Summary:

- While the stock market is the best-performing asset class in history since 1926, the top 5% of stocks generate 105% of total returns.

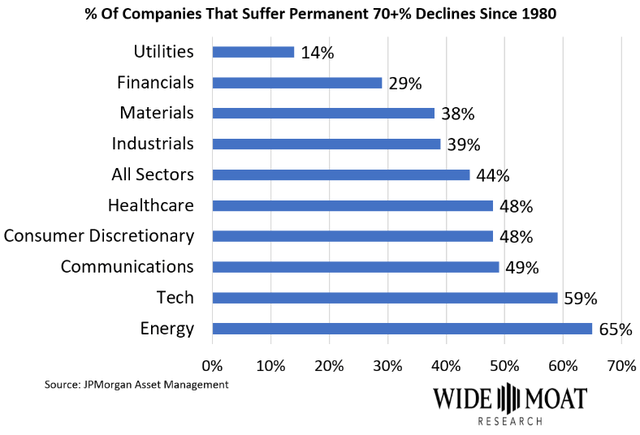

- Because 44% of all U.S. stocks suffer “permanent catastrophic” 70+% declines, including 59% of tech stocks.

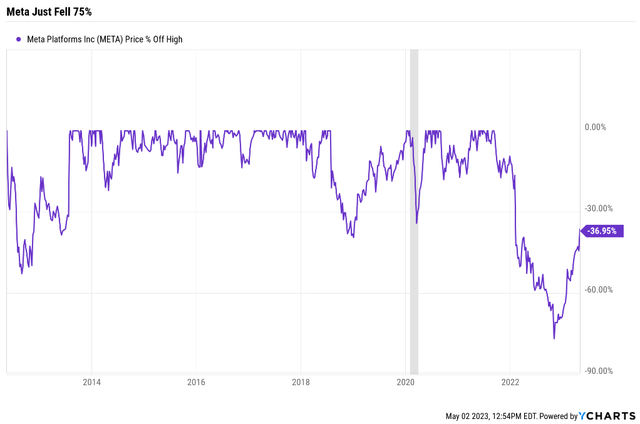

- Meta Platforms, Inc. fell 75% in the great tech crash of 2022 after making a $35 billion and counting) bet on the Metaverse.

- Meta shares have tripled off their lows thanks to layoffs and the “year of efficiency.”

- Whether Meta turns into the next General Electric or the next Apple comes down to the good, bad, and ugly news we learned during earnings. This article shows why Meta’s long-term return potential is between 3% and 36% and how one simple change by CEO Mark Zuckerberg could boost long-term returns by 110%.

DragonImages

This article was published on Dividend Kings on Tuesday, May 2nd.

—————————————————————————————

Most investors know earnings season is important, but few understand its true importance.

Is it because stocks like Meta Platforms, Inc. (NASDAQ:META) can soar 14% in a day after beating expectations? Or fall 27% in a day if they miss? No.

It’s because earnings are the only four times of the year when we get real, hard facts about a company’s business.

The rest of the year is pure speculation based on news headlines, and analyst reports upgrading or downgrading a stock based on 12-month price targets.

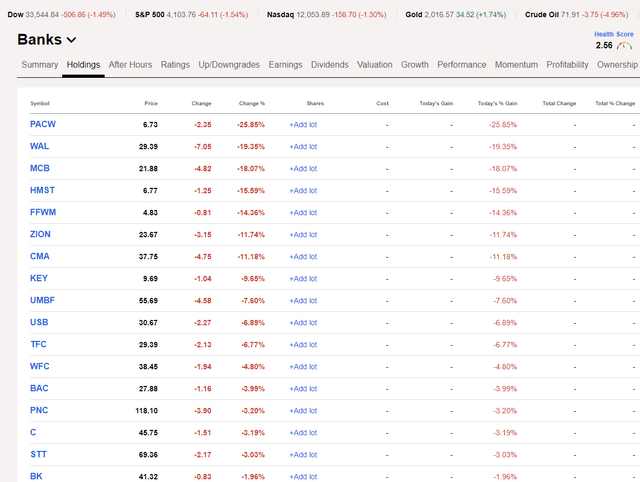

Stock prices can swing violently in a crisis like the current regional banking crisis.

What earnings did PacWest Bancorp (PACW) report today? What news broke that sent its share price down 35% at one point today (May 2nd)?

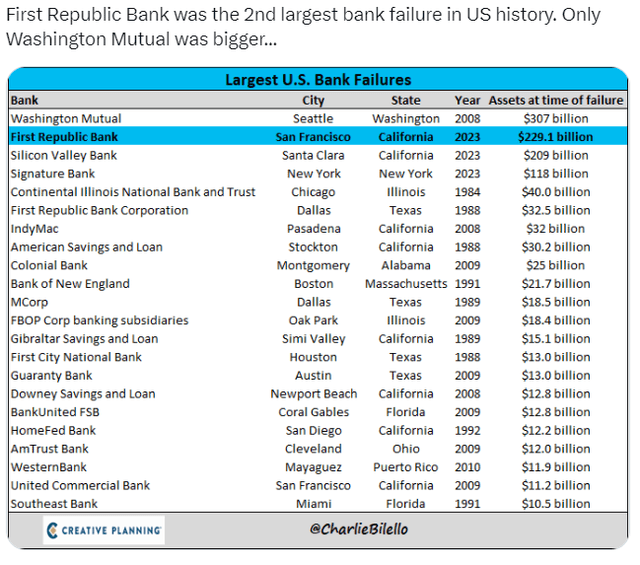

No, there was no banking-related news. The last news on banks was JPMorgan Chase (JPM) acquiring First Republic Bank (OTCPK:FRCB) out of FDIC receivership for $10.6 billion.

What caused the market to fall 1.5% and regional banks to go off a cliff? Most likely, the March JOLTS (job labor and turnover survey) came in much weaker than expected.

Basically, this report shows the strongest part of the economy, the labor market, could be rolling over, and that means wage growth and income might be going with it.

With 65% of the economy driven by consumer spending, that means the most anticipated recession in history is likely arriving…just as expected.

So why are some banks falling 15%, 20%, or even 25%? Pure panic, terror that one of these at-risk regionals is the next domino to fall, with shareholders getting wiped out.

But while bank failures like these are dramatic, there is an important fact that most investors don’t know.

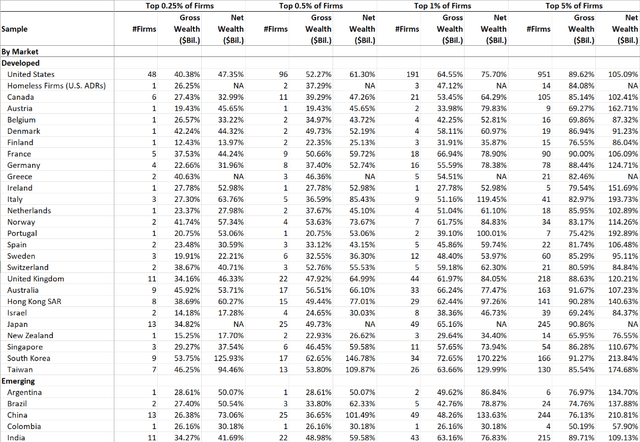

Since 1926, just 5% of U.S. stocks have generated 105% of the net returns of the U.S. stock market.

In fact, the top 0.25%, just 48 companies, generated 47% of the stock market’s incredible, life-changing wealth.

Similar numbers are found in every major country and even emerging markets, where the top 5% of stocks can generate as much as 317% of the net gains of the stock market.

- In Poland, the top 3 stocks generated 120% of the cumulative gains over decades.

How is that possible? How can a handful of stocks deliver more than 100% of gains? Because most stocks aren’t just underperformers, they are downright terrible.

44% of all U.S. stocks don’t just do poorly, the suffer what JPMorgan calls “permanent catastrophic” collapses of 70+%.

In the tech sector, the number is 59%.

So what does this have to do with Meta?

Meta is screaming higher after falling 75%. It’s a speculative turnaround story that will either end in glory for millions of brave investors or, statistically speaking, never-ending tears.

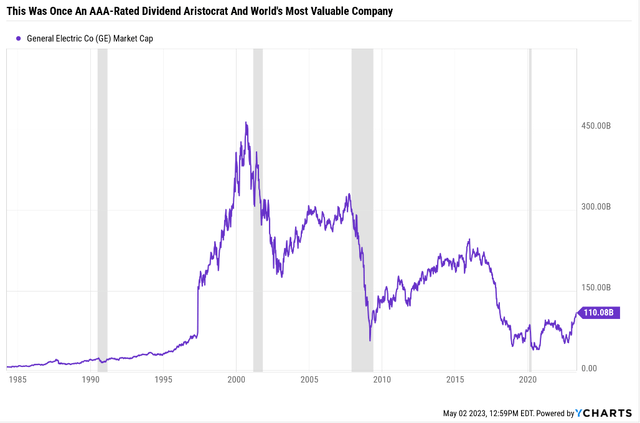

So let’s take a look at the good, bad, and ugly about Meta’s earnings to see whether this red-hot Wall Street darling is likely to soar even more or the next General Electric (GE).

The Good News About Meta’s Earnings: The King Of Social Media Isn’t Being Dethroned

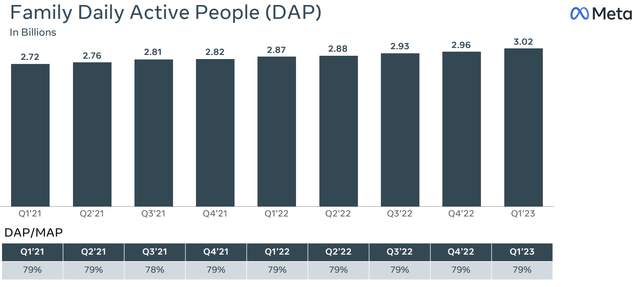

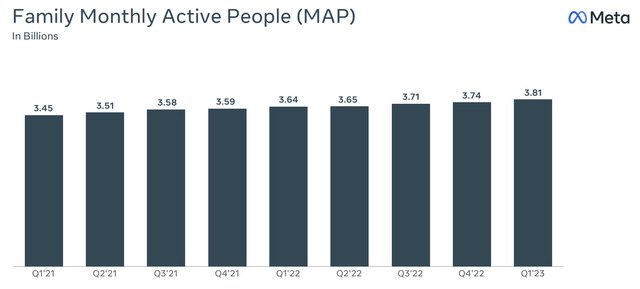

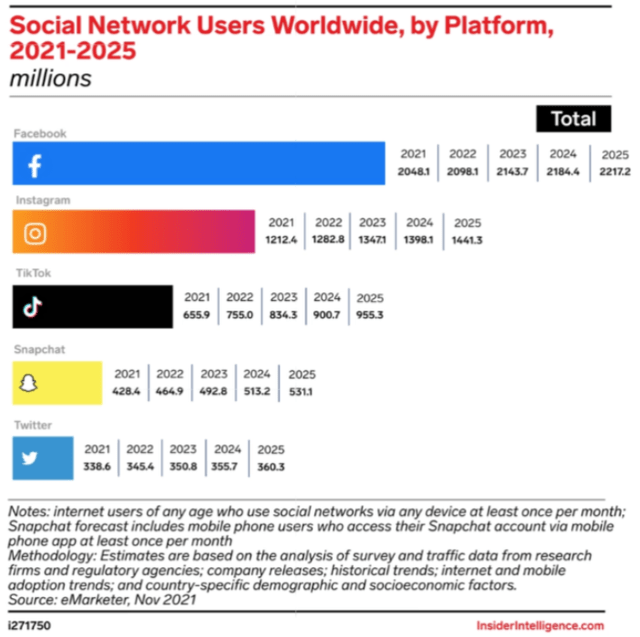

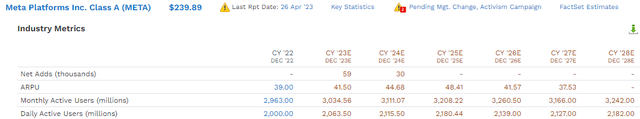

Meta is still managing to grow its daily userbase, which now stands at 3.02 billion, 79% of its monthly active users.

For context, 4.9 billion people have Internet access in the world.

- 78% of everyone with Internet uses Meta’s platforms

- in China, it’s not even allowed

- near-total market penetration.

Of course, when you have almost 4 billion users, it’s hard to grow that base. But this is where monetization of its massive and apparently stable user base comes in.

Meta reported 4% sales growth which was better than expected given the slowing economy and tough advertising market.

With improvement in Reels impressions and ad prices, cannibalization of other ads on Instagram is likely to end this year or early in 2024, which should drive accelerating revenue growth.” – Morningstar.

Reels is Meta’s answer to TikTok, and whether or not young people would find it a worthy challenger has been a big question for investors in the past year.

Reels have also helped increase time spent on Meta apps, which should further increase ad demand not just on Reels but also on Stories and Feed.” – Morningstar.

Reels is starting to improve other platforms on Meta, and most importantly, help the company lower the damage Apple made when it shifted its privacy policy.

On the ever-concerning Apple data policies front, Meta’s on-site ad conversions continue to increase, reducing its dependence on data from non-Meta platforms and Apple. Meta has also enhanced its ad measurement capability to handle Apple’s restrictions better, lowering hesitancy by advertisers.” – Morningstar.

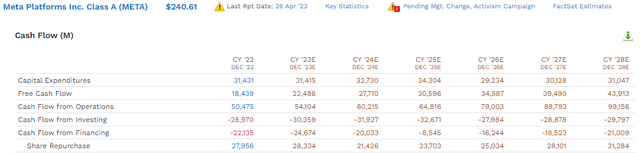

This isn’t just a quarter of modest sales growth we’re talking about; analysts expect Meta’s sales to grow 8% this year.

- 14% per share due to buybacks.

In fact, through 2028, analysts expect sales to grow 9.4% annually.

That might not be the 34% sales growth of the last decade, but with a company buying back $30 billion per year in stock (about 5% of shares at current valuations) it’s a very robust growth rate.

And let’s not forget about the bottom line. After all, this is Meta’s “year of efficiency.”

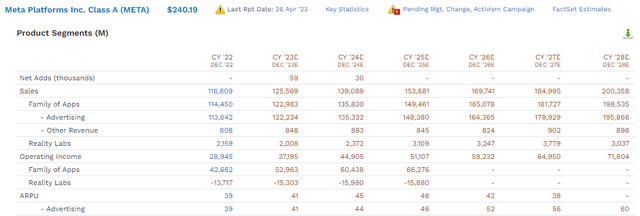

EPS Growth Rates By Year

- 2022: -38%

- 2023: 39%

- 2024: 23%

- 2025: 13%

- 2026: 15%

- 2027: 6%

- 2028: 11%

- 2022-2028: 17.4%

Thanks to cost-cutting and buybacks, Meta is expected to turn modest 9% sales growth into EPS growth twice as strong.

The Bad News About Meta’s Earnings: Pricing Power And Growth Prospects Are In Doubt

There is one big risk to Meta’s long-term future, and that’s competition in social media.

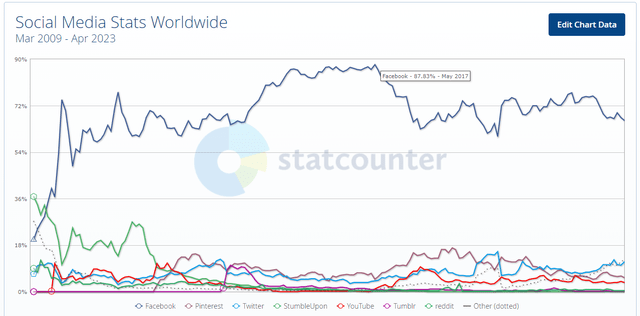

Meta has a 78% market share in global social media, which is phenomenal.

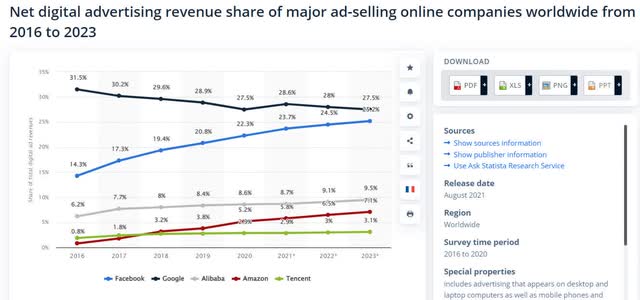

Its digital advertising market share is 26% and climbing to what appears to be a plateau of 27%, the same as Alphabet Inc. (GOOG).

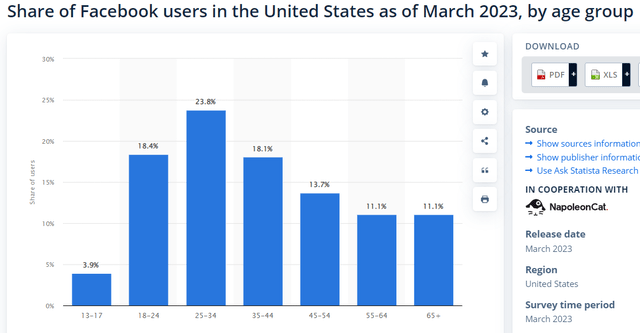

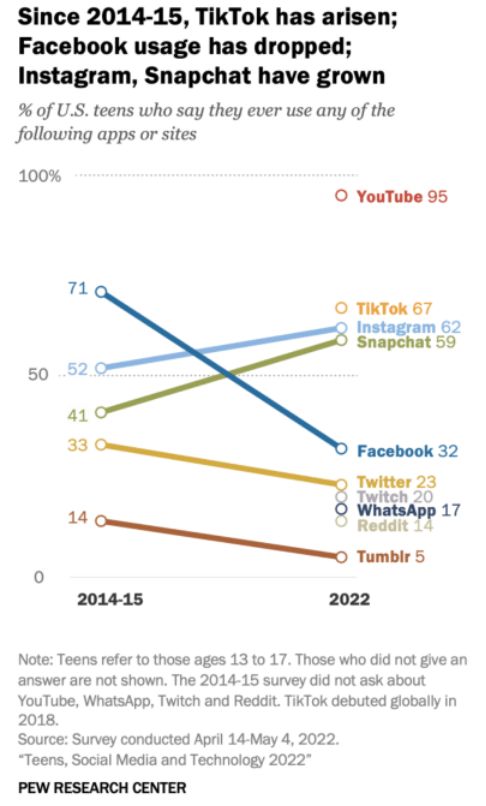

Meta’s market share thus far has fallen from an insane 87% in 2017 to a reasonable 67%, and if you add Instagram in, it’s barely lost any market share at all, despite the rise of Google’s YouTube and TikTok.

And so far, Meta has managed to hold off all challengers. And through 2025, at least, it appears that no one is going to challenge it for the global social media crown.

So what’s the problem?

The problem isn’t that user growth is slow and will eventually top out. The problem isn’t that Meta’s network effects are going to go into reverse, as young people abandon its platforms in favor of TikTok (which is apparently not happening).

The problem is that Meta’s ability to monetize its slow-growing and soon-to-be no-growing user base might be close to peaking.

Remember that almost 80% of everyone on earth with an internet connection is using Meta’s platforms at least monthly.

It’s tough to grow that base, even with a growing global population.

- The United Nations now thinks the world’s population will peak at 10.4 billion in 2085.

Why do analysts think Meta’s average revenue per user, or ARPU, might peak at $48 in 2025 and start declining from there?

Meta has a very large and slowly growing user base, and it’s not expected to shrink for the foreseeable future.

Pew Research

But it will start aging soon, and retired baby boomers are not exactly the prime age advertisers are looking for.

25 to 44 is the peak earnings and spending years that advertisers crave.

Is it possible for Meta to beat these expectations and keep growing ARPU well beyond 2025? It very much could.

Last quarter analysts expected Meta’s userbase to start shrinking by 2025, and now the consensus is a lot more optimistic.

But here’s the problem if it doesn’t.

Even with Meta’s improved userbase growth and strong cost-cutting-driven earnings, the long-term outlook is just 11.5%.

This isn’t a dividend growth stock; it’s not a high-yield stock. It’s not a dividend stock at all. For Meta investors, the only source of returns is earnings growth, and that isn’t exactly lighting the world on fire.

- The long-term growth range is from 3% to 36%.

Morningstar considers Meta’s growth uncertainty “high,” and that’s true of analysts as well. Meta is the most covered company on Wall Street, with 58 analysts, and the range of possible growth outlooks is wide enough to drive a truck through.

Worst case, you buy Meta and earn 3% per year, less than long-duration bonds pay.

- Oppenheimer’s base-case.

According to Evercore ISI, the best case is that CEO Mark Zuckerberg’s Metaverse dreams come true, and Meta will soar by 2000% in the next ten years.

The Ugly News About Meta’s Earnings: Metaverse Is Still A Boondoggle

I’ve emphasized for a number of these calls now that there were two major technological waves driving our roadmap, a huge AI wave today and a building Metaverse wave for the future…

Now over time, this will extend to our work on the metaverse to where people will much more easily be able to create avatars, objects, worlds and code to tile them together…

Now beyond AI, the other major technology wave that we’re focused on is the metaverse. A narrative has developed that we’re somehow moving away from focusing on the metaverse vision. So I just want to say upfront that, that’s not accurate. We’ve been focusing on both AI and the Metaverse for years now, and we will continue to focus on both. ” – Mark Zuckerberg, Q1 conference call (emphasis added).

Given the narrative about the company’s “year of efficiency” and dramatic cost-cutting, you might have thought that Meta had abandoned its Metaverse ambitions.

In fact, its founder and CEO make clear that Meta is hardly done with the Metaverse.

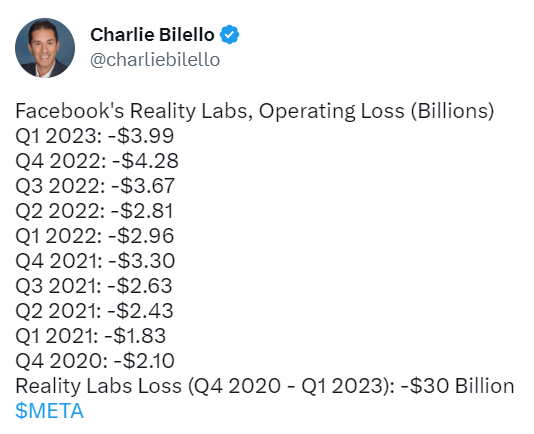

Charlie Bilello

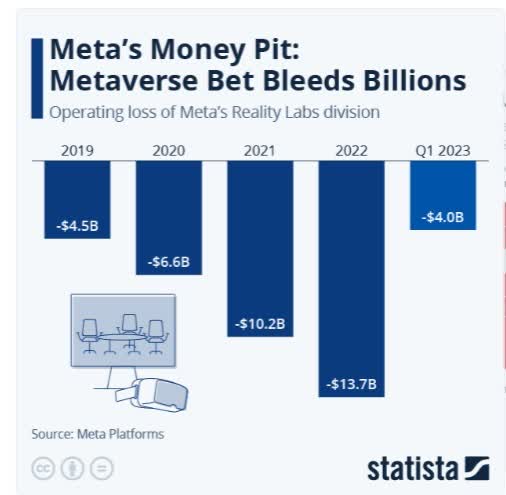

The company has lost $35 billion in total down the black hole of the Metaverse.

Are the losses getting smaller? Nope, not even close.

Statista

Zuckerberg is still spending like a drunken sailor on the Metaverse, now running a $16 billion annualized loss for Realty Labs.

Remember that he changed the name of the company (at the peak of Meta’s market cap) when hype around the Metaverse was at its peak.

And he did a 77-minute video on the glorious future of the Internet that Meta was building.

This is what Zuckerberg promised…

And this is what he’s delivered so far.

This is what $35 billion (and counting) buys

Statista estimates that by 2024, virtual reality gaming is going to be worth about $300 billion per year.

Yes, maybe World of Warcraft (owned by Activision, which Microsoft is trying to buy) can bring in rivers of cash. But what about Mark’s Metaverse, where you don’t even have legs?

Modeling the movements of our legs would require extra sensors, and those sensors are expensive and cumbersome. Executives at Meta, which now controls about 90% of the virtual reality market, have determined that legs aren’t worth the extra cost.” – QZ.

Let me get this straight. Meta controls 90% of the virtual reality market after spending $35 billion since 2019, and they can’t afford to let people have legs.

Not exactly Ready Player One, is it?

In fairness to Mr. Zuckerberg’s childlike whimsey, there is a business case to be made for the Metaverse.

In PwC’s survey of over 5,000 US consumers and 1,000 US business leaders, 50% of consumers call the metaverse exciting, and 66% of executives report that their companies are actively engaged. These companies are building proofs of concept, testing use cases, and generating revenue from metaverse environments or (more commonly) the underlying technologies. Eighty-two percent of executives expect metaverse plans to be part of their business activities within three years.” – PricewaterhouseCoopers (emphasis added).

However, given that this study was from 2022, one must question why Mr. Zuckerberg says it might take until 2030 for the Metaverse to break even and require a potential $140 billion investment.

Maybe the final $100 billion will let people have legs! That’s money well spent.

After all, at the moment, Meta has an ASML/Standard Oil-like 90% market share dominance of the metaverse. Yet it’s losing $16 billion per year.

- $307 million per week

- $4.4 million per day

- $509 per second.

But let’s not forget that not every poll and survey has good news for Zuckerberg’s $140 billion gamble.

In all, 624 technology innovators, developers, business and policy leaders, researchers, and activists provided open-ended responses to a question seeking their predictions about the trajectory and impact of the metaverse by 2040. The results of this non-scientific canvassing:

54% of these experts said that they expect by 2040, the metaverse WILL be a much-more-refined and truly fully-immersive, well-functioning aspect of daily life for a half billion or more people globally.

46% said that by 2040, the metaverse WILL NOT be a much-more-refined and fully-immersive, well-functioning aspect of daily life for a half billion or more people globally.” – Pew Research (emphasis added).

$16 billion per year for something that is a coinflip to be working in 2040, and which there is no guarantee that Meta will still be the “leader” of.

- a potential $307 billion money pit.

Imagine if Meta announced it was investing an extra $16 billion per year into buybacks.

Or that it would pay a dividend with some of that money.

- A 2.5% yield on today’s price is what the metaverse could fund.

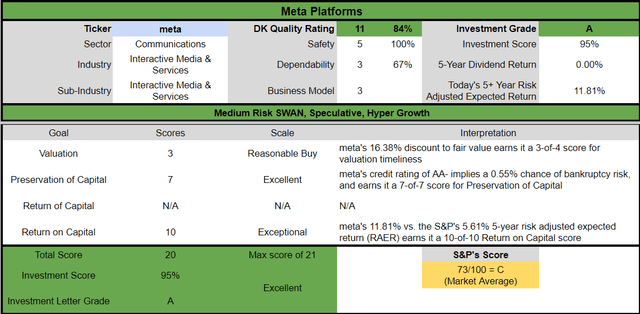

Bottom Line: Meta’s Growth Prospects Look Good For Now Despite Its Metaverse Money Pit

Dividend Kings Automated Investment Decision Tool

The good news is that Meta’s growth outlook has improved considerably in the last few months.

- to 11.5% from 9.7%.

It’s now a growth stock once more. But is Meta worth buying today?

2.5% Dividend Boosts Meta’s Return Potential By 21%

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| Amazon | 0.0% | 27.6% | 27.6% | 19.3% |

| Lowe’s | 2.1% | 19.8% | 21.9% | 15.3% |

| Mastercard | 0.6% | 19.1% | 19.7% | 13.8% |

| Visa | 0.8% | 16.7% | 17.5% | 12.3% |

| Alphabet | 0.0% | 14.6% | 14.6% | 10.2% |

| ZEUS Income Growth (My family hedge fund) | 4.2% | 10.0% | 14.2% | 9.9% |

| Meta Platforms (With 2.5% Dividend) | 2.5% | 11.50% | 14.0% | 9.8% |

| Vanguard Dividend Appreciation ETF | 2.0% | 11.3% | 13.2% | 9.3% |

| Microsoft | 0.9% | 12.2% | 13.1% | 9.2% |

| Nasdaq | 0.8% | 11.2% | 12.0% | 8.4% |

| Meta Platforms | 0.0% | 11.5% | 11.5% | 8.1% |

| Schwab US Dividend Equity ETF | 3.6% | 7.6% | 11.2% | 7.8% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| Apple | 0.6% | 9.7% | 10.3% | 7.2% |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

(Source: DK Research Terminal, FactSet, Morningstar.)

Meta’s current long-term return potential is superior to the S&P and dividend aristocrats. But it’s not better than many popular ETFs, including VIG and the Nasdaq.

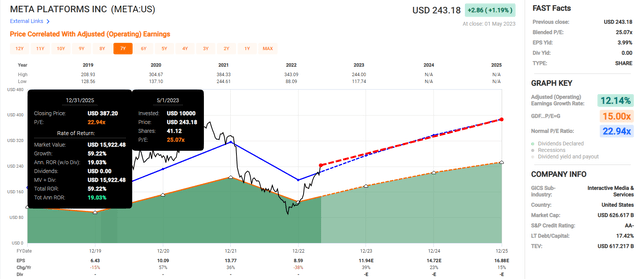

Is there still potential room for Meta to run due to its still reasonable valuation?

Meta Is Still A Reasonable Buy

Meta is reasonably priced at its current 20.8X earnings.

- fair value: $286.49

- current price: $240.32

- discount 16%

- quality score: speculative 84% quality medium-risk blue-chip

- DK rating: potential reasonable buy.

It has about 60% return potential over the next three years, a Buffett-like 19% annually.

But there are far better choices for growth investors, tech investors, and dividend growth investors to choose from right now.

What if Mark Zuckerberg is a mad genius, and the Metaverse turns into a $5 trillion global market by 2030, as McKinsey thinks is possible?

And what if Meta’s $140 billion investment helps it command an AWS market share of 33+% of that? Then Meta would likely become the most valuable company in the world, and Zuckerberg would likely become the world’s first trillionaire.

- A potential 20X in the next ten years, according to Evercore.

Isn’t it worth taking a flier with Zuckerberg in case that optimistic scenario turns out? Sure, but you’re already along for the ride if you own many ETFs.

- By the end of the year, my family’s hedge fund will own about $8,000 worth of Meta via several ETFs.

Am I interested in risking more than $8,000 for this cash-rich, still dominant advertising platform?

No, not when I can buy faster-growing dividend stocks like Mastercard (MA), Lowe’s (LOW), ASML (ASML), or Brookfield (BAM).

But is Meta the next GE? The best available data says no; Meta likely isn’t the next great permanent catastrophic tech failure.

But if Meta Platforms, Inc. were to put its Metaverse spending into a 2.5% dividend? Then suddenly, the global king of Social Media would offer superior return potential to Apple (AAPL) and Microsoft (MSFT).

And then I could recommend it far more enthusiastically.

Why? Because that 2.5% higher annual return could mean an extra 110% higher inflation-adjusted return over 30 years.

Meta Platforms, Inc. investors should ask themselves whether or not $16 billion per year in Metaverse losses is likely to lead to 2.5% higher long-term growth.

If not, then a dividend or extra buybacks is the less risky and more prudent way for Meta Platforms, Inc. to double its long-term returns and potentially change the lives of millions of long-term investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

By the end of the year, I'll own $8,000 worth of Meta via ETFs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my correction watchlist

- my $2.5 million hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.