast anticipates an additional 13% capacity by 2030, primarily due to recent policy changes that could drive an extra 46GW/145GWh. Notable policies include the US Inflation Reduction Act and the European Union’s REPowerEU plan, both of which set ambitious targets for clean technologies and reducing reliance on non-renewable energy sources.

Global Cumulative energy storage forecast trends (BloomberfNEF Report)

Let’s translate this into revenue potential for Tesla. Given that Tesla achieved 3.7 GWh in Q2 2023, let’s consider a hypothetical situation where Tesla’s growth in energy storage continues linearly, they could theoretically achieve approximately 14.8 GWh annually. Of course, growth is rarely linear, and this estimate doesn’t take into account the likely growth accelerations from policy incentives and escalating market demand. However, using these conservative estimates, if Tesla could capture just 5% of the projected market by 2030, that would represent approximately 59.7 GWh of energy storage. Using Tesla’s current pricing for the Megapack, which is the product aimed at utility-scale installations, the revenue from energy storage could be immense.

The Future Forecast of Tesla Energy Storage (Tesla Investor Day Presentation)

Furthermore, it’s crucial to note that this calculation doesn’t take into account potential revenue from associated services, nor does it include the potential for Tesla to leverage its energy storage solutions in tandem with its solar products or vehicle fleet. It also doesn’t account for the potential of Tesla’s energy products to help stabilize grids and potentially provide additional grid services.

In summary, Tesla’s energy storage growth, as reported in Q2 2023, coupled with the anticipated boom in the global energy storage market, provides a clear avenue for considerable expansion and diversification of Tesla’s economic moat. By capitalizing on these opportunities, Tesla has the potential to establish a dominant position not only in the EV market but also in the broader clean energy and storage industry.

The Love to Hate on Elon Musk and Why I Wouldn’t Bet Against Him & His Talented Employees

The Bear Perspective on Elon Musk:

The media and Tesla bears recognize Elon Musk as an undoubtedly prominent figure in the tech industry, known for his ambitious and often grandiose projects. However, his actions and behavior have attracted a significant amount of their criticism. He’s often viewed by this audience as a controversial and unpredictable figure whose tweets and public statements can be erratic and, at times, irresponsible.

One of the criticisms against Musk is his tendency to over-promise and under-deliver. From setting unrealistic production targets to making bold claims about full self-driving capabilities, many feel that he’s more show than substance. This has led to a credibility issue for some. Critics argue that his constant missed deadlines and overhyped promises can cause unnecessary volatility in Tesla’s stock and sow doubt among potential investors.

Cost Reductions Come From Everywhere (Tesla Investor Day Presentation)

Regarding Tesla’s business model, some critics perceive a lack of understanding and question its sustainability. A substantial portion of Tesla’s profits have come from selling regulatory credits, rather than from selling cars themselves. This has led some to wonder whether Tesla can actually turn a profit without these credits, casting doubts on its long-term profitability.

The institutional investors, media, and Tesla bears acknowledge Musk has undeniably been a driving force in pushing the auto industry towards a more sustainable future, however they would argue these criticisms paint a picture of a leader and a company with significant challenges that need addressing.

The Common Sense Perspective on Elon Musk:

Elon Musk, the visionary behind PayPal, SpaceX, and Tesla, has long been committed to the pursuit of a sustainable future for our planet. His passion for clean energy and electric vehicles is not just about innovation and profit; it’s a profound mission to combat climate change and to hasten the advent of sustainable energy worldwide.

Musk’s journey with Tesla started back in 2004, when he first invested in the fledgling company, becoming its chairman. But the path to success was far from smooth. The first major product, the Tesla Roadster, was met with skepticism, while the development of subsequent models, the Model S and Model X, were fraught with delays and cost overruns. At times, Tesla was on the brink of bankruptcy, saved only by last-minute funding rounds and Musk’s own personal fortune.

The 2008 financial crisis presented a daunting obstacle for Tesla, as it did for many businesses. Tesla was only days away from bankruptcy when Musk put every penny he had into the company. It was a move that not only showcased his indomitable belief in the mission but also directly tied his financial success to that of the company, effectively aligning him with shareholders. The risk paid off. In the final days of 2008, Tesla was awarded a $465 million loan from the U.S. Department of Energy, which helped them push through to create the Model S, a car that would go on to revolutionize the auto industry.

Early Days at Tesla in 2011 (Investor Presentation for Tesla in 2011)

Musk has faced persistent criticism and disbelief throughout his career, but he’s proven time and time again that he can overcome the odds. From production issues to skepticism about the feasibility of electric cars, Musk has consistently risen to the challenge and pushed through, driven by an unyielding commitment to his vision of a sustainable future.

His approach to compensation further highlights his commitment to Tesla’s long-term success. Musk does not receive any guaranteed salaries, cash bonuses, or equity that vests simply by the passage of time. Instead, his only compensation is a completely at-risk performance award, which is paid out in stock. This ensures his interests are entirely aligned with shareholders: if the company does not perform, Musk does not get paid.

Musk’s journey has been a combination of audacious vision, relentless effort, and an unwavering commitment to a sustainable future. His work with Tesla has not just created a successful company; it has created a seismic shift in the auto industry, ignited a worldwide interest in electric vehicles, and put us on a path towards a more sustainable future. Elon Musk, through his struggles and triumphs, has shown that the combination of a daring vision, relentless determination, and a commitment to the well-being of our planet can indeed change the world.

My Conclusion and the Common Sense Facts

While Tesla’s stock may indeed be volatile in the short term, it’s important to note that investing in growth companies often involves such volatility. As long-term investors, we should be less concerned about short-term price movements and more focused on the underlying fundamentals of the business and its potential for growth over the next decade. Tesla’s mission to accelerate the world’s transition to sustainable energy is far from complete, and there is still considerable growth ahead.

Tesla Goal to Power Earth (Tesla Investor Day Presentation)

Achieving the Impossible

The common sense of it all is that Elon Musk achieved the impossible creating an industry in electric vehicles that most of the world doubted 20 years ago would ever come to fruition. This founder CEO put his own personal money and compensation to the test along with several near instances where the dream fell through and Tesla becoming bankrupt in the early days. Now, Elon Musk at times this year has been the number one or number two most wealthiest individual in the world, and CEO of not only Tesla but SpaceX, Owner and CTO of Twitter (Now known as X), President of the Musk Foundation, Founder of the Boring Company, X Corp., xAI and Co-founder of Neuralink, OpenAI, Zip2, and X.com (part of PayPal).

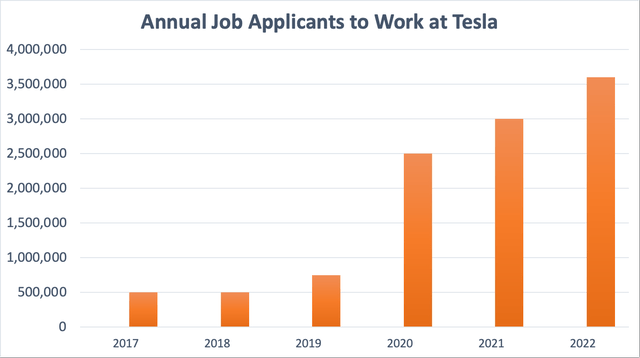

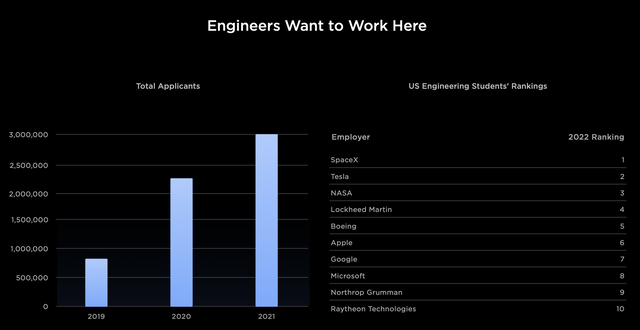

The Demand to Work at Tesla & the Top Talent that Exists There

As I mentioned in the beginning of my article, I look to invest in companies with top talent and they are able to retain it and attract new top talent. Tesla is the definition of this, as you can see the massive growth of applicants to work at Tesla has grown over 7x since 2017 to 3.6M applicants in 2022. Tesla has its pick of the litter for the most talented AI data scientists, engineers, designers, developers, floor workers, etc. When you invest in a company you really are investing in its people that make it create value to its customers. Tesla also aligns its employees and CEO’s compensation towards stock rewards based upon the performance of the company, which aligns to shareholders.

Annual Job Applicants to Tesla (Author’s Analysis from Tesla Reports)

Financial Efficiency and Strength

Institutions and Tesla bear investors underplay the operational excellence in the gross margins and operating margins Tesla creates, compared to the other automakers. Most of the predominant automakers have been around for over 70 to 100 years, and I recommend comparing their financials to Tesla who has only existed for the last 20 years. Tesla’s financial efficiency and strength is a result from their moat in manufacturing and logistics innovation. Tesla has challenged the traditional business model of auto manufacturers by several means:

1. Limiting the amount of parts and suppliers utilized to build a car2. Limit the amount of options a customer can customize for efficiency and scale purposes

3. Not doing business through dealerships but operating in a direct sale to customer model

4. Tesla did not advertise and spend money on marketing but provided referrals to its customers and letting the product speak for itself

5. Every decision made has scale, efficiency, and customer demand in mind

6. Tesla has over $23B in cash and investments as earlier stated, and has 2.9% debt to equity

Tesla’s Clean Balance Sheet (Simply Wall St. App)

Optionality Expansion

Tesla has optionality for future revenue possibilities and current product roadmap items for days! To name a few examples are:

1. Autonomous driving technology for robotaxis2. Scaling the semi-truck business and signing more commercial deals 3. Launching and meeting the demand for the cybertruck 4. Taking massive market share in energy storage over the years 5. Launching a lower cost EV compact vehicle for new marketshare6. Utilizing more Optimus robots to operate factories 24/7 for faster scale to market7. New manufacturing techniques for new factories, lowering costs and improving margins 8. Launching Tesla Insurance Programs across the entire U.S.9. Creating new vehicles like an EV bicycle or motorcycle for new markets10. Creating special pricing offerings or capabilities in the vehicles with integrations for X, XAI, and SpaceX customers

Top Talent Wants to Work at Tesla (Tesla Investor Day Presentation)

My Conclusion For Readers, Just Ask Yourself These Common Sense Questions?

If you have the time horizon, patience, and discipline to hold and follow Tesla Stock, just ask yourself these questions, Do I believe the following:

1. Will Tesla innovate and create new vehicles that will break into new markets and gain more customers?

2. Will Tesla find new ways to lower costs on the creation of vehicles and factories to improve margins and reduce time to production?

3. Will Tesla find a way to get full self-driving cars scaled across the country, approved by regulators, and build a robotaxi business?

4. When inflation and interest rates come down, will more people purchase Tesla vehicles?

5. Could Tesla revolutionize how cars are built further leveraging AI robots and new manufacturing processes?

6. Could Tesla integrate other products and create offerings from the other Elon Musk run companies?

7. Will Tesla spend more efforts or add headcount to capture a market leading first mover advantage in energy storage globally?

8. Can Tesla continue to operate with higher gross and operating margins than the competition? And ask yourself are they fiscally strong, to be able to focus on scale?

9. Does Tesla have some of the best AI and manufacturing talent in the world?

10. Could Tesla create a whole new AI product that we did not anticipate to generate revenues and margins?

I know this is the longest article I have ever produced, but I wanted to provide as much common sense to the approach in investing in Tesla. So ask yourself these questions and then make your decision on what is best for your investment dollars.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters.

References for Self Driving Car Studies can be found from any of the sources at:

0. – https://www.www.fhwa.dot.gov

1. – https://www.www.mckinsey.com

2. – https://www.cyberlaw.stanford.edu

3. – https://www.www.consumerreports.org

4. – https://www.www.motortrend.com

5. – https://www.www.alliedmarketresearch.com

6. – https://www.usa.streetsblog.org

7. – https://www.link.springer.com

8. – https://www.www.ey.com

9. – https://www.www.iihs.org

10. – https://www.www-01.ibm.com

11. – https://www.www.bcg.com

12. – https://www.www.finder.com

13. – https://www.www.energy.gov

14. – https://www.www.dispatcheseurope.com

15. – https://www.www.rand.org

16. – https://www.interestingengineering.com

17. – https://www.www.nhtsa.gov

18. – https://www.www.businessinsider.com

19. – https://www.www.statista.com

20. – https://www.www.sciencedaily.com

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.