Summary:

- Disney’s stock performance has been disappointing, but its operations remain fundamentally strong.

- Despite criticism and “Go woke, go broke” claims, Disney’s diversified portfolio continues to perform well, with significant box office success and stable streaming market share.

- Disney’s content pipeline, including sequels to strong franchises, looks promising, and investments in park attractions and cruise ships are strategically sound.

- While not a growth rocket, Disney’s valuation is now fair, with low downside risk and potential for risk-adequate long-term returns from current levels.

cjp

Looking Back

Since my last Disney coverage in May, Disney’s stock performance has once again been disappointing, while its fundamental operations were not. The article focused on the potentially positive spillover effects from Taylor Swift having sold the streaming rights of her Eras Tour Movie to Disney+. The article explicitly emphasized that this was an EXAMPLE of a strategically correct move by Disney, and it delved into the impressive financial figures surrounding Taylor Swift. At the same time, it was noted that the effect on Disney as a whole could very well be negligible, and that a forward P/E in the mid-twenties as well as a P/S of 2.3 seemed too high in the short term.

The Buy rating was therefore clearly meant to be understood as a long-term, strategic rating. Upon self-reflection, however, I must admit that a Hold rating would have better aligned with the words written. I argued that Disney’s P/E should be below 20 and P/S below 2. We have now arrived there. That is reason enough to shed light on Disney once again.

This article is about how baseless “Go woke, go broke” claims actually appear in the bigger picture versus:

- Box Office Facts

- Streaming Facts

- Pipeline and CAPEX

For transparency reasons: my long-term Disney holding is around 5% of the overall portfolio.

Box Office Facts

Disney is written off by many because they disagree with its politically conveyed messages, or, regardless of whether they agree, simply do not want Disney to take a political stance at all. These viewpoints are, in some ways, quite understandable. The claim is often made: “Go woke, go broke.” From an investor’s perspective, however, it is often forgotten that Disney, as a conglomerate, now appears diversified enough to continue performing fundamentally, despite all the criticism surrounding its so-called “wokeness”. Let’s not forget the phenomenon of “false balancing”, which suggests that the loudest voices, for example, on the internet, are falsely perceived as representing the majority. In reality, the numbers paint a different picture.

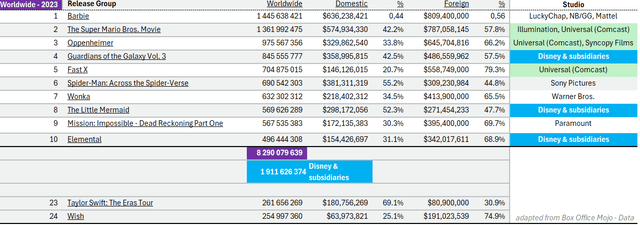

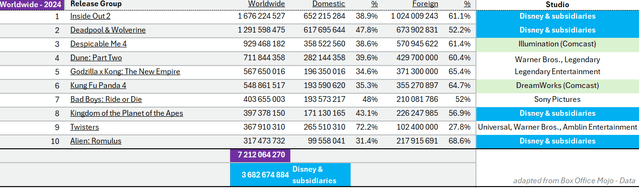

Looking at the box office successes of the past year, it was admittedly disappointing for a company like Disney. Focusing only on the top 10 releases of 2023, after Barbie, studios under Comcast were particularly successful. Among the top 10, three releases came from Disney-owned studios. The top 10 grossed a total of $8.3 billion, with only $1.9 billion, or 23%, coming from Disney studios. Even Taylor Swift’s Eras Tour concert film – which is arguably a niche in the movie world – ranking 23rd ranked higher than Disney’s 100th anniversary film Wish, which came in at 24th but also had a later release.

This year looks much better for Disney. Four films from Disney and its affiliated studios are in the top 10. With a box office gross of $3.7 billion, they have already doubled last year’s total by only about two-thirds of the way through the year and account for more than half of the entire top 10 – compared to just 23% last year. Disney is often written off. “Go woke, go broke” is chanted. Yet, the associated studios are highly successful this year. And in the long run, that is what matters.

Streaming Facts

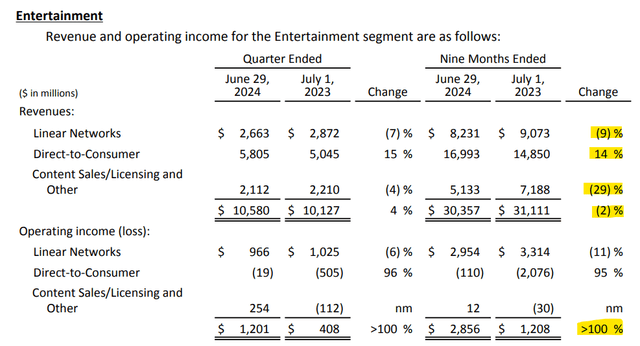

Disney+ may not be the top-line growth rocket the company was once priced for. The streaming market is far too competitive for that. Market participants were probably too euphoric here and saw streaming as the next big thing in entertainment – which it is – but forgot that it is less of an ADDITION and more of a necessary evolutionary step to compensate for the decline of linear TV. Therefore, we should celebrate the growth of DTC less on its own and instead balance it against the decline of linear television. While we see 14% growth in DTC in the first nine months of the fiscal year, we are still witnessing drastic declines in licensing and linear TV, resulting in the overall Entertainment segment remaining approximately flat.

However, the key word here is profitability of DTC, which has pushed the entire Entertainment segment forward by $1.6 billion compared to the prior-year nine-month period regarding operating income. This makes Entertainment a relevant contributor to earnings again, with 24% of operating income in the first nine months.

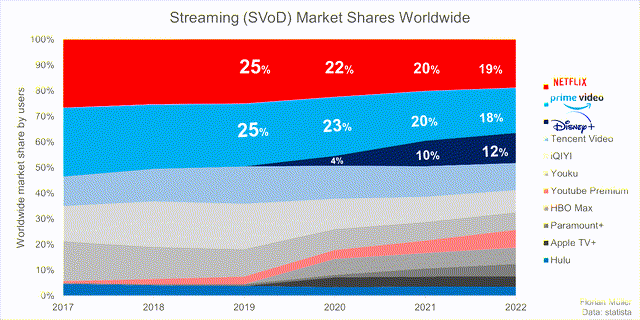

If it is not a growth rocket, at least the position in the competitive market must be solidified. As a starting point, see below an older graphic based on Statista data showing market shares based on user numbers from 2017 to 2022. I have not been able to find updated data to refresh the chart, so a provisional alternative overview will follow in the next step.

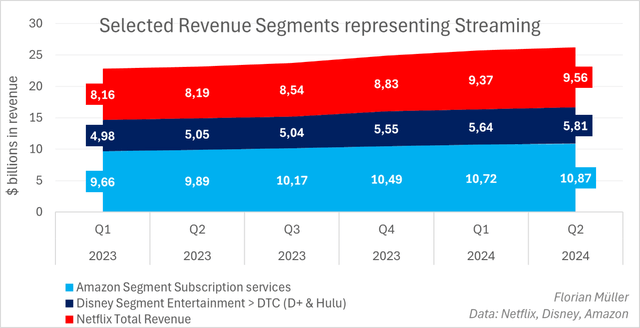

For this purpose, segments were selected based on the companies’ published figures to approximate streaming revenues as closely as possible. The focus was on the top 3 market players – Netflix, Prime Video, and Disney – who have shared around 50% of the market for years, as the graphic above has already shown. The figures were matched by calendar year. For Amazon, the segment ‘subscription services’ for the last six quarters was used, though admittedly this includes more than just Prime Video. For Netflix, the total revenue was considered, and for Disney, the ‘DTC’ subsegment under ‘Entertainment’, which includes Disney+ and Hulu, was used.

Essentially, the data shows that there haven’t been any significant shifts in market shares. Assuming that the top 3 players still account for about half of the market, this simplified market analysis suggests that Amazon Prime and Netflix still each hold around 20% of the market, while Disney – including Hulu – still has over 10%. The battle for market shares seems stable, and future content will be the deciding factor.

Author | Data: Netflix, Disney, Amazon

Pipeline And CAPEX

And exactly this content pipeline looks promising. Yes, we see a lot of sequels, which many criticize in the context of a lack of creativity. However, constantly forcing the creation of new franchises would not be valuable either. Right now, it is difficult to satisfy the negative sentiment. In my opinion, the pipeline of sequels to strong franchises is promising. And not all of them are old classics. Here is a selection: Moana 2 in 2024, Moana Live Action in 2026, Toy Story 5 in 2026, two Avengers movies in 2026 and 2027, three-Star Wars films in 2026 and 2027, Avatar sequels in 2025, 2029, and 2031, Elio in 2025, Zootopia 2 in 2025.

Growth in the Experiences segment seems to be hitting a plateau, likely due to a more challenging situation for consumers. After all, a visit to a Disney Park is no bargain. Nonetheless, as the company’s cash cow, the segment has remained stable so far, delivering an operating margin of 29% in the first nine months, although this declined to 26% in the most recent quarter. Disney is investing heavily in park attractions based on its most popular franchises, which I consider the right move. Additionally, the current fleet of five cruise ships will more than double to 13 by 2031. Therefore, it is worth taking a closer look at the proportionality of capital expenditures.

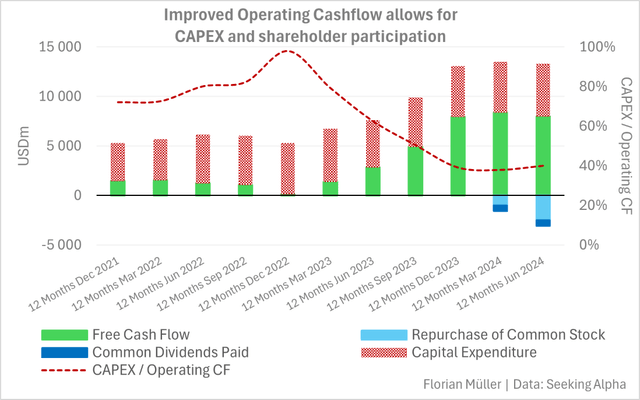

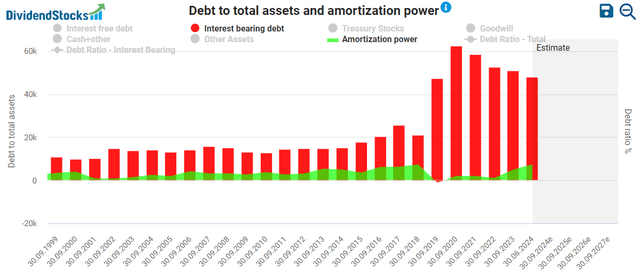

See below a brief summary of Disney’s cash flow components according to Seeking Alpha data. Free Cash Flow is not the company’s or Seeking Alpha’s calculated metric, but defined as Operating Cash Flow minus CAPEX. What we observe is a significant improvement in Operating Cash Flow (green + red bars combined). This has not only reduced the CAPEX share of OCF from 80% and sometimes even close to 100%, down to 40% recently, but also created room for more CAPEX, share buybacks, dividends, and debt reduction. As shown in the second chart, debt balances have been significantly reduced over time.

Author | Data: Seeking Alpha dividendstocks.cash

Takeaway

Despite short-term catch-up, Disney is not a long-term growth rocket, and sentiment weighs heavily against the company. However, operationally, things are undoubtedly improving steadily. Does one need the company in their portfolio? Certainly not. But the downside risk now seems low, the valuation fair – though still not extremely cheap – and fundamentally, Disney remains on solid ground. Significant outperformance should not be expected, but I expect risk-adequate long-term returns from current levels onwards. Clarity on Iger’s successor and his/her direction could be seen as a breakthrough, though I would not necessarily bet on it. Disney remains a long-term holding with potential for increasing the position at current prices, with P/Es under 20 and P/S below 2.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.